Market Overview

The Qatar Aircraft Windows and Windshields market current size stands at around USD ~ million, supported by steady replacement demand and ongoing fleet modernization across commercial, business, and defense aviation. Over the most recent two-year period, annual procurement and retrofit activity accounted for USD ~ million and USD ~ million in cumulative spend, driven by higher safety compliance and lifecycle upgrades. Installed base across active fleets reached ~ units, while aftermarket service volumes crossed ~ units, reflecting growing emphasis on durability and performance under extreme operating conditions.

Doha continues to dominate demand concentration due to the presence of major airline hubs, advanced MRO infrastructure, and centralized procurement by state-linked aviation entities. The city benefits from mature supplier networks, streamlined certification pathways, and proximity to regional aviation corridors. Secondary demand emerges from industrial zones supporting defense aviation and helicopter operations, where ecosystem maturity and policy-backed fleet upgrades reinforce sustained adoption of advanced windshield and window technologies.

Market Segmentation

By Application

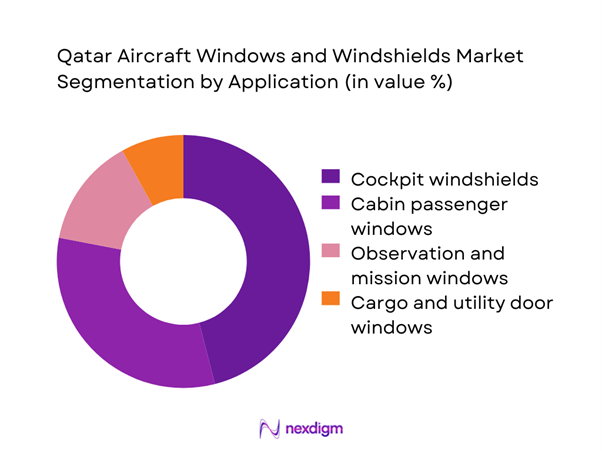

Cockpit windshields dominate the Qatar Aircraft Windows and Windshields market, reflecting their critical role in flight safety, pilot visibility, and regulatory compliance. High replacement frequency, exposure to harsh climatic conditions, and stringent inspection cycles drive consistent demand across commercial and military fleets. Cabin passenger windows follow, supported by rising expectations for passenger comfort and aesthetics, particularly in premium and business aviation segments. Observation and mission windows maintain a niche yet stable share due to ongoing upgrades in surveillance and special mission aircraft. Overall dominance of cockpit applications is reinforced by higher unit value, complex certification needs, and mandatory integration of heating and anti-ice systems, making them the primary revenue contributor across procurement and aftermarket channels.

By Fleet Type

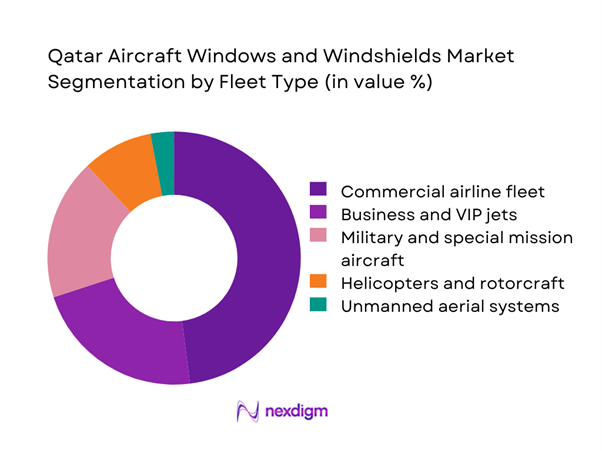

Commercial airline fleets represent the largest share of demand in the Qatar Aircraft Windows and Windshields market, driven by continuous aircraft utilization, strict safety oversight, and proactive maintenance regimes. High flight cycles translate into accelerated wear and replacement schedules, sustaining steady procurement volumes. Business and VIP jets account for a growing segment as fleet owners increasingly adopt smart dimmable and lightweight window systems to enhance comfort and efficiency. Military and special mission aircraft maintain consistent demand through structured modernization programs and mission readiness requirements. Helicopters and unmanned aerial systems form a smaller yet strategically important segment, where specialized glazing solutions are essential for visibility and impact resistance in diverse operating environments.

Competitive Landscape

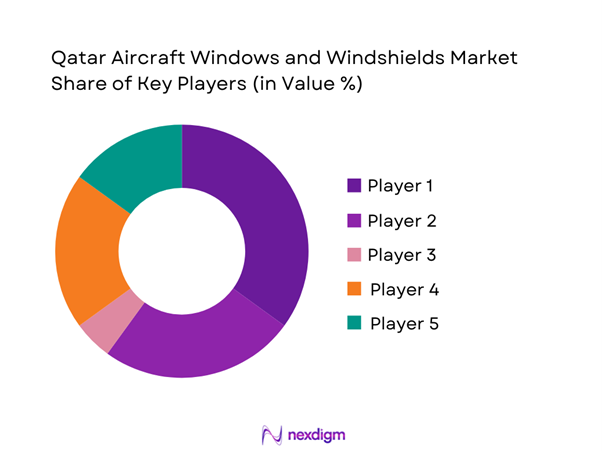

The Qatar Aircraft Windows and Windshields market is moderately concentrated, led by a group of established aerospace glazing specialists supplying OEM and aftermarket channels. Competition centers on certification depth, technological differentiation, and regional service capability, with long-term contracts and preferred supplier arrangements shaping market structure.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| PPG Aerospace | 1883 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Gentex Aerospace | 1974 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Saint-Gobain Aerospace | 1665 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| The NORDAM Group | 1969 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Aircraft Windows and Windshields Market Analysis

Growth Drivers

Rising fleet modernization programs across Qatar Airways and state aviation units

Over the last three years, modernization programs across national carriers and state aviation entities generated procurement volumes of ~ units of advanced windshields and window assemblies, translating into annual spend of USD ~ million in system upgrades and replacements. Fleet renewal initiatives covering widebody, narrowbody, and special mission aircraft have expanded the installed base by ~ units, increasing demand for certified glazing systems with higher durability and safety performance. In the most recent period, MRO-driven replacements alone accounted for ~ units, reflecting proactive lifecycle management strategies. These modernization efforts continue to anchor sustained demand for both OEM-fit and aftermarket aircraft window solutions.

Increasing focus on pilot visibility and flight safety standards

Enhanced emphasis on cockpit visibility and operational safety has driven adoption of high-clarity, heated, and impact-resistant windshield systems across fleets. Over the past three years, safety-led upgrades resulted in installation of ~ units of advanced windshield assemblies, representing cumulative investment of USD ~ million. Regulatory audits and internal airline safety programs accelerated replacement cycles, reducing average service life by ~ months per unit. Defense and special mission operators contributed an additional ~ units of demand through mission-readiness upgrades. This sustained focus on safety performance continues to elevate the strategic importance of certified glazing systems in fleet management decisions.

Challenges

High certification and compliance costs for aerospace glazing systems

Certification and compliance requirements significantly increase time and capital commitment for suppliers and operators. In recent years, qualification programs for new window technologies required testing investments of USD ~ million, with each certification cycle extending over ~ months on average. For fleet operators, compliance-driven retrofits resulted in replacement of ~ units annually, adding USD ~ million to maintenance budgets. Smaller MRO providers face constraints in absorbing these costs, limiting their ability to introduce advanced glazing solutions. The financial and operational burden associated with meeting evolving safety and performance standards remains a structural challenge across the value chain.

Long qualification cycles with OEMs and aviation authorities

Extended qualification timelines with aircraft manufacturers and aviation authorities continue to delay market entry for innovative window and windshield systems. Over the last three years, average approval cycles exceeded ~ months, affecting deployment of ~ units of next-generation glazing technologies. Delayed certifications resulted in deferred revenues of USD ~ million for suppliers and slowed fleet-wide adoption of smart and lightweight solutions. Operators often rely on legacy systems longer than planned, increasing maintenance volumes by ~ units annually. These prolonged cycles constrain responsiveness to emerging safety and performance needs in a rapidly evolving aviation environment.

Opportunities

Localization of window repair and overhaul services in Qatar

Establishing localized repair and overhaul capabilities presents a significant opportunity to reduce turnaround times and lifecycle costs. Over the past two years, operators outsourced ~ units of windshield and window repairs to overseas facilities, incurring service expenditures of USD ~ million. Local MRO expansion could retain a substantial share of this value within the domestic ecosystem, while reducing average repair lead times by ~ days. Development of in-country capabilities would also support rapid-response needs for commercial and defense fleets, strengthening supply chain resilience and positioning Qatar as a regional hub for aerospace glazing services.

Retrofit demand for smart dimmable windows in VIP and business jets

Growing preference for electrochromic and smart dimmable windows among VIP and business jet operators is creating a high-value retrofit market. In recent years, retrofit programs accounted for ~ units of advanced window installations, generating revenues of USD ~ million. Demand is driven by enhanced passenger comfort, reduced cabin heat load, and premium differentiation. Fleet owners increasingly allocate ~ units per aircraft for phased upgrades, accelerating aftermarket penetration of smart technologies. This trend offers suppliers and MRO providers an avenue to capture premium-margin opportunities beyond traditional replacement cycles.

Future Outlook

The Qatar Aircraft Windows and Windshields market is set to evolve steadily through 2035, shaped by fleet renewal, rising safety standards, and growing adoption of smart glazing technologies. Localization of MRO services and stronger regional supply chains will enhance market resilience. Continued investment in defense and special mission aviation will further diversify demand. As sustainability and lightweight materials gain prominence, innovation in glazing systems will remain central to long-term market competitiveness.

Major Players

- PPG Aerospace

- Gentex Aerospace

- Saint-Gobain Aerospace

- The NORDAM Group

- Collins Aerospace

- Safran Cabin

- Diehl Aviation

- GKN Aerospace

- Vision Systems

- Pilkington Aerospace

- LP Aero Plastics

- Llamas Plastics

- Triumph Group

- AIP Aerospace

- Fokker Technologies

Key Target Audience

- Commercial airlines and fleet operators in Qatar

- Business jet and VIP aircraft owners

- Military and defense aviation procurement units

- Helicopter service and offshore operations providers

- Aircraft maintenance, repair, and overhaul providers

- Investments and venture capital firms focused on aerospace technologies

- Qatar Civil Aviation Authority and Ministry of Transport regulatory bodies

- Airport operators and aviation infrastructure authorities

Research Methodology

Step 1: Identification of Key Variables

Assessment of fleet composition, replacement cycles, certification timelines, and technology adoption patterns. Mapping of procurement structures across commercial, business, and defense aviation. Identification of demand drivers influencing OEM and aftermarket channels.

Step 2: Market Analysis and Construction

Compilation of historical procurement and service volumes across major operators. Evaluation of installed base dynamics and lifecycle cost structures. Development of market sizing frameworks using fleet and utilization indicators.

Step 3: Hypothesis Validation and Expert Consultation

Validation of demand assumptions through structured expert interactions. Review of regulatory pathways and certification bottlenecks impacting adoption. Cross-verification of service and retrofit trends across MRO stakeholders.

Step 4: Research Synthesis and Final Output

Integration of quantitative and qualitative insights into a unified market narrative. Development of strategic implications for suppliers, operators, and investors. Finalization of forecasts and competitive positioning analysis.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft window and windshield taxonomy across cockpit and cabin glazing systems, market sizing logic by aircraft fleet and replacement cycles, revenue attribution across new installs spares and MRO services, primary interview program with airlines OEMs and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Usage and maintenance pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising fleet modernization programs across Qatar Airways and state aviation units

Increasing focus on pilot visibility and flight safety standards

Growing adoption of electrochromic and heated windshield technologies

Expansion of MRO activities within Qatar Aviation Services ecosystem

Higher replacement demand driven by sand, heat, and UV exposure conditions

Defense and special mission aircraft upgrades - Challenges

High certification and compliance costs for aerospace glazing systems

Long qualification cycles with OEMs and aviation authorities

Dependence on imported components and global supply chains

Price sensitivity in aftermarket and MRO procurement

Limited local manufacturing and repair capabilities

Volatility in aircraft delivery schedules - Opportunities

Localization of window repair and overhaul services in Qatar

Retrofit demand for smart dimmable windows in VIP and business jets

Strategic partnerships with MRO hubs at Hamad International Airport

Growth in military aviation modernization programs

Adoption of lightweight polycarbonate systems for fuel efficiency

Development of regional distribution hubs for the Gulf market - Trends

Shift toward electrochromic cockpit and cabin windows

Increasing use of advanced coatings for scratch and UV resistance

Rising preference for modular windshield assemblies

Integration of heating and anti-ice systems as standard features

Focus on lifecycle cost optimization in procurement decisions

Digitalization of spares management and aftermarket support - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial airline fleet

Business and VIP jets

Military and special mission aircraft

Helicopters and rotorcraft

Unmanned aerial systems - By Application (in Value %)

Cockpit windshields

Cabin passenger windows

Observation and mission windows

Cargo and utility door windows - By Technology Architecture (in Value %)

Laminated glass assemblies

Acrylic window systems

Polycarbonate impact-resistant windows

Electrochromic and smart dimmable windows

Heated and anti-ice windshield systems - By End-Use Industry (in Value %)

Commercial aviation

Business aviation

Military and defense aviation

Helicopter services and offshore operations

Maintenance, repair, and overhaul providers - By Connectivity Type (in Value %)

Conventional non-connected windows

Smart connected dimmable windows

Sensor-integrated windshield systems - By Region (in Value %)

Doha

Al Wakrah

Al Khor

Dukhan

Mesaieed

Other industrial zones

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, certification coverage, lead time performance, pricing competitiveness, aftermarket support strength, local presence in the Gulf, customization capability, technology innovation roadmap)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

PPG Aerospace

Gentex Aerospace

GKN Aerospace

Saint-Gobain Aerospace

The NORDAM Group

Pilkington Aerospace

Llamas Plastics

LP Aero Plastics

AIP Aerospace

Triumph Group

Collins Aerospace

Safran Cabin

Vision Systems

Fokker Technologies

Diehl Aviation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035