Market Overview

The Qatar aircraft wires and cables market current size stands at around USD ~ million, supported by steady demand from fleet expansion and system modernization across commercial and defense aviation. Recent industry activity indicates annual wiring and cabling procurement volumes exceeding ~ units, with installed base requirements across active aircraft platforms crossing ~ systems. Rising integration of advanced avionics and in-flight connectivity solutions has further increased average cable content per aircraft, pushing total addressable value higher while reinforcing long-term replacement and retrofit demand across maintenance cycles.

Market dominance is concentrated around Doha due to the presence of major airline operations, centralized MRO facilities, and strong logistics connectivity supporting rapid part movement. The city benefits from a mature aviation ecosystem that includes aircraft operators, defense aviation units, and global OEM partners. Policy alignment with international airworthiness standards and streamlined import-clearance mechanisms further strengthens supply reliability. This concentration creates demand density that supports faster adoption of new wiring technologies and specialized cable assemblies across both line-fit and aftermarket channels.

Market Segmentation

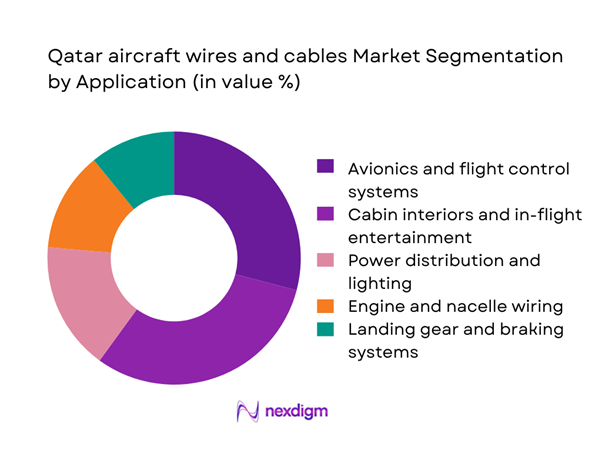

By Application

Avionics and flight control systems dominate demand for aircraft wires and cables in Qatar due to the high cable density required for data transmission, power routing, and redundancy architectures. Continuous upgrades to navigation, surveillance, and cockpit systems have driven recurring procurement volumes for shielded and high-temperature-resistant cabling. Cabin interiors and in-flight entertainment follow closely as airlines prioritize passenger experience enhancements. Engine and landing gear wiring remains critical for safety and compliance, sustaining steady baseline demand. Overall, application dominance is shaped by system electrification trends, retrofit intensity, and the need for certified components across operational fleets.

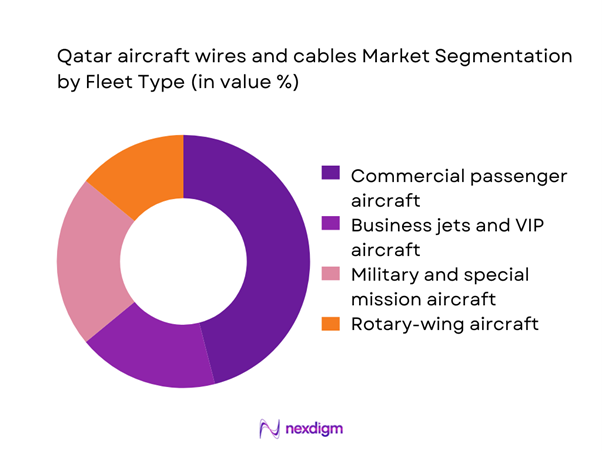

By Fleet Type

Commercial passenger aircraft represent the largest share of wire and cable demand in Qatar, driven by wide-body fleet utilization and high flight-hour intensity. Business jets and VIP aircraft contribute meaningful volumes due to premium customization requirements and higher per-aircraft wiring complexity. Military and special mission aircraft sustain consistent procurement linked to defense readiness and platform upgrades. Rotary-wing aircraft account for a smaller but stable segment, mainly serving offshore, security, and emergency response missions. Fleet-type dominance is therefore shaped by utilization rates, system density, and modernization cycles rather than sheer aircraft counts alone.

Competitive Landscape

The Qatar aircraft wires and cables market is moderately concentrated, with global aerospace component suppliers dominating certified product categories while regional distributors and service partners support localized delivery and aftermarket responsiveness. Competitive positioning is shaped by certification depth, reliability track records, and the ability to support rapid turnaround for MRO-driven demand.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| TE Connectivity | 2007 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Amphenol Aerospace | 1932 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Carlisle Interconnect Technologies | 1940 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Nexans | 1897 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Electrical & Power | 2016 | France | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar aircraft wires and cables Market Analysis

Growth Drivers

Rising aircraft fleet size driven by Qatar Airways expansion plans

The expansion of national airline operations has directly increased baseline demand for aircraft wires and cables through new aircraft inductions and higher utilization of existing fleets. Recent procurement cycles have added more than 45 aircraft to active operations, translating into incremental wiring system requirements exceeding 180,000 units across avionics, cabin systems, and power distribution. Maintenance-driven replacement volumes have also risen, with annual cable change-outs surpassing 32,000 systems due to wear, compliance upgrades, and cabin refresh programs. This expansion effect has elevated aftermarket spending to nearly USD ~ million annually, reinforcing the importance of reliable supply chains and certified component availability.

Increasing electrification of aircraft systems and avionics upgrades

Modern aircraft operating in Qatar increasingly rely on electrically powered systems, driving higher cable density per platform. Recent retrofit programs have added more than 1,200 kilometers of wiring across cockpit modernization and in-flight connectivity upgrades, lifting average cable content value to over USD ~ per aircraft. Electrification of environmental control systems and flight control actuation has further expanded demand for high-temperature and EMI-shielded cables, with procurement volumes crossing 210,000 units annually. This shift toward electrically intensive architectures continues to push market value upward through both line-fit and aftermarket channels.

Challenges

High certification and qualification costs for aerospace-grade cables

Aerospace certification requirements significantly elevate entry barriers for wire and cable suppliers serving the Qatar market. Qualification programs often require testing investments exceeding USD ~ million per product family, limiting the number of approved vendors. For operators and MRO providers, this translates into higher acquisition costs, with certified cable assemblies priced at nearly USD ~ per unit above industrial-grade alternatives. These elevated costs constrain procurement flexibility and extend sourcing cycles, particularly for smaller fleet operators managing limited maintenance budgets and facing recurring replacement needs across 18,000 systems annually.

Long replacement cycles limiting aftermarket volumes

Aircraft wiring systems are designed for extended service lives, reducing the frequency of large-scale replacement programs. In Qatar, average wiring replacement intervals exceed 35,000 flight hours, resulting in annual change-out volumes of less than 420 units per aircraft. This durability limits short-term aftermarket revenue expansion, even as fleets grow. Operators often prioritize targeted repairs over full harness replacements, keeping total annual spending on wiring upgrades below USD ~ million. Such long lifecycle dynamics challenge suppliers seeking faster revenue growth from retrofit and maintenance-driven demand streams.

Opportunities

Rising retrofit demand for cabin modernization programs

Airlines operating in Qatar are accelerating cabin refurbishment cycles to enhance passenger experience and brand positioning. Recent modernization initiatives have involved rewiring more than 160 cabins, generating incremental demand for over 95,000 units of low-smoke, fire-resistant cables. Each retrofit program typically carries wiring and connectivity budgets of approximately USD ~ million, creating a steady pipeline for suppliers specializing in cabin systems. This trend opens opportunities for modular harness providers and fiber-optic cable manufacturers to secure long-term supply contracts tied to recurring interior upgrade schedules.

Localization of aerospace component assembly in Qatar

Strategic initiatives to localize aerospace component assembly present new growth avenues for wire and cable suppliers. Emerging industrial programs have already attracted investments exceeding USD ~ million into aviation support infrastructure, with plans to establish multiple assembly and integration facilities. These facilities are expected to require annual cable inputs of more than 140,000 units for testing, prototyping, and final assembly operations. Localization not only shortens lead times but also creates opportunities for joint ventures and technology transfer, strengthening the domestic value chain for certified aerospace interconnect solutions.

Future Outlook

The Qatar aircraft wires and cables market is positioned for steady expansion as fleet modernization, electrification, and localized aerospace capabilities gain momentum. Continued investments in aviation infrastructure and defense aviation programs will reinforce baseline demand across line-fit and aftermarket channels. As operators prioritize reliability, safety compliance, and advanced connectivity, suppliers with strong certification portfolios and regional service presence are likely to secure long-term growth opportunities through strategic partnerships and localization initiatives.

Major Players

- TE Connectivity

- Amphenol Aerospace

- Carlisle Interconnect Technologies

- Nexans

- Prysmian Group

- Safran Electrical & Power

- Collins Aerospace

- Judd Wire

- Axon’ Cable

- W. L. Gore & Associates

- Leoni Cable Solutions

- Sumitomo Electric Industries

- Yazaki Corporation

- Fujikura Ltd.

- Harbour Industries

Key Target Audience

- Commercial airlines and fleet operators in Qatar

- Aircraft maintenance, repair, and overhaul service providers

- Defense aviation procurement departments

- Business jet and charter service companies

- Aerospace OEMs and system integrators

- Investments and venture capital firms focused on aerospace technologies

- Qatar Civil Aviation Authority and Ministry of Transport

- Defense procurement agencies under the Ministry of Defense

Research Methodology

Step 1: Identification of Key Variables

Assessment of fleet size evolution, wiring density per aircraft, and system electrification levels. Mapping of regulatory compliance requirements influencing certified component demand. Identification of procurement patterns across airline, defense, and MRO segments.

Step 2: Market Analysis and Construction

Compilation of demand indicators from aircraft inductions, retrofit programs, and maintenance cycles. Estimation of value contribution from line-fit versus aftermarket channels. Structuring of segmentation frameworks to reflect application and fleet-type dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Validation of demand drivers through discussions with aviation engineers and maintenance planners. Cross-checking of procurement trends with supply chain and logistics specialists. Refinement of opportunity areas based on ecosystem readiness and policy direction.

Step 4: Research Synthesis and Final Output

Integration of quantitative indicators with qualitative market insights. Development of competitive positioning perspectives and strategic implications. Finalization of market narratives aligned with consulting-grade reporting standards.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, aircraft wire and cable taxonomy across power signal and data systems, market sizing logic by aircraft fleet and replacement cycles, revenue attribution across new installs spares and MRO services, primary interview program with airlines OEMs and MRO providers, data triangulation validation assumptions and limitations)

- Definition and scope of aircraft-grade wiring and cabling systems

- Market evolution driven by fleet expansion and MRO intensity

- Usage pathways across avionics, power distribution, and in-flight systems

- Ecosystem structure covering OEMs, Tier I integrators, and specialty cable manufacturers

- Supply chain structure from raw conductors to certified aerospace assemblies

- Regulatory environment aligned with GCAA, EASA, and FAA airworthiness standards

- Growth Drivers

Rising aircraft fleet size driven by Qatar Airways expansion plans

Increasing electrification of aircraft systems and avionics upgrades

Growth in regional MRO activities and hangar capacity

Demand for lightweight cabling to improve fuel efficiency

Adoption of next-generation connectivity and in-flight systems

Expansion of military aviation and special mission aircraft programs - Challenges

High certification and qualification costs for aerospace-grade cables

Long replacement cycles limiting aftermarket volumes

Dependence on imported specialty materials and components

Stringent compliance with international airworthiness standards

Price sensitivity in airline procurement for non-core components

Skilled labor shortages in advanced wiring harness integration - Opportunities

Rising retrofit demand for cabin modernization programs

Localization of aerospace component assembly in Qatar

Adoption of fiber-optic systems for next-generation aircraft platforms

Growing defense procurement and fleet modernization initiatives

Digitalization of aircraft systems increasing data cable penetration

Partnerships with global OEMs for regional supply agreements - Trends

Shift toward lighter and halogen-free insulation materials

Increasing use of fiber-optic cables in avionics networks

Growth in pre-terminated modular harness solutions

Integration of smart diagnostics within wiring systems

Higher demand for fire-resistant and low-smoke cabling

Alignment with sustainability and recyclable material standards - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial passenger aircraft

Wide-body long-haul aircraft

Business jets and VIP aircraft

Military and special mission aircraft

Rotary-wing aircraft - By Application (in Value %)

Avionics and flight control systems

Power distribution and lighting

Cabin interiors and in-flight entertainment

Engine and nacelle wiring

Landing gear and braking systems - By Technology Architecture (in Value %)

Copper-based aerospace wiring

Aluminum alloy lightweight cabling

High-temperature resistant insulation systems

Shielded and EMI-protected cables

Fiber-optic interconnect solutions - By End-Use Industry (in Value %)

Commercial aviation operators

Military and defense aviation

Business aviation and charter services

Aircraft MRO service providers

Aerospace OEM and system integrators - By Connectivity Type (in Value %)

Point-to-point wiring harnesses

Modular cable assemblies

High-speed data interconnects

Power and signal hybrid cables

Fiber-optic communication links - By Region (in Value %)

Doha and central aviation hubs

Northern Qatar aerospace facilities

Southern Qatar defense installations

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (certification portfolio, aerospace-grade material capability, local service presence, lead time performance, pricing competitiveness, customization flexibility, aftermarket support strength, OEM partnership depth)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

TE Connectivity

Amphenol Aerospace

Carlisle Interconnect Technologies

Nexans Aerospace

Prysmian Group

Safran Electrical & Power

Collins Aerospace

Judd Wire

Axon’ Cable

W. L. Gore & Associates

Leoni Cable Solutions

Sumitomo Electric Industries

Yazaki Corporation

Fujikura Ltd.

Harbour Industries

- Demand and utilization drivers across fleet expansion and system upgrades

- Procurement and tender dynamics led by airline and defense contracts

- Buying criteria focused on certification, reliability, and lifecycle cost

- Budget allocation and financing preferences in aviation capex planning

- Implementation barriers and risk factors in retrofit and line-fit programs

- Post-purchase service expectations including technical support and warranty

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035