Market Overview

The Qatar aircraft seating market, valued at USD ~ million in 2025, is driven by the increasing demand for premium and comfortable seating, particularly in wide-body and private aircraft. The significant rise in air travel and tourism within the Middle East region, especially Qatar, further contributes to the market’s growth. Qatar Airways’ continuous fleet expansion and upgrades to premium seating have notably driven the demand for high-end seating solutions. Moreover, the growth of Qatar as a hub for international airlines is helping fuel an increase in aircraft seating requirements.

The dominant players in the Qatar aircraft seating market include countries with a strong presence in aviation, notably Qatar itself, the United Arab Emirates, and Saudi Arabia. These nations dominate due to their strategic geographical location, significant investments in the aviation sector, and the expansion of their national carriers. Qatar, in particular, stands out because of its flagship carrier, Qatar Airways, known for its emphasis on luxury and comfort, which fuels demand for high-quality, innovative seating solutions across the Middle East and beyond.

Market Segmentation

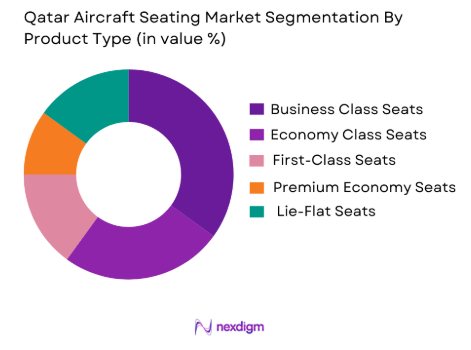

By Product Type

The Qatar aircraft seating market is segmented by product type, which includes economy class seats, business class seats, first-class seats, premium economy seats, and lie-flat seats. Business class seats have the largest market share in this segment, driven by the increasing preference for premium travel experiences. Qatar Airways, for instance, has consistently invested in business-class cabins equipped with state-of-the-art, fully lie-flat beds that offer unmatched comfort. The segment’s dominance is further supported by strong demand for business-class services from both corporate and high-net-worth travelers, particularly in international and long-haul flights.

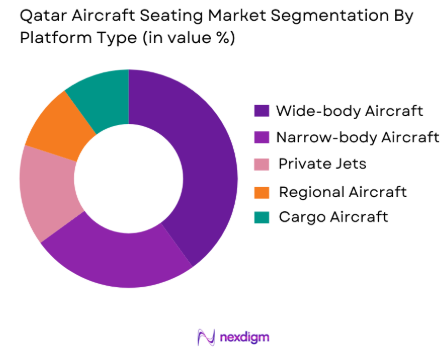

By Platform Type

The Qatar aircraft seating market is further segmented by platform type, including narrow-body aircraft, wide-body aircraft, regional aircraft, private jets, and cargo aircraft. Wide-body aircraft dominate the platform type segment due to the high demand for long-haul international flights and the increasing need for luxury and spacious seating arrangements. Qatar Airways, with its fleet of Airbus A350s and Boeing 777s, has heavily invested in premium seating for its wide-body aircraft to offer comfort on long flights. Additionally, wide-body aircraft allow for more extensive cabin configurations, thus contributing to the growth of this segment.

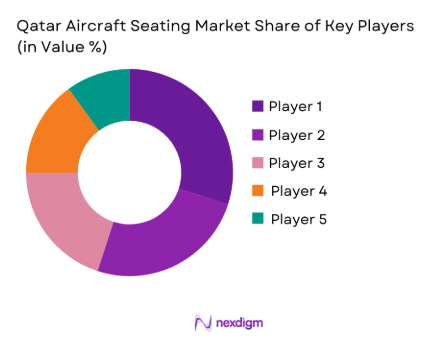

Competitive Landscape

The Qatar aircraft seating market is dominated by several prominent players, both global and regional, that are innovating and leading the market. Key competitors include established aerospace companies such as Boeing, Airbus, and Recaro, alongside specialized seating manufacturers like Geven and Stelia Aerospace. These companies continuously evolve their offerings to meet the needs of premium airlines and high-demand markets, offering cutting-edge seat designs that balance comfort, technology, and sustainability.

| Company Name | Establishment Year | Headquarters | Products/Services | R&D Investment | Strategic Partnerships | Regional Reach |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1906 | Schwäbisch Hall, Germany | ~ | ~ | ~ | ~ |

| Geven | 1952 | Italy | ~ | ~ | ~ | ~ |

| Stelia Aerospace | 2001 | France | ~ | ~ | ~ | ~ |

Qatar Aircraft Seating Market Analysis

Growth Drivers

Increasing Demand for Premium Seating

The growing preference for luxury travel, especially in business and first-class segments, is a significant growth driver in the Qatar aircraft seating market. Airlines, particularly Qatar Airways, are investing heavily in upgrading their fleets with more comfortable and technologically advanced seating options. The demand for more spacious, customizable, and luxurious seating is particularly strong among high-net-worth individuals and corporate travellers, further driving market growth.

Expansion of Qatar Airways and Regional Air Travel

Qatar Airways continues to expand its fleet and network, increasing the demand for high-end seating solutions. The airline’s strong emphasis on customer experience and comfort has set new standards for luxury travel. Additionally, the broader Middle East region is experiencing a rise in air travel due to tourism and business activities, which further fuels the demand for premium aircraft seating, particularly in Qatar.

Market Challenges

High Production and Material Costs

One of the key challenges faced by the Qatar aircraft seating market is the high cost of production and materials. Premium seating solutions often require specialized materials such as lightweight metals, advanced textiles, and customized designs, all of which contribute to high manufacturing costs. This can limit the affordability of such seats for certain segments of the market and create cost pressures for seating manufacturers.

Regulatory and Certification Hurdles

Aircraft seating solutions must comply with stringent international aviation regulations, including safety and certification standards. The process of seat certification is often time-consuming and costly, with numerous testing phases that must be met before seats can be installed in aircraft. These regulatory hurdles can delay market entry and increase operational costs for seating manufacturers, potentially limiting market growth.

Opportunities

Advancement in Sustainable and Lightweight Seat Designs

The growing emphasis on fuel efficiency and sustainability in the aviation industry presents an opportunity for aircraft seating manufacturers to develop lightweight and eco-friendly seating solutions. Seats that are lighter can help airlines reduce fuel consumption, which is an attractive selling point. Additionally, materials such as recyclable composites and bio-based textiles are becoming increasingly popular, offering manufacturers an opportunity to innovate with sustainable products.

Customization and Technology Integration in Seats

There is a significant opportunity in offering more customizable seating options that cater to the diverse needs of travellers. The integration of technology into aircraft seating, such as built-in entertainment systems, smart seat functions, and enhanced ergonomic designs, presents an opportunity for manufacturers to differentiate their products in the competitive market. Airlines are increasingly looking for ways to enhance passenger experience through personalized seating solutions, which presents growth potential for the sector.

Future Outlook

Over the next 5 years, the Qatar aircraft seating market is expected to experience steady growth driven by continued expansion in Qatar Airways’ fleet and the rising demand for luxury air travel. The rapid recovery of global tourism and business travel will boost the demand for high-end seating solutions, particularly in wide-body and private aircraft. Additionally, the emphasis on more sustainable, lightweight seating designs will shape the market’s future, in line with global trends towards reducing aircraft weight for fuel efficiency.

Major Players

- Boeing

- Airbus

- Recaro Aircraft Seating

- Geven

- Stelia Aerospace

- Safran Seats

- B/E Aerospace

- Zodiac Aerospace

- Aviointeriors

- Panasonic Avionics

- Rockwell Collins

- Thales Group

- Vantage

- Acro Aircraft Seating

- Bombardier Aerospace

Key Target Audience

- Airlines

- Aircraft Manufacturers

- Private Jet Operators

- Aircraft Leasing Companies

- Aircraft Maintenance & Repair Organizations

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Aircraft Seating Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves the identification of key variables that influence the Qatar aircraft seating market. These variables include the growing demand for premium seating, innovations in materials and design, and the recovery of the aviation industry post-pandemic. The phase includes extensive desk research leveraging secondary data sources, such as market reports, industry news, and publications.

Step 2: Market Analysis and Construction

In this phase, historical data regarding market trends, seating demand across different aircraft types, and technological advancements will be analysed. The analysis also includes a deep dive into Qatar Airways’ expansion strategies and procurement trends to forecast future market dynamics and value.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses generated during the analysis will be validated through expert consultations. Computer-assisted telephone interviews (CATIs) with key industry figures will offer additional insights into operational practices, consumer preferences, and the latest technological developments in aircraft seating.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing data collected from expert interviews, secondary sources, and market models. This will ensure that the Qatar aircraft seating market report is accurate, comprehensive, and reflective of real-time industry trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for comfortable seating in premium classes

Rising air travel in the Middle East region

Technological advancements in seat design and materials - Market Challenges

High manufacturing and material costs

Regulatory complexities in seat certifications

Competition from low-cost seating options - Market Opportunities

Growth in the private aviation sector

Shift toward more sustainable and lightweight seat designs

Increasing demand for custom seating solutions - Trends

Growth in fully flat-bed and modular seating

Integration of smart technologies and entertainment systems in seats

Customization and luxury features becoming standard in premium seating

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Business Class Seats

Economy Class Seats

First Class Seats

Premium Economy Seats

Lie-Flat Seats - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Private Jets

Cargo Aircraft - By Fitment Type (In Value%)

Retrofit

Linefit

Upgraded Retrofit

Recliner Seat Fitment

Modular Seat Fitment - By End User Segment (In Value%)

Commercial Airlines

Private Aircraft Operators

Aircraft Leasing Companies

Government & Military Operators

Charter Airlines - By Procurement Channel (In Value%)

Direct Procurement

Supplier Partnerships

OEM Contracts

Third-Party Procurement

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters(Market Value Share, Growth Rate, Seat Type Innovation, Technological Advancements, Regional Dominance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Boeing

Airbus

Recaro Aircraft Seating

Zodiac Aerospace

Schaeffler

Honeywell Aerospace

Geven

Stelia Aerospace

Thales Group

Rockwell Collins

Hawker Pacific

Panasonic Avionics

B/E Aerospace

Safran

ThyssenKrupp Aerospace

- Commercial airlines focusing on enhancing customer comfort

- Private aircraft operators investing in high-quality seats

- Aircraft leasing companies adopting more flexible seat options

- Government & military operators upgrading to more durable, comfortable seats

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035