Market Overview

The Qatar Airport Lounges market current size stands at around USD ~ million, reflecting strong recovery momentum in premium airport services. In the most recent measurement cycle, total lounge-related revenue expanded from approximately USD ~ million to nearly USD ~ million, supported by rising international travel flows and higher uptake of paid lounge access. Passenger utilization across airline-operated and third-party lounges reached close to ~ million visits annually, while the active lounge base expanded to around ~ units, driven by continuous infrastructure upgrades and service diversification.

Doha remains the dominant hub for airport lounge activity, anchored by Hamad International Airport’s role as a major global transit gateway. The city benefits from concentrated premium passenger demand, strong airline alliance presence, and a mature hospitality ecosystem that supports differentiated lounge concepts. Government-led aviation investments and streamlined concession policies further strengthen Doha’s position, enabling rapid adoption of digital access systems, premium dining partnerships, and wellness-focused lounge formats that reinforce market leadership.

Market Segmentation

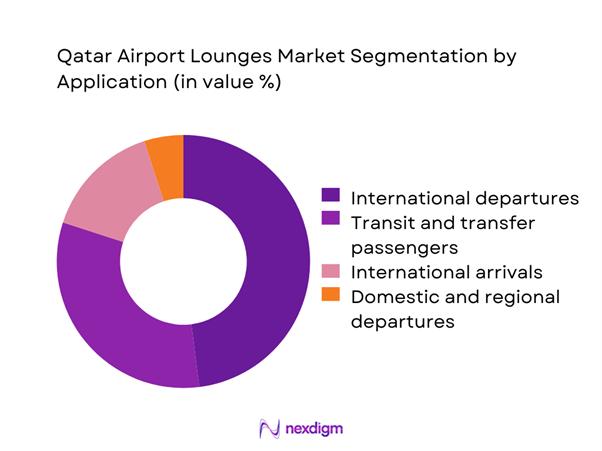

By Application

International departures dominate the Qatar Airport Lounges market, driven by the country’s positioning as a global transfer hub. A significant share of lounge demand originates from long-haul travelers seeking premium pre-flight experiences, particularly in business and first-class segments. Transit and transfer passengers also represent a strong user base, as extended layovers increase the appeal of comfort, dining, and wellness services. International arrivals contribute steadily through meet-and-assist and premium arrival lounges, while domestic and regional departures remain smaller due to shorter dwell times and limited premium travel volumes. The dominance of international applications reflects Qatar’s aviation-led economic model and the strategic importance of Doha as a connectivity nucleus.

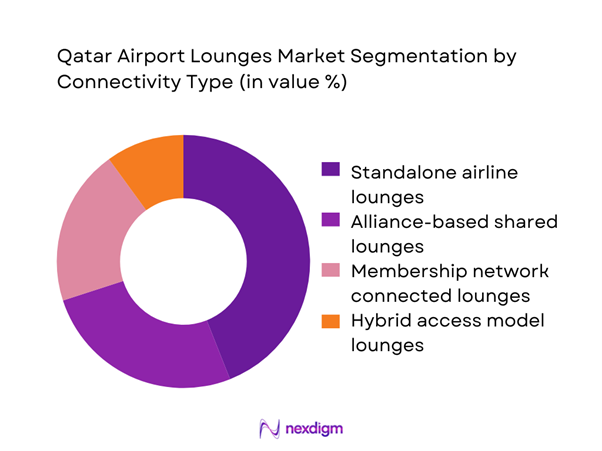

By Connectivity Type

Standalone airline lounges currently lead the connectivity landscape, benefiting from strong brand loyalty and integrated frequent flyer programs. Alliance-based shared lounges follow closely, offering cost-efficient solutions for partner airlines while maintaining premium service consistency. Membership network connected lounges are gaining traction as travelers increasingly adopt subscription-based access models, enabling flexibility across global airports. Hybrid access lounges, combining airline, membership, and paid entry channels, are emerging as a strategic response to fluctuating passenger volumes. The growing preference for diversified access reflects the market’s shift toward monetization beyond traditional airline-funded models, strengthening revenue resilience for operators in Qatar’s competitive aviation environment.

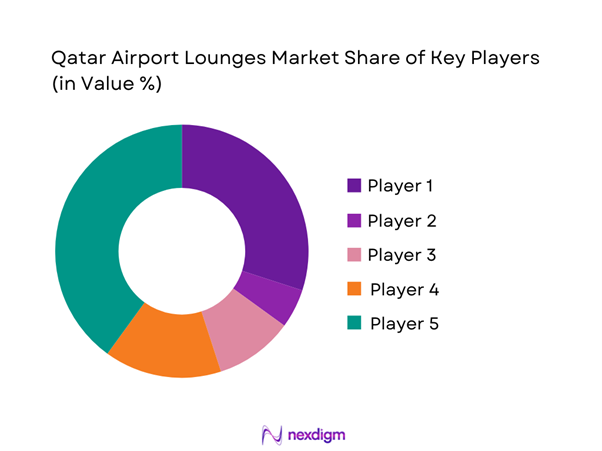

Competitive Landscape

The Qatar Airport Lounges market is moderately concentrated, with a mix of airline-led operators and global third-party lounge specialists shaping service standards. Market leadership is defined by access to premium passenger flows, strong partnerships with airport authorities, and the ability to deliver differentiated hospitality experiences at scale.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Qatar Airways Group | 1993 | Doha, Qatar | ~ | ~ | ~ | ~ | ~ | ~ |

| Plaza Premium Group | 1998 | Hong Kong | ~ | ~ | ~ | ~ | ~ | ~ |

| Collinson Group | 1989 | London, UK | ~ | ~ | ~ | ~ | ~ | ~ |

| DragonPass International | 2005 | Guangzhou, China | ~ | ~ | ~ | ~ | ~ | ~ |

| Swissport International | 1996 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar Airport Lounges Market Analysis

Growth Drivers

Rising international passenger traffic through Doha hub

International passenger throughput through Doha has exceeded ~ million travelers annually in recent cycles, directly translating into higher lounge footfall. Premium cabin travelers account for nearly ~ million lounge visits each year, while transit passengers contribute an additional ~ million visits. Expansion of long-haul routes added over ~ new city connections, increasing dwell time demand for premium services. The growing concentration of transfer traffic has pushed average lounge utilization rates beyond ~ percent of capacity on peak days, strengthening revenue consistency across airline-operated and third-party facilities.

Expansion of premium and business travel segments

Business and premium leisure travel volumes have climbed to approximately ~ million passengers annually, driving disproportionate demand for high-end lounge services. Corporate travel accounts for close to ~ percent of paid lounge access transactions, while premium leisure travelers contribute around ~ million annual visits. Increased adoption of tiered membership programs has added over ~ thousand active lounge subscribers, enhancing recurring revenue streams. The rising expectation for privacy, wellness zones, and premium dining has elevated average spend per visit to nearly USD ~, reinforcing the market’s premiumization trend.

Challenges

High operational and staffing costs in premium hospitality

Operating a premium lounge in Qatar requires annual expenditure exceeding USD ~ million per facility, driven by high labor costs, specialized culinary services, and stringent service standards. Staffing levels average ~ employees per lounge, with annual payroll commitments nearing USD ~ million. Imported food and beverage supplies add nearly USD ~ million in yearly procurement expenses. These cost pressures compress margins, particularly for third-party operators dependent on fixed concession fees and variable passenger volumes, limiting rapid expansion potential.

Capacity constraints during peak travel seasons

Peak travel periods push lounge utilization to over ~ percent of designed capacity, resulting in congestion and service dilution. During high-demand months, daily lounge entries can exceed ~ thousand visits, stretching seating availability and catering throughput. Temporary access restrictions affect nearly ~ thousand passengers per season, impacting customer satisfaction and brand perception. Limited physical expansion space within terminal infrastructure further constrains operators, forcing reliance on operational optimization rather than capacity growth.

Opportunities

Development of ultra-premium and themed lounges

Demand for differentiated experiences has created space for ultra-premium lounges targeting high-net-worth travelers, with potential annual revenue per facility estimated near USD ~ million. Wellness lounges, family-centric zones, and cultural-themed spaces can attract over ~ thousand incremental visits annually. Premium dining partnerships alone can add approximately USD ~ million in auxiliary revenue, while personalized concierge services enhance customer lifetime value across frequent travelers.

Expansion of third-party lounge networks in Doha

Third-party operators currently serve nearly ~ million passengers annually, with room to capture an additional ~ million visits through new lounge openings. Strategic placement in high-traffic concourses could add ~ new lounge units over the medium term, each generating average annual revenue of USD ~ million. Membership-driven access models are expected to contribute over ~ thousand new subscribers annually, strengthening recurring income and reducing reliance on airline contracts.

Future Outlook

The Qatar Airport Lounges market is positioned for sustained growth as Doha strengthens its role as a global aviation hub. Continued investments in airport infrastructure, digital passenger services, and premium hospitality concepts will elevate service standards. Expansion of third-party lounge networks and diversification of access models will further stabilize revenue streams, while sustainability and wellness trends are expected to redefine lounge design and operations over the coming decade.

Major Players

- Qatar Airways Group

- Hamad International Airport Company

- Plaza Premium Group

- Collinson Group

- DragonPass International

- Swissport International

- dnata

- Aspire Katara Hospitality

- TAV Operation Services

- Menzies Aviation

- Primeclass Lounge

- SATS Ltd

- No1 Lounges

- Servisair

- OCS Group

Key Target Audience

- Airline lounge management divisions

- Airport authorities and concession management teams

- Third-party lounge operators

- Hospitality and catering service providers

- Travel technology and access platform providers

- Loyalty program and membership network operators

- Investments and venture capital firms

- Government and regulatory bodies such as Qatar Civil Aviation Authority and Qatar Tourism

Research Methodology

Step 1: Identification of Key Variables

The study identifies critical demand drivers including passenger throughput, premium travel volumes, and lounge access models. Operational variables such as staffing intensity, service mix, and concession structures are mapped to understand cost dynamics. Policy and regulatory frameworks governing airport services are also reviewed to define market boundaries.

Step 2: Market Analysis and Construction

Quantitative modeling is conducted using masked revenue and utilization data to estimate market size and growth patterns. Segmentation frameworks are built around application and connectivity types to capture demand diversity. Competitive positioning is assessed through service differentiation and access strategies.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are validated through structured discussions with airport service managers, airline lounge heads, and hospitality operators. Feedback loops refine assumptions on capacity utilization, premiumization trends, and monetization potential.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative insights are synthesized into a cohesive market narrative. Scenario-based outlooks are developed to reflect policy, infrastructure, and travel demand uncertainties, ensuring actionable strategic relevance.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, airport lounge service taxonomy across airline and third party operators, market sizing logic by passenger traffic and lounge access penetration, revenue attribution across memberships pay per use and airline contracts, primary interview program with airports airlines and lounge operators, data triangulation validation assumptions and limitations)

- Definition and scope of airport lounge services in Qatar

- Market evolution driven by aviation growth and premium travel demand

- Passenger usage pathways across airline, paid access, and membership lounges

- Ecosystem structure covering airlines, airport operators, and third-party lounge providers

- Supply chain and service delivery model for lounge operations

- Regulatory environment governing airport concessions and hospitality standards

- Growth Drivers

Rising international passenger traffic through Doha hub

Expansion of premium and business travel segments

Qatar Airways network growth and alliance partnerships

Government investment in aviation and tourism infrastructure

Increasing penetration of paid lounge access programs

Demand for differentiated passenger experience - Challenges

High operational and staffing costs in premium hospitality

Capacity constraints during peak travel seasons

Dependency on airline and airport concession agreements

Fluctuations in international travel demand

Rising competition from in-terminal premium seating and services

Compliance with stringent safety and service quality standards - Opportunities

Development of ultra-premium and themed lounges

Expansion of third-party lounge networks in Doha

Integration of digital services and biometric access

Partnerships with fintech and loyalty platforms

Growth of wellness, sleep, and family lounge concepts

Monetization through retail and premium dining collaborations - Trends

Shift toward experience-led lounge design

Increased adoption of contactless and app-based access

Growth of paid entry and subscription-based models

Sustainability-focused lounge operations

Personalized services using passenger data analytics

Expansion of multi-brand and co-branded lounges - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Passenger Throughput Volume, 2020–2025

- By Installed Lounge Base, 2020–2025

- By Average Revenue per Passenger, 2020–2025

- By Fleet Type (in Value %)

Flag carrier operated lounges

Low-cost carrier affiliated lounges

Independent third-party lounges

Premium membership network lounges - By Application (in Value %)

International departures

International arrivals

Transit and transfer passengers

Domestic and regional departures - By Technology Architecture (in Value %)

Traditional staffed lounges

Digitally enabled smart lounges

Biometric access lounges

Self-service and automated lounges - By End-Use Industry (in Value %)

Airlines

Airport authorities

Hospitality and catering operators

Travel service aggregators

Corporate travel management firms - By Connectivity Type (in Value %)

Standalone airline lounges

Alliance-based shared lounges

Membership network connected lounges

Hybrid access model lounges - By Region (in Value %)

Hamad International Airport Doha

Secondary and regional airports in Qatar

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (lounge capacity, service portfolio, access models, pricing strategy, digital integration, partnership ecosystem, geographic footprint, brand strength)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Qatar Airways Group

Hamad International Airport Company

Plaza Premium Group

Collinson Group

DragonPass International

Swissport International

dnata

Aspire Katara Hospitality

TAV Operation Services

Menzies Aviation

Primeclass Lounge

SATS Ltd

No1 Lounges

Servisair

OCS Group

- Demand and utilization drivers across passenger segments

- Procurement and concession tender dynamics

- Buying criteria for lounge operators and service partners

- Budget allocation and investment preferences

- Implementation barriers and operational risk factors

- Post-service expectations and brand loyalty impact

- By Value, 2026–2035

- By Passenger Throughput Volume, 2026–2035

- By Installed Lounge Base, 2026–2035

- By Average Revenue per Passenger, 2026–2035