Market Overview

The Qatar Aircraft Sensors Market is projected to experience significant growth due to advancements in aircraft technology and increasing demand for enhanced safety features in aviation. In 2025, the market was valued at approximately USD ~million, driven by the robust expansion of the aviation sector and increasing demand for advanced sensor technologies to improve safety and operational efficiency. The demand is primarily fueled by innovations in radar, infrared, and pressure sensors used in both commercial and military aircraft. These technologies enhance critical aircraft functions, such as navigation, collision avoidance, and environmental monitoring.

Qatar is a dominant player in the aircraft sensors market, with its growing aerospace sector contributing significantly to the demand. Qatar’s strong investments in its national carrier, Qatar Airways, and its strategic location as a global aviation hub are key factors propelling the market. Additionally, ongoing infrastructure expansion, such as Hamad International Airport, supports a growing need for advanced aircraft technologies. The demand from military applications also adds to the country’s influence in the market, as Qatar continues to modernize its air force and defense capabilities.

Market Segmentation

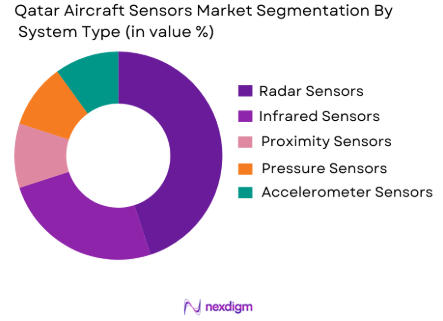

By System Type

The Qatar Aircraft Sensors Market is segmented by system type, with radar sensors being the dominant segment. Radar sensors, which are used for detecting objects, weather conditions, and obstacles, are integral to both military and commercial aviation. Their dominance is driven by the increasing need for accurate navigation and collision avoidance systems. Moreover, radar systems are used extensively in air traffic management and weather monitoring, which makes them essential for ensuring operational efficiency in aviation. The Qatar market sees a strong preference for these systems due to their reliability and ability to function in diverse environmental conditions, which is especially critical for flights operating in high-density airspaces or challenging weather patterns.

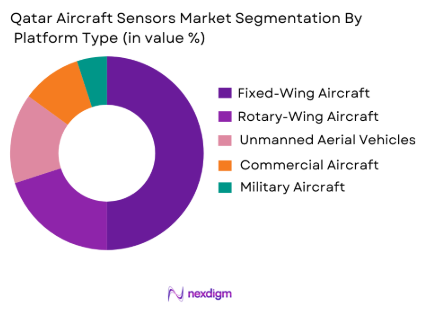

By Platform Type

In the Qatar Aircraft Sensors Market, fixed-wing aircraft dominate the platform type segment. The growth of Qatar Airways and increasing demand for international flights have heightened the need for advanced sensors in commercial airliners. Fixed-wing aircraft sensors, particularly radar and pressure sensors, are critical for long-haul flights, ensuring flight safety, fuel efficiency, and accurate navigation. Furthermore, fixed-wing aircraft are favored for their ability to carry heavier payloads, making them central to both commercial and military aviation in Qatar. With a growing fleet of fixed-wing aircraft in the region, this platform type continues to maintain a significant market share.

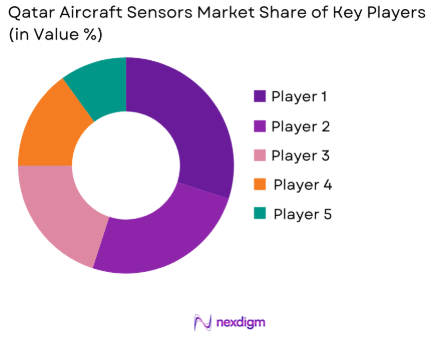

Competitive Landscape

The Qatar Aircraft Sensors Market is dominated by key global and regional players. Major companies such as Honeywell, Thales Group, and Rockwell Collins lead the market with their advanced sensor solutions used in both military and commercial aircraft. Their strong presence is supported by a combination of high-quality products, technological innovations, and deep-rooted partnerships with airlines and defense contractors. Additionally, regional players are gaining ground due to their localized expertise and ability to cater to the specific needs of Qatar’s aviation industry. The market’s competitive nature is underscored by the continuous technological advancements, with players focusing on enhancing sensor accuracy, reliability, and integration capabilities.

| Company | Establishment Year | Headquarters | Radar Sensors | Infrared Sensors | Proximity Sensors | Pressure Sensors | Accelerometer Sensors | Market Focus | Key Partnerships |

| Honeywell | 1906 | USA | Strong | Moderate | Moderate | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | Strong | Strong | Moderate | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | Moderate | Moderate | Strong | ~ | ~ | ~ | ~ |

| Safran Electronics & Defense | 2005 | France | Strong | Moderate | Moderate | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | USA | Moderate | Strong | Moderate | ~ | ~ | ~ | ~ |

Qatar Aircraft Sensors Market Analysis

Growth Drivers

Expansion of Qatar Airways Fleet

The continuous expansion of Qatar Airways’ fleet is a significant driver for the aircraft sensors market in Qatar. As the airline adds more aircraft to its operations, the demand for advanced sensors, particularly radar, infrared, and pressure sensors, increases. These sensors are essential for enhancing safety, navigation, and overall operational efficiency in the airline’s growing fleet of commercial and long-haul aircraft.

Military Modernization Initiatives

Qatar is modernizing its military capabilities, and as part of this effort, there is a growing demand for advanced aircraft sensors for defense purposes. These sensors are used in both manned and unmanned military aircraft, contributing to better situational awareness, defense systems, and overall mission effectiveness. This drive for technological enhancement in Qatar’s defense sector significantly impacts the growth of the aircraft sensors market.

Market Challenges

High Integration and Maintenance Costs

The integration of advanced sensors into aircraft systems can be expensive, particularly for complex radar and infrared sensors. Furthermore, the cost of maintaining these sensors, ensuring they remain fully operational and updated, can be a financial burden for airlines and defense sectors. These high costs present a challenge for widespread adoption, especially for smaller operators or nations with limited budgets for aviation technology.

Regulatory and Certification Hurdles

The aviation industry is highly regulated, with strict certification processes for aircraft components, including sensors. The complexity of these certification processes can delay product launches and market penetration. Additionally, ensuring that sensors meet international safety and performance standards poses a challenge, particularly for new entrants seeking to gain approval from aviation authorities.

Opportunities

Growing Demand for UAV Sensors

The increasing use of unmanned aerial vehicles (UAVs) for both military and commercial purposes presents a significant opportunity for the aircraft sensors market in Qatar. UAVs require a variety of sensors, such as radar and proximity sensors, for safe operation, navigation, and surveillance. As the global UAV market expands, Qatar is likely to see a rise in demand for these sensor technologies, especially for surveillance and defense applications.

Technological Advancements in Sensor Integration

Ongoing advancements in sensor technologies, including miniaturization, IoT integration, and AI-based analytics, present significant opportunities for growth. The integration of AI in aircraft sensors, for instance, enhances data analysis and real-time decision-making capabilities. This provides opportunities for manufacturers to develop more efficient, cost-effective sensors with enhanced capabilities, opening up new markets and applications for these technologies in Qatar’s aviation industry

Future Outlook

Over the next decade, the Qatar Aircraft Sensors Market is expected to witness significant growth, driven by continued expansion in the aviation sector and increased demand for cutting-edge sensor technologies. Technological advancements in radar, infrared, and pressure sensors will play a crucial role in enhancing aircraft safety, performance, and operational efficiency. Moreover, Qatar’s strategic positioning as a major global aviation hub will support further growth, with increasing investments in both commercial and military aviation. Continuous developments in sensor technology, along with the country’s focus on modernizing its defense capabilities, will contribute to a strong future demand for advanced aircraft sensors.

Major Players

- Honeywell International

- Thales Group

- Rockwell Collins

- Safran Electronics & Defense

- Moog Inc.

- General Electric

- Northrop Grumman

- L3 Technologies

- Curtiss-Wright

- TE Connectivity

- Airbus

- Boeing

- BAE Systems

- Raytheon Technologies

- Mitsubishi Electric

Key Target Audience

- Airlines and aviation operators

- Military and defense agencies

- Aircraft manufacturers

- Aviation regulatory bodies

- Aviation technology suppliers

- Aircraft component and sensor suppliers

- Government and regulatory bodies

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the key variables that influence the Qatar Aircraft Sensors Market. Desk research is utilized to identify market drivers, restraints, and trends that affect the market landscape. Secondary research sources, including government reports and company websites, provide a foundation for developing a comprehensive market map.

Step 2: Market Analysis and Construction

This phase involves gathering and analysing historical data on the Qatar Aircraft Sensors Market. This includes evaluating market trends, technological developments, and consumer behaviour. Additionally, historical growth data from reliable sources will be incorporated to construct accurate market projections.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends, growth drivers, and challenges will be validated through consultations with industry experts. These experts provide operational insights from the market, refining data and offering a deeper understanding of the market’s dynamics.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the collected data from expert consultations and market analysis. Insights from industry players and primary data are integrated to deliver an accurate and comprehensive report. The final output will be verified through cross-validation with industry experts to ensure reliability and accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for advanced aircraft safety systems

Rising aircraft fleet expansion in Qatar

Technological advancements in aircraft sensor systems - Market Challenges

High initial cost of advanced sensor technologies

Complexities in sensor integration with existing systems

Stringent regulatory requirements for aircraft certification - Market Opportunities

Growing demand for unmanned aerial vehicle (UAV) sensors

Advances in artificial intelligence and machine learning for sensor enhancement

Development of eco-friendly and energy-efficient sensor technologies - Trends

Shift towards autonomous aircraft and sensor systems

Increased adoption of IoT-enabled aircraft sensors

Rising focus on cybersecurity in aircraft sensor systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-202

- By System Type (In Value%)

Radar Sensors

Infrared Sensors

Proximity Sensors

Pressure Sensors

Accelerometer Sensors - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Unmanned Aerial Vehicles (UAVs)

Commercial Aircraft

Military Aircraft - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Upgrades

Maintenance and Support - By End User Segment (In Value%)

Commercial Airlines

Military

Private Aviation

UAV Operators

Airline OEMs - By Procurement Channel (In Value%)

Direct Sales

Distributors and Resellers

Government Procurement

Online Platforms

Service Providers

- Market Share Analysis

- Cross Comparison Parameters (Market Share, System Complexity, Fitment Type, Procurement Channel, Region-wise Growth)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Honeywell International

Thales Group

General Electric

Northrop Grumman

Rockwell Collins

L3 Technologies

Moog Inc.

Safran Electronics & Defense

Sagem Avionics

Curtiss-Wright

TE Connectivity

Airbus

Boeing

BAE Systems

Raytheon Technologies

- Commercial airlines focusing on enhancing operational safety

- Military adoption of advanced sensors for defense applications

- Private aviation investing in high-end sensor technologies

- UAV operators exploring cost-effective sensor solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035