Market Overview

The Qatar Aircraft Tires market is valued at USD ~ million. The market’s growth is driven by the increasing demand for air travel, fleet expansions, and investments in Qatar’s aviation infrastructure. Additionally, advancements in tire technology, such as the development of high-performance, durable, and eco-friendly tires, have helped boost the market. Qatar’s strategic investments in airport infrastructure and its central role in global air transport are also significant contributors to the demand for aircraft tires. The market has witnessed a continuous rise in the need for high-quality tires that ensure safety, reliability, and fuel efficiency for commercial and military aircraft.

Qatar stands out as a key player in the aircraft tires market, with Doha being the central hub. The country’s rapid infrastructural growth, particularly with the development of Hamad International Airport and Qatar Airways’ expansion, directly influences the demand for high-quality aircraft tires. The Middle Eastern region, with its strategic geographic location, is vital for international air traffic, which drives tire procurement for both commercial airlines and military applications. Furthermore, Qatar’s government investments in the aviation sector ensure the continued demand for aircraft tires as the fleet size grows and modernization efforts take place.

Market Segmentation

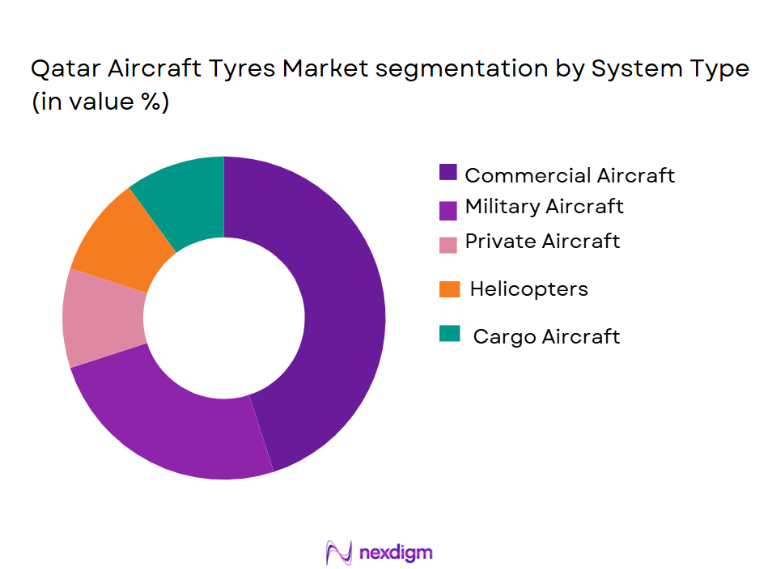

By System Type

The Qatar Aircraft Tires market is segmented by system type into commercial aircraft tires, military aircraft tires, private aircraft tires, helicopter tires, and cargo aircraft tires. Among these segments, commercial aircraft tires dominate the market, driven by the rapidly expanding fleet of Qatar Airways and other commercial airlines. Qatar Airways, as one of the fastest-growing airlines globally, increases demand for durable, high-performance tires. Additionally, advancements in tire technology, such as innovations that improve fuel efficiency and longevity, further contribute to the growth of commercial aircraft tires. These factors position commercial aircraft tires as the dominant subsegment in Qatar’s aircraft tire market.

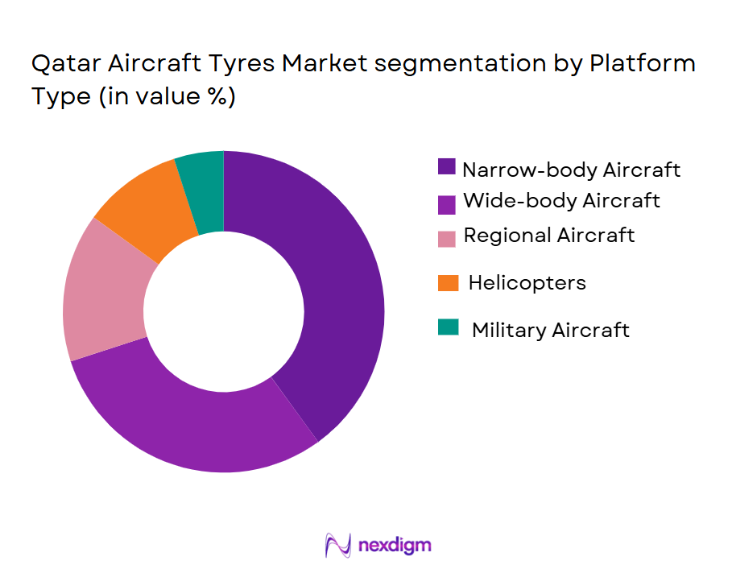

By Platform Type

The market is further segmented by platform type, including narrow-body aircraft tires, wide-body aircraft tires, regional aircraft tires, helicopter tires, and military aircraft tires. Narrow-body aircraft tires hold the dominant position in the market, mainly due to the extensive use of narrow-body aircraft by airlines like Qatar Airways for short to medium-haul routes. These aircraft require specific tire characteristics to ensure efficiency and safety. The proliferation of budget carriers and the increasing volume of domestic and regional flights are major factors fueling the demand for narrow-body aircraft tires, making it the leading subsegment in Qatar’s aircraft tire market.

Competitive Landscape

The Qatar Aircraft Tires market is highly competitive, with key players contributing significantly to the market’s growth. Leading companies such as Michelin, Goodyear, and Bridgestone are the primary suppliers of aircraft tires, offering a range of products designed to meet the unique requirements of the aviation industry. These players focus on technological advancements and partnerships with airlines and aviation operators to maintain their market positions. Local manufacturers, along with global brands, help ensure a diverse supply base for Qatar’s growing aviation market.

| Company Name | Establishment Year | Headquarters | Product Range | Tire Durability Focus | Technological Advancements | Regional Presence |

| Michelin | 1889 | Clermont-Ferrand | ~ | ~ | ~ | ~ |

| Goodyear | 1898 | Akron, Ohio | ~ | ~ | ~ | ~ |

| Bridgestone | 1931 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Trelleborg | 1905 | Trelleborg, Sweden | ~ | ~ | ~ | ~ |

| Dunlop Aircraft Tyres | 1889 | Birmingham, UK | ~ | ~ | ~ | ~ |

Qatar Aircraft Tyres Market Analysis

Growth Drivers

Rising Air Traffic and Fleet Expansion

As global air travel continues to grow, especially with major carriers like Qatar Airways expanding their fleets, the demand for high-quality aircraft tires increases to support this expansion. This growth is further fueled by the increasing number of regional and international flights.

Technological Advancements in Tire Performance

Continuous innovations in tire materials and design, such as improved durability, fuel efficiency, and eco-friendly solutions, are driving demand for advanced aircraft tires. These innovations ensure that airlines can meet regulatory standards while reducing operational costs.

Market Challenges

High Raw Material Costs

The rising prices of materials, including rubber and synthetic compounds, pose a significant challenge to manufacturers. This leads to higher production costs for aircraft tires, which can impact the profitability of tire companies and the overall market dynamics.

Stringent Safety and Regulatory Requirements

Aircraft tires must meet rigorous safety and performance standards. Compliance with these regulatory requirements increases costs and complexity in manufacturing and testing, thus challenging companies to maintain product quality while adhering to aviation regulations.

Opportunities

Growth in Military and Defense Aircraft Segments

As defense spending rises, particularly in countries like Qatar, there is an increasing demand for specialized military aircraft tires. The expansion of military aircraft fleets presents an opportunity for tire manufacturers to tap into this growing market.

Sustainability Trends in Aviation

The shift towards more eco-friendly and sustainable solutions in aviation, such as the use of biodegradable or recyclable materials for aircraft tires, creates opportunities for innovation. Manufacturers that can develop green tire technologies will have a competitive advantage in the market.

Future Outlook

Over the next 5 years, the Qatar Aircraft Tires market is expected to show significant growth, driven by Qatar’s commitment to expanding its aviation infrastructure and fleet. With continued investments in Qatar Airways and the growth of Hamad International Airport, the demand for high-performance, fuel-efficient, and durable aircraft tires will increase. Technological innovations in tire durability and efficiency, along with the rising trend of eco-friendly solutions in the aviation industry, will also contribute to market growth.

Major Players

- Michelin

- Goodyear

- Bridgestone

- Trelleborg

- Dunlop Aircraft Tyres

- Lufthansa Technik

- Airbus

- Boeing

- Meggitt

- UTC Aerospace Systems

- Sumitomo Rubber Industries

- Continental Aerospace Technologies

- AeroTire

- Falken Tire

- Hawker Pacific

Key Target Audience

- Airlines and aircraft operators

- Aircraft Maintenance, Repair, and Overhaul providers

- Government and regulatory bodies

- Aircraft manufacturers

- Investment and venture capital firms

- Tire manufacturers

- Military and defense organizations

- Airports and airport operators

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the major stakeholders in the Qatar Aircraft Tires market, such as airlines, tire manufacturers, airport operators, and MRO service providers. Desk research is employed to gather relevant data from secondary sources, which are supplemented by interviews with industry experts to define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves the analysis of historical data on the market’s growth trends, including tire demand, supply chain dynamics, and technological developments. The research will also assess the role of key drivers and challenges that impact tire demand in Qatar’s aviation sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with experts from key market players like Qatar Airways and Michelin. These consultations will provide insights into the factors shaping the demand for aircraft tires, enabling the refinement of data collected in previous steps.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all the collected data and validating it through direct engagement with tire suppliers and airlines. Insights from both the commercial and military sectors will be analyzed to create a comprehensive view of the Qatar Aircraft Tires market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growth in air traffic and airline fleet expansion in Qatar

Technological advancements in tire durability and fuel efficiency

Increase in military and defense spending for aircraft fleet enhancement - Market Challenges

Rising raw material costs affecting tire prices

Complexity in meeting high safety and performance standards

Challenges in recycling and disposal of aircraft tires - Market Opportunities

Growing demand for sustainable and eco-friendly tire solutions

Opportunities in retrofitting older aircraft with advanced tire technologies

Increased investment in maintenance, repair, and overhaul (MRO) services - Trends

Shift towards advanced materials for enhanced performance and fuel efficiency

Growing demand for next-generation tires with enhanced tread designs

Expansion of Qatar’s aviation industry fueling the demand for high-quality tires

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Commercial Aircraft Tires

Military Aircraft Tires

Private Aircraft Tires

Helicopter Tires

Cargo Aircraft Tires - By Platform Type (In Value%)

Narrow-Body Aircraft Tires

Wide-Body Aircraft Tires

Regional Aircraft Tires

Helicopter Tires

Military Aircraft Tires - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer) Tires

Replacement Aircraft Tires

Retreaded Aircraft Tires

Maintenance Tires

Refurbished Tires - By EndUser Segment (In Value%)

Commercial Airlines

Private Jet Operators

Cargo Operators

Military Organizations

Airports and Ground Services - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Procurement (Distributors)

Online Procurement Channels

Procurement via Airlines and Aircraft Operators

Procurement via Aircraft Maintenance Providers

- Market Share Analysis

- CrossComparison Parameters (Market Share, Product Innovation, Price Range, Distribution Network, Brand Recognition)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Michelin

Goodyear

Bridgestone

Lufthansa Technik

Airbus

Boeing

Meggitt

UTC Aerospace Systems

Trelleborg

Dunlop Aircraft Tyres

AeroTire

Falken Tire

Continental Aerospace Technologies

Sumitomo Rubber Industries

Hawker Pacific

- Increasing preference for premium-quality tires among commercial airlines

- Rising investments in private jet fleets, driving demand for specialized aircraft tires

- Growth in demand for high-performance tires in military aircraft fleets

- Expansion of airport and ground service infrastructure increasing tire procurement

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035