Market Overview

Based on a recent historical assessment, the Qatar aviation headsets market was valued at USD ~ billion, driven by sustained commercial aviation activity, expanding pilot workforce requirements, and continuous fleet operations by national and private operators. Demand is supported by mandatory cockpit communication standards, rising emphasis on pilot hearing protection, and replacement cycles for certified headsets across fixed wing and rotary platforms. Strong procurement by airlines, military aviation units, and training organizations reinforces consistent demand for advanced noise reduction and communication performance.

Based on a recent historical assessment, Doha emerged as the dominant center within the Qatar aviation headsets market due to the concentration of airline headquarters, major airports, aviation training facilities, and defense aviation units. The presence of Qatar Airways operations, government aviation authorities, and military airbases supports continuous headset procurement and replacement demand. Centralized fleet management, high flight activity levels, and strict safety compliance requirements further reinforce dominance, supported by strong links with international aviation equipment suppliers and authorized distributors operating in the country.

Market Segmentation

By Product Type

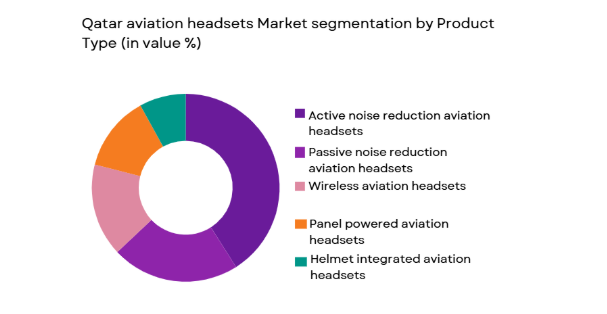

Qatar aviation headsets market is segmented by product type into active noise reduction aviation headsets, passive noise reduction aviation headsets, wireless aviation headsets, panel powered aviation headsets, and helmet integrated aviation headsets. Recently, active noise reduction aviation headsets have a dominant market share due to their superior ability to reduce cockpit noise exposure during long flight hours, especially on jet and rotary aircraft. Pilots operating in high utilization environments increasingly prefer ANR headsets to reduce fatigue and protect hearing. Airline standardization policies favor ANR systems for cockpit crews. Technological improvements in digital signal processing, lighter materials, and extended battery life further enhance adoption. Strong brand presence and proven reliability across commercial and military fleets reinforce dominance in procurement decisions.

By End User

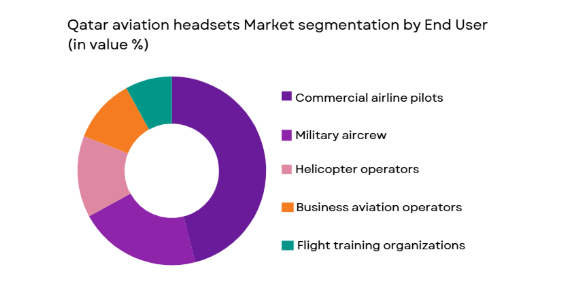

Qatar aviation headsets market is segmented by end user into commercial airline pilots, military aircrew, helicopter operators, business aviation operators, and flight training organizations. Recently, commercial airline pilots have a dominant market share due to the scale of flight operations, standardized cockpit equipment policies, and high replacement frequency driven by intensive utilization. Large fleets operating long haul and regional services require consistent headset performance and compliance with strict safety standards. Airlines invest in high quality headsets to maintain communication clarity and crew comfort. Continuous pilot onboarding and training further increase demand. Centralized procurement by airlines ensures volume purchases, reinforcing dominance among end user segments.

Competitive Landscape

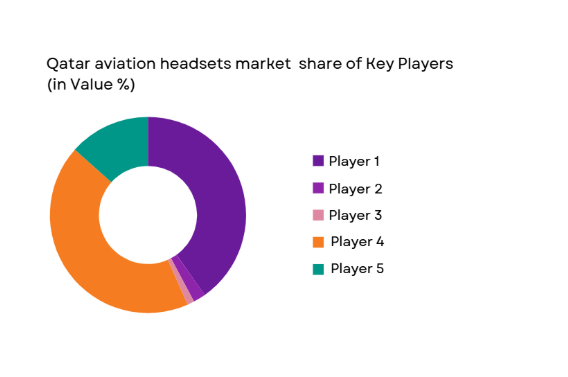

The Qatar aviation headsets market is moderately consolidated, with a small group of internationally established manufacturers dominating supply through authorized distributors and airline procurement channels. Strong brand recognition, certification compliance, and long-standing relationships with airlines and defense operators give major players significant influence over pricing, product selection, and replacement cycles.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Certification Coverage |

| Bose Corporation | 1964 | Massachusetts, USA | ~ | ~ | ~ | ~ | ~ |

| David Clark Company | 1935 | Massachusetts, USA | ~ | ~ | ~ | ~ | ~ |

| Lightspeed Aviation | 1996 | Oregon, USA | ~ | ~ | ~ | ~ | ~ |

| Sennheiser Aviation | 1945 | Wedemark, Germany | ~ | ~ | ~ | ~ | ~ |

| Telex Communications | 1946 | Minnesota, USA | ~ | ~ | ~ | ~ | ~ |

Qatar Aviation Headsets Market Analysis

Growth Drivers

Expansion of Commercial Aviation Operations and Pilot Workforce

Expansion of commercial aviation operations and pilot workforce is a major growth driver for the Qatar aviation headsets market as airline activity remains intensive and operationally demanding. National carriers operate large fleets with high flight frequencies, increasing headset utilization rates. Continuous recruitment of pilots creates sustained baseline demand for certified headsets. Airline safety policies mandate standardized communication equipment. Long haul operations require high comfort and noise protection standards. Replacement demand is driven by wear and certification lifecycle requirements. Centralized airline procurement amplifies volume purchases. These factors collectively ensure stable and recurring market demand.

Rising Emphasis on Pilot Comfort, Hearing Protection, and Safety Compliance

Rising emphasis on pilot comfort, hearing protection, and safety compliance significantly drives the Qatar aviation headsets market as occupational health considerations gain importance. Prolonged exposure to cockpit noise necessitates advanced attenuation solutions. Regulatory oversight reinforces hearing protection standards. Airlines invest in premium headsets to reduce fatigue and improve communication clarity. Improved comfort directly supports operational efficiency. Adoption of ANR technology enhances long duration flight performance. Training organizations align equipment with airline standards. These combined priorities strengthen sustained headset adoption.

Market Challenges

High Cost of Advanced Certified Aviation Headsets

High cost of advanced certified aviation headsets presents a notable challenge in the Qatar aviation headsets market as premium ANR systems carry significant unit prices. Budget constraints affect training organizations and smaller operators. Replacement decisions may be deferred due to cost sensitivity. Import dependence increases landed costs. Limited local alternatives restrict price competition. Certification requirements limit low cost substitutes. Currency exposure affects procurement planning. These factors constrain rapid penetration across all segments.

Stringent Aviation Certification and Compatibility Requirements

Stringent aviation certification and compatibility requirements challenge the Qatar aviation headsets market by restricting product choices. Headsets must comply with FAA and EASA standards. Compatibility with diverse aircraft avionics is essential. Certification processes increase manufacturer costs. Approval timelines delay product introductions. Operators avoid uncertified alternatives. Maintenance documentation requirements add complexity. These constraints limit flexibility for buyers and suppliers.

Opportunities

Adoption of Wireless and Smart Cockpit Headset Technologies

Adoption of wireless and smart cockpit headset technologies represents a key opportunity for the Qatar aviation headsets market as operators modernize flight decks. Bluetooth integration supports secondary communication devices. Reduced cabling improves cockpit ergonomics. Smart features enhance audio clarity and customization. Pilots increasingly prefer advanced connectivity options. New aircraft platforms support digital interfaces. Premium upgrades drive aftermarket demand. These trends create differentiation opportunities.

Growth of Aviation Training and Simulator-Based Programs

Growth of aviation training and simulator-based programs offers opportunity within the Qatar aviation headsets market due to expanding pilot development initiatives. Training centers require durable standardized headsets. Simulator environments demand clear communication systems. Government support for aviation skills development sustains enrollment. Fleet expansion increases training throughput. Replacement cycles are frequent. Alignment with airline specifications boosts demand. These factors create stable institutional purchasing opportunities.

Future Outlook

The Qatar aviation headsets market is expected to experience steady growth over the next five years, supported by sustained airline operations and continuous pilot workforce development. Advancements in noise reduction, wireless connectivity, and ergonomic design will enhance product adoption. Regulatory emphasis on safety and hearing protection will remain strong. Increasing training activity and fleet modernization will further reinforce long-term demand.

Major Players

- Bose Corporation

- David Clark Company

- Lightspeed Aviation

- Sennheiser Aviation

- Telex Communications

- ASA Headsets

- Clarity Aloft

- Flightcom Corporation

- Phonak Communications

- Plantronics Aviation

- UflyMike

- Rugged Air Headsets

- Imtradex Aviation

- Senic Aviation

- Faro Aviation

Key Target Audience

- Commercial airlines

- Military aviation units

- Business jet operators

- Helicopter service providers

- Flight training academies

- Aviation MRO organizations

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Demand drivers, certification requirements, fleet size, pilot workforce data, and procurement practices were identified through structured secondary research and aviation authority publications.

Step 2: Market Analysis and Construction

Collected information was analyzed to construct market size, segmentation, and competitive structure using validated analytical frameworks.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through discussions with aviation equipment suppliers, pilots, and training organization representatives.

Step 4: Research Synthesis and Final Output

All validated insights were synthesized into a coherent report with consistency checks to ensure reliability and clarity.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of commercial aviation operations and pilot workforce

Rising emphasis on pilot comfort and hearing protection

Modernization of military and government aviation fleets

Growth of business aviation and helicopter services

Advancements in noise reduction and wireless headset technologies - Market Challenges

High unit cost of advanced aviation headsets

Stringent aviation certification and compliance requirements

Limited local manufacturing and reliance on imports

Compatibility issues across diverse aircraft platforms

Replacement cycles dependent on fleet utilization rates - Market Opportunities

Increasing adoption of active noise reduction headsets

Rising demand from pilot training academies

Upgrades driven by wireless and smart cockpit integration - Trends

Shift toward lightweight and ergonomically designed headsets

Growing penetration of Bluetooth enabled aviation headsets

Preference for multi-platform compatible headset solutions

Increased focus on long duration comfort and fatigue reduction

Adoption of modular and easily serviceable headset designs - Government Regulations & Defense Policy

Strict civil aviation authority certification standards

Defense aviation safety and communication mandates

Support for aviation safety equipment modernization - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Active noise reduction aviation headsets

Passive noise reduction aviation headsets

Wireless aviation headsets

Panel powered aviation headsets

Helmet integrated aviation headsets - By Platform Type (In Value%)

Commercial fixed wing aircraft

Business jets and general aviation aircraft

Rotary wing helicopters

Military transport and patrol aircraft

Training and flight school aircraft - By Fitment Type (In Value%)

Line fit aircraft installations

Retrofit and aftermarket installations

Pilot owned personal equipment

Fleet standardized fitments

Temporary and leased aircraft fitments - By EndUser Segment (In Value%)

Commercial airline pilots

Military aircrew

Helicopter operators

Business jet operators

Flight training organizations - By Procurement Channel (In Value%)

Direct airline and operator procurement

Defense procurement contracts

Aviation OEM and integrator supply

Aftermarket and MRO procurement

Authorized aviation equipment distributors - By Material / Technology (in Value %)

Advanced acoustic noise cancellation technology

Digital signal processing electronics

Lightweight composite materials

Bluetooth and wireless communication modules

High durability microphone and speaker assemblies

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Noise Reduction Performance, Weight and Ergonomics, Audio Clarity, Wireless Capability, Certification Compliance, Durability, Lifecycle Cost, Aftermarket Support, Platform Compatibility)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Bose Corporation

David Clark Company

Lightspeed Aviation

Sennheiser Aviation

Telex Communications

ASA Headsets

Clarity Aloft

Flightcom Corporation

Phonak Communications

Plantronics Aviation

UflyMike

Farmer Aviation

Imtradex Aviation

Senic Aviation

Rugged Air Headsets

- Airlines prioritize standardized headset specifications for pilots

- Military users demand ruggedized and secure communication headsets

- Helicopter operators focus on high noise attenuation performance

- Training organizations emphasize durability and cost efficiency

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035