Market Overview

The Qatar Aircraft Seals market is valued at USD~ billion, reflecting the country’s growing role in the global aviation industry. The market is driven by the expansion of Qatar Airways, which is one of the world’s largest and most advanced airlines, and the continuous growth of the aviation sector within the Gulf Cooperation Council (GCC) region. The increased demand for aircraft maintenance, repair, and overhaul (MRO) services and the rise in fleet size contribute significantly to this growth. As Qatar’s aviation sector focuses on fleet modernization, sealing systems for both OEM and MRO applications continue to play a crucial role in maintaining operational efficiency and safety standards.

Qatar, with its highly advanced infrastructure and global aviation hub in Doha, dominates the aircraft seals market in the Middle East. Doha’s position as the headquarters for Qatar Airways and its strategic location at the crossroads of East and West makes it the center of commercial and military aviation activity in the region. Qatar’s massive investments in modernizing its fleet, alongside major infrastructure developments such as Hamad International Airport, solidify its role as the primary market for aircraft seals in the GCC region. The aviation-focused economy has further propelled demand for high-quality sealing solutions across both commercial and defense sectors.

Market Segmentation

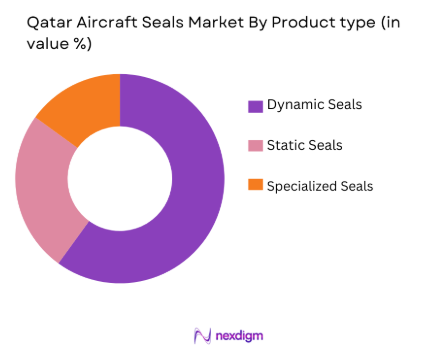

By Product Type

The Qatar Aircraft Seals market is segmented into dynamic seals, static seals, and specialized seals. Dynamic seals, which include rotary and axial seals, dominate the market as they are essential in maintaining operational integrity in moving components such as engines and turbines. These seals have a critical role in ensuring aircraft safety and performance under high pressure and temperature conditions. The demand for dynamic seals is driven by the constant modernization of Qatar’s aircraft fleet, particularly in jet engines, where high-performance materials such as PTFE and elastomers are used to minimize wear and leakage.

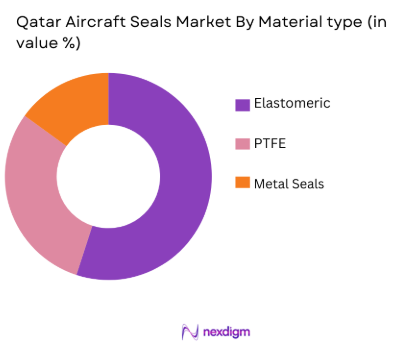

By Material Type

Material types in the Qatar Aircraft Seals market include elastomeric, PTFE, and metal seals. Elastomeric seals dominate the material segment due to their versatility, durability, and cost-effectiveness in sealing applications across a wide range of aircraft systems. They are particularly popular in sealing hydraulic systems, fuel systems, and environmental control systems due to their excellent compression set resistance and high sealing efficiency. PTFE seals, known for their resistance to high temperatures and chemicals, also play a significant role in the high-end commercial aircraft and military platforms, but elastomeric seals continue to maintain a larger market share due to their widespread applicability.

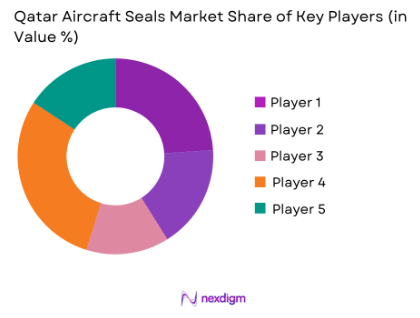

Competitive Landscape

The Qatar Aircraft Seals market is consolidated, with a few dominant players controlling a significant share. These players are equipped with advanced sealing technologies and possess strong relationships with both OEMs and MRO providers, allowing them to cater to both commercial and military aircraft. Companies like Trelleborg, Parker Hannifin, and Meggitt are well-established due to their innovative solutions and broad distribution networks. Qatar’s strategic geographical position further solidifies the influence of global players who have regional offices and facilities to serve the growing demand for sealing solutions.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Focus | Certifications | Regional Presence |

| Trelleborg Sealing Solutions | 1905 | Sweden | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | USA | ~ | ~ | ~ | ~ |

| Meggitt Plc | 1947 | UK | ~ | ~ | ~ | ~ |

| Safran SA | 2005 | France | ~ | ~ | ~ | ~ |

| Eaton Corporation | 1911 | USA | ~ | ~ | ~ | ~ |

Qatar Aircraft Seals Market Dynamics

Growth Drivers

Defense Modernization & Seal Requirements

Qatar’s defense sector is undergoing substantial modernization with a focus on enhancing its military fleet, including fighter jets, helicopters, and unmanned aerial vehicles (UAVs). As of 2025, Qatar has signed multi-billion-dollar contracts with aerospace companies such as Boeing and Dassault Aviation for the acquisition of advanced aircraft, including the F-15QA and Rafale fighters. These aircraft require specialized seals for engines, hydraulic systems, and avionics to ensure mission-critical performance under harsh conditions. With an increasing defense budget, which is projected to reach USD ~ billion in 2025, the demand for high-quality seals is expected to rise alongside the modernization of Qatar’s defense infrastructure.

Increasing MRO Activity and Seal Turnaround

With Qatar’s rapid expansion of its aviation sector, the demand for Maintenance, Repair, and Overhaul (MRO) services has seen significant growth. Qatar Airways has been increasingly investing in MRO facilities in Doha to support its expanding fleet. The growing number of aircraft requiring regular MRO services, especially for seals in engines, hydraulic systems, and landing gear, is driving the demand for replacement seals. In 2025, Qatar Airways MRO has experienced a growth of over 5% in annual maintenance operations, with additional contracts for repair services of engines and other vital components. This high turnover of seals for MRO purposes is a direct result of increasing fleet size and a commitment to maintaining high safety standards.

Market Restraints

Supply Chain Volatility

Supply chain volatility continues to impact the Qatar Aircraft Seals market. The ongoing global supply chain disruptions, exacerbated by the effects of the COVID-19 pandemic and geopolitical factors, have caused delays in the availability of raw materials such as synthetic rubber and metals used for seal manufacturing. In 2025, this issue remains a challenge, with fluctuations in shipping costs and delays in the delivery of essential materials from suppliers. Qatar’s reliance on international suppliers for high-performance seal materials means that such disruptions impact local manufacturers and increase lead times for seal production. These challenges add additional pressure on manufacturers to maintain the reliability of their seal supply for both OEM and MRO applications.

Price Sensitivity in Aftermarket Procurement

In 2025, the price sensitivity of aircraft seal procurement in the aftermarket segment continues to be a significant restraint for market growth. Airlines and MRO providers in Qatar, including Qatar Airways and other regional carriers, are increasingly seeking cost-effective solutions for seal replacements during routine maintenance. The demand for budget-friendly alternatives to OEM seals, often sourced from less expensive suppliers, is growing, particularly for components that are less critical in terms of safety. While these alternatives can offer short-term savings, they can lead to higher long-term operational costs due to reduced durability, thus affecting the overall profitability of aircraft operators and MROs.

Market Opportunities

Localized MRO Seal Inventory Management Solutions

The need for localized MRO seal inventory management solutions in Qatar presents an opportunity for market growth. With Qatar Airways’ rapid fleet expansion and the increasing demand for MRO services, the requirement for efficient and timely seal replacements is growing. In 2025, Qatar Airways’ MRO facility in Doha has significantly increased its spare parts inventory, including seals, to minimize aircraft downtime. Localizing inventory and streamlining the procurement process for seals can reduce lead times, ensure faster maintenance turnaround, and enhance operational efficiency for airlines and MRO providers. This shift towards localized supply chains presents a key opportunity for seal manufacturers to establish strong regional partnerships.

Strategic Partnerships with Global Seal OEMs

Strategic partnerships between local Qatar-based MRO providers and global seal OEMs represent a significant market opportunity. In 2025, key players in Qatar’s aviation sector, including Qatar Airways and local MRO service providers, are increasingly forming alliances with global seal manufacturers to ensure the availability of high-quality sealing solutions. These partnerships offer local MRO providers access to cutting-edge seal technologies, while also providing seal OEMs with a gateway to a high-demand regional market. This collaboration ensures that Qatar’s aircraft fleet is equipped with the best sealing technologies, improving both performance and safety.

Future Outlook

Over the next decade, the Qatar Aircraft Seals market is poised to witness substantial growth, driven by increased aviation activities, fleet expansion, and continuous advancements in sealing technology. Qatar’s focus on enhancing its aviation infrastructure, such as the expansion of Hamad International Airport and the Qatar Airways fleet, will further spur demand for high-quality sealing solutions. Additionally, innovations in materials such as advanced elastomers and composites, designed for high-performance applications, will continue to dominate the market, ensuring greater reliability and safety in Qatar’s growing aerospace sector.

Major Players

- Trelleborg Sealing Solutions

- Parker Hannifin

- Meggitt Plc

- Safran SA

- Eaton Corporation

- SKF Group

- DuPont de Nemours Inc.

- Saint‑Gobain S.A.

- Technetics Group

- Bal Seal Engineering Inc.

- Precision Polymer Engineering

- Hutchinson SA

- Sealtron Inc.

- AeroSeal Technologies

- Camloc Motion Control

Key Target Audience

- Aircraft OEMs

- MRO Providers

- Airlines and Air Cargo Operators

- Defense and Military Aviation Agencies

- Aviation Equipment Suppliers

- Aircraft Seal Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of the aircraft seals market, identifying key stakeholders such as OEMs, MROs, and regulatory bodies. A combination of secondary research and proprietary data sources will be used to define critical variables like seal types, materials, and aircraft categories that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is gathered to understand trends in Qatar’s aircraft fleet size, seal consumption rates, and average seal costs per aircraft. Data from reputable sources such as Qatar Airways, MRO companies, and regulatory agencies will be analysed to ensure a holistic view of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated by conducting interviews with industry experts, including executives from sealing companies, MRO providers, and aircraft manufacturers. These consultations will provide insights into operational practices, demand drivers, and technological advancements in the sealing industry.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and presenting a comprehensive analysis. The research will include a review of industry trends, key technological innovations in sealing materials, and the implications of Qatar’s expanding aviation market on the future demand for aircraft seals.

- Executive Summary

- Research Methodology (Qatar Aerospace Value Chain Mapping, Aircraft Seal Specification Standards, Key Material & Seal Type Classification, Seal Performance Parameter Definitions)

- Market Definition & Scope

- Qatar Aviation Market Genesis & Seal Demand Linkages

- Aircraft Fleet Composition in Qatar

- Supply Chain & Value Chain Analysis for Aircraft Seals

- Seal Qualification & Certification Landscape

- Growth Drivers

Fleet Modernization

Qatar Airways & Regional Aviation Expansion

Defense Modernization & Seal Requirements

Increasing MRO Activity and Seal Turnaround

- Market Restraints

High Qualification & Certification Costs

Supply Chain Volatility

Price Sensitivity in Aftermarket Procurement - Market Opportunities

Next‑Gen Seal Materials

Localized MRO Seal Inventory Management Solutions

Strategic Partnerships with Global Seal OEMs - Market Trends

Shift to High‑Performance Elastomers & Composites

Smart Seal Tracking & Predictive Failure Analytics

On‑site Certification & Test Facilities Development

- Market Value, 2020-2025

- Market Volume, 2020-2025

- Installed Base & Serviceable Fleet Estimation, 2020-2025

- Average Seal Cost per Aircraft Assembly, 2020-2025

- By Seal Type (In Value%)

Dynamic Seals

Static Seals

Specialized Aerospace Seals

Composite & Hybrid Seal Solutions - By Material Type (In Value%)

Elastomeric (FKM, Silicone)

PTFE & Fluoropolymers

Metallic Seals

Composite Material Seals - By Aircraft Type (In Value%)

Commercial Aircraft

Business & VIP Jets

Military Aircraft & Defense Platforms

Helicopters & Specialized AAM

- By Application (In Value%)

Engine & Powerplant Systems

Hydraulic & Pneumatic Systems

Fuel Systems

light Control Systems

Environmental Control & Avionics - By End‑User (In Value%)

Original Equipment Manufacturers

Aftermarket / MRO Providers

Defense & Government Aviation

- Market Share by Value / Volume

- Cross‑Comparison Parameters (Company Overview, Aviation Seal Product Portfolio, Material Technology Expertise, Qualification & Certification Levels, Number of Aviation OEM / MRO Contracts, Seal Performance Metrics, Regional Distribution Footprint, Aftermarket Service Network & Turnaround Time)

- SWOT Analysis (Qatar Market Perspective)

- Porter’s Five Forces

- Detailed Profiles

Trelleborg Sealing Solutions

Parker Hannifin Corporation

SKF Group

Meggitt Plc

Eaton Corporation

Saint‑Gobain S.A.

DuPont de Nemours Inc

Regal Rexnord Corporation

Safran SA

Technetics Group

Bal Seal Engineering Inc

Precision Polymer Engineering

Hutchinson SA

SEAL Aviation LLC

Harwal Ltd

- Commercial Airline Demand Patterns

- MRO Demand & Seal Lifecycle Analysis

- Defense Aviation Requirements & Procurement Cycles

- End‑User Seal Specification Drivers

- Procurement Decision Framework

- Market Value Forecast, 2026-2035

- Market Volume Projection, 2026-2035

- Average Seal Pricing Trajectory, 2026-2035