Market Overview

The Qatar Aircraft Spare Parts market is valued based on the growing demand for spare parts driven by the expansion of the aviation industry, especially in the Middle East. The market size is influenced by the region’s booming aviation sector, supported by increasing air traffic and infrastructure development. In 2023, the market value reached USD ~ billion, with further growth expected due to the rising demand for maintenance, repair, and overhaul (MRO) services. The presence of numerous international and regional airlines like Qatar Airways contributes to this dynamic growth.

Qatar dominates the aircraft spare parts market in the Middle East, bolstered by its strategic location and the presence of key players in the aviation industry. Doha, the capital, is a central hub for air transport and MRO services in the region. Additionally, Qatar Airways, one of the world’s leading airlines, continues to drive demand for aircraft spare parts. The country’s infrastructure investments and government support further solidify its position as a leader in the market.

Market Segmentation

By System Type

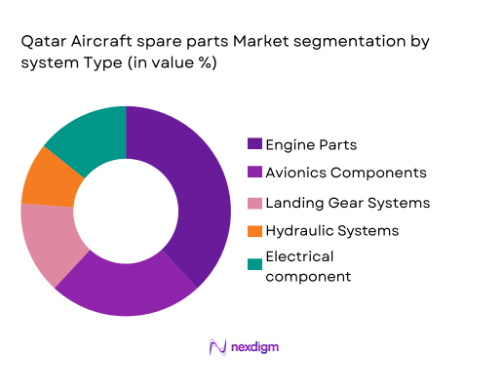

The Qatar Aircraft Spare Parts market is segmented by system type, including engine parts, avionics, landing gear systems, hydraulic systems, and electrical components. Among these, engine parts hold the dominant market share, largely due to the complexity and high cost of engine maintenance. With Qatar Airways’ growing fleet of both wide-body and narrow-body aircraft, engine-related components experience consistent demand, especially for advanced engine parts that require specialized spare parts for repair and maintenance. Engine overhaul services and parts are crucial for ensuring the efficient operation of Qatar Airways’ aircraft, driving the high share of this segment.

By Platform Type

The platform type segmentation in Qatar Aircraft Spare Parts market includes commercial aircraft, military aircraft, private jets, cargo aircraft, and helicopters. Commercial aircraft dominate the market, accounting for the largest share, due to the extensive fleet of commercial airlines such as Qatar Airways. This dominance is driven by the increasing number of long-haul flights, particularly to Europe, Asia, and the Americas. As Qatar Airways continuously expands its fleet, the demand for spare parts to support its commercial aircraft is significantly high. The constant upgrades in fleet technology, including next-gen wide-body aircraft, also play a role in sustaining this dominance.

Competitive Landscape

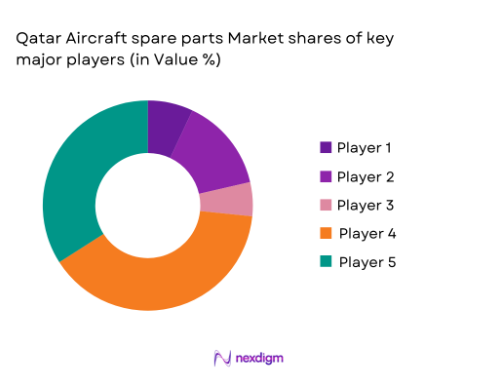

The Qatar Aircraft Spare Parts market is dominated by key global and regional players that supply spare parts, engines, and MRO services. The competition is intense due to the market’s strategic location and the rapid growth of the airline sector. Major players include international giants like Boeing and Rolls-Royce, which are directly linked to Qatar Airways’ aircraft fleet, and regional suppliers that specialize in specific components. This market consolidation reflects the significant influence these companies have in the supply chain, making them integral to the country’s aviation industry.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Presence | Technology Innovation | Supply Chain Network |

| Boeing | 1916 | Chicago, USA | – | – | – | – |

| Rolls-Royce | 1904 | Derby, UK | – | – | – | – |

| Safran | 2005 | Paris, France | – | – | – | – |

| Honeywell Aerospace | 1999 | Phoenix, USA | – | – | – | – |

| Collins Aerospace | 2018 | Charlotte, USA | – | – | – | – |

Qatar Aircraft Spare Parts Market Dynamics

Growth Drivers

Increase in Air Traffic and Fleet Expansion

The Middle East is witnessing a substantial rise in air traffic, with Qatar’s aviation industry being one of the major beneficiaries. According to the International Air Transport Association (IATA), the Middle East aviation sector grew by 6.8% in 2022, and Qatar’s national carrier, Qatar Airways, remains one of the world’s leading airlines in terms of fleet size and routes. In 2023, Qatar Airways increased its fleet by 11%, leading to a higher demand for aircraft spare parts to support this rapid expansion. The rising passenger demand, especially for long-haul international flights, directly impacts the demand for spare parts, including engines, avionics, and other critical components for maintenance and overhaul. The growth in global air traffic, which is forecast to increase by 4.2% annually until 2025, also fuels the need for spare parts.

Government Initiatives for Aviation Infrastructure Growth

Qatar has heavily invested in its aviation infrastructure, particularly through Hamad International Airport, which has been expanding its capacity to accommodate more passengers. This growth is supported by the government’s long-term development plan, Qatar National Vision 2030. In 2023, Qatar Airways’ continued partnership with the Qatari government led to investments in modern aircraft and airport infrastructure to meet rising demand. According to the Qatar Ministry of Transport and Communications, the nation’s aviation sector is expected to generate an estimated USD 7 billion in revenue by 2025, thanks to these infrastructural expansions. Such investments boost demand for aircraft spare parts, including the components required for MRO services. Source: Qatar Ministry of Transport and Communications

Market Challenges

High Cost of Advanced Aircraft Spare Parts

One of the major challenges facing the Qatar Aircraft Spare Parts market is the high cost of advanced components, particularly engine parts and avionics. Aircraft engines require highly specialized parts, which are expensive to manufacture and source. In 2023, engine maintenance costs were reported to account for approximately 40% of total MRO expenditure for Qatar Airways. The high prices are primarily due to the complexity of the components and the extensive research and development needed to maintain and improve engine technology. These high costs pose challenges for airlines and MRO service providers in Qatar, as they strive to manage operational costs while maintaining fleet performance.

Supply Chain Disruptions in the Global Market

The global supply chain for aircraft spare parts is vulnerable to disruptions, which can significantly impact the availability of critical components. Qatar’s reliance on international suppliers for spare parts makes it susceptible to these disruptions. For instance, the COVID-19 pandemic severely impacted global supply chains, leading to delays and shortages of aircraft parts in 2022. These challenges are compounded by geopolitical tensions and trade restrictions, which can delay parts delivery and increase procurement costs. The global chip shortage, for example, has impacted the availability of avionics components, a crucial segment in the Qatar Aircraft Spare Parts market.

Market Opportunities

Expanding Tourism Sector Driving Aircraft Fleet Growth

Qatar’s tourism sector has been experiencing steady growth, with tourist arrivals reaching over 2.3 million in 2023, up from ~ million in 2022. This increasing influx of tourists has spurred demand for flights, particularly to destinations in Europe, Asia, and North America. As a result, Qatar Airways continues to expand its fleet to accommodate growing passenger demand. In turn, the demand for aircraft spare parts has surged, as fleet expansions require regular maintenance and new components. The growing tourism sector not only boosts air traffic but also encourages investment in modern aircraft, further driving demand for high-quality spare parts.

Growth of Low-Cost Carriers Increasing Demand for Spare Parts

The rise of low-cost carriers (LCCs) in the Middle East is providing a significant opportunity for the Qatar Aircraft Spare Parts market. Qatar’s airline industry has seen a growing presence of budget airlines, which are expanding their fleets to meet the needs of cost-conscious travelers. As LCCs increase their operations, they require a steady supply of affordable aircraft parts for maintenance. These carriers typically operate a high volume of short-haul flights, increasing the frequency of parts replacement and driving demand for spare parts in the region. In 2023, Qatar Airways’ budget subsidiary, Qeshm Air, saw a 15% increase in fleet size, further stimulating the demand for spare parts.

Future Outlook

Over the next decade, the Qatar Aircraft Spare Parts market is expected to experience substantial growth, with a focus on modernization and fleet expansion. This growth is driven by the consistent rise in air traffic and the region’s ongoing infrastructure projects, such as the development of new airports and expansion of MRO facilities. Additionally, advancements in aircraft technologies and sustainability efforts will likely lead to new innovations in spare parts, further propelling the demand for specialized components.

Major Players in the Market

- Boeing

- Rolls-Royce

- Safran

- Honeywell Aerospace

- Collins Aerospace

- Pratt & Whitney

- MTU Aero Engines

- GE Aviation

- Liebherr Aerospace

- Embraer

- Northrop Grumman

- Thales Group

- Lockheed Martin

- United Technologies

- SIA Engineering

Key Target Audience

- Airlines operating within the Middle East

- MRO Service Providers

- Aircraft Fleet Operators

- Government Agencies

- Aviation Regulatory Bodies

- Defense Ministries

- Investments and Venture Capitalist Firms

- Aircraft Component Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying all key variables influencing the Qatar Aircraft Spare Parts market. This is achieved through comprehensive desk research, using both secondary and primary data sources. The objective is to map out the major stakeholders, including airlines, MRO service providers, and component manufacturers, to understand the industry’s dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data to understand market size, revenue generation, and market penetration. Detailed segmentation analysis is conducted, with a focus on system type, platform type, and procurement channels, to ensure accuracy in estimating the current market structure.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through in-depth consultations with industry experts, including senior officials from major airlines and aircraft component suppliers. This step ensures the validity of the assumptions made and the reliability of the projected figures.

Step 4: Research Synthesis and Final Output

The final phase includes synthesis of all findings from previous phases and cross-validation with key stakeholders. Direct engagement with aircraft manufacturers and MRO service providers is essential to fine-tune the insights and provide an accurate depiction of market growth and future prospects.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in air traffic and fleet expansion

Government initiatives for aviation infrastructure growth

Rising demand for aircraft maintenance and repair services - Market Challenges

High cost of advanced aircraft spare parts

Supply chain disruptions in the global market

Stringent regulatory and certification requirements - Market Opportunities

Expanding tourism sector driving aircraft fleet growth

Growth of low-cost carriers increasing demand for spare parts

Technological advancements in aircraft part manufacturing - Trends

Shift toward digitalization in spare parts procurement

Growing preference for eco-friendly aircraft parts

Integration of predictive maintenance technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Engine Parts

Avionics Components

Landing Gear Systems

Hydraulic Systems

Electrical Components - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Jets

Cargo Aircraft

Helicopters - By Fitment Type (In Value%)

OEM Parts

Aftermarket Parts

MRO Services

Engine Overhaul Parts

Refurbished Parts - By End User Segment (In Value%)

Airlines

MRO Service Providers

Private Jet Owners

Government & Military

Air Cargo Operators - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Authorized Distributors

Third-Party Resellers

Online Platforms

Fleet Operators

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Revenue, Product Portfolio, Regional Reach, Technological Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Boeing

Airbus

GE Aviation

Rolls-Royce

Safran

Honeywell Aerospace

Collins Aerospace

Pratt & Whitney

MTU Aero Engines

GE Aviation

Embraer

Northrop Grumman

Liebherr Aerospace

SABCA

Thales Group

- Airlines focusing on reducing aircraft downtime

- MRO providers expanding services to cover new aircraft models

- Private jet owners investing in high-quality spare parts

- Military operators upgrading fleet maintenance capabilities

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035