Market Overview

The Qatar Aircraft Radome market is a vital component of the country’s growing aerospace and defense sector. As of the latest available data, the market is estimated to be valued at approximately USD ~ million, driven by substantial investments in both military and commercial aviation sectors. The increasing demand for radar transparency and the vital role of radomes in ensuring the performance of aircraft sensors, particularly in extreme climatic conditions, fuel this growth. Key growth drivers include Qatar’s modernizing defense infrastructure, expansion of Qatar Airways’ fleet, and a strategic push for cutting-edge aviation technologies. With a continued rise in military aircraft procurement and air traffic control upgrades, the radome market is positioned for steady growth, meeting the needs of both military and commercial aviation.

Qatar remains a dominant force in the regional Aircraft Radome market due to its geopolitical position and active investment in both defense and civil aviation sectors. Qatar’s capital, Doha, serves as a hub for aerospace activity, housing key infrastructure projects such as Hamad International Airport and the Qatar Emiri Air Force bases. The government’s investment in modernization programs for Qatar Airways, coupled with the growing defense contracts with international defense manufacturers, consolidates Qatar’s leadership in the region. Additionally, the strategic location of Qatar within the GCC region further enhances its status as a market leader, attracting global aviation players and fostering innovation in aerospace technology.

Market Segmentation

By Radome Material

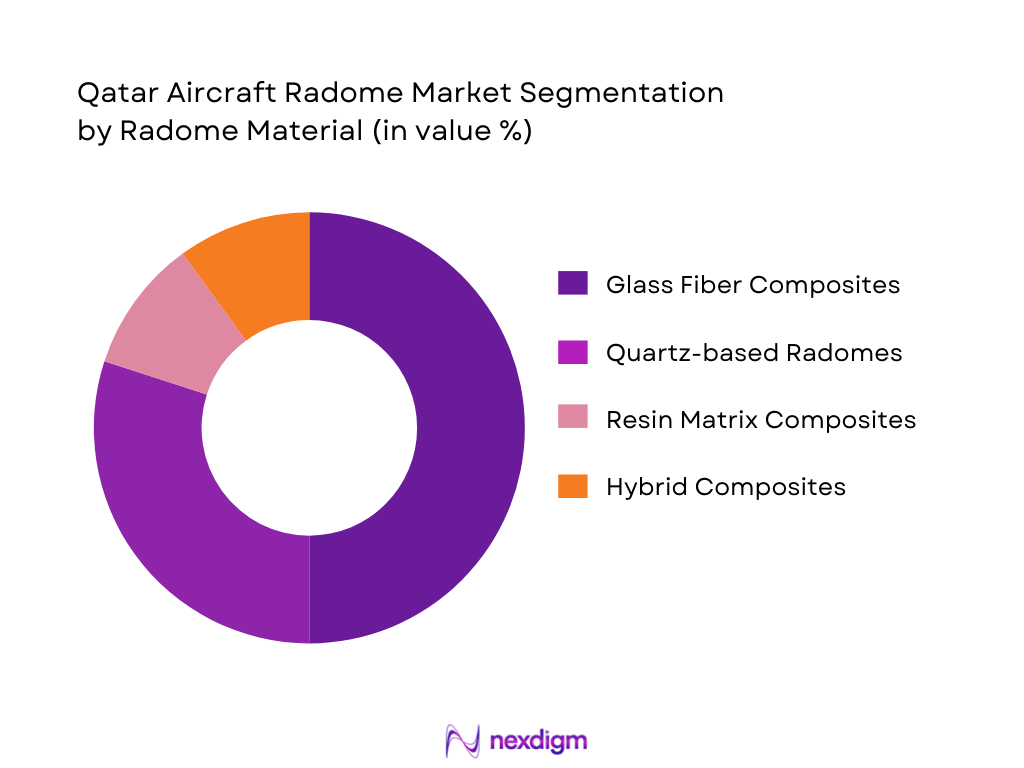

The Qatar Aircraft Radome market is segmented into various radome materials including glass fiber composites, quartz-based radomes, resin matrix composites, and hybrid composites. Among these, glass fiber composites dominate the market due to their affordability, excellent signal transparency, and robust thermal resistance, which is crucial for Qatar’s harsh environmental conditions. The demand for this material is primarily driven by commercial aircraft manufacturers, including Qatar Airways, which require cost-effective and high-performance solutions for their fleet. Furthermore, hybrid composites, which offer superior radar transparency and lower weight, are gaining traction in military applications, especially in advanced defense aircraft where stealth capabilities are vital.

By Aircraft Type

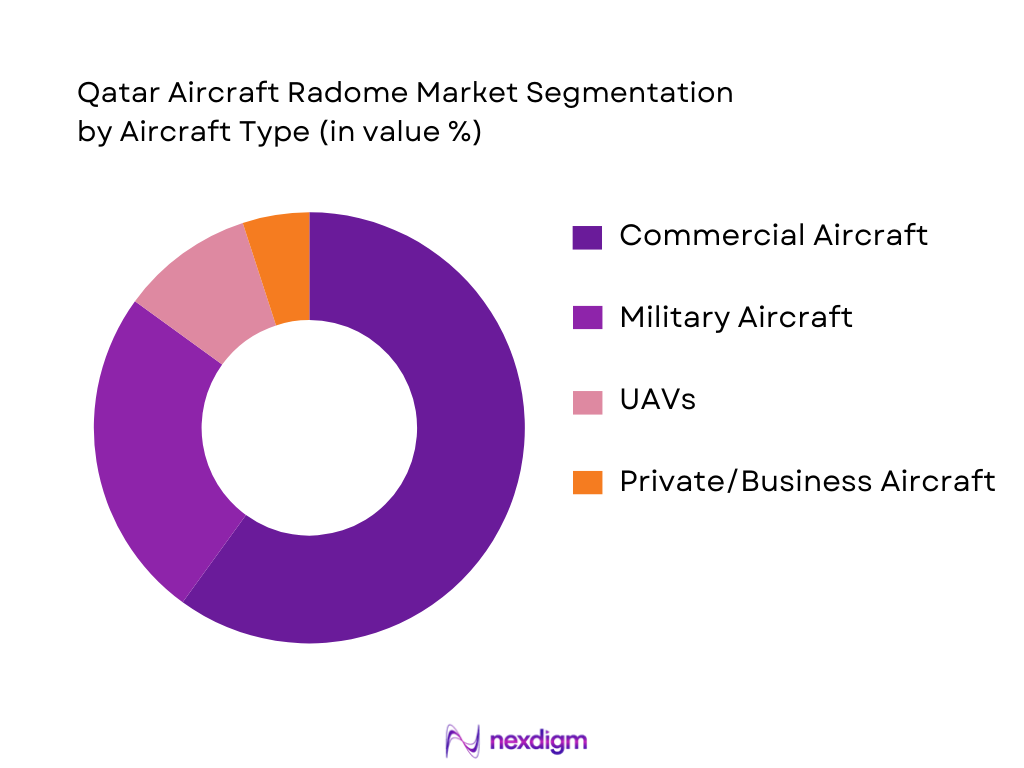

The Aircraft Radome market in Qatar is segmented by aircraft type into commercial aircraft, military aircraft, UAVs, and private/business aircraft. Commercial aircraft have the largest share in the market, driven by the growing fleet of Qatar Airways and regional carriers. With Qatar Airways’ fleet expansion and increased passenger air traffic, there is a consistent demand for high-quality radomes that ensure uninterrupted radar and communication performance. The military aircraft segment follows closely, with ongoing defense procurement programs focusing on advanced radomes for both combat and surveillance aircraft. UAVs are expected to see increased demand in the coming years due to their growing application in military surveillance and commercial sectors.

Competitive Landscape

The Qatar Aircraft Radome market is characterized by a competitive landscape featuring both global aerospace giants and regional manufacturers. Companies like Raytheon Technologies, L3Harris Technologies, and Meggitt PLC dominate the market by offering a broad range of high-performance radomes for both military and commercial aircraft. Local firms and joint ventures with international players are emerging, as they benefit from Qatar’s defense spending and the expansion of its aviation industry. The competition revolves around innovation in material technologies, signal transmission efficiency, and the ability to meet the region’s stringent certification and regulatory standards.

| Company Name | Year of Establishment | Headquarters | Key Products/Services | Technology/Innovation Focus | Market Focus | Annual Revenue |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~

|

~

|

~

|

| L3Harris Technologies | 1898 | Melbourne, USA | ~

|

~

|

~

|

~

|

| Meggitt PLC | 1947 | Coventry, UK | ~

|

~

|

~

|

~

|

| Parker Hannifin | 1917 | Cleveland, USA | ~

|

~

|

~

|

~

|

| Astronics Corporation | 1968 | East Aurora, USA | ~

|

~

|

~

|

~

|

Qatar Aircraft Radome Market Analysis

Growth Drivers

Defense Modernization & Airspace Safety Mandates

Qatar’s focus on defense modernization significantly drives the demand for aircraft radomes. The country has made substantial investments in its defense capabilities, including upgrading its fleet with advanced aircraft that require high-performance radome systems. Radomes are essential for ensuring the proper functioning of radar and communication systems in modern military aircraft. Qatar’s military modernization efforts, coupled with increasing airspace safety mandates set by global aviation bodies, have heightened the demand for radomes that offer enhanced radar transparency and durability in various operational conditions. These initiatives drive the growth of the radome market in both military and civilian aviation sectors.

Civil Aviation Radar Performance Requirements

The growth of Qatar’s civil aviation sector, particularly the expansion of Qatar Airways, drives the demand for radomes that meet high radar performance standards. Modern aircraft, such as the Airbus A350 and Boeing 787, rely on advanced radar and communication systems that require high-performance radomes to operate effectively. As airspace becomes more congested and navigation systems become more advanced, there is an increasing need for radomes that ensure optimal radar transparency and signal integrity. Civil aviation radar performance requirements, along with Qatar’s strategic position as an international aviation hub, continue to fuel the market demand for cutting-edge radome technologies.

Market Challenges

High-Performance Composite Material Supply Constraints

A significant challenge facing the Qatar Aircraft Radome Market is the supply constraints of high-performance composite materials. Radomes require advanced composites, such as fiberglass, carbon fiber, and other specialized materials, to meet the stringent requirements for radar transparency, durability, and lightweight design. However, global supply chain disruptions and the increasing demand for these materials across various industries have created supply shortages and price volatility. These constraints can delay production timelines for radome manufacturers and increase costs, potentially limiting the market’s growth and affecting the timely deployment of radome solutions in both commercial and military aircraft.

Certification & Airworthiness Testing Complexity

The complexity of certification and airworthiness testing for radomes is another significant challenge in the market. Aircraft radomes must undergo rigorous testing to meet the safety and performance standards set by regulatory bodies such as the Qatar Civil Aviation Authority (QCAA), EASA, and the FAA. These tests assess the radome’s structural integrity, radar transparency, and environmental resilience. The lengthy and costly certification process for new radome technologies can delay their entry into the market and increase production costs. Additionally, ensuring that radomes meet the specific requirements for both military and civilian aircraft complicates the certification process further, presenting a significant barrier for manufacturers.

Market Opportunities

Adoption of Advanced Composite Radomes with Low Radar Cross-Section

One of the key opportunities in the Qatar Aircraft Radome Market is the adoption of advanced composite materials that provide a low radar cross-section (RCS). As radar and communication systems become more sophisticated, the demand for radomes that reduce the aircraft’s radar visibility while maintaining high performance is increasing. Advanced composites, such as carbon fiber and hybrid materials, allow radomes to provide superior radar transparency and durability while minimizing RCS. This development is particularly relevant for military aircraft, where stealth capabilities are crucial. The growing emphasis on low RCS radomes presents an opportunity for manufacturers to innovate and develop radomes that meet the evolving needs of both defense and commercial aviation sectors in Qatar.

Demand for Multi-Band Connectivity Radomes

Another significant opportunity in the Qatar Aircraft Radome Market lies in the growing demand for multi-band connectivity radomes. As the aviation industry increasingly integrates satellite communication (SATCOM) and other communication technologies, there is a need for radomes that can support multiple frequency bands simultaneously. These multi-band radomes enable aircraft to maintain reliable communication and radar systems, even in remote or congested airspace. Qatar’s aviation sector, particularly Qatar Airways, continues to modernize its fleet with advanced technologies that require high-performance radomes capable of handling diverse connectivity systems. The demand for multi-band connectivity radomes offers significant growth potential for manufacturers who can develop solutions that meet these complex requirements.

Future Outlook

The Qatar Aircraft Radome market is poised for substantial growth over the next five years. Driven by ongoing investments in defense modernization and the expansion of Qatar Airways’ fleet, the market will see increasing demand for advanced radome technologies. This growth will be further accelerated by the country’s focus on innovation, with a rising demand for multi-frequency and hybrid radomes in both military and commercial aircraft. The market is also expected to benefit from the regional geopolitical environment, with a rise in defense spending and technological collaboration with global aerospace companies.

Major Players in the Market

- Raytheon Technologies

- L3Harris Technologies

- Meggitt PLC

- Parker Hannifin

- Astronics Corporation

- General Dynamics Corporation

- Jenoptik AG

- Ducommun Incorporated

- Vermont Composites Inc

- Starwin Industries

- Vox Technologies

- Nordam Group

- Leonardo S.p.A

- Comtech Telecommunications

- Trelleborg AB

Key Target Audience

- Military Procurement Agencies (Qatar Emiri Air Force)

- Commercial Airline Operators (Qatar Airways, regional airlines)

- Aircraft Manufacturers (Qatar Aircraft Industries)

- Defense Contractors (Raytheon, L3Harris Technologies)

- Aerospace Equipment Suppliers (Parker Hannifin, Meggitt)

- Aviation Regulatory Bodies (Qatar Civil Aviation Authority)

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Qatar Ministry of Defense)

Research Methodology

Step 1: Identification of Key Variables

This phase focuses on mapping the key variables influencing the Qatar Aircraft Radome market. Through a combination of secondary research from authoritative databases and expert interviews, the research identifies the crucial drivers, restraints, and emerging trends that define the market landscape.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data and trends relevant to the Qatar Aircraft Radome market. This includes assessing the market size, growth rates, and performance metrics, while also evaluating the current market segmentation to understand consumer demand and behavior.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated via consultations with industry experts from leading aerospace companies. These experts provide crucial insights on technology adoption, regulatory factors, and operational practices, ensuring that the research is based on real-world perspectives.

Step 4: Research Synthesis and Final Output

Finally, detailed consultations with key industry players, along with data validation and cross-referencing, will culminate in the creation of a comprehensive market report. This step ensures the accuracy and reliability of the report’s findings, providing an in-depth understanding of the Qatar Aircraft Radome market.

- Executive Summary

- Research Methodology (Definitions & Assumptions (Aircraft Radome functional scope, Qatar market definitions, frequency bands & platforms), Acronyms & Abbreviations (RF, L‑band, Ka‑band, composite indices), Data Sources (Primary interviews with OEM/Defense buyers, government procurement data, aerospace clusters), Market Sizing & Forecasting Framework (Top‑down + Bottom‑up triangulation, historical radar installations), Material Technology Assessment Approach (Composite materials vs resin vs quartz), Limitations and Future Research Areas)

- Overview of aircraft radomes in Qatar aerospace & defense infrastructure

- Role in aircraft radar & communication systems

- Qatar strategic imperatives: military, air traffic control, civil aviation expansion

- Environmental factors: extreme heat, sand & humidity impacts on radomes

- Supply Chain & Industry Architecture

- Raw materials supply ecosystem (composites, quartz, advanced polymers)

- Local fabrication & international sourcing dynamic

- Growth Drivers

Defense modernization & airspace safety mandates

Civil aviation radar performance requirements

Government policy on technology transfer & local assembly

Integration with GCC aerospace initiatives

Material R&D & durability performance in harsh climate - Challenges & Market Barriers

High performance composite material supply constraints

Certification & airworthiness testing complexity

Price sensitivity in commercial aviation spares

Dependence on global OEMs for advanced radome components

Counterfeit & quality risk in aftermarket components - Opportunities & Technological Trends

Adoption of advanced composite radomes with low radar cross‑section

Demand for multi‑band connectivity radomes

Smart radomes with embedded sensors

Local partnerships & knowledge transfer models

Sustainability & recyclable composite solutions - Regulatory & Compliance Landscape

Qatar CAA aviation material standards

Military procurement norms (defense contracting)

Export controls & ITAR implications

Quality assurance & ISO certifications

Environmental & safety compliance - Market Ecosystem & Competitive Forces

- Value chain mapping

- Supplier power, buyer power & technology disruption

- Cross‑Supply chain constraints

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Radome Material (In Value %)

Glass Fiber Composites

Quartz Based Radomes

Resin Matrix Composites

Advanced Hybrid Composites

Kevlar & Carbon Fiber variants - By Aircraft Type (In Value %)

Commercial Aircraft Radomes (Qatar Airways, Charter & regional airlines)

Military aircraft (Defense radars & avionics integration)

UAS/UAV Platforms

Business/Private Aircraft

Special Mission Aircraft (ISR, EW) - By Frequency Band (In Value %)

L‑Band Radomes (Broadband comms)

S‑Band Radomes (Surveillance)

C‑Band Radomes (ATC/ Weather Radar)

X‑Band Radomes (Tactical/Military)

Multi‑Band High Frequency Radome - By Application Interface (In Value %)

Nose Radome Integration (Aerodynamic & sensor performance impact)

Fuselage Radome Modules

Tail / Rear Mounted Radomes

Wing‑tip & Dorsal Radomes

Modular Retrofit Systems - By End User Procurement Channel (In Value %)

Original Equipment Manufacturer (OEM) Programs

Aftermarket / Retrofit Contracts

Defense & Government Contracts

MRO Service Providers

Licensed Regional Assemblers

- Market Share by Product/Segment

- Cross‑Comparison Parameters (Company Strategy Overview, Product Portfolio Strengths, Radome Material & Frequency Capabilities, Manufacturing Footprint & Capacity, Technology & R&D Investment, Aftermarket & Service, Support, Supply Chain Resilience Index, Certification & Compliance Credentials, Key Defense Certifications, Regional Sales & Distribution Network, Pricing Positioning vs Value Delivered)

- Major Competitors & Profiles

General Dynamics Corporation (Defense radomes & composites)

Airbus SE (Aerospace radomes)

Saint‑Gobain Performance Plastics (Advanced composite materials)

Jenoptik AG (Precision radome tech)

Meggitt PLC (Aerospace components)

Nordam Group (Aircraft radome assemblies)

Astronics Corporation (Aerospace systems)

Ducommun Incorporated (Electronic & radome systems)

Starwin Industries (Composite radomes)

Vermont Composites Inc (Precision composites)

Parker Hannifin Corp (Aerospace radome components)

Raytheon / RTX Corp (Defense radar solutions)

L3Harris Technologies (Advanced aerospace systems)

Leonardo S.p.A (Aircraft radome segments)

Comtech Telecommunications (RF component provider)

- Pricing Analysis & Cost Modelling

- Unit pricing benchmarks by material classification

- Cost drivers (material, production complexity, certification)

- Warranty & service pricing models

- Benchmarking Qatar vs GCC regional pricing

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035