Market Overview

The Qatar aircraft tugs market current size stands at around USD ~ million, reflecting steady capital deployment across airport ground handling fleets. Recent annual spending has moved from USD ~ million to USD ~ million, driven by modernization of towing equipment and replacement of legacy diesel platforms. Shipment activity has expanded from ~ units to ~ units, while installed base has increased from ~ systems to ~ systems. Average selling values have shifted from USD ~ thousand to USD ~ thousand, indicating a gradual transition toward higher-specification electric and towbarless models.

Operational demand is concentrated around Hamad International Airport and associated aviation clusters, where high aircraft movements, cargo throughput, and hub connectivity sustain continuous tug utilization. Dominance is reinforced by advanced apron infrastructure, centralized fleet management, and strong service ecosystems supporting maintenance and uptime. Policy emphasis on sustainability and safety accelerates adoption of low-emission ground support equipment. Secondary demand emerges from military and industrial airfields, where fleet renewal cycles and specialized towing requirements further strengthen the national market footprint.

Market Segmentation

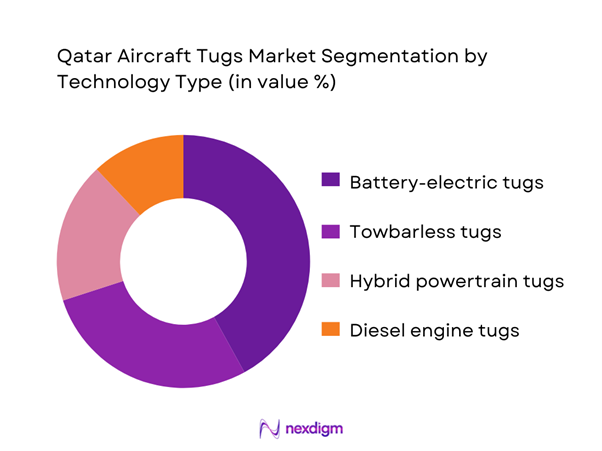

By Technology Type

Battery-electric and towbarless configurations dominate the Qatar aircraft tugs market due to strong alignment with national sustainability priorities and airport efficiency goals. Operators increasingly prioritize platforms that reduce emissions, minimize noise, and enhance maneuverability in congested apron environments. Advanced control systems and telematics integration improve fleet visibility and maintenance planning, supporting higher equipment utilization rates. Conventional diesel variants continue to serve niche heavy-duty applications, but procurement momentum is clearly shifting toward electric alternatives. This transition is further supported by infrastructure upgrades for charging and energy management, enabling airports to standardize on next-generation towing solutions.

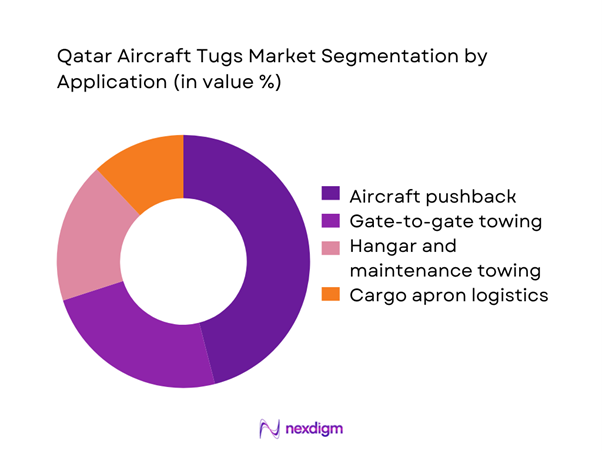

By Application

Pushback operations account for the largest share of tug deployment, reflecting continuous aircraft turnaround requirements at major terminals. Gate-to-gate towing and hangar movements form the next layer of demand, particularly for wide-body fleets and cargo aircraft requiring specialized handling. Growth in maintenance, repair, and overhaul activity has elevated the role of precision towing within hangars, where safety and maneuvering accuracy are critical. Cargo apron logistics also contribute meaningfully as freighter traffic expands. Collectively, these applications create a diversified utilization profile that supports steady fleet expansion and replacement cycles across Qatar’s aviation ecosystem.

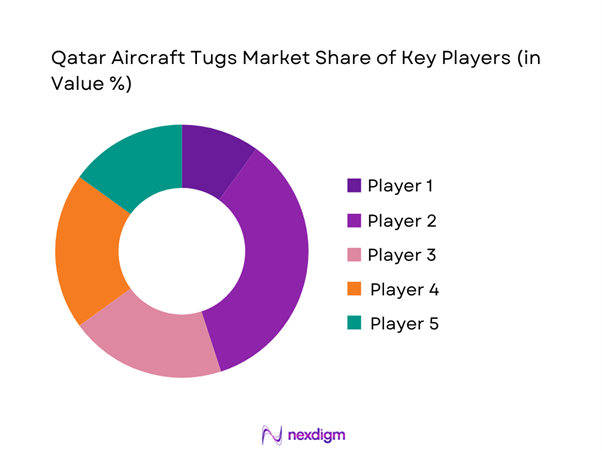

Competitive Landscape

The Qatar aircraft tugs market is moderately concentrated, characterized by a small group of global equipment manufacturers supported by regional distributors and service partners. Competitive differentiation centers on technology depth, service responsiveness, and compliance with aviation safety standards, while long-term contracts with airports and ground handling firms shape market stability.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| TLD Group | 1946 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| JBT AeroTech | 1981 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Goldhofer AG | 1705 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| MULAG Fahrzeugwerk | 1953 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| TREPEL Airport Equipment | 1981 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Tugs Market Analysis

Growth Drivers

Expansion of Hamad International Airport capacity and traffic growth

Operational scale has expanded from ~ aircraft movements to ~ aircraft movements, increasing tug utilization cycles from ~ turns per day to ~ turns per day. Annual ground handling expenditure has risen from USD ~ million to USD ~ million, supporting fleet additions from ~ units to ~ units. Cargo handling volumes have progressed from ~ tons to ~ tons, requiring higher-capacity towing solutions. Maintenance spending linked to apron equipment has moved from USD ~ million to USD ~ million, reinforcing replacement demand. These numeric shifts collectively elevate procurement momentum for advanced aircraft tugs across the primary aviation hub.

Rising aircraft fleet size across commercial and cargo operators

The active aircraft base has grown from ~ aircraft to ~ aircraft, driving towing assignments from ~ operations to ~ operations annually. Ground service contracts have expanded from ~ agreements to ~ agreements, lifting equipment deployment from ~ systems to ~ systems. Capital allocation toward ground support equipment has increased from USD ~ million to USD ~ million, reflecting higher operational intensity. Cargo fleet additions from ~ aircraft to ~ aircraft have further amplified heavy-duty tug requirements. These measurable changes underline a structurally expanding demand environment for aircraft towing solutions.

Challenges

High capital cost of advanced and electric tugs

Acquisition budgets for next-generation tugs have escalated from USD ~ million to USD ~ million, while per-unit outlays have shifted from USD ~ thousand to USD ~ thousand. Financing cycles have lengthened from ~ months to ~ months, delaying fleet upgrades. Total cost of ownership calculations now extend from ~ years to ~ years, increasing procurement scrutiny. Annual maintenance allocations have also moved from USD ~ million to USD ~ million due to specialized components. These numeric pressures collectively constrain rapid adoption despite clear operational benefits.

Limited local manufacturing and reliance on imports

Imported equipment share has remained high, with inbound shipments rising from ~ units to ~ units annually. Lead times have extended from ~ weeks to ~ weeks, impacting deployment schedules. Logistics and customs-related expenses have increased from USD ~ million to USD ~ million, affecting overall project economics. Spare parts availability cycles have stretched from ~ days to ~ days, influencing uptime metrics. This quantified dependence on external supply chains introduces cost volatility and operational risk for end users.

Opportunities

Fleet electrification programs at major airports

Public and private stakeholders have earmarked USD ~ million to USD ~ million for low-emission ground equipment transitions. Electric tug deployment has increased from ~ units to ~ units, supported by charging infrastructure expansion from ~ points to ~ points. Energy cost savings have improved from USD ~ million to USD ~ million annually, strengthening the business case for conversion. Emissions reduction targets have driven replacement of ~ diesel units with ~ electric units, creating a sustained pipeline for suppliers aligned with electrification strategies.

Adoption of autonomous towing solutions for efficiency gains

Pilot programs have progressed from ~ trials to ~ operational deployments, increasing autonomous tug fleets from ~ units to ~ units. Productivity gains have translated into handling cost reductions from USD ~ million to USD ~ million. Incident rates linked to manual towing have declined from ~ cases to ~ cases, reinforcing safety-driven adoption. Technology investment has grown from USD ~ million to USD ~ million, indicating a measurable shift toward automation as a core efficiency lever in ground handling operations.

Future Outlook

The Qatar aircraft tugs market is positioned for steady advancement through the next decade, supported by airport expansion, sustainability mandates, and operational efficiency goals. Continued electrification of ground support equipment fleets and gradual introduction of autonomous towing systems will reshape procurement priorities. Policy alignment with low-emission aviation infrastructure will further accelerate modernization. As service models evolve toward lifecycle partnerships, the market is expected to maintain a stable growth trajectory with increasing emphasis on technology-enabled performance.

Major Players

- TLD Group

- JBT AeroTech

- Goldhofer AG

- MULAG Fahrzeugwerk

- TREPEL Airport Equipment

- Kalmar Motor AB

- Douglas Equipment

- Mototok International

- Airtug LLC

- NMC-Wollard

- TUG Technologies

- Tronair

- Mallaghan GSE

- Weihai Guangtai Airport Equipment

- Schopf Maschinenbau

Key Target Audience

- Airport authorities and terminal operators

- Ground handling service providers

- Commercial airline operations teams

- Cargo and logistics aviation operators

- Maintenance, repair, and overhaul providers

- Qatar Civil Aviation Authority and Ministry of Transport agencies

- Defense and government aviation units

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Core demand indicators, fleet renewal cycles, and technology adoption patterns were mapped. Operational metrics across airport ground handling were defined. Policy drivers and sustainability objectives were incorporated.

Step 2: Market Analysis and Construction

Segment-level demand was structured across applications and technologies. Procurement flows and service models were evaluated. Scenario frameworks were built to reflect infrastructure expansion.

Step 3: Hypothesis Validation and Expert Consultation

Industry practitioners and operational managers were consulted. Assumptions were tested against real-world deployment patterns. Risk factors and adoption barriers were refined.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a coherent market narrative. Strategic implications for stakeholders were articulated. Findings were structured for decision-oriented clarity.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft tug taxonomy across conventional electric and towbarless systems, market sizing logic by airport traffic and GSE fleet deployment, revenue attribution across equipment sales leasing and service, primary interview program with airports ground handlers and MROs, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational and usage pathways across airport ground handling

- Ecosystem structure and key stakeholders

- Supply chain and distribution channels

- Regulatory environment and aviation safety compliance

- Growth Drivers

Expansion of Hamad International Airport capacity and traffic growth

Rising aircraft fleet size across commercial and cargo operators

Shift toward electric GSE to meet sustainability targets

Increasing focus on apron safety and operational efficiency

Government investment in aviation infrastructure modernization

Growth of third-party ground handling services - Challenges

High capital cost of advanced and electric tugs

Limited local manufacturing and reliance on imports

Skilled operator and technician availability constraints

Battery performance issues in high-temperature environments

Long procurement cycles and tender-based purchasing

Maintenance and spare parts lead-time challenges - Opportunities

Fleet electrification programs at major airports

Adoption of autonomous towing solutions for efficiency gains

Service and maintenance contract expansion

Local assembly and customization partnerships

Integration of telematics and predictive maintenance

Growth in military and government aviation support equipment demand - Trends

Rising penetration of towbarless tug technology

Transition from diesel to full-electric tug fleets

Increased use of leasing and rental models

Deployment of digital fleet monitoring systems

Focus on lightweight and modular tug designs

Growing emphasis on total cost of ownership metrics - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Airport-owned fleets

Airline-owned fleets

Ground handling service provider fleets

Leasing and rental fleets - By Application (in Value %)

Aircraft pushback operations

Gate-to-gate towing

Hangar and maintenance towing

Cargo apron and logistics towing - By Technology Architecture (in Value %)

Internal combustion engine tugs

Hybrid powertrain tugs

Battery-electric tugs

Autonomous and semi-autonomous tugs - By End-Use Industry (in Value %)

Commercial airports

Airlines and aviation operators

MRO and aircraft maintenance facilities

Ground handling service providers

Military and government aviation - By Connectivity Type (in Value %)

Standalone equipment

Telematics-enabled tugs

Fleet management integrated systems

Autonomous-ready and V2X-enabled platforms - By Region (in Value %)

Hamad International Airport zone

Al Udeid Air Base aviation operations

Ras Laffan and industrial airfields

Other regional and private airstrips

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (towing capacity range, powertrain type, automation level, aircraft compatibility, energy efficiency, service network coverage, total cost of ownership, delivery lead time)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

TLD Group

JBT AeroTech

Kalmar Motor AB

Goldhofer AG

MULAG Fahrzeugwerk

Schopf Maschinenbau

Douglas Equipment

TREPEL Airport Equipment

Mototok International

Airtug LLC

NMC-Wollard

TUG Technologies

Tronair

Mallaghan GSE

Weihai Guangtai Airport Equipment

- Demand and utilization drivers across airport operations

- Procurement and tender dynamics in public and private sectors

- Buying criteria and vendor selection priorities

- Budget allocation and financing preferences

- Implementation barriers and operational risk factors

- Post-purchase service and lifecycle support expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035