Market Overview

The Qatar aircraft switches market is valued at approximately USD ~ million in 2024. The market is driven by the growing demand for advanced aircraft switches in both commercial and military sectors. As Qatar expands its aviation infrastructure, with Qatar Airways continuing its fleet expansion and the Qatari military modernizing its aircraft fleet, there is an increasing need for state-of-the-art switches to enhance the safety and control systems within aircraft. The market’s growth is further supported by technological advancements in avionics systems, making switches more efficient and reliable in modern aircraft.

Qatar is a dominant player in the Middle East aircraft switches market due to its strategic location, robust aviation sector, and heavy investments in military and civilian aviation. The country’s flagship carrier, Qatar Airways, which is expanding its fleet to over 250 aircraft, drives the demand for advanced aircraft systems, including switches. Furthermore, the government’s focus on defense modernization, with the procurement of new fighter jets and military helicopters, supports the demand for high-quality, durable switches that can meet the rigorous operational needs of the military aviation sector.

Market Segmentation

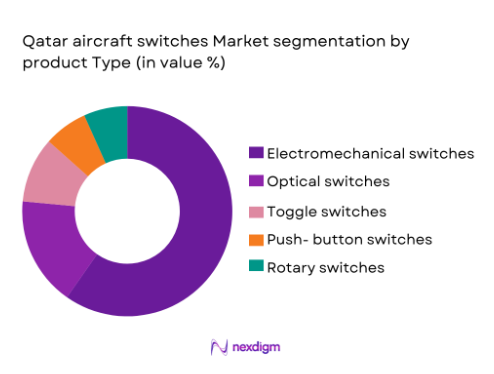

By Product Type

The Qatar aircraft switches market is segmented by product type, which includes electromechanical switches, optical switches, toggle switches, push-button switches, and rotary switches. Among these, electromechanical switches dominate the market. This dominance is driven by their extensive use in commercial and military aircraft. Electromechanical switches are preferred due to their reliability, durability, and ease of use in various control systems, such as cockpit avionics and cabin lighting. These switches provide the necessary precision for critical flight operations and are thus in high demand among aviation manufacturers, making them a significant subsegment in the market.

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, military aircraft, general aviation, helicopters, and unmanned aerial vehicles (UAVs). The commercial aircraft segment holds the largest market share in Qatar. This segment is dominated by the significant growth of Qatar Airways, which is investing heavily in new aircraft, including the Boeing 787 and Airbus A350. These advanced aircraft require sophisticated switching systems for a range of operational needs, from cockpit controls to cabin management. The increasing number of aircraft operating within the region has driven up demand for advanced switches in the commercial aviation sector.

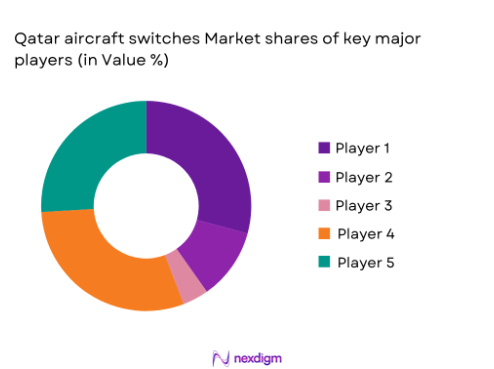

Competitive Landscape

The Qatar aircraft switches market is highly competitive, with a few key players dominating both the commercial and military aircraft segments. Companies such as Honeywell Aerospace, Safran, Collins Aerospace, Moog, and TE Connectivity play a pivotal role in the market by providing high-quality, reliable switches that meet rigorous safety standards. The consolidation of these key players in the market highlights their influence on the development and adoption of new switching technologies in aircraft systems. Their established brand presence, extensive distribution networks, and robust technological capabilities contribute to their dominance in the market.

| Company Name | Establishment Year | Headquarters | Product Offering | Market Presence | Innovation Focus | Major Partnerships | Revenue | Product Quality | R&D Investment | Certifications |

| Honeywell Aerospace | 1906 | United States | – | – | – | – | – | – | – | – |

| Safran | 2005 | France | – | – | – | – | – | – | – | – |

| Collins Aerospace | 1930 | United States | – | – | – | – | – | – | – | – |

| Moog | 1951 | United States | – | – | – | – | – | – | – | – |

| TE Connectivity | 2007 | Switzerland | – | – | – | – | – | – | – | – |

Qatar Aircraft Switches Market Dynamics

Growth Drivers

Rising Demand for Safety and Control Systems in Modern Aircraft

With the increasing complexity of modern aircraft systems, there is a rising demand for more sophisticated control systems, including advanced switches. In 2023, the International Civil Aviation Organization (ICAO) reported that the number of international air passengers in the Middle East, particularly in Qatar, was projected to reach over 75 million by 2025. This growing passenger traffic leads to the requirement for more reliable, high-performance safety and control systems. Aircraft switches play a pivotal role in controlling avionics, cabin lighting, and emergency systems, driving demand for advanced, durable switching technologies in both commercial and military aircraft.

Government Investments in the Aviation and Aerospace Sectors in Qatar

Qatar’s government is investing significantly in its aviation and aerospace sectors, boosting infrastructure and procurement, which further drives the demand for aircraft switches. Qatar’s National Vision 2035 includes extensive plans for modernizing its aviation infrastructure, with a particular focus on expanding Hamad International Airport and advancing the aerospace sector. In 2023, the government allocated substantial funding for these initiatives, including the procurement of advanced aircraft for both civilian and military uses. This focus on modernization translates into a growing need for sophisticated aircraft switches, as the country seeks to maintain its status as a leading aviation hub in the region.

Market Challenges

Supply Chain Disruptions in the Global Aviation Industry Affecting Timely Delivery of Aircraft Parts

Supply chain disruptions, exacerbated by global crises such as the COVID-19 pandemic, have had a significant impact on the aviation industry. In 2022, the World Trade Organization (WTO) noted that disruptions in global supply chains had led to delays in the delivery of critical aviation components, including switches. These disruptions, compounded by challenges in the logistics network, have delayed aircraft maintenance schedules and the availability of replacement parts in Qatar. Aircraft manufacturers and maintenance operators in the region face difficulties in sourcing high-quality switch components, which affects both the production and operational timelines for aircraft fleet upgrades and new aircraft procurements.

Regulatory Hurdles for Certification of New Switching Technologies in the Aviation Sector

In Qatar, as in many other regions, the regulatory environment for the certification of new aviation technologies, including switches, is highly stringent. New switching systems need to meet international aviation standards, which requires significant testing and validation. In 2023, the Civil Aviation Authority of Qatar (QCAA) reported that the process for certifying new technologies could take up to two years due to the comprehensive testing and approval process required by both national and international aviation bodies such as ICAO and the FAA. These regulatory hurdles delay the adoption of innovative switching technologies, as manufacturers must comply with numerous regulations before their products are deemed safe for use in aircraft.

Market Opportunities

Growing Demand for Smart Switches Offering Improved Efficiency and Safety in Next-Generation Aircraft

The demand for smart switches in aircraft is on the rise as airlines and military operators increasingly seek more efficient and safer systems. Smart switches, which can integrate multiple functions into a single control interface, offer improved operational efficiency and enhanced safety features, such as emergency override and fault detection systems. As aircraft manufacturers develop next-generation models, there is a growing demand for such smart switches to manage various systems more effectively. In Qatar, where the aviation industry is rapidly modernizing, the need for these advanced control systems is expected to increase as airlines and military sectors move toward adopting the latest technological innovations in aircraft design.

Rising Focus on Enhancing Military Aircraft Capabilities in Qatar, Boosting Demand for Specialized Switches

Qatar has been increasing its defense budget, which includes the modernization of its military aircraft fleet. The country has procured advanced fighter jets, including the Dassault Rafale and F-15, and continues to invest in new aircraft and military infrastructure. These advancements drive the need for specialized switches that can withstand the demanding operational environments of military aircraft. The rising focus on defense capabilities presents a significant market opportunity for manufacturers of specialized switches, such as fire-resistant switches and highly durable control systems, which are critical for military aviation operations in Qatar.

Future Outlook

The Qatar aircraft switches market is expected to grow significantly over the next 5-10 years. The major growth drivers include the increasing fleet size of commercial airlines, particularly Qatar Airways, as well as the expansion of the military aircraft sector. The rise of technological advancements, such as smart switches and multi-functional systems, will also contribute to market growth. Additionally, government initiatives supporting infrastructure growth in aviation and defense will create ample opportunities for market players to introduce innovative switching systems to meet the increasing demands of modern aircraft.

Major Players

- Honeywell Aerospace

- Safran

- Collins Aerospace

- Moog

- TE Connectivity

- Rockwell Collins

- Meggitt

- Curtiss-Wright

- L3 Technologies

- Diehl Aviation

- General Electric

- United Technologies Corporation

- Thales

- Zodiac Aerospace

- Avionics Systems Inc.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Commercial Aviation Operators

- Military Aircraft Manufacturers

- Original Equipment Manufacturers (OEMs)

- Aerospace Component Suppliers

- Aircraft Maintenance and Repair Organizations (MROs)

- Defense Contractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research involves mapping key stakeholders within the Qatar aircraft switches market. This will include identifying key manufacturers, end-users, and regulatory bodies that influence demand. Desk research will leverage both secondary and proprietary databases to gather relevant information on the market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will analyze historical data concerning market penetration, product performance, and overall demand in the Qatar aircraft switches market. The aim is to build a comprehensive understanding of the market’s growth trajectory and establish revenue estimates based on product type and platform usage.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts and stakeholders such as aircraft manufacturers, airline operators, and military officials. These consultations will provide deeper insights into operational requirements and emerging trends in the aircraft switches market.

Step 4: Research Synthesis and Final Output

The final phase will synthesize all collected data and insights into a detailed report on the Qatar aircraft switches market. This will include a thorough analysis of market segmentation, competitive landscape, and future growth opportunities, ensuring a comprehensive understanding of the market’s potential.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing aircraft fleet size in the Middle East, specifically in Qatar, driving demand for advanced switches.

Rising demand for safety and control systems in modern aircraft, leading to more sophisticated switches.

Government investments in the aviation and aerospace sectors in Qatar supporting infrastructure and procurement. - Market Challenges

High costs associated with advanced switch systems limiting adoption in smaller aircraft segments.

Supply chain disruptions in the global aviation industry affecting the timely delivery of aircraft parts.

Regulatory hurdles for certification of new switching technologies in the aviation sector. - Market Opportunities

Expansion of Qatar Airways’ fleet, increasing procurement of advanced switch systems for modern aircraft.

Growing demand for smart switches that offer improved efficiency and safety in next-generation aircraft.

Rising focus on enhancing military aircraft capabilities in Qatar, boosting demand for specialized switches. - Trends

Adoption of more intuitive, touch-based switches in modern commercial and military aircraft.

Integration of multi-functional switches that combine several controls into a single device.

Technological advancements driving the evolution of durable, lightweight, and energy-efficient switches.

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Electromechanical Switches

Optical Switches

Toggle Switches

Push-button Switches

Rotary Switches - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

Linefit

Retrofit

Maintenance and Overhaul

Original Equipment Manufacturers (OEM)

Aftermarket - By End User Segment (In Value%)

Commercial Aviation Operators

Military Operators

OEMs and Suppliers

Private Aviation Owners

Aerospace Component Manufacturers - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Aftermarket Suppliers

OEM Channels

Government Procurement

Online Retail

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Market Reach, Supply Chain Efficiency, Cost Leadership, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Honeywell Aerospace

Safran

Collins Aerospace

Rockwell Collins

Moog

Thales

L3 Technologies

Diehl Aviation

Curtiss-Wright

Meggit

TE Connectivity

General Electric

Sierra Nevada Corporation

United Technologies Corporation

Boeing

Airbus

- Commercial airlines in Qatar looking for highly reliable and innovative switches for fleet upgrades.

- Military contractors requiring advanced switching systems to enhance the operational capabilities of fighter jets.

- OEMs investing in smart switches for enhanced control and safety in new aircraft models.

- Private aviation owners seeking advanced switches for increased cockpit comfort and functionality.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035