Market Overview

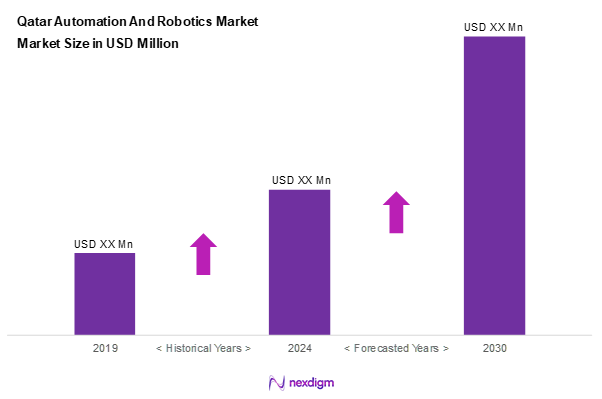

As of 2024, the Qatar automation and robotics in manufacturing market is valued at USD 47.5 million, with a growing CAGR of 7.4% from 2024 to 2030, reflecting its robust expansion driven by increasing investments in advanced manufacturing technologies and a growing focus on efficiency in production processes. Enhanced productivity and precision in manufacturing operations have spurred the adoption of automation and robotics solutions, reshaping the industrial landscape in Qatar.

Dominant cities like Doha, Al Rayyan, and Al Wakrah play a pivotal role in the market due to their strategic location, thriving industrial sectors, and government support for technological advancements. The Qatari government’s initiatives, such as Vision 2030, are focused on modernizing the economy, which further supports the growth of automation and robotics in these urban areas.

Market Segmentation

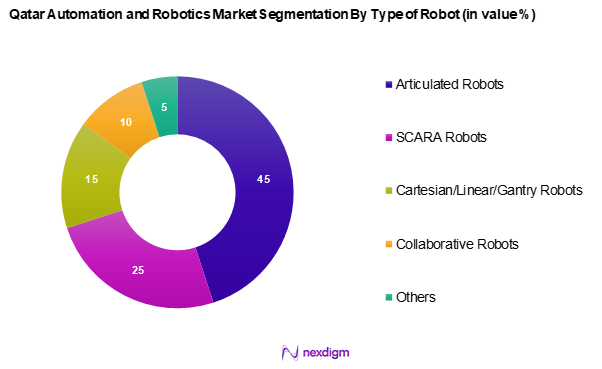

By Type of Robot

The Qatar automation and robotics market is segmented into articulated robots, SCARA robots, Cartesian / linear / gantry robots, collaborative robots, and others. Articulated robots hold a significant market share due to their versatility and ability to perform complex tasks, making them ideal for various applications in manufacturing sectors. Their design allows for greater flexibility and precision, which is crucial for specific tasks like welding, assembly, and material handling, leading to their dominance in the market.

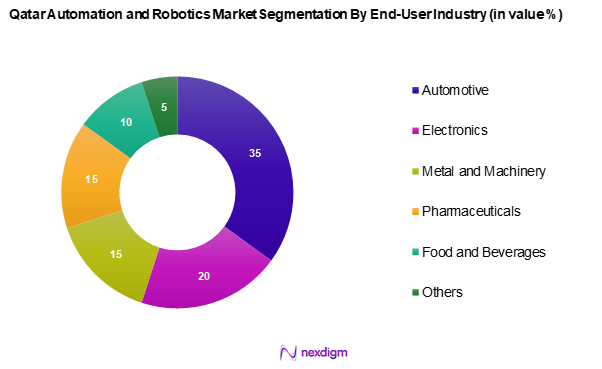

By End-User Industry

The Qatar automation and robotics market is segmented into automotive, electronics, metal and machinery, pharmaceuticals, food and beverages, and others. The automotive industry takes the lead in market share as a primary user of automation and robotics technologies for processes such as assembly lines and quality control. The industry’s constant need for increased efficiency and speed in production drives significant investment in robotic solutions, securing its status as the dominant segment.

Competitive Landscape

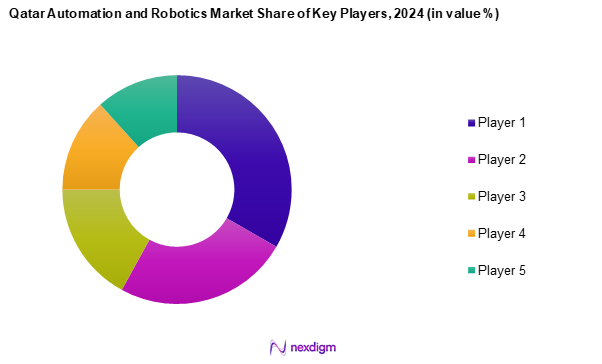

The Qatar automation and robotics market is highly competitive, featuring key players like ABB Ltd., Siemens AG, Rockwell Automation, Fanuc Corp, and Kuka AG. These companies leverage their technological expertise and global reach to establish a strong presence in the market, innovating continuously to maintain competitive advantages. The consolidation of major corporations underscores their significant influence and ability to drive market trends.

| Company | Establishment Year | Headquarters | Product

Range |

Market

Focus |

Revenue

(USD Mn) |

Market Share |

| ABB Ltd. | 1988 | Zurich, Switzerland | – | – | – | – |

| Siemens AG | 1847 | Munich, Germany | – | – | – | – |

| Rockwell Automation | 1903 | Wisconsin, USA | – | – | – | – |

| Fanuc Corp | 1972 | Yamanashi, Japan | – | – | – | – |

| Kuka AG | 1898 | Augsburg, Germany | – | – | – | – |

Qatar Electronics Manufacturing Market Analysis

Growth Drivers

Accelerating Urbanization

Qatar is witnessing rapid urban growth, marked by a continuous movement of the population towards urban areas. This urban expansion is cultivating increased demand for electronics in city-centric sectors such as transport, infrastructure, and consumer lifestyle. The growing focus on smart city development further amplifies the need for advanced electronic systems. As more citizens adopt tech-integrated living, manufacturers are motivated to enhance local production capabilities to cater to evolving consumer needs, making urbanization a strong catalyst for market growth.

Digital Economy Push Through Government Initiatives

National strategies aimed at building a robust digital economy are acting as a powerful driver for the electronics manufacturing industry. The government’s investments in digital transformation — including better internet connectivity, improved e-services, and support for tech startups — are laying the foundation for a technology-driven ecosystem. These initiatives encourage innovation, attract global partnerships, and elevate the demand for high-tech electronics, thereby reinforcing the need for localized manufacturing to meet the growing technological requirements of both public and private sectors.

Market Challenges

Ongoing Supply Chain Disruptions

Global supply chain instability continues to affect electronics manufacturing in Qatar. Delays in sourcing critical components especially those reliant on international suppliers have strained production schedules and elevated operational risks. Geopolitical uncertainties and pandemic-induced backlogs have further intensified these disruptions, leading to inefficiencies and limiting the capacity of local firms to respond swiftly to market demands.

Rising Production Costs

Manufacturers in Qatar face mounting operational costs, with labour and raw materials becoming increasingly expensive. Inflationary trends and global fluctuations in the prices of essential electronic components are putting pressure on production budgets. These cost challenges can hinder profit margins and reduce the competitiveness of local manufacturers compared to their international counterparts, especially in price-sensitive segments.

Opportunities

Growth in Renewable Energy Technology

The national pivot toward sustainability is creating new pathways for electronics manufacturers. With growing investments in renewable energy initiatives, there is an increasing demand for electronic products used in solar systems, energy storage, and smart grid management. This transition encourages the development and production of specialized electronic components, fostering innovation and positioning Qatar as a contributor to green technology solutions.

Increased Adoption of IoT and Smart Systems

The expanding use of IoT-based technologies across various sectors presents a major growth opportunity for electronics manufacturing. From smart homes and transportation to healthcare and industrial automation, the need for connected, intelligent electronic devices is surging. This shift towards real-time data, automation, and smart infrastructure is prompting manufacturers to align their production capabilities with the growing appetite for IoT-enabled solutions, strengthening Qatar’s presence in the global tech landscape.

Future Outlook

Over the next five years, the Qatar automation and robotics market is poised for significant growth, driven by ongoing advancements in technology, increased adoption of smart manufacturing solutions, and favorable government initiatives. The growing emphasis on efficiency, productivity, and precision within the manufacturing sector will propel the integration of robotics and automation technologies, positioning the market for robust expansion.

Major Players

- ABB Ltd.

- Siemens AG

- Rockwell Automation

- Fanuc Corp

- Kuka AG

- Mitsubishi Electric Corporation

- Kawasaki Heavy Industries Ltd.

- Omron Corporation

- Stäubli International AG

- Denso Corporation

- Universal Robots

- Epson Robots

- Techman Robots

Key Target Audience

- Industrial Manufacturers

- Automation Technology Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Qatar Financial Centre)

- SMEs in Manufacturing

- Logistics and Supply Chain Companies

- Research and Development Organizations

- Construction and Engineering Firms

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves creating an ecosystem map that includes all major stakeholders in the Qatar automation and robotics market. Comprehensive data is collected from secondary and proprietary databases, aimed at defining critical variables that influence the market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Qatar automation and robotics market is compiled and analyzed. This includes assessing market penetration rates, the ratio of technology adoption in different sectors, and resultant revenue generation. An evaluation of service quality metrics also supports the reliability and accuracy of revenue estimates, ensuring a comprehensive view of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and dynamics will be developed and validated through comprehensive interviews with industry experts, utilizing methods such as computer-assisted telephone interviews (CATIs). This will involve a diverse array of participants from major companies within the sector, all of whom can provide insights that refine and corroborate the data collected.

Step 4: Research Synthesis and Final Output

The final phase consists of direct engagement with multiple automation and robotics manufacturers in Qatar. This engagement will yield detailed insights into specific product segments, sales performance, consumer preferences, and other pertinent market factors. The information gathered will serve to verify and complement statistics drawn from the previous phases, ensuring a thorough and validated analysis of the market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, In-Depth Industry Interviews, Primary Research Approach)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increased Demand for Precision

Integration of IoT in Robotics - Market Challenges

High Initial Costs

Technical Skill Gap - Opportunities

Expansion in SMEs

Customized Solutions - Industry Trends

Rising Adoption of Cobots

Automation in SMEs - Regulatory Framework

Labor Laws

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Robot (In Value %)

Articulated Robots

– 4-axis Robots

– 6-axis Robots

– Heavy-Duty Industrial Robots

SCARA Robots

– Pick-and-Place SCARA

– Small Parts Assembly SCARA

Cartesian/Linear/Gantry Robots

– Single-Axis

– Multi-Axis

– Gantry Configurations for CNC/3D Printing

Collaborative Robots (Cobots)

– Light Assembly Cobots

– Medical Cobots

– Packaging Cobots

Others

– Delta Robots

– Cylindrical Robots

– Hybrid Robotic Systems - By End-User Industry (In Value %)

Automotive

– Welding & Painting Automation

– EV Component Assembly

Electronics

– Microchip Placement

– PCB Soldering

Metal and Machinery

– CNC Automation

– Cutting & Forming Automation

Pharmaceuticals

– Cleanroom Robots

– Precision Dispensing & Packaging

Food and Beverages

– Robotic Packaging Lines

– Sorting & Quality Control

Others

– Logistics & Warehousing

– Utilities and Energy - By Application (In Value %)

Assembly

– Micro-assembly

– Heavy Component Assembly

Material Handling

– Palletizing/Depalletizing

– Pick-and-Place Systems

Dispensing

– Glue/Sealant Dispensing

– Pharmaceutical Dispensing

Welding

– Arc Welding

– Spot Welding

Others

– Inspection and Testing

– Surface Treatment - By Technology (In Value %)

Machine Learning & AI

– Predictive Maintenance

– Adaptive Task Programming

Vision Systems

– 2D/3D Vision for Quality Inspection

– Object Recognition

Force Sensing

– Torque Feedback Systems

– Adaptive Gripping Solutions

Others

– Digital Twins

– Wireless Integration Technologies - By Deployment Mode (In Value %)

Cloud-Based

– Centralized Monitoring Platforms

– AI-driven Robotic Process Control

On-Premise

– Localized High-Security Control Systems

– Offline Industrial Controllers - By Mode of Automation (In Value %)

Fully-Automation

– Lights-Out Manufacturing

– End-to-End Robotic Assembly

Semi-Automation

– Human-Robot Collaboration

– Operator-Assisted Robotic Tasks - By Region (In Value %)

Doha

Al Rayyan

Al Wakrah

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Robot Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue, Market Positioning, Technological Geographies, Partnerships and Collaborations, Product Portfolio, Strategic Outlook)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

ABB Ltd.

Siemens AG

Rockwell Automation

Fanuc Corp

Kuka AG

Mitsubishi Electric Corporation

Kawasaki Heavy Industries Ltd.

Omron Corporation

Stäubli International AG

Denso Corporation

Universal Robots

Epson Robots

Techman Robot

- Market Demand and Utilization

- Adoption Rate by Industry

- Investment Patterns

- Industry-specific Challenges

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030