Market Overview

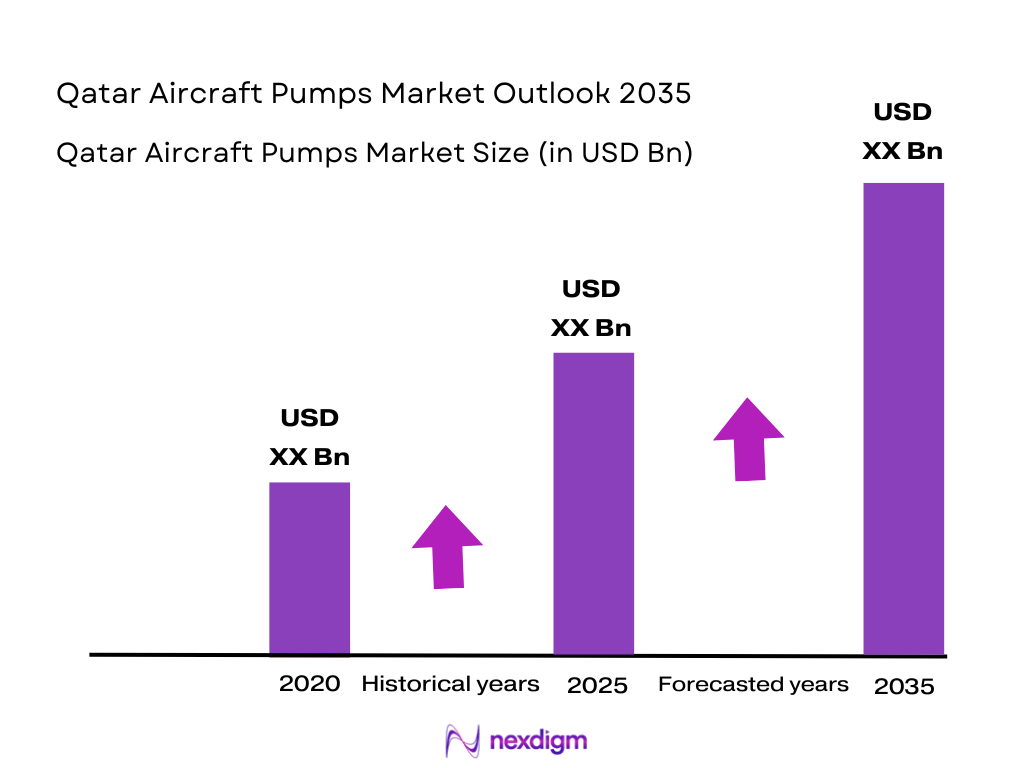

The Qatar Aircraft Pumps Market is valued at USD ~ million, driven by factors such as Qatar’s strong aviation growth, the expansion of Hamad International Airport (HIA), and the increase in commercial and defense aviation operations. A significant portion of the market is propelled by the demand for fuel, hydraulic, and lubrication pumps, necessary for aircraft functionality. Aircraft pump suppliers benefit from high demand, primarily fueled by Qatar Airways’ extensive fleet expansion and ongoing airport infrastructure investments. This growing demand for pumps is expected to increase with rising air traffic and a fleet modernization drive.

Qatar is a dominant player in the aviation market due to the substantial investments made in airport infrastructure, such as the HIA, and Qatar Airways’ international expansion. The country’s strategic location as a hub for the Middle East and its aggressive growth in aviation services have positioned it as a market leader. Moreover, government policies, including favorable regulations for the aviation sector, play a crucial role in ensuring the market’s dominance. The aviation sector in Qatar is expected to continue its upward trajectory, consolidating its position as a global aviation hub.

Market Segmentation

By Pump Type

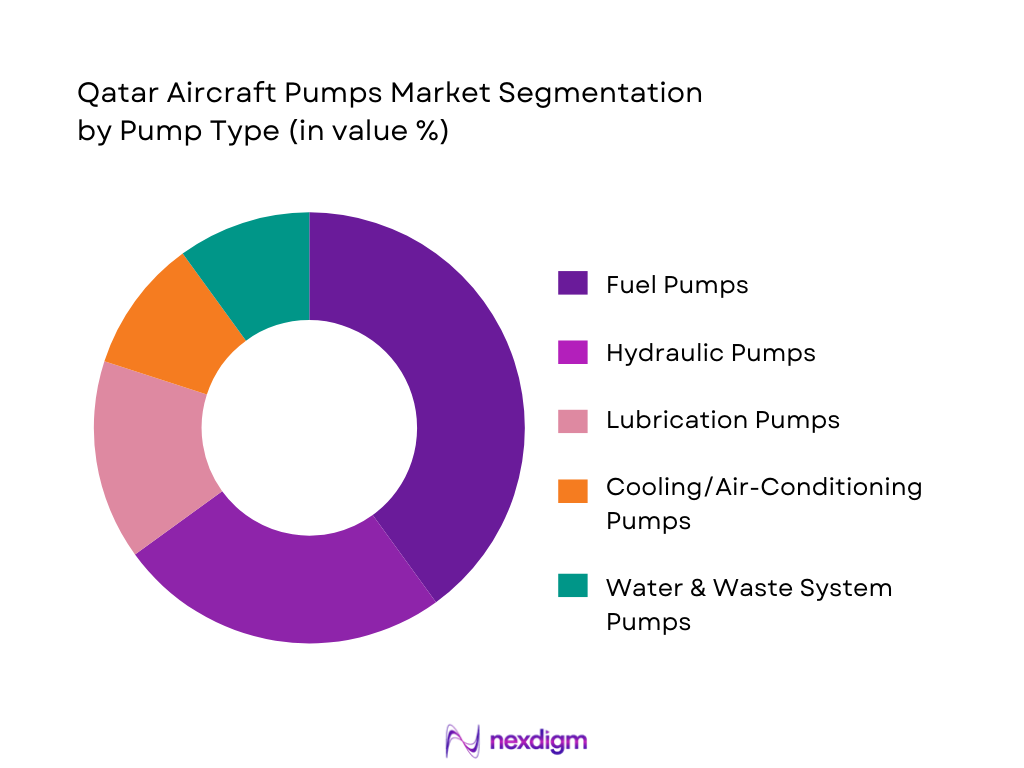

The Qatar Aircraft Pumps Market is segmented by pump type into fuel pumps, hydraulic pumps, lubrication pumps, cooling/air-conditioning pumps, and water & waste system pumps. Among these, fuel pumps dominate the market share due to their essential role in the operations of both commercial and military aircraft. Fuel pumps, especially for jet fuel, experience constant demand driven by the growing fleet size of Qatar Airways and the military sector’s need for specialized fuel delivery systems. The global demand for fuel-efficient and reliable fuel pump systems is further enhanced by Qatar’s leadership in energy-efficient aviation operations.

By Technology

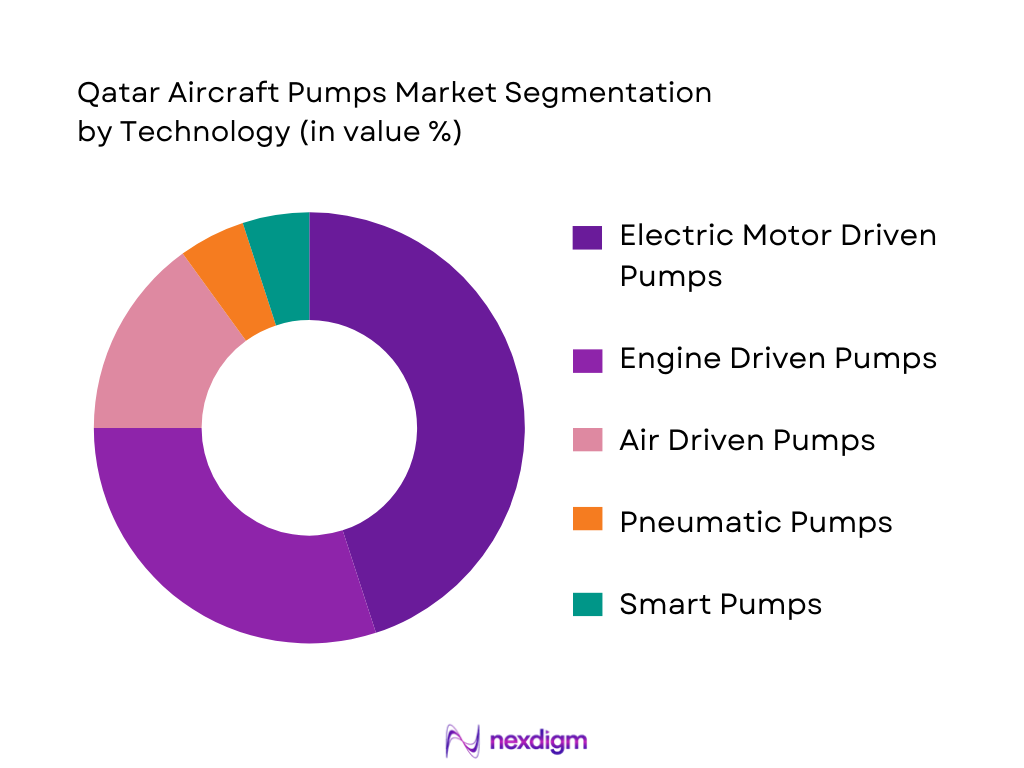

In the technology segment, Qatar’s aircraft pumps are primarily driven by electric motor-driven pumps, engine-driven pumps, and air-driven systems. Electric motor-driven pumps are leading due to their energy efficiency, integration with modern aircraft systems, and the trend toward electric propulsion in the aerospace industry. As more aircraft incorporate smart technologies, the use of electric pumps is expected to rise. Electric motor-driven pumps are especially prevalent in commercial aircraft fleets, with Qatar Airways investing in next-generation airframes that optimize fuel efficiency and reduce operational costs.

Competitive Landscape

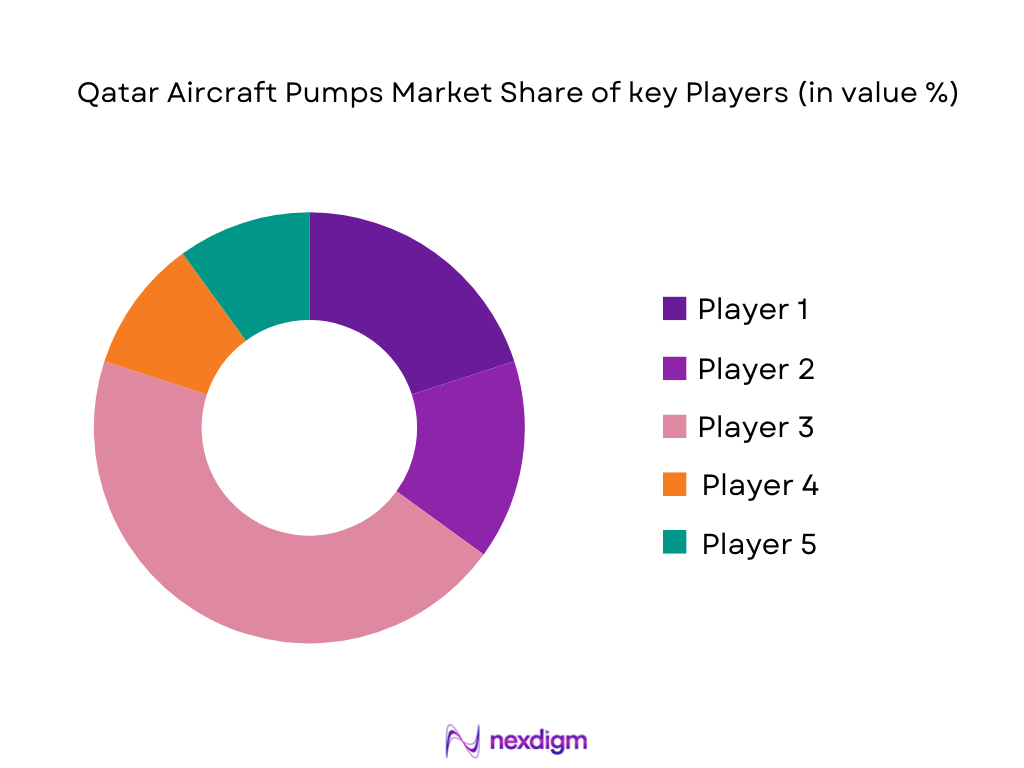

The Qatar Aircraft Pumps Market is dominated by a few key global and regional players, with companies such as Honeywell, Parker Hannifin, and Eaton leading the sector. These companies, known for their innovation in fuel and hydraulic systems, leverage their established product portfolios and technical expertise to secure a substantial share of the market. Regional players like Al-Massira Industries also play a crucial role, providing localized services and pump products designed specifically for the regional aerospace industry. The competition is intensifying as the demand for specialized pumps for both commercial and military aircraft grows.

| Company | Establishment Year | Headquarters | Technology Focus | Market Segment Focus | Regional Presence | Key Product Offerings |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | USA | ~ | ~ | ~ | ~ |

| Eaton Aerospace | 1911 | USA | ~ | ~ | ~ | ~ |

| Safran Landing Systems | 2005 | France | ~ | ~ | ~ | ~ |

| Al-Massira Industries | 1995 | Qatar | ~ | ~ | ~ | ~ |

Qatar Aircraft Pumps Market Analysis

Growth Drivers

Qatar National Aviation Growth

The Qatar National Aviation sector has experienced remarkable growth, driven by significant investments in infrastructure and the expansion of Qatar Airways. As Qatar Airways continues to grow its global presence, the demand for high-performance aircraft components, including pumps, has surged. The airline’s focus on fleet modernization, acquiring aircraft like the Airbus A350 and Boeing 787, has further boosted demand for aircraft pumps, which are critical for fuel systems, hydraulic systems, and environmental control systems. Qatar’s vision to become a global aviation hub, supported by world-class airports like Hamad International Airport, further propels the growth of the aircraft pumps market in the region.

Fleet Expansion

The steady expansion of Qatar’s aviation fleet is another key driver for the aircraft pumps market. Qatar Airways is not only increasing its fleet size but also updating its existing fleet with new-generation aircraft. As new aircraft enter the market, the demand for advanced pump systems, including fuel pumps, hydraulic pumps, and cooling pumps, grows. These pumps are integral to ensuring the efficiency and safety of aircraft operations. With Qatar Airways’ ambitious fleet expansion plan and the growing fleet base in the region, the demand for aircraft pumps is expected to continue rising, contributing to the market’s sustained growth.

Market Challenges

Certification Qualification Barriers

One of the significant challenges in the Qatar Aircraft Pumps Market is the certification qualification process. Aircraft pumps must meet rigorous international standards for safety, performance, and reliability, as stipulated by regulatory bodies such as the Qatar Civil Aviation Authority (QCAA), EASA, and the FAA. The certification process for pumps is often complex and time-consuming, involving detailed testing to ensure compliance with stringent aviation regulations. The lengthy qualification process, coupled with the high costs involved, creates barriers for manufacturers and can delay the introduction of new pump technologies into the market, limiting market dynamics and innovation.

Import Dependence

Qatar’s reliance on imported components, including aircraft pumps, presents a significant challenge to the growth of the domestic aircraft pumps market. While Qatar has a strong aviation sector, the country depends heavily on imports for aircraft parts and components due to limited local manufacturing capabilities. This import dependence makes the market vulnerable to global supply chain disruptions, such as those seen during the COVID-19 pandemic, which can result in delays, increased costs, and inventory shortages. Additionally, the reliance on foreign suppliers for critical components can impact the long-term sustainability and growth potential of the local aircraft pumps market.

Opportunities

Localization Initiatives

Qatar’s ongoing efforts to localize production and manufacturing present a significant opportunity for the aircraft pumps market. The government is actively encouraging the establishment of local manufacturing and assembly plants for aircraft components, including pumps, through initiatives such as the Qatar National Vision 2030. By fostering a more self-sufficient aerospace industry, Qatar aims to reduce its reliance on imports and create job opportunities for its growing workforce. Localizing the production of aircraft pumps will also help reduce lead times and manufacturing costs, making the market more competitive and providing long-term growth potential for domestic suppliers.

Free Zone Incentives

Qatar’s free zone incentives, particularly in areas like the Qatar Free Zones Authority (QFZA), present an attractive opportunity for aircraft pump manufacturers. The country offers tax incentives, regulatory exemptions, and access to state-of-the-art infrastructure within these zones, making it an appealing destination for foreign and local investors. Establishing manufacturing plants or distribution centers within these zones allows companies to take advantage of reduced operational costs and ease of doing business. These incentives can accelerate the growth of the aircraft pumps market by attracting both local and international players to set up production and supply chain operations in Qatar, further boosting the market’s potential.

Future Outlook

Over the next 5 years, the Qatar Aircraft Pumps Market is expected to show significant growth driven by Qatar’s continued investments in aviation infrastructure, the expansion of Qatar Airways’ fleet, and increasing air traffic demands. Furthermore, advancements in pump technologies such as electric and smart pumps will continue to drive the market forward. Additionally, the adoption of sustainable and energy-efficient solutions in aircraft systems, combined with rising defense sector demands, will fuel the expansion of the aircraft pump market. Innovation in pump design and integration with next-generation aircraft systems will further enhance market opportunities.

Major Players

- Honeywell Aerospace

- Parker Hannifin

- Eaton Aerospace

- Safran Landing Systems

- Mitsubishi Heavy Industries Aerospace

- Collins Aerospace

- Rolls-Royce

- Hamilton Sundstrand

- Curtiss-Wright

- AeroControlex

- Al-Massira Industries

- BAE Systems

- United Technologies Corporation

- SKF Aerospace

- Moog Inc.

Key Target Audience

- Aircraft OEMs

- MRO Service Providers (Airline Technical Services)

- Aviation Component Manufacturers

- Defense & Military Agencies (Qatar Armed Forces, Qatar Ministry of Defense)

- Aviation Regulatory Authorities (Qatar Civil Aviation Authority)

- Aviation and Aerospace Investment Firms

- Aviation Component Distributors and Dealers

- Venture Capitalists (Investors in Aviation Technologies)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar Aircraft Pumps Market. This step uses a combination of secondary and primary research to identify and define critical variables, including pump types, technological innovations, market dynamics, and consumer demand.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical data related to pump types, regional distribution, and key market drivers. It focuses on assessing market penetration, growth rates, and the overall competitive landscape within Qatar’s aerospace sector, with a particular focus on major players and product trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by conducting interviews with industry experts from both the public and private sectors. These consultations, including engineers, MRO specialists, and military officers, will provide deeper insights into product preferences, market growth drivers, and technological advancements in aircraft pumps.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with manufacturers and suppliers to gain direct insights into production processes, market demand, and consumer feedback. These insights will be integrated with market trends and forecasts to provide a comprehensive analysis of the Qatar Aircraft Pumps Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions (Fluid Types: fuel/hydraulic/lube/cooling), Abbreviations, Primary & Secondary Research Framework, Qatar‑Specific Data Sources, Interviewee Profiles (OEM, MRO, Fleet Operators), Forecast Validation, Data Triangulation, Limitations and Future Opportunities)

- Market Definition and Scope (Aircraft Pump Systems, Modules, Spares, Aftermarket),

- Qatar Aviation Sector Profile, Aircraft Pump Functional Architecture

- Aviation‑Specific Performance Metrics

- Qatar’s Strategic Plan for Aviation Component Localization.

- Timeline of Major Global & Gulf Region Innovation

- Growth Drivers

Qatar National Aviation Growth

Fleet Expansion

Air Infrastructure port

HIAMRO Ecosystem

Rising Air Traffic Demand

Fleet Modernization

Fuel Efficiency - Market Challenges

Certification Qualification Barriers

Import Dependence

Tariff Exposure - Opportunities

Localization Initiatives

Free Zone Incentives

Smart Pumps

Predictive Maintenance Adoption - Market Trends

Electrification Pump Drives

Lightweight Composite Pumps

Connected Sensor Diagnostics - Regulatory Environment

Qatar CAA Regulations

Component Certification

Import Norms

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Pump Type (In Value %)

Fuel Pumps (Jet Fuel Pumps)

Hydraulic Pumps (Aircraft Actuation)

Lubrication & Scavenge Pumps (Engine)

Cooling / Air‑Conditioning Pumps (Environmental Control Systems)

Water & Waste System Pumps (Cabin Systems)

- By Technology (In Value %)

Engine Driven Pumps

Electric Motor Driven Pumps (Electric Architecture Adoption)

Air Driven / Pneumatic Pumps

Smart/Connected Pumps (Predictive Diagnostics, IoT)

- By Pressure Class (In Value %)

Low‑Pressure (<500 PSI)

Medium Pressure (500–3000 PSI)

High Pressure (>3000 PSI)

- By Aircraft Application (In Value %)

Commercial Jets (Narrow‑body / Wide‑body)

Business Jets & VIP

Helicopters (HCM Market)

Military Fighters and Support Aircraft

Unmanned Aerial Platforms

- By Market Channel (In Value %)

Direct OEM Contracts

Distributor / Regional Stockists

Aftermarket & MRO Contracts

eProcurement / Digital Supply Chains

- Market Share Analysis (Value & Unit Deployment) for Qatar (by Pump Type, Technology)

- Cross‑Comparison Parameters (Company Market Position (Qatar Installed Base), Product Portfolio Breadth (Types/Pressure Class), Certification Footprint (FAA/EASA/QAER Compliance), Production Footprint (Regional Stock/Repair Hubs), Aftermarket Support Agreements, ASP by SKU, Warranty & Service Terms, Technical Performance Benchmarks (Flow/Pressure), Materials & Life‑Cycle Metrics, Distribution Network Density (Dealers/MRO Partners), R&D Investment, Competitive Strengths & Weaknesses)

- SWOT Profiles of Major Competitors in Qatar Market Context

- Pricing Benchmarking by SKU Class and Procurement Channel

- Detailed Profiles of Key Global & Regional Players

Honeywell International Inc.

Parker Hannifin Corp.

Eaton Aerospace (Hydraulic Systems)

United Technologies / Collins Aerospace

Safran Landing Systems

Mitsubishi Heavy Industries Aerospace Pumps Unit

Donaldson Company, Inc.

Secondo Mona S.p.A. (Precision Pumps

Jihostroj a.s. (Fuel & Hydraulic Pumps)

AeroControlex (Specialized Aerospace Pumps)

SKF Aerospace Pump Segment

BETA AIRCRAFT PUMP Solutions (Regional Specialist)

Aerodyne Pump Technologies (Advanced)

Sundstrand / UTC legacy pumps lines

Héroux‑Devtek Pump Integration Lines

- Fleet Demand Analysis

- Service Life & Replacement Cycles

- Procurement Budgets, Storage Turnover, Reliability KPIs

- Operational Readiness & Failure Cost Analysis

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035