Market Overview

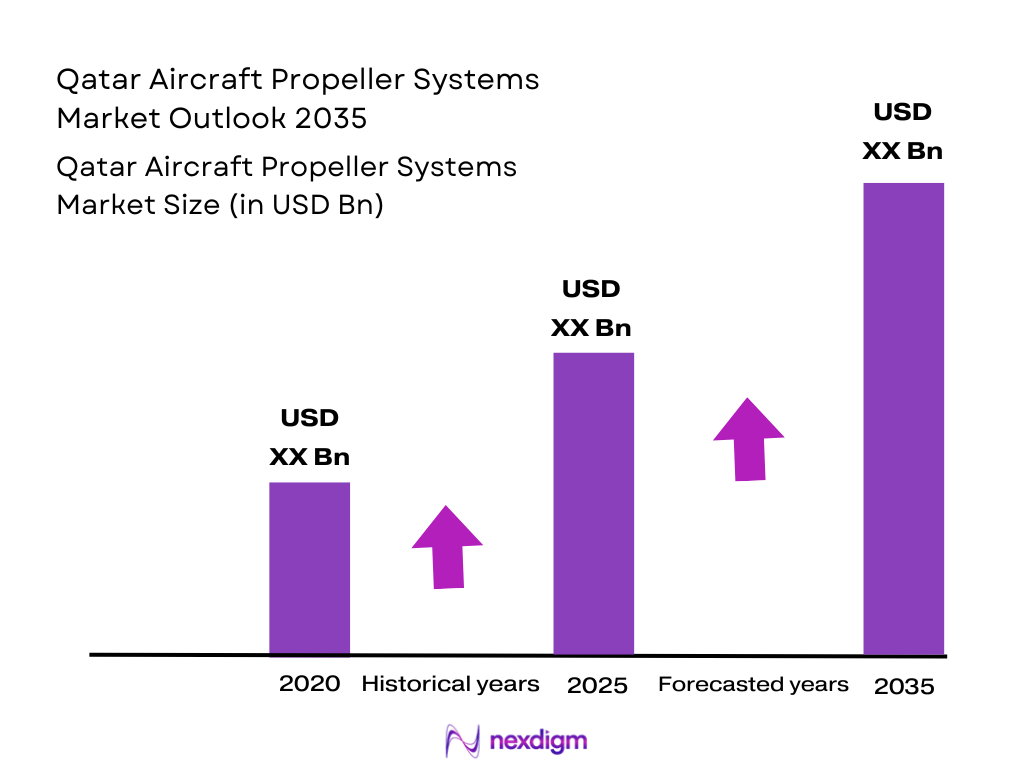

The Qatar Aircraft Propeller Systems market is valued at approximately USD ~ million in 2024. The growth of this market is primarily driven by the increasing demand for turboprop aircraft and UAVs (Unmanned Aerial Vehicles), along with the rise in air connectivity and infrastructure development in Qatar. The growing investments in military and defense sectors further fuel the demand for specialized propeller systems in military aviation. Additionally, the adoption of advanced materials like carbon composites and aluminum alloys, along with continuous innovations in propeller blade technologies, is contributing to the growth of the market. As Qatar modernizes its aviation infrastructure and increases its regional connectivity, the propeller systems market is expected to witness steady growth.

Qatar is a dominant player in the regional aircraft propeller systems market, mainly due to its rapidly expanding aviation sector and strategic geographical location as a global travel hub. Doha, as the capital and major economic center, serves as the focal point for Qatar Airways’ operations, which includes a wide fleet of turboprop aircraft, driving the demand for propeller systems. Additionally, the country’s growing defense procurement and investments in local aerospace manufacturing make it an essential player in the GCC region’s aircraft systems market. Qatar’s proximity to key defense bases and its strategic focus on technological advancements in aviation further contribute to its leadership in this sector.

Market Segmentation

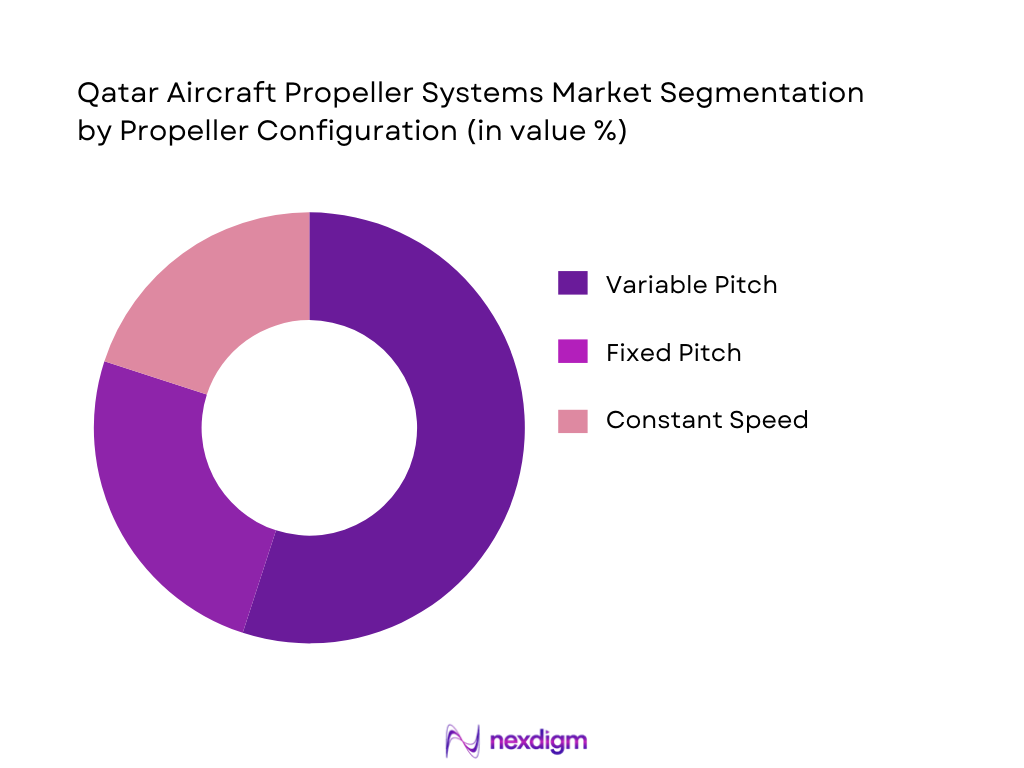

By Propeller Configuration

The Qatar Aircraft Propeller Systems market is segmented by propeller configuration into variable pitch, fixed pitch, and constant speed systems. Among these, variable pitch propellers dominate the market due to their superior performance and fuel efficiency. Variable pitch systems allow for optimal performance adjustments during flight, which enhance fuel efficiency and operational cost savings. This configuration is especially favored in turboprop aircraft, which are extensively used by Qatar’s regional operators and military forces. Furthermore, the ability to adjust the propeller pitch to different flight conditions is a crucial factor in improving aircraft range and speed.

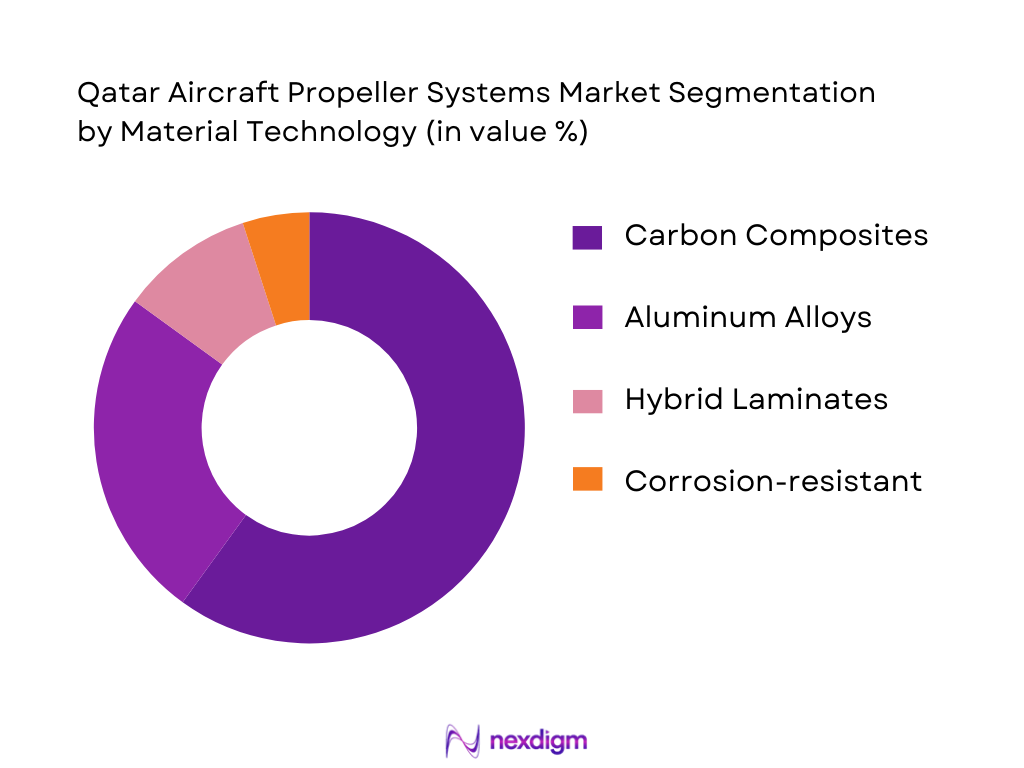

By Material Technology

The segment of material technology in the Qatar Aircraft Propeller Systems market includes carbon composites, aluminum alloys, hybrid laminates, and corrosion-resistant coatings. Carbon composites hold a dominant share in this market due to their lightweight nature, which significantly enhances fuel efficiency and reduces wear and tear. Qatar’s increasing focus on reducing carbon emissions in aviation, paired with global trends towards adopting sustainable materials, makes carbon composite propellers the preferred choice. These materials also offer better resistance to corrosion, which is vital for aircraft operating in Qatar’s hot and humid climate, contributing to their market dominance.

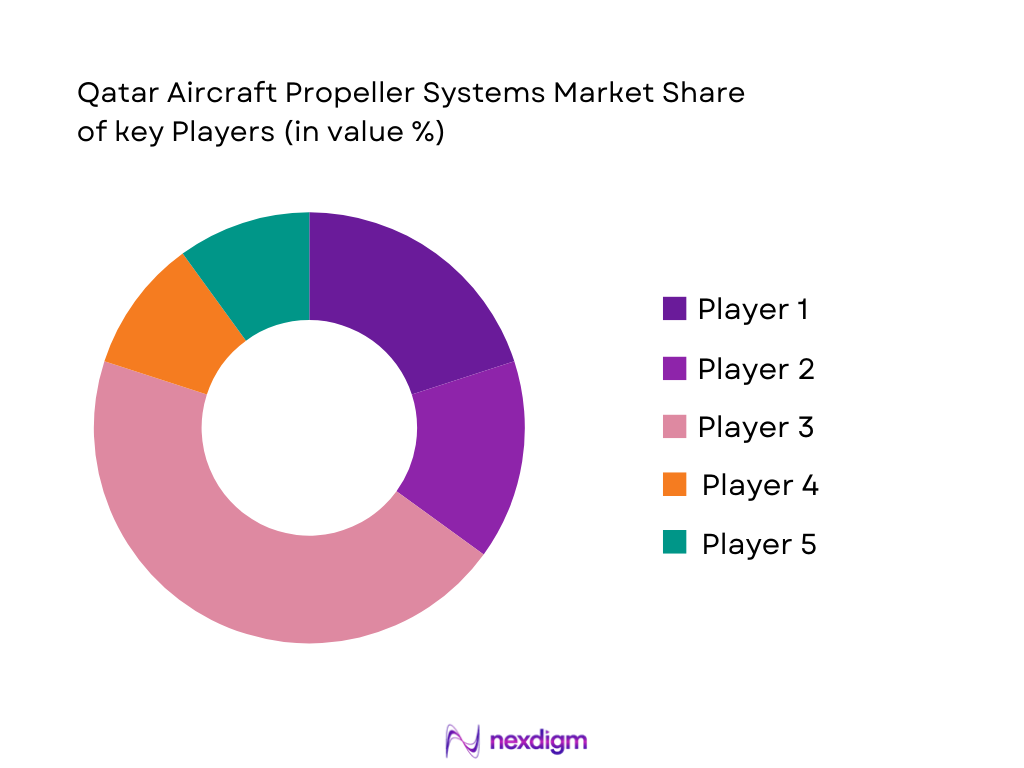

Competitive Landscape

The competitive landscape of the Qatar Aircraft Propeller Systems market is characterized by the presence of both global players and regional companies. The market is primarily dominated by key international manufacturers such as Hartzell Propeller, McCauley, and MT-Propeller. These companies hold a significant market share due to their established reputation, extensive product portfolios, and technological expertise. Regional players like Gulf Aerospace Components also contribute to the competitive dynamic, offering specialized services and products tailored to the unique demands of the Middle East.

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Manufacturing Capacity | Key Regional Clients |

| Hartzell Propeller | 1917 | United States | ~ | ~ | ~ | ~ |

| McCauley Propeller | 1937 | United States | ~ | ~ | ~ | ~ |

| MT-Propeller | 1980 | Germany | ~ | ~ | ~ | ~ |

| Gulf Aerospace Components | 2005 | Qatar | ~ | ~ | ~ | ~ |

| Sensenich Propeller | 1932 | United States | ~ | ~ | ~ | ~ |

Qatar Aircraft Propeller Systems Market Analysis

Growth Drivers

Emission Compliance

The Qatar Aircraft Propeller Systems Market is experiencing growth due to the increased focus on emission compliance within the aviation industry. Qatar, as part of its commitment to sustainability and environmental responsibility, is aligned with global aviation regulatory bodies like ICAO, which have set stringent standards for reducing carbon emissions. Aircraft propeller systems are being developed to optimize fuel efficiency, thereby reducing carbon footprints. Propeller technology advancements, such as the development of lighter materials and more efficient designs, help airlines meet emission regulations while improving operational performance, thereby driving the demand for modern, compliant propeller systems.

Connectivity

The increasing importance of connectivity in modern aviation is also driving growth in the Qatar Aircraft Propeller Systems Market. As both commercial and defense aircraft increasingly rely on sophisticated electronic systems for navigation, communication, and operational efficiency, propeller systems must be optimized for integration with these advanced technologies. Qatar Airways and other regional airlines are investing in fleets equipped with advanced avionics and propulsion systems, which require highly efficient and reliable propellers. Enhanced connectivity also supports real-time performance monitoring, allowing for predictive maintenance and improved operational efficiency, further boosting the demand for advanced propeller systems in the region.

Market Restraints

Certification Costs

One of the key challenges in the Qatar Aircraft Propeller Systems Market is the high cost of certification. Propeller systems must meet rigorous safety, performance, and environmental standards set by aviation regulatory bodies such as the Qatar Civil Aviation Authority (QCAA), EASA, and the FAA. The certification process for propeller systems involves extensive testing, including vibration, fatigue, and material performance trials, which require substantial investment. These certification costs add a layer of financial burden to manufacturers, limiting the speed at which new technologies can be introduced to the market. The complex regulatory landscape also increases the time and cost involved in bringing propeller systems to market, posing a restraint to market growth.

Supplier Risks

Supplier risks are another significant restraint for the Qatar Aircraft Propeller Systems Market. The market relies on a limited number of specialized suppliers for critical components, such as propeller blades, hubs, and control systems. Any disruptions in the supply chain, whether due to geopolitical factors, raw material shortages, or quality control issues, can lead to delays in production and increased costs. Moreover, fluctuations in raw material prices for high-performance metals and composites used in propellers can impact the overall cost structure for manufacturers. Such supplier risks can hinder manufacturers’ ability to meet growing demand efficiently, thus limiting market growth.

Opportunities

MRO Hub

Qatar’s position as a leading regional Maintenance, Repair, and Overhaul (MRO) hub presents a significant opportunity for the Aircraft Propeller Systems Market. The country’s growing aviation industry and its strategic location between Europe, Asia, and Africa make it an ideal base for MRO services. With airlines such as Qatar Airways expanding their fleets and operating a diverse range of aircraft, the demand for MRO services, including propeller maintenance and replacement, continues to rise. The country’s investments in infrastructure, including state-of-the-art MRO facilities, create an environment where propeller system manufacturers can tap into a robust aftermarket service market, driving demand for replacement parts, repairs, and upgrades.

UAV Propulsion

The increasing demand for Unmanned Aerial Vehicles (UAVs) in both military and commercial sectors presents a significant growth opportunity for the Qatar Aircraft Propeller Systems Market. UAVs require specialized propulsion systems, including advanced propellers, for their operations. As Qatar looks to diversify its aerospace industry and strengthen its defense capabilities, the demand for UAVs and related propulsion technologies is expected to grow. Propeller systems designed for UAVs offer a unique opportunity for manufacturers to develop lighter, more efficient solutions tailored to the specific needs of unmanned aircraft, thus opening up a new and expanding market segment in the region.

Future Outlook

Over the next 5 years, the Qatar Aircraft Propeller Systems market is expected to grow significantly, driven by continuous investments in aviation infrastructure, regional connectivity, and defense modernization programs. The country’s strategic focus on expanding its domestic aircraft fleet, coupled with an increasing number of regional and international flights, is poised to enhance the demand for advanced propeller systems. Additionally, innovations in lightweight materials and more efficient technologies for propellers are expected to further boost market growth. Qatar’s defense procurement will also continue to drive demand for specialized military aircraft propellers, contributing to the sustained growth of the market.

Major Players in the Market

- Hartzell Propeller

- McCauley Propeller

- MT-Propeller

- Gulf Aerospace Components

- Sensenich Propeller

- Dowty Propellers

- Ratier-Figeac

- Hoffmann Propeller

- Woodward, Inc.

- AeroTech Propulsion Systems

- Prince Aviation Propellers

- Duke Helicopter Systems

- Al-Faisal Group

- Unilever Aerospace

- Gulf Oil Industries

Key Target Audience

- Aviation OEMs (Original Equipment Manufacturers)

- Military and Defense Agencies (Qatar Ministry of Defense, Qatar Armed Forces)

- Airline Operators (Qatar Airways, Gulf Air)

- Aerospace and Aviation Component Manufacturers

- Aircraft MRO Providers (Maintenance, Repair, Overhaul)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Civil Aviation Authority, GCC Aerospace Authorities)

- Defense Contractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves conducting a thorough market analysis to identify the key stakeholders and operational parameters within the Qatar Aircraft Propeller Systems Market. This step is supported by secondary research from proprietary industry databases and expert interviews, providing an accurate mapping of the key market drivers.

Step 2: Market Analysis and Construction

In this phase, historical data is reviewed to establish a baseline for market penetration and growth. The analysis considers various configurations of propellers, material technologies, and regional demand trends, focusing on understanding the performance drivers and barriers to market expansion.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through expert consultations with industry practitioners, OEM representatives, and MRO providers. These interviews offer insights into current and future market trends, enabling more accurate forecasts and a comprehensive understanding of the market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves validating the synthesized data through additional consultations with key manufacturers, government agencies, and procurement officers. This ensures a robust and reliable market report that can provide actionable insights for industry stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions (Propeller System Configurations, Aircraft Categories, OEM vs Aftermarket), Abbreviations and Conversion Metrics, Primary Research Framework (Industry Experts, Regional Air Carriers, Defense Procurement), Limitations and Future Analytical Scope)

- Definition and Scope

- Aviation Industry Context in Qatar

- Regional Ecosystem – GCC Aerospace Dynamics and Qatar’s Strategic Position

- Historical Adoption Trends in Propeller Technologies

- Value Chain and Supply Chain Analysis (Local, Regional, Global Tier Suppliers)

- System Integration Standards (Certification Metrics, EASA/FAA/CAA Qatar)

- Aircraft Operational Performance Benchmarks

- Growth Drivers

Aviation Fuel Efficiency

Emission Compliance

Connectivity - Market Restraints

Certification Costs

Supplier Risks

Workforce - Opportunities

MRO Hub

UAV Propulsion

Composites - Market Trends

Smart Systems

Digital Twin

Predictive Maintenance - Regulatory Dynamics

QCAA

International Standards - SWOT Analysis

- Porter’s Forces

- Ecosystem Mapping

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Propeller Configuration (In Value %)

Variable Pitch

Fixed Pitch

Constant Speed

Feathering Systems

Composite VS Metal - By Material Technology (In Value %)

Carbon Composite

Aluminum Alloys

Hybrid Laminate

Corrosion‑Resistant Coatings - By End‑Use Application (In Value %)

Commercial Turboprop Operators

Military Aviation Fleets

General Aviation

UAV / Remotely Piloted Aircraft

Special Mission Platforms - By Distribution Channel (In Value %)

Original Equipment Manufacturer

Aftermarket Services and Upgrades

MRO Specialists - By Propeller Blade Count (In Value %)

Two‑Blade

Three‑Blade

Four‑Blade, Five‑Plus Blade

- Market Share Analysis – By Revenue and Units

- Cross‑Comparison Parameters (Company Overview, Product Portfolio Breadth, Certification Ratings, R&D Investment in Propulsion Efficiency, Regional Supply Network, Aftermarket Service Footprint, Quality & Reliability Metrics, Installed Base Scale)

- SWOT of Key Players (Market Position Strength & Strategic Gaps)

- Pricing & Configuration Benchmarking

- Profiles of Major Competitors

Hartzell Propeller Inc (US)

McCauley Propeller Systems, Inc (US)

MT‑Propeller Entwicklung GmbH (DE)

Dowty Propellers Limited (UK)

Hoffmann Propeller GmbH (DE)

Ratier‑Figeac SAS (FR)

Sensenich Propeller Manufacturing Co (US)

Duc Hélices (FR)

Prince Aviation Propellers (US)

Woodward, Inc (US)

AeroTech Propulsion Systems (Regional Supplier)

Gulf Aerospace Components (GCC Service Provider)

Qatar Aircraft Components Services (Local MRO)

Airborne Systems & Technologies FZCO (MEA Player)

Advanced Propulsion & Efficiency Solutions

- Demand & Utilization Patterns (Scheduled Carriers, Charter Operators)

- Budget Allocation & Procurement Cycles (Defense vs Civil)

- Operational Needs & Performance Pain Points

- Decision‑Making Frameworks (Spec Compliance, Lifecycle Cost Targets)

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035