Market Overview

The Qatar aircraft turbine engine market current size stands at around USD ~ million, reflecting active procurement cycles and sustained aftermarket demand. During the most recent measured period, engine deliveries reached ~ units while installed base crossed ~ systems across commercial, military, and business aviation fleets. Aftermarket service revenue accounted for USD ~ million, supported by long-term maintenance contracts and engine leasing activity. Fleet modernization programs added ~ units to operational capacity, reinforcing steady demand for high-efficiency propulsion systems.

Doha dominates market activity due to its dense concentration of international airlines, MRO facilities, and defense aviation infrastructure. The city benefits from integrated airport ecosystems, strong logistics connectivity, and proximity to key regional flight corridors. Government-backed aviation development policies, advanced maintenance capabilities, and a mature supplier base further reinforce its leadership position. Secondary activity clusters around strategic air bases and offshore aviation service zones, driven by energy sector operations and special mission aviation requirements.

Market Segmentation

By Fleet Type

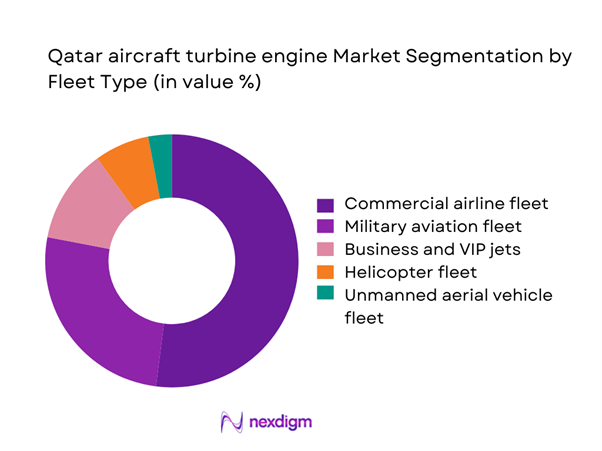

The commercial airline fleet segment leads the Qatar aircraft turbine engine market due to sustained widebody and narrowbody expansion programs supporting long-haul and regional connectivity. National carrier fleet upgrades have driven consistent demand for next-generation turbofan engines, supported by long-term service agreements and power-by-the-hour models. Military aviation follows closely, reflecting modernization initiatives across transport, surveillance, and combat aircraft platforms. Business and VIP jets form a growing niche, fueled by increased charter operations and corporate mobility. Helicopter and unmanned aerial vehicle fleets contribute specialized demand, particularly in offshore energy support and defense reconnaissance missions, reinforcing a diversified fleet-based demand structure.

By Application

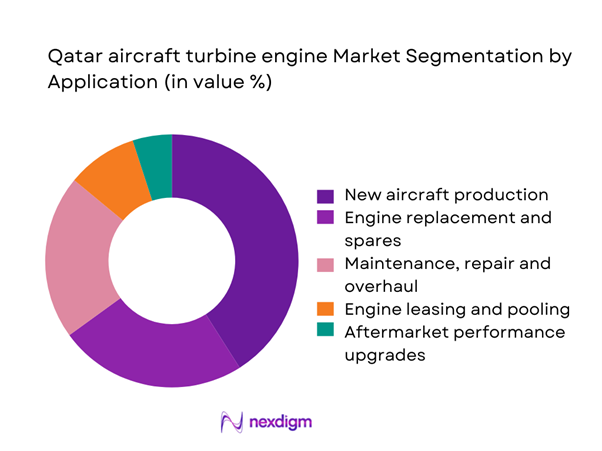

New aircraft production remains the dominant application area as Qatar continues fleet renewal across commercial and defense aviation platforms. Engine replacement and spares form the second-largest segment, driven by aging fleet components and the need for performance upgrades to meet fuel efficiency and emissions standards. Maintenance, repair and overhaul services play a critical role, supported by expanding in-country MRO capabilities and regional servicing mandates. Engine leasing and pooling is gaining traction, offering operational flexibility to airlines and charter operators. Aftermarket performance upgrades further enhance lifecycle value, particularly for long-haul and high-utilization aircraft categories.

Competitive Landscape

The Qatar aircraft turbine engine market is moderately concentrated, led by a small group of global engine manufacturers with strong OEM relationships and extensive aftermarket networks. Competitive dynamics are shaped by long-term service agreements, technology leadership in fuel-efficient propulsion, and the depth of local maintenance partnerships. Barriers to entry remain high due to certification requirements, capital intensity, and the critical safety nature of aero-engine systems.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| GE Aerospace | 1917 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce plc | 1906 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 1945 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar aircraft turbine engine Market Analysis

Growth Drivers

Rising fleet expansion by national and regional airlines

Fleet growth across Qatar’s commercial aviation sector has been a primary demand catalyst for turbine engines, with recent delivery schedules adding ~ units to operational fleets. Airlines have allocated USD ~ million toward propulsion system upgrades, prioritizing fuel efficiency and long-haul performance. Installed base expansion has surpassed ~ systems, increasing recurring demand for spare engines and service contracts. Cargo fleet additions of ~ aircraft have further strengthened engine utilization rates, while charter and regional operators introduced ~ units to meet rising travel volumes. This expansion cycle has reinforced steady procurement pipelines across OEMs and MRO partners.

Long-term defense aviation modernization programs

Defense aviation modernization has driven sustained investment in advanced turbine engines for transport, surveillance, and tactical aircraft platforms. Procurement budgets allocated USD ~ million for propulsion system upgrades, supporting induction of ~ units into active service. Engine overhaul cycles expanded to cover ~ systems annually, strengthening aftermarket demand. Fleet recapitalization programs added ~ aircraft to operational strength, emphasizing reliability and mission endurance. This modernization trajectory continues to generate stable long-term contracts for engine manufacturers and service providers, reinforcing the defense sector as a strategic demand anchor.

Challenges

High capital cost of next-generation turbine engines

The acquisition cost of advanced turbine engines remains a significant constraint, with procurement budgets often exceeding USD ~ million per engine set for widebody platforms. Airlines operating fleets of ~ aircraft face substantial capital exposure during replacement cycles, while defense operators allocate USD ~ million annually to sustain modernization targets. High upfront expenditure limits rapid fleet turnover, extending service life of older engines across ~ systems. Leasing options covering ~ units mitigate short-term pressure, yet long-term financial commitments remain substantial, slowing adoption of next-generation propulsion technologies despite clear efficiency gains.

Long certification timelines for new engine platforms

Lengthy certification processes for new turbine engine architectures delay market entry and fleet integration. Regulatory approval cycles often extend across ~ months, affecting deployment schedules for ~ units intended for commercial and military platforms. Airlines managing fleets of ~ aircraft face operational planning challenges due to postponed deliveries, while MRO providers must maintain legacy engine support for ~ systems longer than anticipated. These extended timelines translate into deferred revenue streams of USD ~ million for OEMs and service partners, constraining near-term market momentum.

Opportunities

Localization of MRO and engine overhaul services

Expanding in-country MRO capabilities presents a major opportunity to capture aftermarket value within Qatar. Investments of USD ~ million have supported development of new engine overhaul lines capable of handling ~ units annually. Local servicing reduces turnaround time for fleets of ~ aircraft and lowers dependency on overseas facilities managing ~ systems. Airlines benefit from faster engine availability, while defense operators gain enhanced readiness levels. This localization trend strengthens ecosystem resilience and opens pathways for component repair, testing, and digital diagnostics services aligned with regional aviation growth.

Adoption of sustainable aviation fuel compatible engines

Growing emphasis on sustainability is accelerating demand for turbine engines compatible with sustainable aviation fuel. Airlines have committed USD ~ million to engine retrofits and new acquisitions supporting SAF operations across ~ aircraft. Engine manufacturers are certifying ~ systems for blended fuel use, enabling immediate emissions reductions without fleet replacement. This transition creates new service lines around performance optimization and compliance testing, while positioning Qatar as a regional leader in greener aviation practices aligned with long-term environmental goals.

Future Outlook

The Qatar aircraft turbine engine market is set to evolve around efficiency-driven fleet renewal, deeper localization of maintenance services, and greater alignment with sustainability objectives through the next decade. Continued expansion in commercial aviation and steady defense modernization will sustain demand for advanced propulsion systems. Partnerships between airlines, OEMs, and MRO providers are expected to strengthen ecosystem resilience. By 2035, the market will increasingly emphasize digital engine management, lifecycle cost optimization, and regional service leadership.

Major Players

- GE Aerospace

- Rolls-Royce plc

- Pratt & Whitney

- Safran Aircraft Engines

- CFM International

- MTU Aero Engines

- Honeywell Aerospace

- Safran Helicopter Engines

- IHI Corporation

- Avio Aero

- GKN Aerospace

- Collins Aerospace

- Lufthansa Technik

- Qatar Airways Engineering

- International Aero Engines

Key Target Audience

- Commercial airlines and fleet operators

- Defense aviation procurement agencies

- Business jet and charter service providers

- Aircraft leasing and asset management firms

- MRO service providers and technical support companies

- Investments and venture capital firms

- Ministry of Transport of Qatar and Civil Aviation Authority

- Qatar Armed Forces Aviation Command

Research Methodology

Step 1: Identification of Key Variables

Demand drivers across commercial, defense, and business aviation were mapped.

Supply-side capabilities of engine OEMs and MRO providers were assessed. Regulatory frameworks influencing certification and deployment were reviewed.

Step 2: Market Analysis and Construction

Fleet expansion data and engine replacement cycles were analyzed. Aftermarket service flows and leasing dynamics were evaluated. Regional infrastructure readiness and ecosystem maturity were incorporated.

Step 3: Hypothesis Validation and Expert Consultation

Industry specialists validated demand assumptions and technology trends. Operational insights from maintenance professionals refined service forecasts. Policy perspectives shaped regulatory impact assessment.

Step 4: Research Synthesis and Final Output

Quantitative and qualitative insights were integrated. Market narratives were aligned with strategic implications. Final outputs were structured for executive decision-making relevance.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft turbine engine taxonomy across commercial military and business aviation, market sizing logic by fleet size and engine delivery cycles, revenue attribution across engine sales spares and MRO services, primary interview program with airlines OEMs MROs and lessors, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Usage and maintenance pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising fleet expansion by national and regional airlines

Long-term defense aviation modernization programs

Growing demand for high-efficiency next-generation engines

Expansion of MRO capabilities within Qatar

Increased air cargo and charter flight activity

Strategic investments in aviation infrastructure - Challenges

High capital cost of next-generation turbine engines

Long certification timelines for new engine platforms

Dependence on global OEM supply chains

Limited local manufacturing base for aero-engines

Volatility in airline profitability cycles

Skilled workforce constraints in advanced engine maintenance - Opportunities

Localization of MRO and engine overhaul services

Adoption of sustainable aviation fuel compatible engines

Deployment of digital twins and predictive maintenance

Expansion of business aviation and VIP fleet demand

Regional hub positioning for engine leasing and pooling

Participation in global engine component supply chains - Trends

Shift toward geared turbofan and ultra-high bypass engines

Increasing use of digital engine health monitoring

Rising focus on emissions reduction and noise compliance

Growth in power-by-the-hour service contracts

Strategic partnerships between airlines and OEMs

Higher adoption of modular engine architectures - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial airline fleet

Military aviation fleet

Business and VIP jets

Helicopter fleet

Unmanned aerial vehicle fleet - By Application (in Value %)

New aircraft production

Engine replacement and spares

Maintenance, repair and overhaul

Engine leasing and pooling

Aftermarket performance upgrades - By Technology Architecture (in Value %)

Turbofan engines

Turboprop engines

Turboshaft engines

Turbojet engines

Hybrid-electric assisted turbines - By End-Use Industry (in Value %)

Commercial aviation

Defense and security

Business and private aviation

Offshore oil and gas aviation services

Government and special mission aviation - By Connectivity Type (in Value %)

Fully connected digital engine systems

Semi-connected condition monitoring systems

Non-connected conventional engines

Satellite-enabled fleet monitoring solutions - By Region (in Value %)

Doha metropolitan aviation hubs

Northern Qatar aviation operations

Central Qatar logistics corridors

Southern Qatar military air bases

Offshore aviation service zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (engine efficiency ratings, total lifecycle cost, MRO network depth, delivery lead time, digital support capabilities, sustainability compliance, local partnership footprint, aftermarket service coverage)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

GE Aerospace

Rolls-Royce plc

Pratt & Whitney

Safran Aircraft Engines

CFM International

International Aero Engines

MTU Aero Engines

Honeywell Aerospace

Safran Helicopter Engines

IHI Corporation

Avio Aero

GKN Aerospace

Collins Aerospace

Lufthansa Technik

Qatar Airways Engineering

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035