Market Overview

The Qatar Aircraft Paint Market is a vital component of the broader aerospace and aviation services sector, reflecting significant growth due to the country’s strategic position as a global aviation hub. The market is primarily driven by demand from Qatar Airways, which is known for its large fleet size and frequent aircraft repainting cycles to maintain brand identity and ensure compliance with safety and regulatory standards. Additionally, the market is supported by ongoing MRO (Maintenance, Repair, and Overhaul) activities at Qatar’s dedicated aerospace facilities, bolstered by the country’s investments in aerospace infrastructure. In 2025, the market size was estimated at approximately USD ~ million, driven by increasing passenger traffic, new aircraft acquisitions, and the need for regular aircraft painting services.

Qatar’s aircraft paint market is dominated by its capital city, Doha, which houses the headquarters of Qatar Airways and serves as a key aviation center in the Middle East. Doha’s strategic location at the crossroads of Asia, Europe, and Africa positions it as a critical hub for international airlines, fueling high demand for aircraft painting services. Additionally, the city’s investment in state-of-the-art aerospace infrastructure, such as the Qatar Airways Maintenance Facility, further cements its dominance. The country’s strong regulatory environment, combined with continuous fleet expansion by Qatar Airways, drives significant demand for painting and coating services within the region.

Market Segmentation

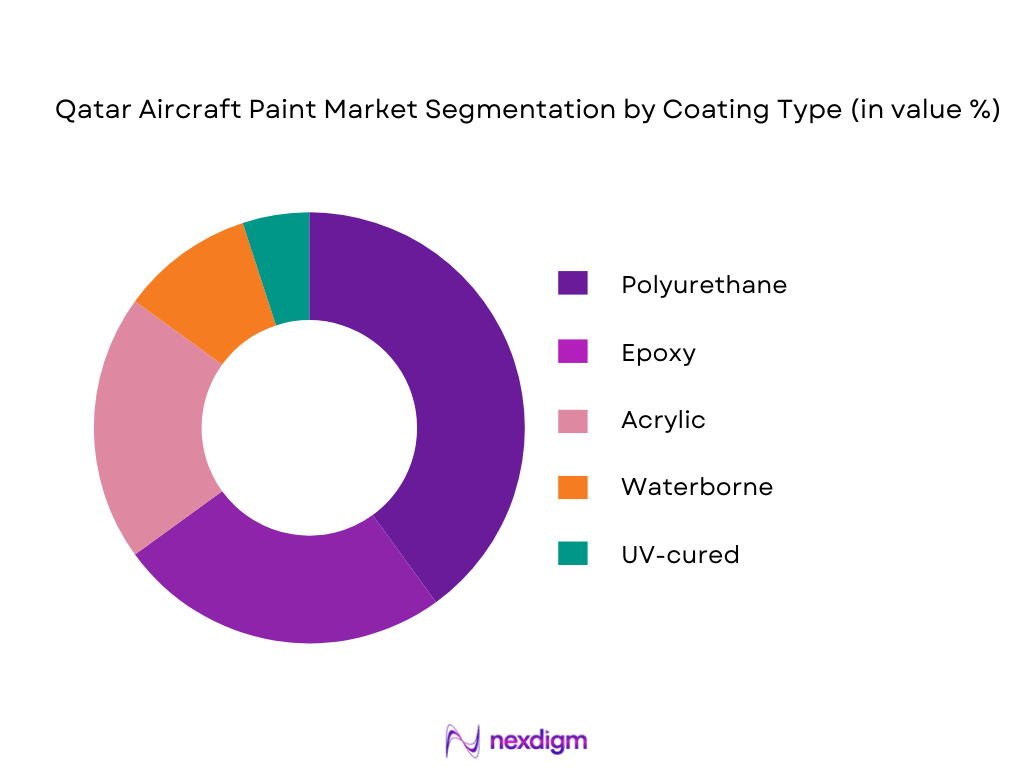

By Coating Type

The Qatar Aircraft Paint Market is segmented by the type of coating used, including polyurethane, epoxy, acrylic, waterborne, and UV-cured coatings. Among these, polyurethane coatings dominate the market due to their durability and ability to withstand extreme temperatures and environmental conditions. The need for lightweight, durable coatings to reduce aircraft fuel consumption has led to increased adoption of polyurethane, particularly for long-haul commercial aircraft used by carriers like Qatar Airways. This segment continues to thrive due to advancements in coating technology, focusing on improving corrosion resistance and environmental compliance.

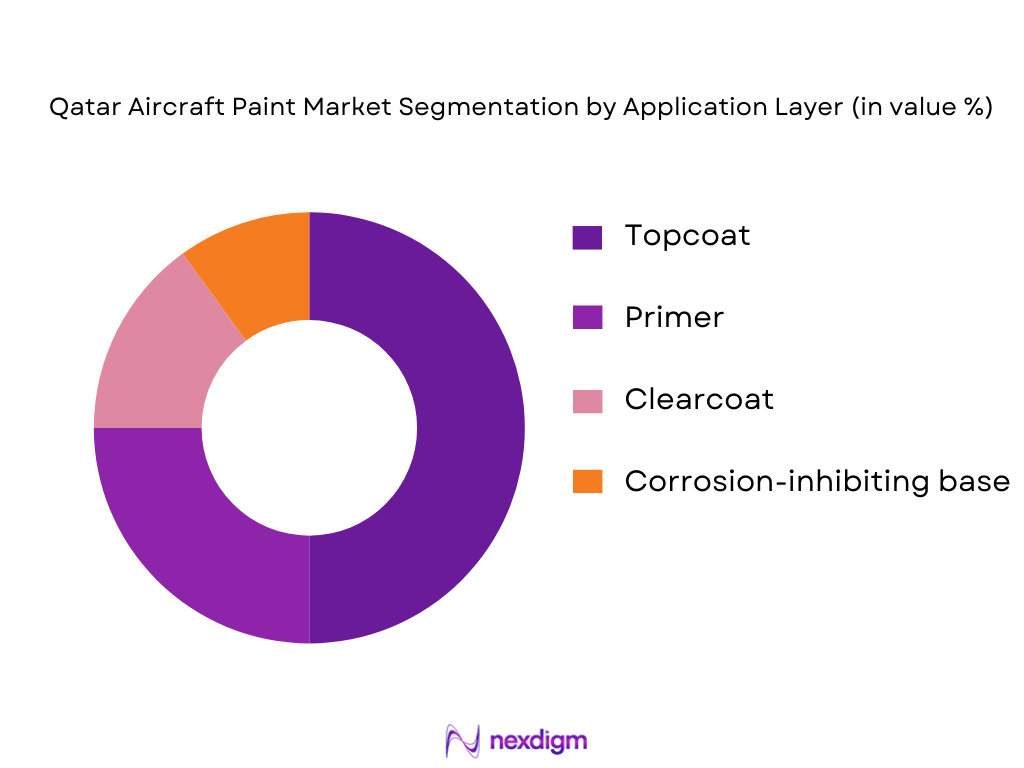

By Application Layer

The Qatar Aircraft Paint Market is also segmented by the application layer, including primer, topcoat, clearcoat, and corrosion-inhibiting base layers. Topcoats hold the largest market share, largely due to their essential role in protecting aircraft exteriors from environmental damage, such as UV radiation and corrosion. Airlines like Qatar Airways and other regional carriers demand top-quality topcoats to maintain the aesthetic appearance of their fleets, which contributes significantly to their brand identity. This segment has witnessed growth driven by the push for more sustainable and efficient coatings with reduced environmental impact.

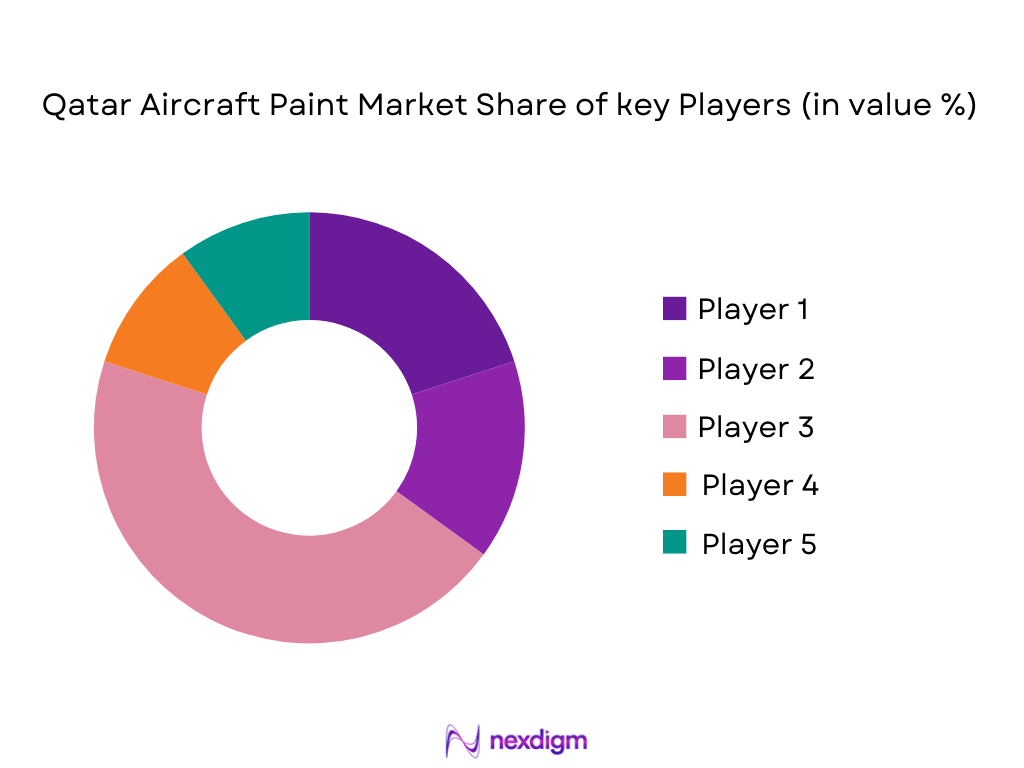

Competitive Landscape

The Qatar Aircraft Paint Market is highly competitive, dominated by both regional and international players who provide a range of coatings and MRO services. The market is concentrated, with a few key players holding a substantial share due to their established track records and brand loyalty in the aviation sector.

| Company Name | Establishment Year | Headquarters | Annual Revenue | Market Share | Fleet Repaint Services | Certification (FAA/EASA/QCAA) | R&D Investment |

| PPG Industries | 1883 | Pittsburgh, USA | ~ | ~ | ~ | ~ | ~ |

| Akzo Nobel | 1646 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Sherwin-Williams | 1866 | Cleveland, USA | ~ | ~ | ~ | ~ | ~ |

| Mankiewicz | 1895 | Hamburg, Germany | ~ | ~ | ~ | ~ | ~ |

| Hempel | 1915 | Kgs. Lyngby, Denmark | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Paint Market Analysis

Growth Drivers

Expansion of Qatar Airways Fleet & Repaint Frequency

The expansion of Qatar Airways’ fleet is a major driver for the Qatar Aircraft Paint Market. With the airline continuously growing its fleet, including acquiring new aircraft such as the Boeing 787 and Airbus A350, there is a corresponding increase in the need for high-quality paint and coatings for new aircraft and regular repaints. Aircraft repainting is an essential part of fleet maintenance, ensuring not only aesthetic appeal but also protecting the aircraft from corrosion and environmental elements. With Qatar Airways consistently modernizing its fleet, the frequency of repainting for aircraft in service also increases, thereby driving demand for aircraft coatings and paints.

Rising MRO Demand from GCC Carriers

Maintenance, Repair, and Overhaul (MRO) demand in the GCC region is a significant driver for Qatar’s aircraft paint market. As major airlines across the GCC, including Emirates, Etihad, and Qatar Airways, expand their fleets, the need for MRO services, including aircraft repainting, grows. Qatar’s strategic location in the Middle East makes it a key hub for regional and international MRO services. The increasing number of aircraft in service, along with the growing importance of regular maintenance, creates a steady demand for high-quality coatings that can withstand the harsh Middle Eastern climate and enhance aircraft durability.

Market Restraints

Raw Material Price Volatility

One of the major restraints in the Qatar Aircraft Paint Market is the volatility in raw material prices. Aircraft paints require specialized chemicals, resins, and pigments, which are subject to price fluctuations due to supply chain disruptions, global demand, and economic factors. The volatility in raw material costs can directly impact the price of aircraft coatings, leading to increased production costs for manufacturers and, consequently, higher costs for airlines and MRO providers. This price volatility can make it challenging for businesses to maintain profitability, especially in a market that relies on precise and consistent coatings for aircraft performance.

Skilled Coating Labor Scarcity

The scarcity of skilled labor for aircraft painting and coating processes is a significant restraint in the market. Properly applying and maintaining aircraft coatings requires specialized expertise and training to ensure safety and regulatory compliance. The demand for skilled labor in the GCC region is high, but the availability of trained professionals in aircraft coatings is limited. This labor shortage poses challenges for MRO providers and manufacturers in meeting the growing demand for aircraft repainting services. Additionally, the training and certification processes for skilled coating professionals require time and resources, further complicating workforce expansion.

Opportunity Landscape

MRO Digital Paint Process Optimization

The adoption of digital technologies in the aircraft MRO sector presents a significant opportunity for optimizing the aircraft paint process. Digital paint process optimization, which includes automation, advanced inspection systems, and data analytics, can improve efficiency, reduce waste, and enhance coating quality. By integrating digital technologies, MRO providers can streamline paint application, minimize turnaround time, and improve the consistency of coatings applied to aircraft. This opportunity is particularly relevant as MRO providers in Qatar and the GCC region continue to invest in digital solutions to meet the growing demand for quick and efficient maintenance services.

EV & Sustainable Coating Formulations

As sustainability becomes an increasingly important focus for the aviation industry, there is growing interest in environmentally friendly and sustainable coating formulations. The rise of electric aircraft (EV) and a broader industry trend towards sustainable practices have opened new opportunities for the aircraft paint market in Qatar. Coatings that are less harmful to the environment, with reduced volatile organic compounds (VOCs) and improved recyclability, are gaining popularity. Manufacturers are increasingly focusing on developing coatings that meet both performance standards and environmental regulations, positioning the market to benefit from the growing demand for sustainable aviation technologies. This trend also aligns with global efforts to reduce carbon footprints and meet environmental goals.

Future Outlook

Over the next five years, the Qatar Aircraft Paint Market is expected to grow steadily, driven by Qatar’s robust airline industry, expansion of its fleet, and ongoing demand for repainting and maintenance services. Continuous innovations in coating technologies, such as eco-friendly formulations and lightweight solutions, are anticipated to further bolster market growth. Additionally, the region’s increasing focus on sustainability and compliance with international aviation safety standards will contribute to the expansion of more environmentally friendly aircraft paints.

The ongoing investments in the aerospace infrastructure of Qatar, particularly at Hamad International Airport and through joint ventures like the Qatar Airways-Satys partnership, will play a crucial role in reinforcing Qatar’s dominant position in the regional MRO and aircraft paint services market.

Major Players in the Market

- PPG Industries

- Akzo Nobel

- Sherwin-Williams

- Mankiewicz

- Hempel

- Jotun

- Nippon Paint Holdings

- BASF Coatings GmbH

- IHI Ionbond AG

- Chemetall

- International Aerospace Coatings

- Airmark

- Fluorochem

- A&D Technology

- Global Coatings

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Civil Aviation Authority, EASA, FAA)

- Airline Operations and Management (Qatar Airways, Gulf Air, Emirates)

- Aerospace OEMs

- MRO Facilities and Service Providers

- Aircraft Maintenance and Coating Specialists

- Coatings Manufacturers

- Aerospace Research & Development Teams

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders within the Qatar Aircraft Paint Market. Secondary research using publicly available data from industry reports, government publications, and company disclosures is conducted to identify relevant market variables. These variables include demand drivers, key players, and regulatory factors.

Step 2: Market Analysis and Construction

In this phase, historical data for Qatar’s aircraft paint market is analyzed to determine the market’s current size and forecasted growth. Market penetration rates and service provider engagement are reviewed to understand growth patterns. This phase also includes the analysis of product offerings and pricing models.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted through structured interviews with industry professionals such as MRO specialists, aircraft manufacturers, and coatings suppliers. These interviews help validate the market assumptions and provide deeper insights into operational and financial conditions.

Step 4: Research Synthesis and Final Output

The final phase synthesizes findings from all previous steps, integrating expert feedback and operational insights to form a cohesive market report. The comprehensive data gathered will be used to deliver actionable insights for stakeholders, ensuring that the final analysis is accurate, thorough, and reflective of current and future trends in the market.

- Executive Summary

- Research Methodology (Market Definitions & Technical Terms (e.g., dry film thickness (DFT), VOC limits), Data Sources (Civil aviation authorities, Qatar MRO facilities, OEM supply agreements), Research Assumptions (fleet repaint cycles, aircraft types mix, MRO throughput), Qatar Aircraft Paint Ecosystem Mapping, Limitations & Confidence Levels)

- Qatar Aviation Sector Overview

- Qatar Air Traffic Growth & Fleet Size Trends (demand platform)

- National Defense & Business Aviation Repainting Activities

- Aircraft Painting Service Infrastructure Landscape

- Strategic Initiatives (e.g., Qatar Airways – Satys JV advanced painting facility)

- Qatar MRO Industry Positioning in the Middle East

- Value Chain & Supply Network Specifics (local vs imported coatings)

- Growth Drivers

Expansion of Qatar Airways Fleet & Repaint Frequency

Rising MRO Demand from GCC Carriers

Premium Coating Adoption (Lightweight, Low VOC, Heat Reflective)

Regulatory & Environmental Painting Standards

- Market Restraints

Raw Material Price Volatility

Skilled Coating Labor Scarcity

- Opportunity Landscape

MRO Digital Paint Process Optimization

EV & Sustainable Coating Formulations

JV and Facility‑Level Capacity Expansion

- Technical & Regulatory Framework

Aviation Coating Product Standards (FAA/EASA)

Qatar Civil Aviation QCAA Requirements

Environmental & VOC Limits

Certification & Compliance Cycles

- Porter’s Five Forces

Supplier Power (Resin, pigment, thinner sources)

Buyer Power (Airlines/MRO negotiation dynamics)

Competitive Rivalry

Threat of Substitution (Alternate surface protection technologies)

Barriers to Entry

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Coating Type (In Value %)

Polyurethane

Epoxy

Acrylic

Waterborne

UV‑cured

- By Application Layer (In Value %)

Primer

Topcoat

Clearcoat

Corrosion‑Inhibiting Base

- By Aircraft Type (In Value %)

Commercial Jets

Wide‑body

Narrow‑body

Business Jets

Helicopters - By End User (In Value %)

OEM Coating

MRO Repainting Services

Component Suppliers - By Certification Standard (In Value %)

FAA

EASA

GCAA/QCAA

Aviation Paint Standards

- Market Share Analysis

- Competitive Positioning Matrix

- Cross‑Comparison Parameters ( Product Portfolio Breadth (Aircraft coating types offered), Certification Coverage (FAA, EASA, QCAA approvals), Application Facility Footprint (Qatar & MEA), Technical Service Support Network, Coating Lifecycle Performance Metrics (corrosion resistance, fuel drag impact), Supply Chain Integration Strength (local distribution), Pricing, Strategy & TCO Positioning, Innovation Intensity (R&D spend in aerospace coatings))

- Company Profiles

Akzo Nobel N.V. (Aerospace Coatings)

PPG Industries, Inc.

Sherwin‑Williams Aerospace

Nippon Paint Holdings Co., Ltd

Hempel A/S (Aerospace Division

Jotun Aerospace Coatings

Satys Aerospace Services

IHI Ionbond AG

Mankiewicz Gebr. & Co.

Chemetall (Basf Coatings GmbH)

Nycote Laboratories Corporation

HMG Aerospace

Mapaero Inc.

Resoltech (Aero Coatings)

Zircotec Ltd.

- OEM Paint Application Demand

- MRO Paint Application Demand

- Commercial Airlines

- Cargo Airlines

- Government & Military Aviation

- Business & Private Aviation

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035