Market Overview

The Qatar aircraft water and waste systems market current size stands at around USD ~ million, reflecting steady demand from commercial and government aviation fleets supported by ongoing cabin system upgrades and sanitation-focused retrofits. Over the most recent two-year period, system shipments reached approximately ~ units, while active installations across operational aircraft exceeded ~ systems. Capital deployment toward MRO-led upgrades accounted for close to USD ~ million, with procurement volumes concentrated around fleet renewal cycles and regulatory-driven compliance programs shaping near-term purchasing behavior.

Market activity is primarily concentrated in Doha, driven by the operational scale of Hamad International Airport and the presence of major airline engineering and maintenance ecosystems. The city benefits from integrated MRO infrastructure, strong regulatory oversight, and a dense supplier network that accelerates certification and deployment timelines. Demand is further reinforced by centralized fleet management practices, advanced aviation hygiene standards, and supportive policy frameworks that encourage system modernization across both commercial and government aviation segments.

Market Segmentation

By Fleet Type

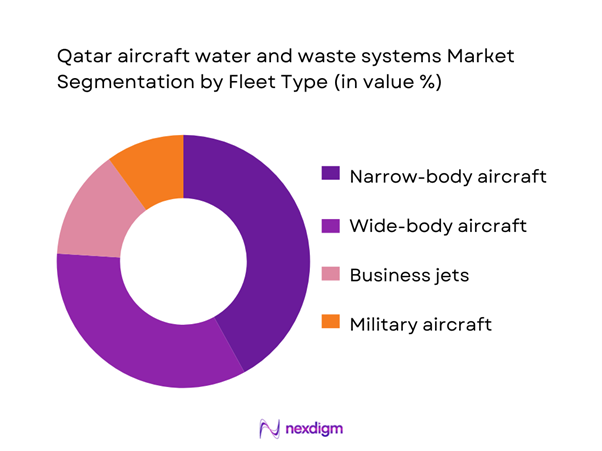

Narrow-body aircraft dominate system adoption due to higher utilization intensity and frequent cabin refurbishments driven by short-haul operations. These aircraft account for a substantial share of potable water and waste management retrofits, supported by consistent turnaround schedules and standardized system configurations. Wide-body fleets follow closely, driven by premium cabin hygiene requirements and long-haul service expectations. Business jets and military aircraft represent smaller but strategically important segments, where customization, reliability, and regulatory compliance play a decisive role in supplier selection and system integration decisions.

By Application

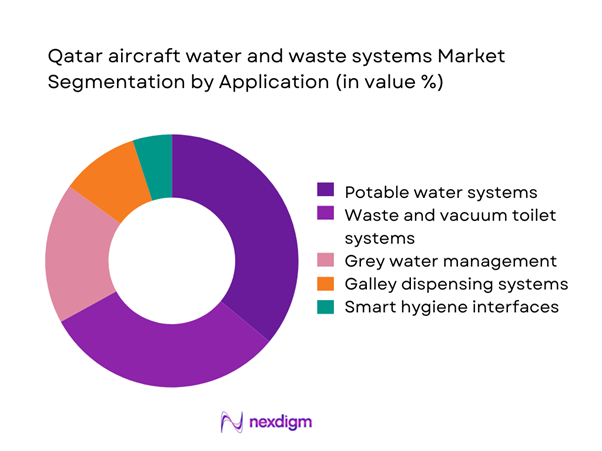

Potable water storage and distribution systems represent the most dominant application area, reflecting rising hygiene standards and regulatory emphasis on onboard water quality. Waste and vacuum toilet systems follow closely, driven by passenger comfort expectations and efficiency gains from lightweight system architectures. Grey water management and galley dispensing systems are gaining traction as airlines focus on operational efficiency and sustainability benchmarks. Smart hygiene interfaces are emerging as a niche but fast-developing segment, particularly in premium cabins and long-haul fleets.

Competitive Landscape

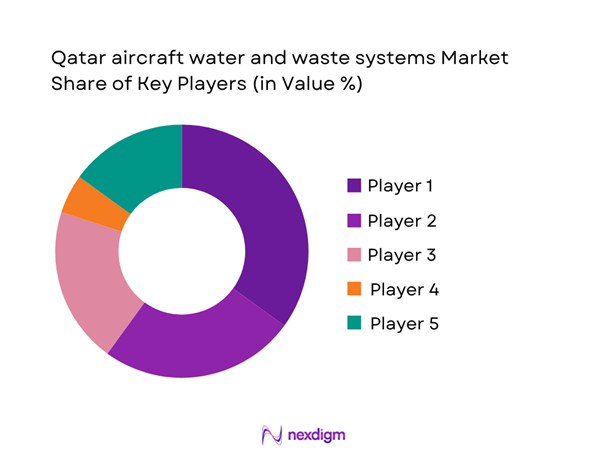

The Qatar aircraft water and waste systems market is moderately concentrated, with a small group of global aerospace system suppliers dominating OEM fitment and high-value retrofit projects. These players benefit from established certification portfolios, long-term airline relationships, and integrated service capabilities that create high entry barriers for new participants.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Cabin | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Diehl Aviation | 2006 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Jamco Corporation | 1955 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Zodiac Aerospace | 1896 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar aircraft water and waste systems Market Analysis

Growth Drivers

Fleet expansion and modernization of Qatar-based airlines

Ongoing fleet modernization programs have significantly increased demand for advanced water and waste systems, with recent procurement cycles covering more than ~ aircraft across narrow-body and wide-body categories. Over the last three years, retrofit volumes surpassed ~ units, reflecting the prioritization of cabin system upgrades alongside avionics and seating refurbishments. Capital allocations toward these programs exceeded USD ~ million, supporting the adoption of lightweight tanks, vacuum-based waste systems, and modular plumbing architectures. The modernization push is also driving standardization across fleets, enabling faster installation cycles and higher replacement frequencies within existing maintenance windows.

Rising passenger traffic driving higher cabin hygiene standards

Increased passenger throughput across Qatar’s primary aviation hubs has elevated expectations around onboard sanitation, leading airlines to accelerate upgrades of potable water lines and waste management modules. Recent service data indicates that more than ~ systems were replaced or overhauled within a two-year operational window, driven by hygiene audits and service quality benchmarks. Spending on cabin sanitation enhancements reached approximately USD ~ million, reflecting investments in antimicrobial materials, touchless interfaces, and contamination monitoring technologies. These measures are reshaping procurement priorities, with hygiene performance now ranking alongside reliability and weight efficiency.

Challenges

High certification and qualification costs for new system suppliers

Entry into the aircraft water and waste systems segment requires extensive compliance with aviation safety and sanitation standards, creating significant financial and operational hurdles. Recent qualification programs for new suppliers have required investments exceeding USD ~ million per system platform, covering testing, documentation, and multi-stage regulatory approvals. The process typically involves more than ~ validation cycles before commercial deployment, extending time-to-market and increasing risk exposure. These barriers limit supplier diversity and slow the introduction of innovative technologies, reinforcing the dominance of established players with pre-certified product portfolios.

Complex integration with legacy aircraft platforms

A substantial portion of Qatar’s active fleet operates on legacy cabin architectures, complicating the installation of next-generation water and waste systems. Retrofit projects often require custom engineering for more than ~ aircraft annually, increasing labor hours and extending maintenance downtime. Integration costs associated with structural modifications and system interfacing have surpassed USD ~ million across recent upgrade cycles. These complexities discourage rapid adoption of advanced technologies and push airlines to prioritize incremental upgrades over full system replacements, slowing overall modernization momentum.

Opportunities

Retrofit demand for in-service aircraft fleets

The large base of operational aircraft presents a strong opportunity for system suppliers focused on retrofit solutions. Over the last three years, more than ~ aircraft have entered scheduled cabin refurbishment programs, generating demand for approximately ~ systems across potable water and waste management applications. Retrofit budgets allocated to these programs exceeded USD ~ million, with airlines prioritizing modular designs that minimize installation time. This trend supports recurring revenue streams for suppliers offering line-replaceable units, predictive maintenance features, and standardized kits compatible with multiple aircraft types.

Localization of MRO and system integration capabilities

Qatar’s push to strengthen domestic aviation services is creating new opportunities for localized system integration and aftermarket support. Recent infrastructure investments have supported the development of more than ~ specialized maintenance bays dedicated to cabin systems, enabling faster turnaround and reduced dependency on overseas service centers. Funding directed toward these capabilities has reached approximately USD ~ million, encouraging partnerships between global suppliers and local engineering teams. This localization drive enhances supply chain resilience and positions Qatar as a regional hub for aircraft water and waste system servicing.

Future Outlook

The Qatar aircraft water and waste systems market is expected to maintain steady growth through 2035, supported by continuous fleet renewal and rising hygiene expectations. Increased localization of MRO capabilities will strengthen aftermarket demand and reduce lifecycle costs. Regulatory emphasis on sanitation and sustainability will further accelerate the adoption of advanced system architectures. As digital monitoring becomes standard, suppliers with integrated service models will gain a competitive edge.

Major Players

- Collins Aerospace

- Safran Cabin

- Diehl Aviation

- Jamco Corporation

- Zodiac Aerospace

- Nordisk Aviation

- Turkish Cabin Interior

- Aim Altitude

- FACC AG

- Parker Hannifin Aerospace

- Crane Aerospace & Electronics

- Meggitt

- Latecoere

- Spirit AeroSystems

- Lufthansa Technik

Key Target Audience

- Commercial airlines and fleet operators in Qatar

- Aircraft maintenance, repair, and overhaul providers

- Business jet and VIP completion centers

- Military and government aviation procurement units

- Qatar Civil Aviation Authority and Ministry of Transport

- Airport operators including Hamad International Airport management

- Aircraft interior system integrators and engineering firms

- Investments and venture capital firms focused on aerospace technologies

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, and regulatory variables were identified through structured industry mapping. Operational metrics related to fleet activity, retrofit cycles, and maintenance patterns were prioritized. Technology adoption indicators and compliance requirements were defined to frame market boundaries.

Step 2: Market Analysis and Construction

Segment-wise demand models were developed using fleet composition and service intensity indicators. Supply-side capabilities were assessed across OEM fitment and aftermarket service ecosystems. Scenario frameworks were created to evaluate short-term and long-term adoption pathways.

Step 3: Hypothesis Validation and Expert Consultation

Initial market assumptions were tested through structured consultations with aviation system specialists. Operational feedback was incorporated to refine adoption timelines and service models. Regulatory perspectives were integrated to validate compliance-driven demand projections.

Step 4: Research Synthesis and Final Output

All quantitative and qualitative insights were consolidated into a unified analytical framework. Cross-segment linkages were established to ensure internal consistency of findings. The final output was structured to support strategic decision-making and investment planning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft water and waste system taxonomy across potable water and vacuum waste solutions, market sizing logic by aircraft fleet and retrofit cycles, revenue attribution across system sales spares and MRO services, primary interview program with airlines OEMs and MROs, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care and usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Fleet expansion and modernization of Qatar-based airlines

Rising passenger traffic driving higher cabin hygiene standards

Regulatory emphasis on water quality and sanitation compliance

Increasing adoption of lightweight systems to improve fuel efficiency

Growth of MRO activities at Hamad International Airport

Demand for touchless and smart cabin technologies post-pandemic - Challenges

High certification and qualification costs for new system suppliers

Complex integration with legacy aircraft platforms

Supply chain disruptions for aerospace-grade components

Stringent reliability and safety testing requirements

Limited local manufacturing base for specialized subsystems

Long replacement cycles for aircraft cabin systems - Opportunities

Retrofit demand for in-service aircraft fleets

Localization of MRO and system integration capabilities

Adoption of predictive maintenance and health monitoring

Partnerships with Qatar Airways Engineering for system upgrades

Sustainability-driven demand for water-efficient technologies

Growth in VIP and business jet completions in Qatar - Trends

Shift toward lightweight composite tanks and piping

Increasing use of antimicrobial materials in water lines

Integration of smart sensors for leak and contamination detection

Rising preference for modular and line-replaceable units

Expansion of digital twins for cabin system maintenance

Adoption of vacuum toilet systems in narrow-body aircraft - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Narrow-body aircraft

Wide-body aircraft

Regional jets

Business jets

Military aircraft - By Application (in Value %)

Potable water storage and distribution systems

Waste and vacuum toilet systems

Grey water management systems

Galley water heating and dispensing systems

Cabin hygiene and touchless interface systems - By Technology Architecture (in Value %)

Vacuum-based waste systems

Gravity-based waste systems

Recirculating potable water systems

Smart sensor-enabled monitoring systems

Lightweight composite tank architectures - By End-Use Industry (in Value %)

Commercial aviation

Business and general aviation

Military and government aviation

Offshore and rotary-wing aviation - By Connectivity Type (in Value %)

Standalone mechanical systems

Wired health monitoring systems

Wireless condition monitoring systems

Integrated aircraft IoT platforms - By Region (in Value %)

Hamad International Airport aviation cluster

Al Udeid Air Base aviation ecosystem

Doha MRO and completion centers

Secondary airports and heliports

Offshore energy aviation hubs

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system reliability, weight efficiency, water consumption per cycle, lifecycle maintenance cost, certification lead time, retrofit compatibility, digital monitoring capability, local MRO support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Collins Aerospace

Safran Cabin

Diehl Aviation

Jamco Corporation

Zodiac Aerospace

Nordisk Aviation

Turkish Cabin Interior

Aim Altitude

FACC AG

Parker Hannifin Aerospace

Crane Aerospace & Electronics

Meggitt

Latecoere

Spirit AeroSystems

Lufthansa Technik

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035