Market Overview

The Qatar aircraft towbar market current size stands at around USD ~ million, reflecting steady procurement volumes driven by airport expansion and fleet renewal cycles. During the most recent two-year period, market value increased from USD ~ million to USD ~ million as airlines and ground handling operators upgraded towing equipment to meet higher safety and efficiency standards. Installation demand reached ~ units annually, while replacement cycles accounted for ~ units, supported by rising operational intensity across commercial and defense aviation segments.

Market dominance is concentrated in Doha, where major aviation infrastructure, airline headquarters, and MRO hubs are clustered. The city benefits from mature ground handling ecosystems, advanced airside logistics, and strong regulatory oversight, creating sustained demand for certified towbar systems. Surrounding logistics zones in Al Wakrah and Al Rayyan further reinforce this dominance by hosting cargo terminals and maintenance bases. Policy support for aviation services localization and continuous airport modernization continues to strengthen regional leadership in procurement and deployment.

Market Segmentation

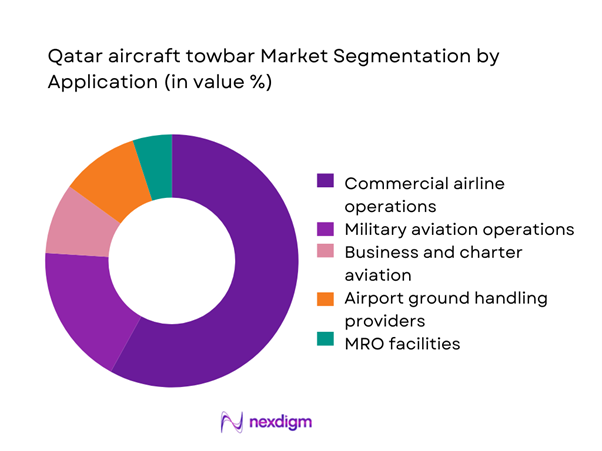

By Application

Commercial airline operations dominate the Qatar aircraft towbar market due to the scale of fleet movements, high aircraft turnaround frequency, and strict safety compliance standards at major airports. Airlines account for the bulk of replacement demand, driven by wear-and-tear cycles and evolving compatibility needs for new-generation aircraft. Military and government aviation contribute a stable but specialized share, focused on heavy-duty and customized towbars. Business and charter aviation remains a niche but growing segment, particularly as private aviation facilities expand. MRO facilities play a strategic role by influencing specification standards and recommending equipment upgrades, reinforcing demand for technologically advanced towbar systems across applications.

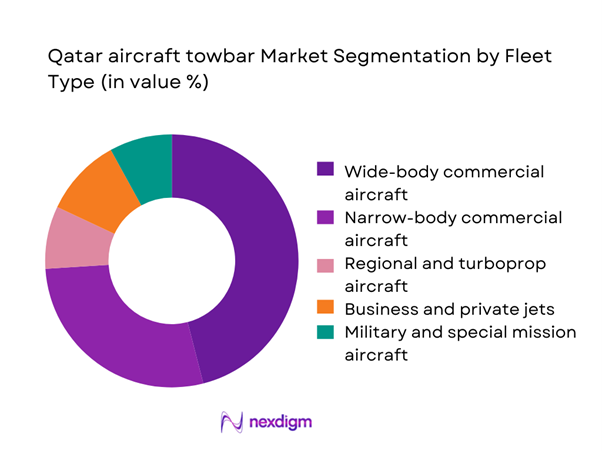

By Fleet Type

Wide-body commercial aircraft form the dominant fleet category in the Qatar aircraft towbar market, reflecting the country’s strong position in long-haul aviation and international connectivity. These aircraft require high-capacity and reinforced towbar systems, driving higher average spending per unit. Narrow-body aircraft represent a consistent secondary segment, supported by regional routes and feeder operations. Business jets and special mission aircraft generate specialized demand for compact and adjustable towbar designs. Military transport aircraft add a layer of complexity, requiring ruggedized solutions. The overall fleet mix drives a market preference for modular and multi-aircraft compatible towbar platforms.

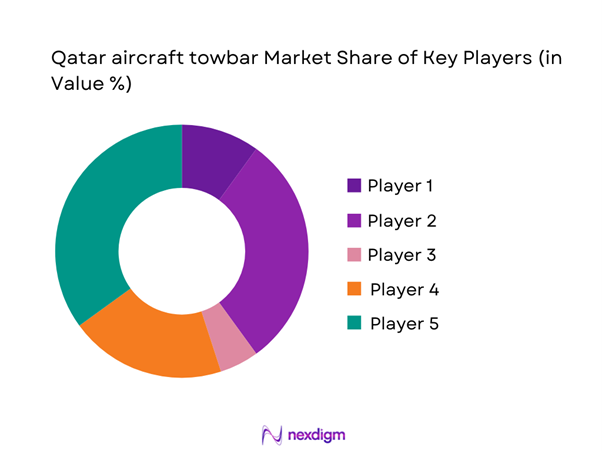

Competitive Landscape

The Qatar aircraft towbar market is moderately concentrated, characterized by a mix of established international manufacturers and specialized ground support equipment suppliers operating through regional distributors. Competitive intensity is shaped by certification standards, long-term service contracts, and the ability to provide rapid aftermarket support. Buyers favor suppliers with proven performance in high-traffic airport environments, resulting in relatively stable vendor relationships and limited short-term switching.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Tronair | 1971 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| TLD Group | 1946 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| JBT AeroTech | 1884 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Goldhofer AG | 1705 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Malabar International | 1977 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar aircraft towbar Market Analysis

Growth Drivers

Expansion of Hamad International Airport and associated airside infrastructure

Recent airside expansion projects have added ~ terminals and ~ gates, increasing daily aircraft movements by ~ operations. This surge has translated into annual towbar deployment of ~ units to support expanded ramp capacity. Ground handling fleets recorded replacement demand of ~ systems as older equipment reached operational limits. Infrastructure investments of USD ~ million in airfield logistics created downstream demand for high-capacity towing solutions, particularly for wide-body aircraft. The scale of these developments has reinforced continuous procurement cycles across airport authorities and third-party service providers.

Fleet modernization and growth of Qatar Airways wide-body aircraft

The introduction of ~ new wide-body aircraft over the last operational cycle has driven the need for compatible heavy-duty towbars. Fleet modernization programs led to the retirement of ~ legacy aircraft, triggering equipment standardization initiatives across ground support fleets. Towbar compatibility upgrades accounted for ~ units in additional procurement volume. Operational efficiency targets have further encouraged adoption of modular towbar systems, reducing downtime by ~ hours annually across major terminals and strengthening demand momentum within airline-led purchasing channels.

Challenges

High upfront cost of heavy-duty and smart towbar systems

Advanced towbar platforms equipped with monitoring features require initial investments of USD ~ million annually across major operators. Smaller ground handling firms face capital constraints, limiting adoption to ~ units compared to potential demand of ~ units. Budget allocation pressures have extended replacement cycles by ~ months in some fleets, slowing market turnover. The financial burden is further amplified by certification and compliance expenses, which add USD ~ million in indirect costs over multi-year equipment lifecycles.

Limited local manufacturing and dependence on imports

The absence of domestic production facilities results in import volumes of ~ units annually, exposing buyers to extended lead times of ~ weeks. Logistics and customs processing contribute additional handling costs of USD ~ million per year across the sector. Supply chain disruptions have previously delayed ~ system deployments, impacting operational readiness at peak traffic periods. This dependency restricts rapid scaling of ground support fleets and constrains the ability to customize equipment for localized operational conditions.

Opportunities

Development of smart towbars with predictive maintenance features

The integration of sensor-enabled towbars offers potential to reduce unscheduled downtime by ~ hours per year across large fleets. Pilot deployments of ~ smart systems have demonstrated maintenance cost savings of USD ~ million annually through early fault detection. As digital ramp management platforms expand, demand for connected towbar solutions is projected to rise by ~ units over near-term planning cycles. This technological shift positions advanced manufacturers to capture premium segments within airport and airline procurement programs.

Localization of assembly and service centers in Qatar

Establishing regional assembly hubs could reduce lead times by ~ weeks and lower logistics expenses by USD ~ million annually. Local service facilities would support faster turnaround for ~ maintenance events per year, improving fleet availability. Policy incentives for industrial localization further strengthen the case for domestic value addition. Such developments could stimulate demand for ~ additional units by enabling flexible customization and improving aftersales responsiveness across major aviation clusters.

Future Outlook

The Qatar aircraft towbar market is expected to maintain steady expansion through 2035, supported by continued airport capacity upgrades and airline fleet growth. Increasing emphasis on safety automation and digital ground handling will accelerate adoption of advanced towbar systems. Localization initiatives and stronger aftermarket ecosystems are likely to reshape competitive dynamics, while defense and business aviation segments add incremental demand layers. Overall, the market outlook remains resilient, aligned with the country’s long-term aviation infrastructure strategy.

Major Players

- Tronair

- TLD Group

- JBT AeroTech

- Goldhofer AG

- Douglas Equipment

- Malabar International

- Aero Specialties

- SACO Airport Equipment

- Doll Fahrzeugbau

- TUG Technologies

- Red Box International

- ITW GSE

- Lektro

- Mulag

- Cavotec

Key Target Audience

- Commercial airlines operating in Qatar

- Airport authorities and operators

- Independent ground handling service providers

- MRO service organizations

- Defense and government aviation units

- Business and charter aviation operators

- Investments and venture capital firms focused on aviation infrastructure

- Government and regulatory bodies including Qatar Civil Aviation Authority and Ministry of Transport

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, and operational variables were mapped across airline fleets, airport infrastructure expansion, and ground handling service capacity. Equipment lifecycle parameters, certification requirements, and replacement cycles were identified to structure baseline market assumptions.

Step 2: Market Analysis and Construction

Market sizing models were developed using deployment volumes, fleet mix dynamics, and procurement patterns across commercial, military, and business aviation segments. Regional infrastructure pipelines and policy frameworks were integrated to refine demand projections.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through structured discussions with airport operations managers, GSE maintenance heads, and aviation logistics specialists. Feedback loops ensured alignment between modeled trends and real-world procurement behavior.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative inputs were consolidated into a unified analytical framework. Findings were synthesized to present actionable insights on market structure, competitive positioning, and long-term growth pathways.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft towbar taxonomy by aircraft class and towbarless compatibility, market sizing logic by airport traffic and GSE fleet count, revenue attribution across new sales rentals spares and maintenance, primary interview program with airports ground handlers MROs and GSE distributors, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and usage pathways in airport ground handling

- Ecosystem structure across airlines, MROs, and GSE providers

- Supply chain and distribution structure

- Regulatory and safety environment in Qatari aviation operations

- Growth Drivers

Expansion of Hamad International Airport and associated airside infrastructure

Fleet modernization and growth of Qatar Airways wide-body aircraft

Rising demand for efficient ground handling turnaround times

Increased outsourcing of ramp services to specialized GSE providers

Growth in military and government aviation operations

Higher safety compliance standards driving replacement demand - Challenges

High upfront cost of heavy-duty and smart towbar systems

Limited local manufacturing and dependence on imports

Long replacement cycles reducing short-term repeat sales

Harsh climatic conditions impacting equipment lifespan

Training gaps in advanced GSE handling and maintenance

Procurement delays linked to public-sector tender processes - Opportunities

Development of smart towbars with predictive maintenance features

Localization of assembly and service centers in Qatar

Rising MRO activity supporting aftermarket demand

Growing business aviation segment in the Gulf region

Integration with digital ramp management platforms

Public-private partnerships in airport services modernization - Trends

Shift toward modular and multi-aircraft compatible towbar designs

Adoption of sensor-based safety and load monitoring

Preference for long-life corrosion-resistant materials

Bundled sales with towbarless tractor and GSE packages

Increasing role of rental and leasing models for ground equipment

Focus on lifecycle cost optimization in procurement decisions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body commercial aircraft

Wide-body commercial aircraft

Regional and turboprop aircraft

Business and private jets

Military transport and fighter aircraft

Rotary-wing and special mission aircraft - By Application (in Value %)

Commercial airline operations

Military aviation operations

Business and charter aviation

Airport ground handling service providers

Maintenance, repair, and overhaul facilities

Aircraft manufacturing and completion centers - By Technology Architecture (in Value %)

Conventional mechanical shear-pin towbars

Heavy-duty high-capacity towbars

Adjustable and modular towbar systems

Towbars with load and stress monitoring sensors

Electro-assisted and semi-automated towbar designs - By End-Use Industry (in Value %)

Airlines

Airport authorities

Independent ground handling companies

MRO service providers

Defense and government aviation units

VIP and charter aviation operators - By Connectivity Type (in Value %)

Standalone mechanical systems

Digitally monitored towbar systems

Bluetooth-enabled inspection and tracking

IoT-integrated fleet management connectivity - By Region (in Value %)

Doha metropolitan aviation hubs

Al Rayyan and central Qatar aviation zones

Al Wakrah and southern logistics corridors

Al Khor and northern industrial regions

Western Qatar and energy-sector airfields

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product range coverage, aircraft compatibility breadth, safety and certification standards, customization capability, lead time and delivery performance, aftermarket service footprint, local distributor presence in Qatar, pricing and total cost of ownership)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Tronair

TLD Group

JBT AeroTech

Goldhofer AG

Douglas Equipment Ltd

Malabar International

Aero Specialties

SACO Airport Equipment

Doll Fahrzeugbau

TUG Technologies

Red Box International

ITW GSE

Lektro

Mulag

Cavotec

- Demand and utilization drivers in airline and MRO operations

- Procurement and tender dynamics across public and private airports

- Buying criteria and vendor selection priorities

- Budget allocation and financing preferences

- Implementation barriers and operational risk factors

- Post-purchase service, training, and spare parts expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035