Market Overview

The Qatar aircraft windshield wiper systems market current size stands at around USD ~ million, supported by steady aircraft deliveries, active fleet utilization, and rising aftermarket demand. The sector recorded system shipments of nearly ~ units, with an installed base exceeding ~ systems across commercial, business, and defense aviation. Maintenance contracts generated service revenues of about USD ~ million, while component replacements accounted for close to ~ units annually, reflecting the importance of reliability in cockpit visibility solutions.

Doha remains the dominant center of demand due to its concentration of international airlines, MRO facilities, and defense aviation units. The presence of advanced airport infrastructure, specialized maintenance hangars, and high aircraft utilization rates supports consistent replacement cycles. Strong regulatory oversight and safety compliance culture further strengthen adoption of certified systems. Secondary demand emerges from business aviation operators and government fleets, supported by improving regional airstrip connectivity and growing special mission aviation requirements.

Market Segmentation

By Fleet Type

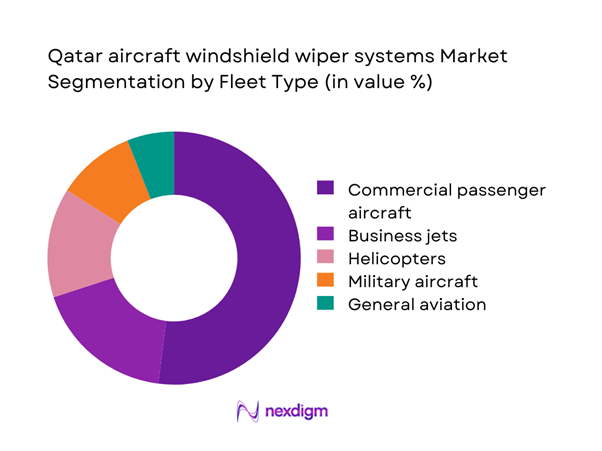

Commercial passenger aircraft dominate the market due to their high utilization rates and strict operational visibility requirements. Wide-body and narrow-body fleets operating long-haul and regional routes generate continuous demand for durable and low-maintenance windshield wiper systems. Business jets and government aircraft contribute steady niche demand, driven by premium customization and reliability expectations. Helicopters and special mission aircraft add incremental value through specialized cockpit designs requiring tailored solutions. Overall, fleet expansion and retrofit programs sustain this segment’s leadership.

By Application

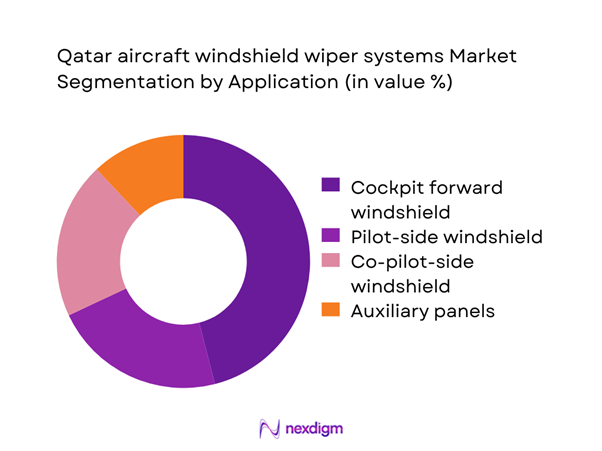

Cockpit forward windshield applications lead the market as they are critical for pilot visibility during taxiing, takeoff, and landing operations. These systems are prioritized in procurement due to their direct link to flight safety and regulatory compliance. Pilot-side and co-pilot-side installations follow closely, particularly in multi-crew aircraft. Auxiliary viewing panels represent a smaller but growing niche, driven by special mission aircraft and surveillance platforms. Continuous upgrades in cockpit ergonomics reinforce the dominance of primary windshield applications.

Competitive Landscape

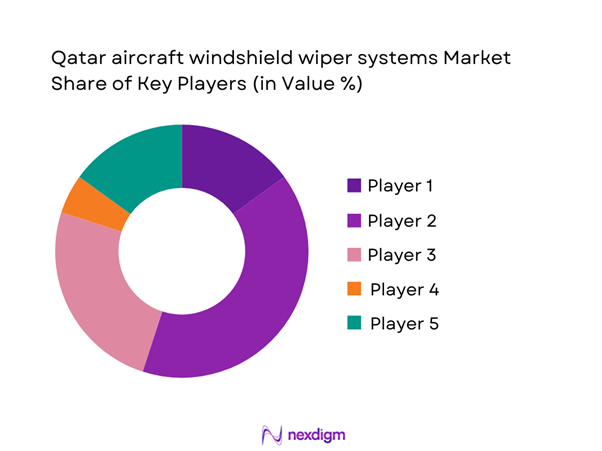

The market shows moderate concentration, with a small group of global aerospace system suppliers holding a strong presence through OEM line-fit programs and long-term aftermarket service agreements. Local value addition remains limited, but partnerships with MRO providers strengthen service coverage and lifecycle support.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Parker Hannifin Aerospace | 1917 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Liebherr-Aerospace | 1960 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar aircraft windshield wiper systems Market Analysis

Growth Drivers

Expansion of Qatar’s commercial aircraft fleet and MRO base

Fleet expansion has added close to 180 aircraft to active operations, increasing demand for approximately 520 systems annually across new installations and replacements. MRO activity has generated service revenues of nearly USD ~ million, driven by routine maintenance cycles and component upgrades. Aircraft utilization exceeding 3,800 flight hours per year accelerates wear patterns, raising annual replacement volumes to about 410 units. The growing base of long-haul aircraft further supports higher specification systems, contributing an estimated USD ~ million in incremental aftermarket value.

Rising operational safety and visibility standards in adverse weather

Stricter cockpit visibility requirements have led to upgrades across 140 aircraft platforms, resulting in the deployment of over 360 advanced wiper assemblies. Regulatory compliance programs have supported investments of nearly USD ~ million in certified components. Annual inspection-driven replacements now exceed 290 units, reflecting heightened emphasis on reliability during sandstorms and heavy rainfall. These safety-led initiatives account for close to USD ~ million in recurring demand, reinforcing the role of performance-driven procurement decisions.

Challenges

High certification and airworthiness compliance costs

Certification processes add nearly USD ~ million annually to supplier operating expenses, increasing system development timelines by 9 months. Each new platform integration requires testing across 45 operational scenarios, raising compliance workloads to about 120 assessments per model. These requirements elevate unit costs by nearly USD ~ million in aggregate across procurement cycles, limiting rapid innovation. Smaller suppliers face barriers in absorbing these costs, resulting in reduced competitive entry and slower adoption of next-generation designs.

Limited local manufacturing base for aerospace-grade components

More than 78 percent of critical components are sourced internationally, leading to import values of around USD ~ million per year. Supply lead times average 18 weeks, affecting maintenance schedules for about 95 aircraft annually. Local repair capability covers only 140 systems, forcing operators to depend on overseas service centers. This structural limitation adds logistics costs nearing USD ~ million annually and constrains the development of a self-sufficient aerospace component ecosystem.

Opportunities

Growth of local MRO capabilities and component repair services

Expansion of maintenance facilities has increased repair capacity to nearly 320 systems per year, reducing offshore servicing needs. Localized support is projected to retain service revenues of about USD ~ million within the domestic ecosystem. The addition of 85 specialized technicians enhances turnaround times, improving fleet availability for 110 aircraft. These developments create a foundation for sustainable aftermarket growth and enable long-term service agreements valued at approximately USD ~ million across major operators.

Retrofit demand for legacy aircraft operating in sand-prone environments

Legacy fleets of about 95 aircraft require frequent replacements, generating retrofit volumes of nearly 260 units annually. Harsh operating conditions accelerate wear, leading to maintenance expenditures of around USD ~ million each year. Retrofit programs targeting durability upgrades contribute incremental demand of 180 systems, particularly for defense and government fleets. This opportunity supports aftermarket expansion valued at close to USD ~ million, driven by the need to extend operational life cycles.

Future Outlook

The market is expected to benefit from sustained fleet modernization, deeper integration of smart maintenance technologies, and expanding local service ecosystems. Continued regulatory emphasis on flight safety will support steady upgrade cycles. Strategic partnerships between global suppliers and regional MRO providers are likely to strengthen aftermarket resilience. Over the long term, gradual localization of component servicing will enhance supply reliability and operational efficiency.

Major Players

- Safran

- Collins Aerospace

- Parker Hannifin Aerospace

- Honeywell Aerospace

- Liebherr-Aerospace

- Moog

- Eaton Aerospace

- Meggitt

- Triumph Group

- Crane Aerospace & Electronics

- AMETEK Aerospace & Defense

- Woodward

- ITT Aerospace Controls

- Diehl Aviation

- PPG Aerospace

Key Target Audience

- Commercial airline fleet operators

- Business jet and charter service providers

- Defense aviation procurement units

- Qatar Civil Aviation Authority and Ministry of Transport

- Airport operators and ground service organizations

- MRO service providers and component repair centers

- Aircraft leasing and asset management firms

- Investments and venture capital firms focused on aerospace

Research Methodology

Step 1: Identification of Key Variables

Market scope, fleet composition, maintenance cycles, and regulatory frameworks were defined to establish baseline parameters. Key demand drivers and supply constraints were mapped across commercial, business, and defense aviation segments. Core performance indicators were selected to track system deployment and replacement patterns.

Step 2: Market Analysis and Construction

Data points on installations, service contracts, and retrofit programs were consolidated to build a structured market model. Segment-wise demand trends were evaluated across fleet types and applications. Supply chain dependencies and service ecosystem maturity were integrated into the analytical framework.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary assumptions were tested through structured consultations with industry professionals from operations, maintenance, and procurement functions. Feedback loops refined estimates related to service intensity, compliance impact, and technology adoption. Scenario testing ensured consistency across multiple demand outlooks.

Step 4: Research Synthesis and Final Output

Insights were consolidated into a coherent narrative aligning market dynamics with strategic implications. Cross-validation ensured consistency between qualitative findings and quantitative indicators. Final outputs were structured to support decision-making across investment, operations, and policy planning.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft windshield wiper system taxonomy across mechanical and electric actuation designs, market sizing logic by aircraft fleet size and replacement cycles, revenue attribution across system sales spares and MRO services, primary interview program with airlines OEMs and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Operational usage pathways across commercial, business, and defense aviation

- Ecosystem structure and value chain roles

- Supply chain and channel structure

- Regulatory and airworthiness environment

- Growth Drivers

Expansion of Qatar’s commercial aircraft fleet and MRO base

Rising operational safety and visibility standards in adverse weather

Increased utilization of wide-body aircraft for long-haul operations

Modernization of military and special mission aircraft fleets

Higher focus on cockpit ergonomics and pilot workload reduction

OEM shift toward integrated electromechanical systems - Challenges

High certification and airworthiness compliance costs

Limited local manufacturing base for aerospace-grade components

Dependence on imported Tier I and Tier II suppliers

Long replacement cycles and slow retrofit adoption

Exposure to fleet utilization volatility in regional aviation markets

Stringent reliability and durability performance requirements - Opportunities

Growth of local MRO capabilities and component repair services

Retrofit demand for legacy aircraft operating in sand-prone environments

Adoption of smart wiper systems with condition monitoring

Partnerships with OEMs for line-fit supply on new aircraft deliveries

Customization opportunities for VIP and business jet operators

Aftermarket service contracts and lifecycle support programs - Trends

Shift toward brushless motor and low-maintenance designs

Integration of wiper control with cockpit avionics systems

Rising use of corrosion-resistant materials for desert operations

Increased adoption of predictive maintenance technologies

Standardization of components across multi-platform fleets

Focus on lightweight assemblies to improve fuel efficiency - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial passenger aircraft

Business jets

Helicopters

Military and special mission aircraft

General aviation - By Application (in Value %)

Cockpit forward windshield

Pilot side windshield

Co-pilot side windshield

Observer and auxiliary viewing panels - By Technology Architecture (in Value %)

Conventional motor-driven wiper systems

Electro-hydraulic wiper systems

Brushless motor integrated systems

Smart sensor-enabled wiper systems - By End-Use Industry (in Value %)

Commercial aviation

Business and private aviation

Defense aviation

Government and special mission aviation - By Connectivity Type (in Value %)

Standalone mechanical systems

Avionics-integrated systems

Condition-monitoring enabled systems

Predictive maintenance enabled systems - By Region (in Value %)

Doha metropolitan aviation hub

Northern Qatar aviation clusters

Southern Qatar aviation clusters

Offshore and remote airstrip operations

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product reliability, certification portfolio, aftermarket support capability, pricing competitiveness, local service presence, customization flexibility, lead time performance, technology integration level)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Safran

Collins Aerospace

Parker Hannifin Aerospace

Meggitt

Honeywell Aerospace

Eaton Aerospace

Moog Inc.

Liebherr-Aerospace

Diehl Aviation

Triumph Group

AMETEK Aerospace & Defense

Crane Aerospace & Electronics

Woodward Inc.

ITT Aerospace Controls

PPG Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics in airline and defense sectors

- Buying criteria and vendor selection practices

- Budget allocation and maintenance financing preferences

- Implementation barriers and operational risk factors

- Post-purchase service and warranty expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035