Market Overview

The Qatar Aircraft Nacelle Systems Market is valued at approximately USD ~ million, with steady growth driven by the expanding aviation industry in the region. Qatar’s robust fleet expansion and increasing demand for newer, more efficient aircraft are key factors propelling this market. Notably, the launch of new aircraft models by Qatar Airways and other regional carriers is expected to continue stimulating demand for advanced nacelle systems, including components such as engine nacelles, thrust reversers, and exhaust systems. The rise in airline fleets and modernization efforts at regional MRO facilities are expected to sustain long-term growth for this market.

Qatar, particularly its capital, Doha, stands as a key hub driving the demand for aircraft nacelle systems in the Gulf region. This dominance is primarily attributed to Qatar’s significant aviation infrastructure, which includes Hamad International Airport and the region’s largest airline, Qatar Airways. Doha serves as a nexus for both commercial aviation and aircraft maintenance, repair, and overhaul (MRO) services. Furthermore, the government’s continuous investment in aviation, coupled with its strategic position as a transit hub, fortifies Qatar’s position in the global aircraft nacelle systems market.

Market Segmentation

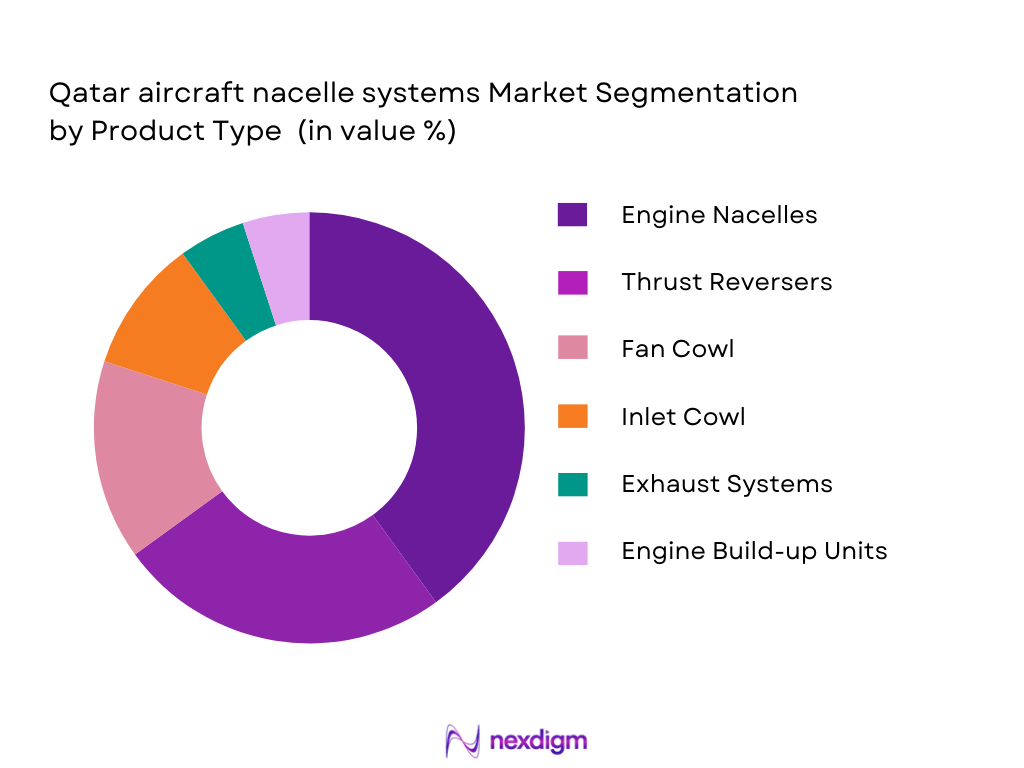

By Product Type

The Qatar Aircraft Nacelle Systems market is segmented by product type, with engine nacelles, thrust reversers, fan cowl, inlet cowl, exhaust systems, and engine build-up units (EBUs) being the primary components. In particular, engine nacelles continue to dominate the market share, owing to their critical function in protecting the engine and contributing to the aerodynamics and noise reduction of the aircraft. These nacelles are designed to fit various aircraft types, ensuring operational efficiency, fuel optimization, and noise control. The demand for nacelles is also fueled by the growing fleet sizes of Qatar Airways and other regional airlines, with frequent replacements and technological upgrades driving market activities.

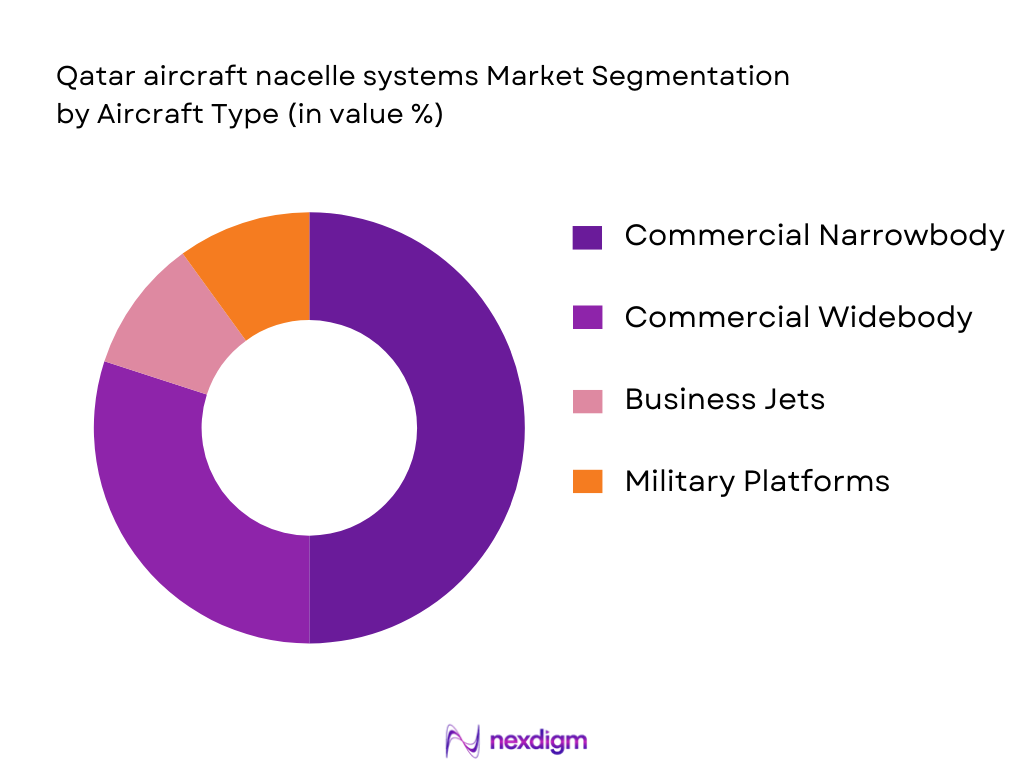

By Aircraft Type

The market is further segmented by aircraft type, encompassing commercial narrowbody, widebody, business jets, and military platforms. Among these, the commercial narrowbody aircraft segment holds the largest market share, as these aircraft are the most commonly used for short- and medium-haul flights, particularly by major carriers such as Qatar Airways. Their increased operational frequency and higher number of engines per aircraft make them prime candidates for nacelle system installations. Additionally, widebody aircraft also contribute significantly to market growth due to their usage in international long-haul flights, demanding advanced nacelle systems for engine optimization and fuel efficiency.

Competitive Landscape

The competitive landscape of the Qatar Aircraft Nacelle Systems market is dominated by a few major global players, including Safran Nacelles, Collins Aerospace, and GKN Aerospace, who are leading the innovation and supply of nacelle systems for both commercial and military aircraft. The market also sees participation from regional firms offering specialized products for specific aircraft types. The competition is intensified by advancements in material technologies, fuel efficiency, and noise reduction, where these players are focusing on developing lighter, more durable nacelle systems for next-generation aircraft.

| Company | Establishment Year | Headquarters | Market Share | Technology Leadership | MRO Integration | Product Diversification | Regional Presence | Supply Chain Strength |

| Safran Nacelles | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1999 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| GKN Aerospace | 2000 | Redditch, UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Spirit AeroSystems | 2005 | Wichita, USA | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Nacelle Systems Market Analysis

Growth Drivers

Fuel Efficiency Goals

The demand for aircraft nacelle systems in Qatar is strongly driven by the aviation industry’s emphasis on fuel efficiency. As the global airline industry faces increasing pressure to reduce carbon emissions and fuel costs, Qatar Airways and other regional carriers are focusing on improving fuel efficiency across their fleets. Modern nacelle systems are integral to achieving these goals, as they help optimize airflow around engine components, reducing drag and improving fuel consumption. The adoption of advanced nacelle technologies that enhance aerodynamics and reduce weight is critical to meeting international fuel efficiency targets and sustainability objectives.

Fleet Modernization

Fleet modernization is a significant growth driver for Qatar’s aircraft nacelle systems market. Qatar Airways, one of the region’s leading carriers, continues to expand its fleet with advanced aircraft like the Boeing 787 and Airbus A350. These new aircraft come equipped with next-generation nacelle systems that offer improved fuel efficiency, reduced noise levels, and better performance. As the airline industry globally and in the Middle East focuses on fleet upgrades, the demand for modern nacelle systems that can accommodate new engine designs and comply with stricter environmental regulations will continue to grow, driving the market.

Market Challenges

Certification

The certification of aircraft nacelle systems is a key challenge for manufacturers in Qatar’s market. Nacelles, which house engines and are crucial for the overall aerodynamics and safety of an aircraft, must undergo rigorous testing and certification from aviation authorities such as the Qatar Civil Aviation Authority (QCAA) and international bodies like EASA and FAA. This process ensures that nacelle systems comply with stringent safety and environmental standards, particularly concerning noise reduction, drag, and overall engine performance. The lengthy and costly certification process, which involves multiple phases of testing and regulatory approval, can delay the introduction of new nacelle technologies into the market, posing a challenge to timely innovation.

Supply Chain Complexities

Supply chain complexities are another major challenge facing the aircraft nacelle systems market in Qatar. Nacelle systems are intricate components that require the integration of numerous materials and technologies, including advanced composites and metal alloys. As a result, the manufacturing process for nacelle systems involves complex sourcing of materials, tight coordination among suppliers, and sophisticated assembly processes. Geopolitical factors and disruptions in global supply chains, as seen in recent years, can cause delays in production and increase costs. These challenges are especially relevant for Qatar’s market, as the country imports a significant portion of its aerospace components and materials, making the local nacelle manufacturing ecosystem vulnerable to global supply chain issues.

Opportunities

Digital Nacelle Solutions

One of the key opportunities in the Qatar Aircraft Nacelle Systems Market lies in the development of digital nacelle solutions. With the aviation industry increasingly adopting digital technologies, there is growing interest in the use of digital nacelle systems that enable real-time monitoring of nacelle performance. By integrating sensors and advanced data analytics into nacelle designs, manufacturers can provide airlines with predictive maintenance capabilities and insights into the health of engine components. This shift towards digitalization in nacelle systems can significantly improve operational efficiency, reduce maintenance costs, and enhance overall aircraft performance, opening up new growth avenues for manufacturers in the Qatar market.

Predictive Health Monitoring

Predictive health monitoring of nacelle systems represents a significant opportunity for growth in Qatar’s aviation market. As airlines seek to minimize downtime and maximize the efficiency of their fleets, predictive maintenance technologies are becoming increasingly important. Nacelle systems equipped with health monitoring sensors can provide real-time data on component performance and detect potential issues before they lead to failures. This proactive approach helps airlines plan maintenance schedules more effectively, reduce unscheduled repairs, and enhance the reliability of aircraft operations. Qatar’s strong focus on fleet modernization and technological adoption in aviation creates a ripe environment for the integration of predictive health monitoring solutions in nacelle systems.

Future Outlook

Over the next five years, the Qatar Aircraft Nacelle Systems market is expected to experience consistent growth, driven by technological advancements in aircraft efficiency, noise reduction, and environmental sustainability. The ongoing fleet expansion of Qatar Airways and other regional carriers, alongside increased investments in MRO facilities in the region, will continue to fuel demand for nacelle systems. Furthermore, Qatar’s strategic aviation investments, particularly in the context of its global aviation hub status, will contribute to the growth of the nacelle systems market. Advances in composite materials and the adoption of next-generation aircraft will further stimulate demand for high-performance nacelle components.

Major Players

- Safran Nacelles

- Collins Aerospace

- GKN Aerospace

- Leonardo S.p.A.

- Spirit AeroSystems

- Triumph Group

- Aernnova Aerospace

- ST Engineering Aerospace

- Nordam Group LLC

- Barnes Group Inc.

- FACC AG

- Composites Technology Research Malaysia

- Heico Aerospace

- Mitsubishi Heavy Industries Aerospace

- UTC Aerospace Systems

Key Target Audience

- Aircraft Manufacturers (OEMs)

- Aircraft Leasing Companies

- Airline Operators

- Maintenance, Repair, and Overhaul (MRO) Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (QCAA, EASA, FAA)

- Component Suppliers and Tier 1 Suppliers

- Aerospace & Aviation Industry Associations

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing a detailed ecosystem map of all stakeholders in the Qatar Aircraft Nacelle Systems market, using secondary data from industry reports and primary research from interviews with key players. This ensures comprehensive identification of the critical factors that drive market dynamics, such as technological innovations, regulatory changes, and supply chain trends.

Step 2: Market Analysis and Construction

We will collect and analyze historical market data to understand the market’s structure, including the segmentation by aircraft type and component type. This step will also involve evaluating the relationship between nacelle system supply and aircraft fleet expansion, ensuring accurate revenue projections and growth forecasts.

Step 3: Hypothesis Validation and Expert Consultation

We will validate the market hypotheses by conducting interviews with industry experts, including OEMs, MRO providers, and key suppliers in the nacelle systems supply chain. These consultations will offer deeper insights into operational and financial factors impacting the market’s growth trajectory.

Step 4: Research Synthesis and Final Output

In the final phase, we will refine and consolidate the data through additional interviews with manufacturers and stakeholders, ensuring that all insights and statistics align with market realities. This phase involves synthesizing collected information into actionable insights for clients, enabling informed strategic decision-making.

- Executive Summary

- Research Methodology (Market Definitions (Nacelle Systems, Engine Build‑Up Units, Thrust Reversers), Abbreviations & Technical Terms, Qatar Macro Inputs (Aviation Traffic, ASKs, Fleet Age, National Budget Allocations), Market Sizing Approach (Top‑Down, Bottom‑Up, Supply Chain Demand Mapping), Primary Research Protocol (OEMs, Airlines, MROs, Regulatory Bodies), Limitations & Risk Controls)

- Historical Market Genesis & Milestones

- Qatar Aerospace Ecosystem Linkages

- Regulatory & Certification Landscape (QCAA, EASA/FAA Reciprocity)

- Supply Chain Network Mapping (Local vs Imports, Logistics Cost Dynamics)

- Growth Drivers

Fuel Efficiency Goals

Fleet Modernization - Market Challenges

Certification

Supply Chain Complexities - Opportunities

Digital Nacelle Solutions

Predictive Health Monitoring - Industry Trends

Lightweight Structures

Noise/Efficiency Innovation - Regulatory Framework

Safety, Emissions

Noise Standards - Value Chain Dynamics

Tier Networks

Local MRO Influence

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Component Type (In Value %)

Engine Nacelle

Inlet Cowl (Aerodynamic Performance Demand Index)

Fan Cowl (Thermal Optimization Demand)

Thrust Reverser (Deceleration System Demand)

Exhaust System (Noise & Emissions Compliance)

Engine Build‑Up Units (EBU) - By Aircraft Type (In Value %)

Commercial Narrowbody

Commercial Widebody

Business & Corporate Jets

Military Aviation - By Engine Architecture (In Value %)

Turbofan

Turboprop

Turboshaft - By End‑User (In Value %)

OEM Demand Patterns

Aftermarket & Spare Exchanges

MRO & Overhaul Activities

Aircraft Leasing Fleet Demand

- Market Shares by Value & Volume (Local + Gulf Demand)

- Cross‑Comparison Parameters (Company Positioning, Overview, Product Portfolio Depth, Technology Leadership, Material Capabilities, Regional Footprint, Certification Strength, Aftermarket Support, MRO Partnerships)

Competitive SWOT Benchmarks - Pricing & Contract Practices (OEM vs Aftermarket Qatar)

- Strategic Positioning Maps

- Detailed Company Profiles

Safran Nacelles

Collins Aerospace (RTX)

Spirit AeroSystems

GKN Aerospace

Leonardo S.p.A.

Nexcelle (CFM/Safran JV)

Triumph Group

Aernnova Aerospace

ST Engineering Aerospace

Nordam Group LLC

Barnes Group Inc.

FACC AG

Composites Technology Research Malaysia

Heico Aerospace (EBU Focus)

Mitsubishi Heavy Industries Aerospace

- OEM Decision Drivers

- Aftermarket Buyer Insights (Turnaround Times, Reliability Metrics)

- Qatar Airline Fleet Procurement Preferences

- Budget Constraint & Fleet Renewal Cycles

- Pain Points & Purchase Process

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035