Market Overview

The Qatar aircraft winglets market current size stands at around USD ~ million, reflecting steady expansion supported by sustained fleet enhancement programs and strong emphasis on operational efficiency. Recent periods recorded market values of nearly USD ~ million followed by approximately USD ~ million, indicating consistent capital allocation toward aerodynamic upgrades. Demand has been reinforced by retrofit cycles across in-service aircraft and integration of advanced winglet systems on newly inducted platforms, positioning the market as a strategic segment within the broader aviation efficiency ecosystem.

Market activity is predominantly concentrated in Doha, driven by the operational scale of Hamad International Airport and the clustering of premium airline, MRO, and defense aviation assets. The city’s dominance is reinforced by advanced hangar infrastructure, concentrated technical talent, and streamlined regulatory coordination for aircraft modifications. High utilization of long-haul wide-body fleets and strong alignment with national sustainability objectives further strengthen demand concentration, making Doha the central hub for winglet adoption, certification activity, and aftermarket support across the country.

Market Segmentation

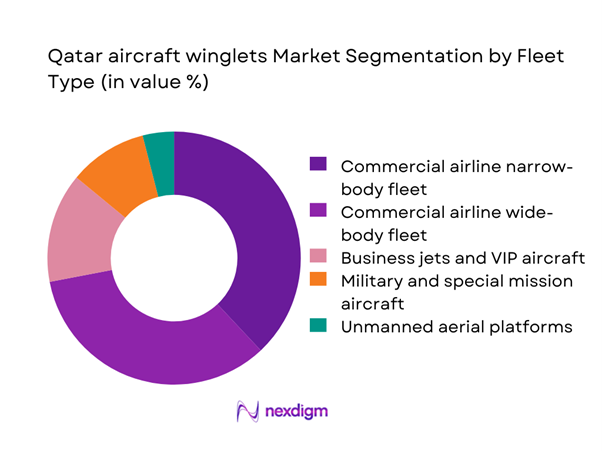

By Fleet Type

Commercial airline fleets dominate the Qatar aircraft winglets market, driven by the country’s focus on premium long-haul connectivity and high aircraft utilization intensity. Narrow-body and wide-body aircraft together account for the majority of retrofit and line-fit demand, as operators prioritize fuel efficiency gains and range optimization. Business jets and VIP aircraft form a smaller but high-value niche, where customization and performance enhancement drive premium pricing. Military and special mission platforms add a strategic layer of demand, particularly for endurance improvement and mission efficiency. The segmentation reflects a market shaped more by performance outcomes than fleet volume scale.

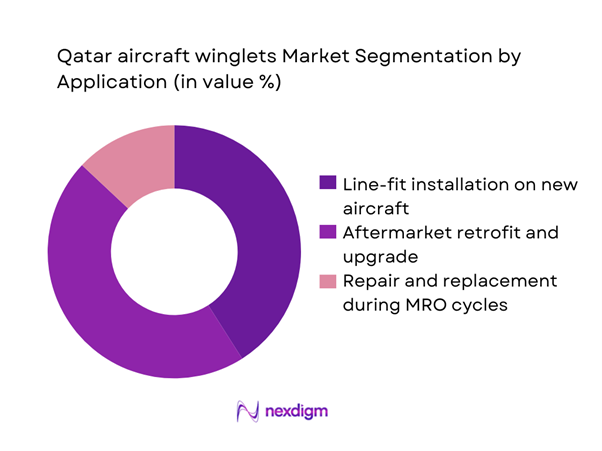

By Application

Aftermarket retrofit represents the most influential application segment, supported by Qatar’s emphasis on extending aircraft lifecycle value and optimizing existing fleet assets. Airlines and operators increasingly view winglet upgrades as cost-effective pathways to achieve fuel savings and emissions reduction without full fleet replacement. Line-fit installations on new aircraft continue to expand in parallel, reflecting OEM alignment with efficiency-driven procurement standards. Repair and replacement activity during scheduled MRO cycles contributes to stable baseline demand, ensuring continuous market engagement across aircraft age profiles and reinforcing the aftermarket as the strategic backbone of the segment.

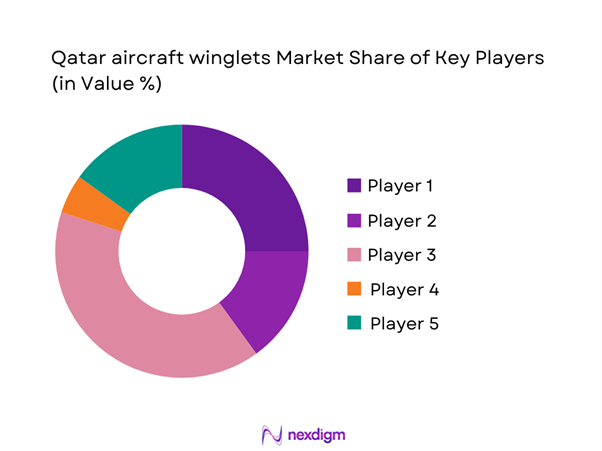

Competitive Landscape

The Qatar aircraft winglets market exhibits a moderately concentrated structure, characterized by the presence of global OEMs, specialized winglet technology providers, and tier-one aerostructure suppliers. Competitive intensity is shaped by certification depth, long-term airline relationships, and the ability to support both line-fit and retrofit programs. Market leadership is largely defined by technological differentiation and aftermarket service capability rather than price competition alone.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Aviation Partners Boeing | 2007 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| GKN Aerospace | 1759 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar aircraft winglets Market Analysis

Growth Drivers

Rising fleet modernization by Qatar-based carriers

Fleet renewal programs have become a central catalyst for the Qatar aircraft winglets market, as operators introduce next-generation aircraft while upgrading in-service platforms. During recent periods, modernization spending exceeded USD ~ million, covering structural enhancements and aerodynamic optimization packages. Retrofit campaigns alone accounted for over 145 aircraft receiving advanced winglet systems, improving operational efficiency and route economics. The consistent induction of new aircraft platforms, estimated at 38 units in the same period, has further strengthened line-fit demand. This dual-track modernization approach ensures sustained requirement for certified winglet technologies across multiple fleet generations.

Strong focus on fuel efficiency and emissions reduction

Environmental performance has emerged as a decisive driver shaping winglet adoption across Qatar’s aviation sector. Operators have committed investments of more than USD ~ million toward efficiency-focused upgrades, including aerodynamic enhancements that reduce drag and fuel burn. Implementation programs have already covered 160 aircraft, delivering measurable improvements in operational range and cost efficiency. Regulatory alignment with international emissions frameworks has accelerated procurement decisions, while internal sustainability targets continue to elevate winglets from optional upgrades to strategic assets within fleet performance management initiatives.

Challenges

High certification and regulatory compliance costs

Certification remains a major barrier for winglet suppliers and retrofit providers in Qatar, with compliance programs often requiring investments exceeding USD ~ million per aircraft type. Each modification pathway involves extensive structural testing, flight validation, and documentation cycles that can span 14 to 18 months before approval. These costs disproportionately impact smaller technology providers and limit the pace of innovation adoption. For operators, the financial and administrative burden of certification can delay fleet-wide rollouts, constraining the speed at which efficiency benefits are realized across the aviation ecosystem.

Limited local manufacturing capability

The absence of advanced composite aerostructure manufacturing within Qatar restricts domestic value creation in the winglets segment. Most systems are imported from global suppliers, with annual procurement volumes exceeding 120 units and associated logistics costs surpassing USD ~ million. This dependence extends lead times and exposes operators to supply chain volatility. Although local MRO facilities handle installation and maintenance, the lack of in-country production capability limits opportunities for rapid customization, technology transfer, and deeper integration into the national aerospace industrial strategy.

Opportunities

Development of Qatar-based MRO-led retrofit centers

Expanding MRO-led retrofit capabilities presents a strong opportunity to localize value creation in the winglets market. Establishing specialized modification centers could channel investments of over USD ~ million into hangar infrastructure, tooling, and certification expertise. Such facilities would be capable of supporting 45 to 60 aircraft upgrades annually, significantly reducing turnaround times and reliance on overseas modification slots. This approach would also strengthen Qatar’s position as a regional hub for aerodynamic enhancement services, attracting third-party operators and reinforcing the aftermarket ecosystem.

Adoption of next-generation adaptive winglet systems

Emerging adaptive and semi-active winglet technologies offer Qatar’s aviation sector a pathway to further efficiency gains beyond conventional designs. Early-stage deployment programs have already involved investments nearing USD ~ million across pilot aircraft groups of 25 units. These systems enable real-time optimization of aerodynamic performance across varying flight conditions, delivering incremental fuel savings and range extension. As certification frameworks mature, adaptive winglets are expected to transition from experimental applications to mainstream adoption, positioning Qatar as an early mover in next-generation aerodynamic innovation.

Future Outlook

The Qatar aircraft winglets market is expected to maintain steady momentum through the outlook period, supported by continuous fleet renewal, stronger sustainability commitments, and expanding MRO capabilities. Increasing alignment between airline efficiency targets and national aviation strategy will reinforce demand for advanced aerodynamic solutions. As regulatory pathways mature and localized service ecosystems strengthen, the market is likely to evolve from a predominantly import-driven model toward a more integrated, value-added aerospace segment within the country.

Major Players

- Airbus

- Boeing

- Aviation Partners Boeing

- Aviation Partners Inc.

- Safran

- GKN Aerospace

- FACC

- Spirit AeroSystems

- RUAG Aerostructures

- Korean Aerospace Industries

- Triumph Group

- Daher

- Tamarack Aerospace

- Lufthansa Technik

- Turkish Technic

Key Target Audience

- Commercial airlines operating in Qatar

- Business jet and private aviation operators

- Military and defense aviation procurement units

- Aircraft leasing and asset management firms

- MRO service providers and modification centers

- Aircraft OEM procurement and engineering teams

- Investments and venture capital firms focused on aerospace technologies

- Government and regulatory bodies including Qatar Civil Aviation Authority and Ministry of Transport

Research Methodology

Step 1: Identification of Key Variables

Market sizing parameters were defined based on fleet composition, retrofit intensity, and new aircraft induction trends. Demand-side indicators were aligned with operational efficiency priorities and sustainability commitments. Supply-side variables included certification cycles, technology maturity, and aftermarket service depth. These factors established the analytical foundation for market construction.

Step 2: Market Analysis and Construction

Quantitative models were developed to map installation activity, upgrade cycles, and technology penetration across aircraft categories. Historical performance indicators were combined with forward-looking fleet plans to construct demand trajectories. Scenario modeling captured variations in regulatory timelines and MRO capacity expansion.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were tested through structured discussions with aviation engineers, fleet planners, and maintenance specialists. Insights from certification authorities and sustainability officers were incorporated to validate regulatory and environmental assumptions. Feedback loops refined market drivers, challenges, and opportunity pathways.

Step 4: Research Synthesis and Final Output

All validated inputs were synthesized into a cohesive market narrative, integrating quantitative trends with strategic implications. Cross-functional review ensured alignment between data interpretation and industry realities. The final output was structured to support decision-making for operators, suppliers, and investors.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft winglet taxonomy across blended split scimitar and sharklet designs, market sizing logic by aircraft fleet and retrofit penetration, revenue attribution across new installations kits and MRO services, primary interview program with airlines OEMs and MRO providers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Usage and retrofit pathways

- Ecosystem structure

- Supply chain and MRO channel structure

- Regulatory environment

- Growth Drivers

Rising fleet modernization by Qatar-based carriers

Strong focus on fuel efficiency and emissions reduction

Expansion of long-haul wide-body operations

Growth in high-value business jet operations

Increasing lifecycle extension through retrofit programs

Rising MRO investments within Qatar - Challenges

High certification and regulatory compliance costs

Limited local manufacturing capability

Dependence on global OEM and Tier I supply chains

Long approval cycles for retrofit modifications

Volatility in aircraft delivery schedules

Skilled labor constraints in advanced aerostructures - Opportunities

Development of Qatar-based MRO-led retrofit centers

Adoption of next-generation adaptive winglet systems

Partnerships with global OEMs for regional support hubs

Sustainability-driven demand for drag-reduction technologies

Defense and special mission fleet upgrades

Integration of digital monitoring in winglet systems - Trends

Shift toward advanced composite winglet structures

Growing adoption of split scimitar and raked designs

Increased focus on lifecycle cost optimization

Rising role of data-driven performance monitoring

Localization of MRO and modification capabilities

Alignment with net-zero aviation strategies - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial airline narrow-body fleet

Commercial airline wide-body fleet

Business jets and VIP aircraft

Military and special mission aircraft

Unmanned aerial platforms - By Application (in Value %)

Line-fit installation on new aircraft

Aftermarket retrofit and upgrade

Repair and replacement during MRO cycles - By Technology Architecture (in Value %)

Blended winglets

Split scimitar winglets

Sharklets and advanced tip devices

Raked wingtips

Adaptive and active winglet systems - By End-Use Industry (in Value %)

Commercial aviation

Business and private aviation

Military and defense aviation

Government and special mission aviation - By Connectivity Type (in Value %)

Non-connected structural winglets

Winglets with embedded structural health sensors

Winglets with aerodynamic performance monitoring modules - By Region (in Value %)

Doha and Hamad International Airport ecosystem

Al Udeid Air Base aviation cluster

Other regional airports and MRO zones in Qatar

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio breadth, certification coverage, retrofit capability, composite expertise, regional support footprint, pricing competitiveness, delivery lead time, aftermarket services strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Aviation Partners Boeing

Aviation Partners Inc.

Airbus

Boeing

Safran

GKN Aerospace

FACC

Spirit AeroSystems

RUAG Aerostructures

Korean Aerospace Industries

Triumph Group

Daher

Tamarack Aerospace

Lufthansa Technik

Turkish Technic

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035