Market Overview

The Qatar airport sleeping pods market is growing steadily, with a market size valued at approximately USD ~ in 2025. The demand for sleeping pods is driven by a combination of factors, including increased passenger traffic at Hamad International Airport , the need for premium amenities, and the rising trend of long layovers. Airport sleeping pods offer travelers a comfortable and convenient resting option, reducing the stress of extended waiting times. The market is expected to continue expanding as Qatar further enhances its airport infrastructure, positioning itself as a hub for international transit travelers. Moreover, the growth of Qatar’s tourism sector, spurred by major global events, continues to drive up demand for sleeping pods at key transit points.

Qatar is the dominant player in the airport sleeping pods market due to the rapid expansion of Hamad International Airport . HIA serves as a key international transit hub, with millions of passengers passing through annually. The airport’s efforts to provide a premium experience to passengers are driving the market for sleeping pods. Furthermore, Qatar’s focus on infrastructure development, aided by the nation’s strategic location, positions it as a key player in the Middle East’s airport services market. Along with Qatar, other major countries with advanced airports like the UAE (Dubai, Abu Dhabi) and Singapore (Changi) also see dominance in the airport sleeping pods segment, fueled by large-scale airport developments and high transit passenger numbers.

Market Segmentation

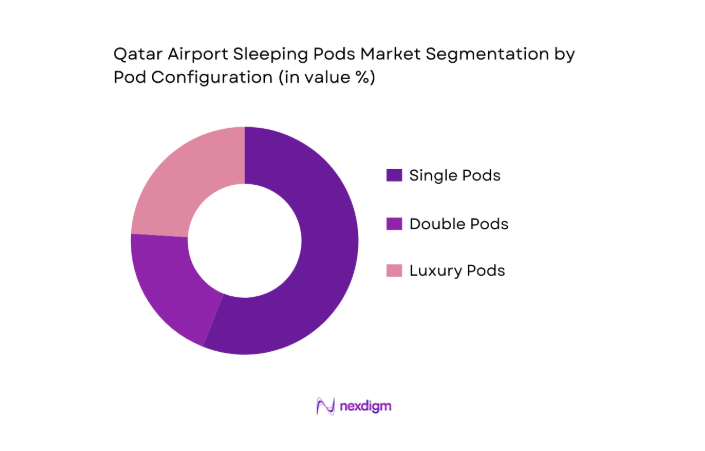

By Pod Configuration

The Qatar airport sleeping pods market is segmented into various configurations, including single pods, double pods, and luxury pods. Single pods currently dominate the market, accounting for the largest share due to their cost-effectiveness and space optimization. Travelers who prefer quick rest breaks during layovers typically opt for these compact sleeping pods. Luxury pods, however, are gaining popularity, driven by affluent travelers seeking enhanced comfort and privacy during their layovers. These pods feature advanced amenities such as soundproofing, ergonomic beds, privacy screens, and tech integration, attracting high-end users willing to pay a premium for a comfortable experience.

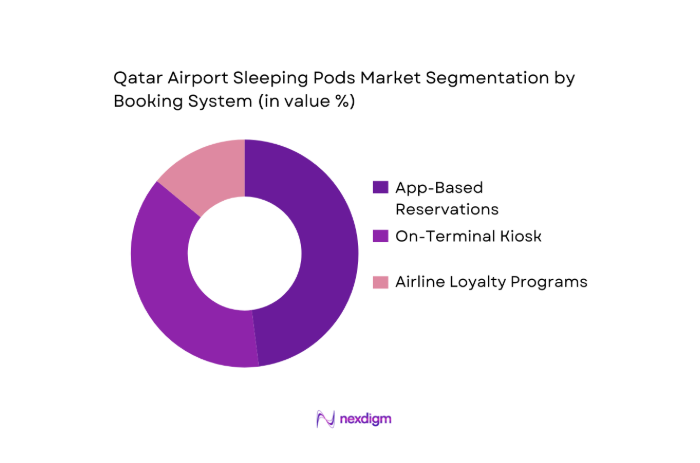

By Booking System

The market is also segmented based on the booking system. The three primary types are on-terminal kiosk bookings, app-based reservations, and airline loyalty integrations. App-based reservations are currently leading the segment due to the increasing use of smartphones and the convenience they offer to travelers. Travelers can book a pod directly through their phone, even before arriving at the airport, making the process seamless. Additionally, airport loyalty programs and partnerships with airlines are expected to fuel growth in this segment as passengers leverage their membership benefits for exclusive access to sleeping pods.

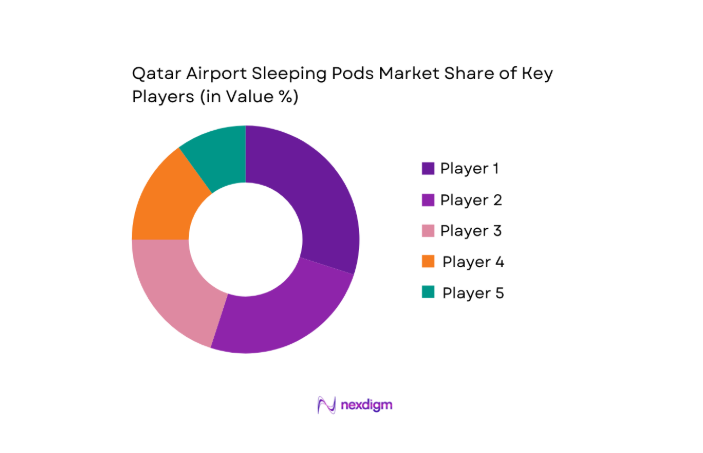

Competitive Landscape

The Qatar airport sleeping pods market is characterized by the presence of several global and regional players competing for market share. The major players in this market include Sleepover, Yotel, Minute Suites, GoSleep, and Napcabs, among others. These companies dominate the market by offering a range of pod configurations, high-tech features, and flexible booking systems to cater to the diverse needs of travelers. Local players, particularly those in Qatar, are integrating their offerings into the airport’s overall service portfolio, providing customers with a seamless and efficient service. Global brands such as Yotel leverage their international presence and brand recognition to attract both leisure and business travelers.

| Company | Establishment Year | Headquarters | Market Focus | Pod Configuration | Revenue Model | Tech Integration |

| Sleepover | 2017 | Qatar | ~ | ~ | ~ | ~ |

| Yotel | 2007 | UK | ~ | ~ | ~ | ~ |

| Minute Suites | 2009 | USA | ~ | ~ | ~ | ~ |

| GoSleep | 2005 | Finland | ~ | ~ | ~ | ~ |

| Napcabs | 2009 | Germany | ~ | ~ | ~ | ~ |

Qatar Airport Sleeping Pods Market Analysis

Growth Drivers

Transit Passenger Growth & Layover Duration Increase

The growth in global transit passengers is a key driver for the Qatar airport sleeping pods market. In 2024, Hamad International Airport (HIA) saw an increase in its passenger traffic by approximately ~, handling over ~ passengers. As global air travel continues to recover from the pandemic, international airport hubs like HIA are seeing increased layover durations, driven by longer connection times between flights. In 2024, the average layover time at major international airports is projected to reach 4.5 hours, boosting the demand for resting amenities like sleeping pods to accommodate tired travelers. Airports are investing in improving customer experience, with Qatar’s investment in infrastructure enhancements supporting this shift.

Rising Demand for Premium Resting Experiences

As air travel shifts towards a more luxurious and personalized experience, the demand for premium resting services is rising significantly. In 2024, global air travel revenue for premium cabins (business class and first class) surpassed USD ~. This trend is expected to continue with growing disposable incomes and higher expectations from affluent travelers, especially in Middle Eastern hubs like Qatar. In Qatar, luxury travelers’ preference for premium amenities, including high-end sleeping pods, is supported by the country’s increasing focus on enhancing airport luxury services. The integration of technology, such as automated booking systems and in-pod services, is further driving this demand. In 2024, over ~ of Qatar’s international travelers are expected to have longer layovers, prompting the rise of premium resting services to cater to this high-value market segment.

Market Challenges

High Capex/Opex per Terminal Footprint Deployment

One of the primary challenges in the Qatar airport sleeping pods market is the high capital and operational expenditure associated with deploying such services in airport terminals. Building a pod infrastructure requires substantial investment in both equipment and real estate within the terminal. In 2024, the average cost of deploying a single premium sleeping pod was around USD ~, excluding ongoing operational and maintenance costs. Airports such as Hamad International are seeing rising real estate costs, with terminal space increasing in demand for retail and commercial purposes. Moreover, operating these pods incurs substantial maintenance and staffing expenses, further complicating cost management for airports. This is particularly challenging when airports face fluctuating passenger numbers due to geopolitical factors or global health crises, which can lead to financial instability.

Integration with Airport Security & Safety Regulations

Integrating sleeping pods into airport terminals also presents challenges related to airport security and safety regulations. Sleeping pods must comply with strict safety standards, particularly around fire safety, accessibility, and structural integrity. Qatar’s Civil Aviation Authority and international regulations stipulate that all passenger-related services within airport terminals must be evaluated against these stringent standards, making the approval process slow and complex. Compliance with the latest fire safety regulations, including the installation of fire-resistant materials and the integration of emergency exits, is costly. Furthermore, ensuring data privacy for pod booking systems poses another challenge, especially as airports use increasingly advanced biometric systems for identification and tracking.

Market Opportunities

AI-Driven Personalization & Occupancy Forecasting

Artificial intelligence (AI) is emerging as a transformative force in the Qatar airport sleeping pods market. Airports are increasingly leveraging AI-driven systems to personalize the passenger experience and optimize pod occupancy. With the growth of machine learning and big data, AI can predict peak demand times, enabling airports to adjust their pod availability and pricing accordingly. In 2023, over 60% of global airports were experimenting with AI to enhance operational efficiencies, including dynamic pricing and personalized services. Qatar’s Hamad International Airport has begun implementing AI solutions to analyze passenger data, improving pod allocation and forecasting, which has led to better resource utilization. With AI, Qatar’s airports can significantly reduce costs and enhance the overall passenger experience, contributing to future market growth.

Strategic Alliances with Airlines & Airport Retail

Strategic alliances between sleeping pod providers, airlines, and airport retail operators present significant growth opportunities in the Qatar market. By partnering with airlines, especially for premium travelers, sleeping pod providers can offer targeted promotions, loyalty programs, and exclusive booking options. Qatar Airways, one of the leading airlines in the region, is increasingly focusing on integrating services across its ecosystem, including airport amenities, to offer a seamless experience for its passengers. Retail partnerships within airports, where sleeping pods are integrated with retail spaces, will create cross-promotional opportunities, driving increased foot traffic to both retail shops and sleeping pods. These partnerships are expected to reduce costs for sleeping pod operators while increasing demand.

Future Outlook

Over the next decade, the Qatar airport sleeping pods market is expected to experience substantial growth driven by an increasing number of international travelers and a greater focus on passenger convenience. Qatar’s strategic positioning as a hub for transit travelers, alongside the growth of its aviation industry, will continue to drive demand for sleeping pods. The market will also see advancements in pod technology, with smart features such as biometric authentication, personalized comfort settings, and enhanced booking systems becoming more prevalent. Additionally, the trend towards sustainable design and the integration of environmentally friendly materials will shape the future of this market, appealing to eco-conscious travelers.

Major Players

- Sleepover

- Yotel

- Minute Suites

- GoSleep

- Napcabs

- Sleepbox

- ZzzleepandGo

- JetQuay

- Restworks

- Podtime

- Smart Sleep

- Airport Sleep Pods

- SnoozeCube

- Cocoon

- 9hours

Key Target Audience

- Airport Authorities

- Airlines

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airport Retail Operators

- Premium Travel Service Providers

- Technology Solution Providers

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping key stakeholders in the Qatar airport sleeping pods market, identifying the key drivers such as passenger demand, technological integration, and infrastructure growth. Secondary data will be gathered from credible sources like industry reports, databases, and government publications.

Step 2: Market Analysis and Construction

Historical data from Qatar’s airport traffic, pod deployment rates, and revenue generation will be compiled. The focus will be on segmenting the market based on pod types, booking systems, and locations within terminals. Trends such as technological innovations and shifts in traveler preferences will be analyzed.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market trends and growth drivers will be validated through expert consultations with industry professionals from airport operations, hospitality, and technology providers. Interviews and surveys will provide real-time insights into customer preferences and operational challenges.

Step 4: Research Synthesis and Final Output

In this final stage, comprehensive data from the previous steps will be synthesized into a structured market report. Key findings will be presented, focusing on actionable insights for market participants. The report will undergo rigorous validation to ensure reliability and accuracy.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions; Abbreviations; Market Sizing Approach; Consolidated Research Approach; Primary/Secondary Data Sources; In‑Depth Industry Interviews; Data Validation & Triangulation; Limitations and Future Conclusions)

- Definition and scope

- Market taxonomy and segmentation logic

- Historical overview & maturity curve

- Role of airport sleeping pods in Qatar non‑aeronautical revenue strategy

- Consumer behavior dynamics in transit traffic

- Growth Drivers

Transit passenger growth & layover duration increase

Rising demand for premium resting experiences

Integration into non‑aeronautical revenue stream - Market Challenges

High capex/opex per terminal footprint deployment

Integration with airport security & safety regulations

Competitive pressure from airport lounges & hotels - Market Opportunities

AI‑driven personalization & occupancy forecasting

Strategic alliances with airlines & airport retail

Qatar tourism and mega‑event travel spikes - Market Trends

Tech‑enabled amenities

Premiumization & loyalty‑linked benefits

Sustainability & green pod design focus - Government & Regulatory Framework

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installation Volume, 2020-2025

- By Average Rental Yield, 2020-2025

- By Occupancy Utilization Rate, 2020-2025

- By Pod Configuration (In Value %)

Single Pods

Double/Family Pods

Luxury & Premium Pods

Smart/Tech‑Integrated Pods

- By Booking System (In Value %)

On‑terminal kiosk bookings

App‑based reservations

Airline loyalty integrations - By Location within Airport Terminal (In Value %)

International Arrivals

International Departures

Transit Zones - By Revenue Stream (In Value %)

Hourly Pay‑Per‑Use

Subscription & Corporate Packages

- Market Share of Major Players

- Cross‑Comparison Parameters (Pod Occupancy Rate, Average Daily Rental Yield, Terminal Area Footprint, Booking Conversion Rate, Tech‑Feature Score)

- SWOT Analysis of Key Players

- Pricing Strategy & Yield Analysis

Hourly vs Block Pricing

Dynamic Pricing adoption

Price Elasticity by Pod Segment - Detailed Profile of Major Players

Sleepover

Sleepbox

Minute Suites

Napcabs

YOTEL

GoSleep

ZzzleepandGo

Restworks

Airport Sleeping Pods

SnoozeCube

Podtime

Metronaps

Smart Carte

JetQuay

9hours

- Layover traveler comfort priorities

- Business vs leisure traveler behavior

- Corporate travel contracting propensity

- Pricing sensitivity & booking channel preferences

- By Market Value, 2026-2035

- By Installation Volume , 2026-2035

- By Average Rental Yield, 2026-2035

- By Occupancy Utilization Rate, 2026-2035