Market Overview

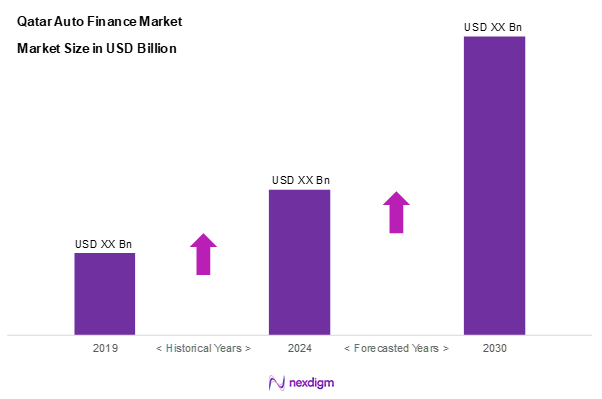

As of 2024, the Qatar auto finance market is valued at USD ~ billion, with a growing CAGR of 3.4% from 2024 to 2030, demonstrating growth driven by rising disposable incomes and increased vehicle ownership. Factors such as an expanding middle class and favourable financing options have significantly contributed to this market size, making auto affordability more accessible to consumers. The market reflects a five-year historical trend emphasizing the sector’s growth potential, supported by government initiatives and improved financial services.

Dominant cities in the Qatar auto finance market include Doha and Al Rayyan, primarily due to their advanced infrastructure and population density. These urban areas have a higher concentration of financial institutions offering competitive auto financing options, along with a vibrant automotive market. Additionally, the strategic location of these cities attracts numerous international automotive brands, further fuelling demand for auto financing solutions tailored to consumers and businesses alike.

Market Segmentation

By Vehicle Type

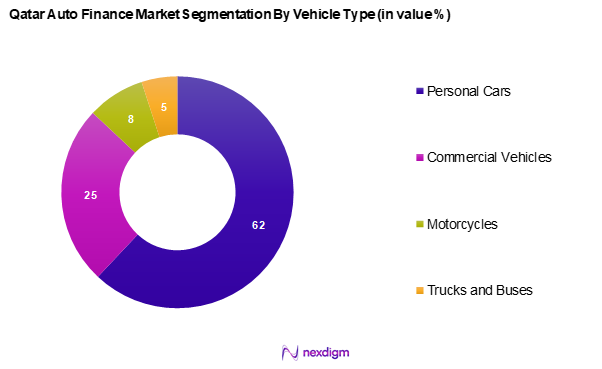

The Qatar auto finance market is segmented into personal cars, commercial vehicles, motorcycles, and trucks and buses. Personal cars hold a dominant share in the market, primarily because of their essential role in everyday transportation needs. With increasing urbanization and a growing population in Qatar, the demand for personal vehicles rises significantly. Moreover, favourable financing rates and consumer preferences for ownership over leasing have further cemented the prevalence of personal car financing.

By Financing Type

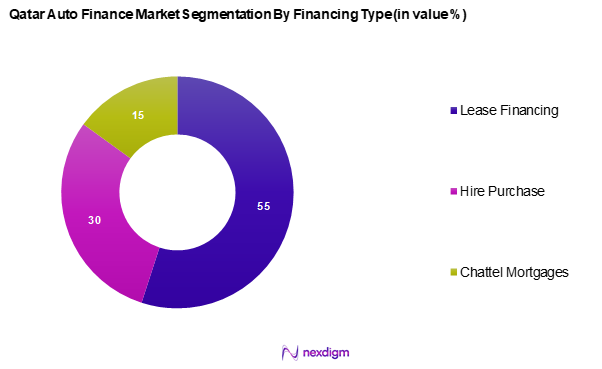

The Qatar auto finance market is segmented into lease financing, hire purchase, and chattel mortgages. Lease financing enjoys a significant market share due to its appeal to consumers seeking flexibility and lower initial payments compared to traditional loans. This financing model facilitates access to new vehicles without the long-term commitment of ownership, appealing especially to business clients and individual consumers who prefer to update their vehicles regularly. The growing trend toward flexible leasing agreements has solidified lease financing’s dominance in the market.

Competitive Landscape

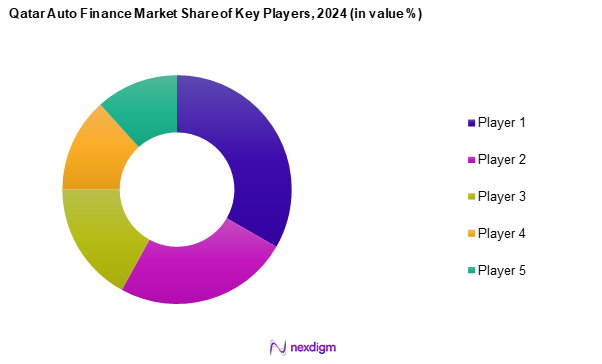

The Qatar auto finance market is characterized by a competitive landscape dominated by several key players, including both local and international organizations. Major players such as QNB, Doha Bank, and Commercial Bank of Qatar are pivotal in shaping the market. Their consolidation indicates a significant influence of these companies within the sector, highlighting their expansive operations and commitment to innovative financing solutions that cater to various consumer needs.

| Company Name | Establishment Year | Headquarters | Revenue in 2024 (USD Bn) | Financing Products Offered | Number of Branches | Market Share Trend |

| QNB | 1964 | Doha, Qatar | – | – | – | – |

| Doha Bank | 1990 | Doha, Qatar | – | – | – | – |

| Commercial Bank of Qatar | 1975 | Doha, Qatar | – | – | – | – |

| Gulf International Bank | 2006 | Manama, Bahrain | – | – | – | – |

| QIB | 1982 | Doha, Qatar | – | – | – | – |

Qatar Auto Finance Market Analysis

Growth Drivers

Increasing Disposable Income

The rising disposable income among Qatari consumers is contributing to the expansion of the auto finance market. As economic conditions improve and household earnings grow, more individuals are opting for financing solutions to purchase vehicles. With a stable economy and financial institutions offering attractive loan terms, consumers are increasingly inclined toward financing rather than outright purchases. The trend aligns with the country’s broader economic diversification efforts, encouraging private vehicle ownership.

Expanding Middle Class

Qatar’s middle class is expanding due to urbanization and increasing wealth distribution. A larger proportion of the population is now falling into the middle-income bracket, leading to greater demand for consumer goods, including automobiles. Financial institutions are responding by introducing tailored loan products that cater to this segment, enabling more individuals to access vehicle financing. Government policies supporting economic inclusion further reinforce this trend, fostering an environment where middle-class consumers play a pivotal role in market growth.

Market Challenges

High Competition among Financers

The auto finance market in Qatar is characterized by intense competition among banks and non-bank financial institutions. The presence of multiple players offering similar financing solutions results in pressure on profit margins, as lenders strive to differentiate themselves through lower interest rates and flexible repayment terms. While this benefits consumers by increasing accessibility, it also makes it challenging for financial institutions to maintain profitability. To stand out, companies must focus on customer service, technological advancements, and innovative financing solutions.

Regulatory Compliance

Financial institutions in Qatar must adhere to stringent regulations set by the central banking authority. These rules, designed to ensure transparency and consumer protection, require institutions to maintain strict compliance regarding lending practices and financial disclosures. While these regulations build consumer trust in the market, they also add to operational costs and complexity for lenders. Any failure to comply with these guidelines can result in financial penalties and reputational risks, making regulatory adherence a key challenge for auto finance providers.

Opportunities

Rise of Digital Financing Platforms

The increasing adoption of digital solutions is reshaping the auto finance landscape in Qatar. With widespread internet access and a digitally engaged consumer base, financial institutions are leveraging online platforms to streamline loan applications and approvals. Younger consumers, in particular, are drawn to the convenience of digital financing, encouraging banks and non-bank lenders to enhance their digital offerings. The shift toward online loan processing is expected to improve accessibility and customer engagement, driving further market growth.

Partnership with Automotive Dealerships

Collaborations between financial institutions and automotive dealerships are creating new growth opportunities in the auto finance market. Many vehicle purchases are now facilitated through dealership financing options, allowing consumers to access loans directly at the point of sale. These partnerships enhance the purchasing experience by integrating financing solutions with value-added services such as insurance packages and trade-in programs. As dealerships and financial institutions continue to strengthen their collaborations, the availability of seamless financing solutions is expected to further drive vehicle sales and financing uptake.

Future Outlook

Over the next five years, the Qatar Auto Finance market is expected to experience substantial growth driven by the rising demand for vehicles, favourable financial conditions, and advancements in Fintech solutions. The ongoing shift towards digital financing platforms is set to enhance customer convenience and accessibility, allowing consumers and businesses to engage with financing options more effortlessly. Furthermore, partnerships with automotive dealerships are anticipated to further stimulate growth in this sector as the market adapts to evolving consumer preferences.

Major Players

- QNB

- Doha Bank

- Commercial Bank of Qatar

- Gulf International Bank

- QIB

- Al Ahli Bank

- Arab Bank

- Al Rayan Bank

- Qatar International Islamic Bank

- Dukhan Bank

- Ahli United Bank

- ADCB

- BBAC Bank

- Al Jazeera Finance

- HSBC

- Others

Key Target Audience

- Automakers and vehicle manufacturers

- Financial institutions and banks

- Investment and venture capitalist firms

- Government and regulatory bodies (Qatar Central Bank, Ministry of Finance)

- Automotive dealerships

- Insurance companies

- SMEs and corporate clients

- Consumer automotive associations

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map encompassing all major stakeholders within the Qatar Auto Finance Market is constructed. This step involves extensive desk research, leveraging a combination of secondary and proprietary databases to gather comprehensive information about industry dynamics. The primary objective is to identify critical variables that influence the market, such as consumer behaviour, financing trends, and regulatory aspects.

Step 2: Market Analysis and Construction

During this phase, historical data pertinent to the Qatar Auto Finance Market is compiled and analysed. This includes evaluating market penetration levels, the ratio of financing options available, and the resultant revenue generation from these avenues. Furthermore, service quality metrics are assessed to ensure the reliability and accuracy of revenue estimates and market share computations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed during the analysis phase are validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing various companies in the market. These consultations provide valuable operational insights, financial data, and qualitative feedback, which are essential for refining and corroborating the gathered market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple key players within the auto finance sector to gather detailed insights into products and services offered, sales performance trends, and consumer preferences. This interaction is critical in verifying and complementing statistics derived from the bottom-up approach of market analysis, leading to a comprehensive and validated examination of the Qatar Auto Finance Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Disposable Income

Expanding Middle Class - Market Challenges

High Competition among Financers

Regulatory Compliance - Opportunities

Rise of Digital Financing Platforms

Partnership with Automotive Dealerships - Trends

Growing Shift towards Online Financing

Adoption of Artificial Intelligence in Credit Assessment - Government Regulation

Financing Regulations

Consumer Protection Laws

Interest Rate Policies - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rate, 2019-2024

- By Vehicle Type, (In Value %)

Personal Cars

Commercial Vehicles

Motorcycles

Trucks and Buses - By Financing Type, (In Value %)

Lease Financing

Hire Purchase

Chattel Mortgages - By Customer Type, (In Value %)

Individual Consumers

Businesses - By Region, (In Value %)

Doha

Al Rayyan

Umm Salal

Others - By Duration of Finance, (In Value %)

Short-term (1-3 years)

Medium-term (4-6 years)

Long-term (7+ years)

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Financing Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenue by Financing Type, Number of Branches/Offices, Distribution Channels)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

QNB

Al Ahli Bank

Doha Bank

QIB

Commercial Bank of Qatar

Gulf International Bank

Arab Bank

AlRayan Bank

Qatar International Islamic Bank

Dukhan Bank

Ahli United Bank

ADCB

BBAC bank

Al Jazeera Finance

HSBC

Standard Chartered

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rate, 2025-2030