Market Overview

The Qatar aircraft refurbishing market has demonstrated robust growth, fuelled by the strong demand for both domestic and international airlines. The Qatar Airways fleet, one of the largest and most modern in the region, serves as a significant driver of this market. Qatar Airways continues to enhance its fleet through periodic refurbishing, updating both interiors and avionics, to ensure a premium travel experience for its passengers. Additionally, Qatar’s strategic position as a major international transit hub boosts refurbishing demand, as airlines seek to maintain their fleets in optimal condition for long-haul flights. This trend is further strengthened by the expansion of private aviation services and the increasing trend of retrofitting cabins for luxury travellers’, positioning the country as a key player in the Middle East’s aircraft refurbishing industry.

Qatar, particularly Doha, stands at the forefront of the aircraft refurbishing market in the Middle East due to its central role in aviation, underpinned by Qatar Airways’ fleet and the rapidly growing aviation infrastructure at Hamad International Airport. As a global aviation hub, Doha attracts major international airlines for aircraft maintenance, including refurbishing services. Additionally, the region’s robust financial backing, bolstered by governmental support through investments in airport facilities and MRO services, drives further dominance. Neighbouring countries like the UAE and Saudi Arabia also contribute to regional demand, with their advanced aviation markets reinforcing the sector’s importance across the Gulf.

Market Segmentation

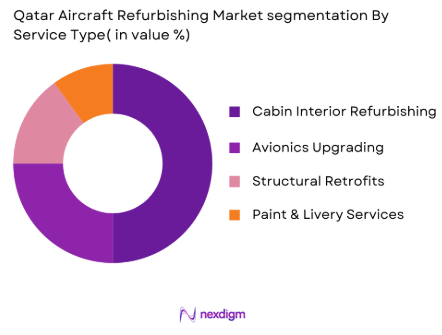

By Service Type

The Qatar aircraft refurbishing market is primarily segmented by service type, which includes cabin interior refurbishing, avionics upgrading, structural retrofits, and paint & livery services. Each of these service types caters to different needs within the airline and private aviation sectors. Cabin interior refurbishing is the dominant segment within the Qatar aircraft refurbishing market. Airlines, particularly Qatar Airways, prioritize this service to maintain their premium cabin experiences, offering upgraded seating, new materials, lighting, and in-flight entertainment systems. The growing demand for luxury and comfort in long-haul flights drives this segment’s dominance. Additionally, private aviation companies seeking bespoke cabin designs also contribute to the increase in demand for cabin refurbishing services.

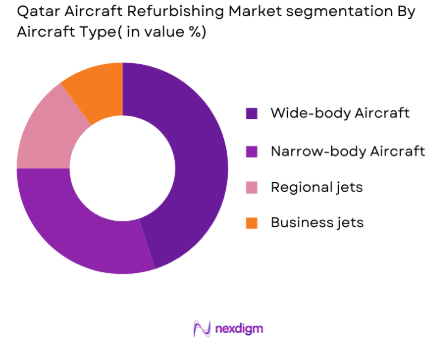

By Aircraft Type

In the Qatar aircraft refurbishing market, segmentation by aircraft type is a crucial driver of demand, with narrow-body, wide-body, regional jets, and business jets each having distinct refurbishing requirements.Wide-body aircraft, especially those used for long-haul international flights, dominate the market share in the Qatar aircraft refurbishing sector. These aircraft often require more extensive refurbishing due to the wear and tear associated with extended flight durations and high passenger volume. Wide-body aircraft from major international airlines like Qatar Airways undergo frequent refurbishments to maintain operational efficiency and passenger comfort. Given the strong presence of Qatar Airways’ fleet, which is composed of numerous wide-body aircraft such as the Boeing 777 and Airbus A350, this segment holds the largest market share.

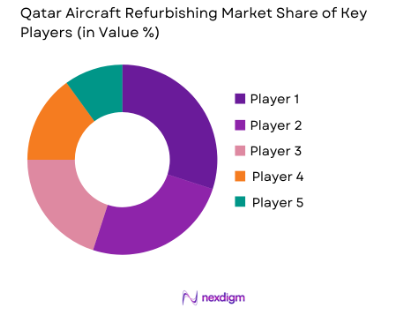

Competitive Landscape

The Qatar aircraft refurbishing market is highly competitive, with several international and regional players vying for dominance. Major players include both specialized refurbishing providers and broader maintenance, repair, and overhaul (MRO) companies. These companies offer a range of refurbishing services from avionics upgrades to complete cabin overhauls.

| Company Name | Establishment Year | Headquarters | Core Services | Aircraft Types Supported | Fleet Size | Certifications |

| Qatar Airways Engineering | 2003 | Doha, Qatar | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1995 | Frankfurt, Germany | ~ | ~ | ~ | ~ |

| AAR Corp | 1955 | Wood Dale, USA | ~ | ~ | ~ | ~ |

| ST Engineering Aerospace | 1990 | Singapore | ~ | ~ | ~ | ~ |

| SR Technics | 1931 | Zurich, Switzerland | ~ | ~ | ~ | ~ |

Qatar Aircraft Refurbishing Market Dynamics & Influencers

Growth Drivers

Fleet Aging

Qatar’s aviation sector faces a growing demand for aircraft refurbishing due to fleet aging. As of 2025, approximately 34% of Qatar Airways’ fleet consists of aircraft that are over 10 years old, signaling an increased need for maintenance and refurbishment. Aircraft older than 10 years generally require more frequent refurbishing, including cabin interior upgrades, avionics, and structural modifications. The aging of fleets across the GCC region highlights the demand for refurbishing services. The growing emphasis on fleet rejuvenation is supported by regional airline strategies that aim to maintain fleet competitiveness and enhance passenger experience. These efforts are further backed by economic recovery in the Gulf, which sees a rise in disposable income and business-class travel, further driving refurbishing needs.

Airline Premium Cabin Demand

The demand for premium cabins within the GCC is rising sharply, particularly for Qatar Airways. The demand for business and first-class cabins, which command higher refurbishing costs due to luxury features and more sophisticated designs, is increasingly becoming a key revenue driver for airlines. Qatar Airways’ strategy focuses on expanding its premium cabin offerings, which necessitates frequent updates and refurbishing to meet customer expectations. The Middle East’s travel market is expected to see more luxury-oriented travel as the region’s tourism and business sectors grow. As a result, the cabin refurbishing segment is projected to increase due to the necessity of maintaining high standards for high-end travellers.

Market Restraints

Labor Cost Pressure

Labor costs in Qatar’s aircraft refurbishing sector have been rising steadily. As of 2025, labor wages for skilled workers in MRO sectors, including aircraft refurbishing, have increased by 7% over the past year. With Qatar’s rapid infrastructure development and increasing competition in the MRO market, skilled labor shortages are becoming more prevalent, especially in specialized fields like avionics and interior refurbishing. These rising costs, combined with a shortage of trained personnel, result in higher operational expenses for refurbishing services, potentially limiting the ability of smaller MROs to scale their businesses. Additionally, competition from international firms offering lower-cost labor solutions in regions such as India and Southeast Asia may put pressure on local firms.

Supply Chain Lead Times

The supply chain for aircraft parts and materials in Qatar faces significant delays, exacerbated by global disruptions and geopolitical tensions. As of 2025, the lead time for critical components needed for aircraft refurbishing has increased by an average of 6 weeks compared to pre-pandemic levels. The rise in global demand for specific aircraft parts, such as advanced avionics and interior fittings, has led to longer procurement cycles and greater logistical challenges. These delays are impacting the turnaround times for refurbishing services, leading to potential downtime for airlines and affecting the timely delivery of services. In particular, the procurement of composite materials, lighting systems, and cabin seating has faced substantial delays.

Opportunities

Digital Cabin Customization

The shift towards digital cabin customization presents a substantial growth opportunity for Qatar’s aircraft refurbishing market. As airlines strive to meet the growing demands of business-class and luxury travelers, there is an increasing push for integrating technology in aircraft cabins. This includes installing high-tech lighting, entertainment systems, and enhanced connectivity, which can all be updated or refurbished. Qatar Airways’ focus on providing personalized experiences to passengers is set to drive demand for advanced cabin retrofits. The digitalization of passenger cabins, with more advanced entertainment systems and connected devices, is expected to grow as airlines focus on integrating smart technologies into their fleets. With Qatar’s investment in innovation and technology, refurbishing companies are poised to capture a significant share of this digital transformation.

Sustainable Materials

The push for sustainability is another key opportunity in the Qatar aircraft refurbishing market. With global focus on reducing carbon footprints, airlines in Qatar are increasingly interested in using eco-friendly materials during refurbishing projects. Sustainable cabin materials, such as recycled plastics, eco-friendly upholstery, and lightweight composites, are becoming more mainstream in the region. Qatar Airways, in its commitment to sustainability, has begun integrating these materials into its refurbishing efforts, aiming to reduce overall weight and environmental impact. The ongoing emphasis on sustainability, backed by Qatar’s long-term vision for reducing emissions in line with global environmental standards, is creating opportunities for refurbishing providers to specialize in green refurbishing services.

Future Outlook

Over the next decade, the Qatar aircraft refurbishing market is poised for steady growth, driven by increasing demand for premium cabin services, expansion of Qatar Airways’ fleet, and the overall regional growth of the aviation sector. Advancements in materials and technologies, along with higher demand for retrofitting services, are expected to further fuel the market. Innovations such as eco-friendly refurbishing practices and the integration of digital technologies for in-flight services will likely become significant drivers of market evolution.

Major Players

- Qatar Airways Engineering

- Lufthansa Technik

- AAR Corp

- ST Engineering Aerospace

- SR Technics

- Jet Aviation

- Aviation and Maintenance Solutions

- Al Jaber Aviation

- TAM Aircraft Services

- KLM Engineering & Maintenance

- Air France-KLM Group

- Joramco

- Boeing MRO Services

- Honeywell Aerospace

- Bombardier Aerospace Services

Key Target Audience

- Government and Regulatory Bodies

- Aircraft Manufacturers

- Aviation Investors and Venture Capitalists

- Airline Executives and Fleet Managers

- Private Aviation Companies

- MRO Service Providers

- Aircraft Interior and Avionics Suppliers

- Luxury Aircraft Design Companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the major variables driving the Qatar aircraft refurbishing market, such as key service types, aircraft types, and customer demand patterns. This is done through desk research and consultations with industry experts, which provides a robust framework for understanding the sector.

Step 2: Market Analysis and Construction

This phase includes gathering and analysing historical data to determine market growth patterns and segmentation. It focuses on evaluating fleet profiles, service adoption trends, and geographical factors that influence market performance in Qatar.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, expert consultations via interviews with aviation maintenance professionals, airline fleet managers, and regulatory bodies are conducted. These insights are critical in refining the hypothesis and validating data accuracy.

Step 4: Research Synthesis and Final Output

The final output is based on a combination of primary data from expert interviews and secondary data from reports and databases. These results are cross-validated to ensure they are comprehensive, accurate, and aligned with the latest market trends.

- Executive Summary

- Research Methodology (Market Definition & Refurbishing Scope, Data Sources, Primary/Secondary Research, Fleet Profiling Approach, Bottom‑Up Service Valuation, Top‑Down Economic Benchmarking, Data Triangulation, Limitations)

- Aviation Ecosystem

- Qatar Refurbishing Market Genesis

- Aircraft Lifecycle & Refurbishing Demand Triggers

- Qatar Civil Aviation Regulatory Framework

- Qatar MRO & Refurbishing Infrastructure Overview

- Growth Drivers

Fleet Aging

Airline Premium Cabin Demand

Qatar Air Connectivity Growth - Market Restraints

Labor Cost Pressure

Supply Chain Lead Times - Opportunities

Digital Cabin Customization

Sustainable Materials

VIP/Business Jet Refurbishing - Trends

Predictive Maintenance Integration

Lightweight Material Adoption

Smart Cabin Tech

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Service Ticket Value, 2020-2025

- By Service Type (In Value%)

Cabin Interiors Refurbishment

Avionics Modernization, Structural Retrofits

Engine Cabin Retrofits, Paint & Livery

- By Aircraft Type (In Value%)

Narrow‑Body

Wide‑Body

Regional Jets

Business Jets

Cargo Aircraft

- By Customer Type (In Value%)

Commercial Airlines

Business/Private Jets

Cargo Operators, Government & Defense - By Service Category (In Value%)

Heavy Refurbish

Line Refurbish

Scheduled Overhaul + Refurbish Bundles

On‑Ground Upgrades

- By Contract Model (In Value%)

Fixed‑Price

Time & Materials

Long‑Term MRO/Refurbish Agreements

- Market Share (Service Revenue, Aircraft Count)

- Cross‑Comparison Parameters (Refurbish & MRO Mix), Certifications , Regional Presence, Fleet Support Capability, Average Contract Value, Hangar Capacity, Workforce Competence, Innovation Index, Digital Service Adoption, Warranty & SLA Terms, OEM Partnerships, Custom Cabin Solutions, Turnaround Time, Aftermarket Parts Supply Network)

- SWOT Analysis of Key Players

- Pricing Analysis

- Porter’s Five Forces

- Competitor Profiles

Qatar Airways Engineering

Lufthansa Technik Global MRO/Refurbish Specialist

HAECO Group Aircraft Interiors & Refurbish Services

AAR Corp MRO & Refurbish Provider

SR Technics Independent MRO Services

Delta TechOps MRO & Third‑Party Refurbish

SIA Engineering Company Asia Pacific MRO/Refurbish

Jet Aviation

JETMS

Air France‑KLM Engineering & Maintenance

ST Engineering Aerospace

Airpac Enterprises

Flying Colours Corp

StandardAero

Fokker Services

- Airline Demand Drivers

- Fleet Refurbish Cadence & Forecast

- Decision‑Making Criteria

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Service Ticket, 2026-2035