Market Overview

The Qatar Aircraft Seat Actuation Systems market is valued at USD ~ million, driven by the increasing demand for advanced seating technologies in the Middle East’s booming aviation industry. The growth is mainly attributed to rising air travel, increasing fleet sizes, and the push for more comfortable and efficient seating solutions in both commercial and business aircraft. These factors have significantly influenced the demand for actuation systems, supporting a steady market size expansion.

The dominant players in the Qatar Aircraft Seat Actuation Systems market include key regional hubs like Doha, which is home to Qatar Airways, a major driver of the local aviation industry. Qatar has become a focal point due to its well-established infrastructure, government backing, and a growing fleet of aircraft. Additionally, the Gulf Cooperation Council (GCC) region, led by Qatar, is seeing rapid advancements in aviation technologies, making it a key market in the sector, with increasing investments in next-gen aircraft technologies.

Market Segmentation

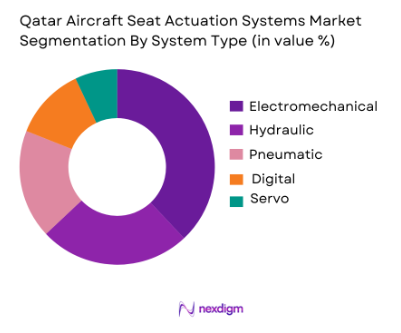

By System Type

The Qatar Aircraft Seat Actuation Systems market is segmented into electromechanical actuators, hydraulic actuators, pneumatic actuators, digital actuators, and servo actuators. Among these, electromechanical actuators dominate the market share. This is due to their efficiency, compactness, and the growing shift toward electric systems in the aviation industry, which provides better weight efficiency, energy savings, and easier maintenance. Electromechanical systems are particularly favored for their integration with modern lightweight aircraft seating, making them ideal for both commercial and business jets in the region.

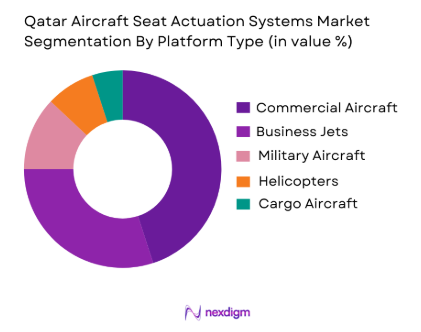

By Platform Type

The platform types in the Qatar Aircraft Seat Actuation Systems market include commercial aircraft, business jets, military aircraft, helicopters, and cargo aircraft. The commercial aircraft segment holds the highest market share, driven by the significant expansion of Qatar Airways and other regional carriers investing in fleet upgrades. The demand for high-end passenger comfort in these aircraft has pushed the commercial segment to the forefront. Furthermore, the consistent increase in international and domestic air travel further boosts the demand for advanced seating solutions within this segment.

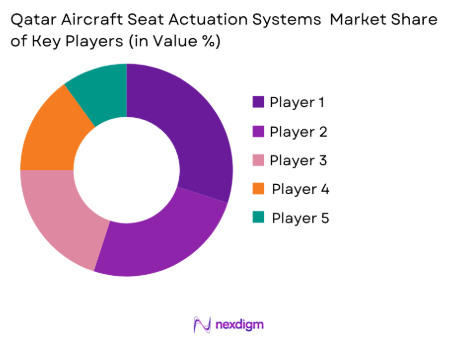

Competitive Landscape

The Qatar Aircraft Seat Actuation Systems market is characterized by strong competition from both regional and global players. The market is largely dominated by a few key players, including major manufacturers like Boeing, Thales Group, and UTC Aerospace Systems, which have established a strong presence in Qatar and the wider GCC region. This competitive landscape reflects the influence of global aviation companies collaborating with local airlines and aircraft manufacturers.

| Company | Establishment Year | Headquarters | Product Portfolio | Technology Focus | Key Partnerships | R&D Investment | Regional Reach |

| Boeing | 1916 | Chicago, USA | Aircraft Systems | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | Actuation Systems | ~ | ~ | ~ | ~ |

| UTC Aerospace Systems | 1934 | Farmington, USA | Seating Systems | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | Aerospace Systems | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1934 | Charlotte, USA | Aircraft Seating | ~ | ~ | ~ | ~ |

Qatar Aircraft Seat Actuation Systems market Analysis

Growth Drivers

Expansion of Qatar’s Commercial Aviation Fleet

Qatar’s aircraft seat actuation systems market is strongly driven by the continuous expansion and modernization of the country’s commercial aviation fleet, led primarily by Qatar Airways. As one of the world’s fastest-growing premium carriers, Qatar Airways consistently invests in wide-body and long-haul aircraft equipped with advanced seating configurations, particularly in business and first-class cabins. Seat actuation systems—responsible for reclining, leg rests, lumbar adjustment, and flat-bed conversion—are critical to passenger comfort and brand differentiation. The airline’s focus on luxury travel experiences increases demand for high-precision, electrically powered, and lightweight actuation systems. Additionally, fleet expansion requires both line-fit installations for new aircraft and retrofit programs for cabin upgrades, further driving system demand. Qatar’s strategic positioning as a global aviation hub amplifies aircraft utilization rates, accelerating wear and replacement cycles and supporting sustained growth for seat actuation system suppliers.

Rising Focus on Passenger Comfort and Cabin Innovation

Increasing competition among global airlines has intensified the focus on passenger comfort, driving innovation in aircraft interiors and seating systems. In Qatar, airlines emphasize premium cabin experiences as a key differentiator, which directly supports demand for advanced seat actuation systems. Modern aircraft seats now incorporate multi-axis motion, memory positioning, noise reduction, and smooth actuation performance—features that rely on sophisticated electro-mechanical and electromechanical actuators. The integration of smart cabin technologies, including in-flight entertainment synchronization and passenger control interfaces, further boosts system complexity and value. As passengers increasingly expect customizable comfort, especially on long-haul routes common in Qatar’s aviation network, airlines are compelled to upgrade seating systems. This trend drives higher spending per seat and supports the adoption of next-generation actuation technologies, strengthening long-term market growth.

Market Challenges

High Cost and Complex Certification Requirements

One of the key challenges in the Qatar aircraft seat actuation systems market is the high cost associated with system development, certification, and installation. Actuation systems must comply with stringent aviation safety and quality standards set by global regulatory bodies such as EASA and FAA, which are also adopted by Qatar’s aviation authorities. Certification processes are time-consuming, expensive, and technically complex, creating high entry barriers for new suppliers. For airlines and MRO providers, the cost of certified systems and spare parts significantly impacts capital and maintenance budgets. Any design modification or technology upgrade requires recertification, further increasing costs. These financial and regulatory constraints limit supplier flexibility, slow innovation adoption, and can delay retrofit programs, especially during periods of cost optimization within the aviation sector.

Dependence on Global Supply Chains

The Qatar aircraft seat actuation systems market is highly dependent on global supply chains for components, raw materials, and specialized manufacturing capabilities. Most advanced actuators and control systems are produced by international suppliers, making the market vulnerable to supply disruptions, geopolitical tensions, and logistical delays. Events such as global trade restrictions, semiconductor shortages, or transportation bottlenecks can significantly impact system availability and lead times. For airlines operating high-utilization fleets, delays in spare part availability can disrupt maintenance schedules and aircraft turnaround times. Additionally, reliance on imported systems increases procurement costs due to currency fluctuations and import duties. This dependency challenges market stability and emphasizes the need for improved supplier diversification and localized MRO support within the region.

Opportunities

Growing Demand for Retrofit and Cabin Upgrade Programs

A major opportunity in the Qatar aircraft seat actuation systems market lies in the increasing demand for retrofit and cabin upgrade programs. Airlines operating in Qatar frequently refurbish aircraft interiors to maintain competitive service standards and extend aircraft service life. Retrofitting older aircraft with modern seat actuation systems allows airlines to enhance passenger comfort without investing in new aircraft purchases. These programs generate strong aftermarket demand for replacement actuators, control units, and installation services. As passenger expectations continue to rise, especially in premium cabins, retrofit activities are expected to grow steadily. This creates long-term revenue opportunities for system manufacturers, MRO providers, and technology suppliers specializing in lightweight, energy-efficient, and modular actuation solutions.

Adoption of Lightweight and Energy-Efficient Actuation Technologies

The aviation industry’s increasing emphasis on fuel efficiency and sustainability presents a significant opportunity for advanced seat actuation system providers in Qatar. Airlines are actively seeking lightweight components that reduce overall aircraft weight and improve fuel economy. Next-generation actuation systems made from advanced materials and optimized designs can significantly lower power consumption and maintenance requirements. Additionally, the shift toward electric and smart actuation systems aligns with broader aircraft electrification trends. Suppliers that offer compact, reliable, and energy-efficient actuation technologies stand to benefit from both OEM installations and aftermarket demand. As Qatar continues to invest in next-generation aircraft and sustainable aviation practices, adoption of innovative actuation solutions is expected to accelerate, supporting market expansion

Future Outlook

Over the next decade, the Qatar Aircraft Seat Actuation Systems market is expected to witness substantial growth, fuelled by continued advancements in seat technologies, the rise of demand for passenger comfort, and the expansion of the Middle Eastern aviation industry. The market will benefit from the increasing focus on electric and hybrid actuation systems that promise higher energy efficiency and reduced maintenance costs. Moreover, Qatar’s strategic positioning as a major hub for international travel and aviation development will further reinforce the market’s growth prospects. Advancements in aerodynamics and seating solutions will further drive demand for next-generation actuation systems in both commercial and business aviation platforms.

Major Players

- Boeing

- Thales Group

- UTC Aerospace Systems

- Safran

- Collins Aerospace

- Zodiac Aerospace

- Moog Inc.

- Sargent Aerospace

- Liebherr-Aerospace

- Curtiss-Wright

- Honeywell International

- Airbus

- Parker Hannifin

- B/E Aerospace

- Kongsberg Gruppen

Key Target Audience

- Airlines

- Aircraft Manufacturers

- Aerospace Engineers

- Aircraft Maintenance & Repair Organizations

- Aviation Regulatory Bodies

- Aviation Equipment Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the key variables that influence the Qatar Aircraft Seat Actuation Systems market. This is achieved by compiling data on the major stakeholders, including seat manufacturers, actuation system suppliers, and major airlines operating in the region. Desk research is conducted using proprietary databases to build a comprehensive understanding of the market ecosystem.

Step 2: Market Analysis and Construction

The next step involves analysing historical data on market penetration and industry revenue generation. This includes studying past demand trends, market saturation, and sales performance of various actuation system types across different aviation platforms. The focus is on building reliable data models that project future market behaviour.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from airlines, manufacturers, and suppliers. These experts provide insights into emerging technologies, customer preferences, and supply chain dynamics, helping refine and corroborate the initial market data.

Step 4: Research Synthesis and Final Output

The final phase involves gathering detailed feedback from the key players in the market. This includes direct engagements with manufacturers, airlines, and MRO service providers to refine market projections and provide a validated analysis. This interaction is critical to ensure accuracy and completeness in the final report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for lightweight and energy-efficient aircraft components

Technological advancements in actuation systems for better passenger comfort

Increase in air travel and fleet modernization initiatives - Market Challenges

High manufacturing costs and complexities in aircraft seat actuation systems

Regulatory hurdles and certification requirements

Supply chain disruptions in component sourcing - Market Opportunities

Expansion in the Middle East aviation market

Collaborations with aircraft manufacturers for integrated solutions

Growing demand for advanced seating systems in business jets and luxury aircraft - Trends

Shift towards electric and hybrid actuation systems

Increased focus on passenger experience and comfort features

Rising trends in digitalization and automation of seat systems

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electromechanical Actuators

Hydraulic Actuators

Pneumatic Actuators

Digital Actuators

Servo Actuators - By Platform Type (In Value%)

Commercial Aircraft

Business Jets

Military Aircraft

Helicopters

Cargo Aircraft - By Fitment Type (In Value%)

Linefit

Retrofit

OEM

Aftermarket

MRO - By End-user Segment (In Value%)

OEMs

MRO Service Providers

Airlines

Private Jet Owners

Government/Military - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Online Platforms

Third-Party Distributors

OEM Partnerships

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Revenue Growth, Technological, Innovations, Product Portfolio, Regional Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company Profiles

Boeing

Thales Group

UTC Aerospace Systems

Safran

Collins Aerospace

Zodiac Aerospace

Moog Inc.

Sargent Aerospace

Liebherr-Aerospace

Curtiss-Wright

Honeywell International

Airbus

Parker Hannifin

B/E Aerospace

Kongsberg Gruppen

- Growing adoption by airlines seeking to enhance passenger experience

- Government and military sectors adopting advanced seat systems for specialized aircraft

- Private jet owners investing in premium seating options

- MRO service providers expanding offerings to include seat system repairs and upgrades

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035