Market Overview

The Qatar Aviation Manufacturing Market is valued at approximately USD ~ billion, driven by growing demand for both commercial and military aviation products. This market is heavily influenced by government spending on defense and infrastructure, which has accelerated the development of aviation technologies in Qatar. The rapid expansion of the aviation industry, coupled with Qatar’s efforts to enhance its domestic manufacturing capabilities, further propels market growth. Qatar’s efforts to diversify its economy have also resulted in increased investment in aviation manufacturing, expanding beyond aerospace to include components, avionics, and aircraft assemblies.

Dominant countries in the Qatar Aviation Manufacturing Market include the United States and countries in the European Union, which hold significant shares due to their advanced technologies and large-scale production capabilities. Qatar’s proximity to these global players allows it to tap into international supply chains, making it a key player in the regional aerospace sector. The influence of regional competitors like the UAE and Saudi Arabia also affects the market dynamics. Qatar’s aviation industry is primarily shaped by its strategic location, geopolitical considerations, and substantial government investments in the aviation infrastructure and defense sectors.

Market Segmentation

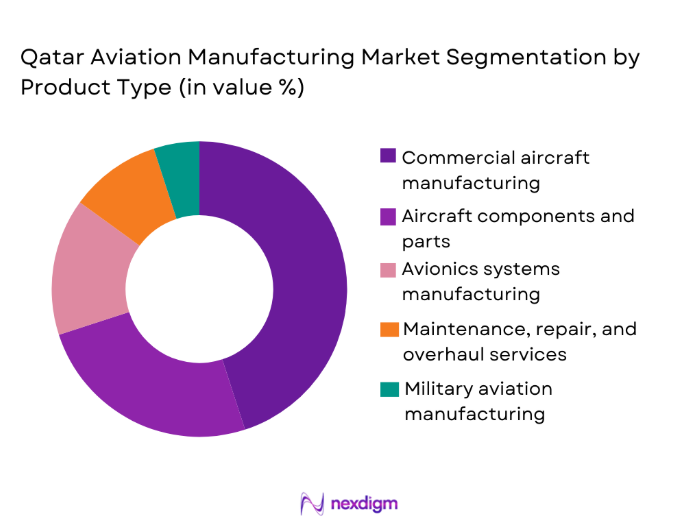

By Product Type

Qatar Aviation Manufacturing Market is segmented by product type into commercial aircraft manufacturing, aircraft components and parts, avionics systems manufacturing, maintenance, repair, and overhaul (MRO) services, and military aviation manufacturing. The commercial aircraft manufacturing segment dominates the market share, driven by Qatar Airways’ expanding fleet and the increasing demand for advanced, fuel-efficient aircraft. Additionally, the availability of high-tech avionics systems, coupled with enhanced demand for MRO services, supports growth in this segment. Qatar’s focus on integrating the latest technologies in aircraft design and manufacturing solidifies the position of commercial aircraft manufacturing in the market.

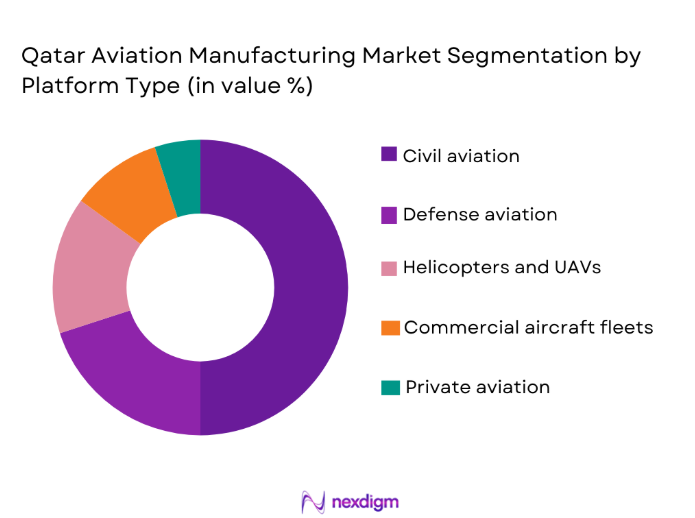

By Platform Type

The Qatar Aviation Manufacturing Market is segmented by platform type into civil aviation, defense aviation, helicopters and UAVs, commercial aircraft fleets, and private aviation. The civil aviation segment commands a dominant share, owing to the continuous expansion of Qatar Airways, which is one of the largest international carriers. Qatar’s growing reputation as a global aviation hub further boosts the civil aviation segment’s share. With increasing passenger air traffic, the demand for new commercial aircraft and related systems continues to soar, contributing to the dominance of civil aviation in the overall market.

Competitive Landscape

The Qatar Aviation Manufacturing Market features a competitive landscape with both global and regional players. Major players include Boeing, Airbus, Raytheon Technologies, and Lockheed Martin, which have a strong presence in the region, supported by partnerships with Qatar’s defense and aviation sectors. While international companies dominate the high-tech segment, local players, backed by government initiatives, are gaining ground. The market has seen increasing consolidation, as established players seek to expand their presence in the region by forming joint ventures and enhancing local capabilities. Qatar’s strategic location and investment policies make it an attractive market for both local and global aviation manufacturers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Qatar Airways | 1993 | Qatar | ~ | ~ | ~ | ~ | ~ |

Qatar Aviation Manufacturing Market Analysis

Growth Drivers

Government Investment in Aviation Infrastructure

Government investment in aviation infrastructure has been a major growth driver for the Qatar Aviation Manufacturing Market. The Qatari government has committed substantial funds to build world-class airports, which has, in turn, facilitated the growth of the aviation manufacturing sector. Major projects such as Hamad International Airport and the Qatar Airways fleet expansion highlight this trend. These investments provide the foundation for enhancing manufacturing capabilities in the region, fueling demand for aircraft parts, avionics, and maintenance services. This robust investment climate enables local companies to enter the market and form strategic alliances with global players, increasing market competitiveness. Additionally, government support for defense and aviation policies creates a favorable regulatory environment for aviation manufacturers. The increasing importance of Qatar as a global aviation hub further drives the demand for more advanced manufacturing technologies and capabilities.

Rising Demand for Commercial Aircraft

Another significant growth driver is the rising demand for commercial aircraft, driven by the expanding Qatar Airways fleet. Qatar’s positioning as a major international air traffic hub has increased the need for newer, more fuel-efficient aircraft, resulting in growth in aircraft manufacturing. The expansion of Qatar Airways’ network and the growing travel and tourism industry in the region have significantly impacted the demand for aircraft. The commercial aviation segment of the Qatar Aviation Manufacturing Market is expected to maintain dominance, driven by both rising passenger traffic and growing demand for technologically advanced aircraft. As a result, local manufacturers are increasingly focused on producing high-quality components and systems that cater to the evolving needs of the commercial aviation sector. The demand for avionics and MRO services is also on the rise, contributing further to market growth.

Market Challenges

High Production and Maintenance Costs

One of the main challenges faced by the Qatar Aviation Manufacturing Market is the high production and maintenance costs associated with manufacturing advanced aviation products. Manufacturing aircraft and their components involves cutting-edge technologies and highly skilled labor, making it a capital-intensive industry. For manufacturers, these high costs pose a barrier to scaling up production, especially for smaller companies in Qatar. Despite the availability of government support and financing, production costs remain a significant challenge, particularly for local players looking to expand. Additionally, the rising cost of raw materials, including high-performance alloys and composites used in aircraft manufacturing, further exacerbates the financial strain. These cost-related challenges limit the ability of companies to compete on price, affecting the profitability of operations in the region.

Geopolitical and Supply Chain Disruptions

Another challenge for the market is geopolitical instability and the resulting supply chain disruptions. Qatar’s position in the Middle East places it at the crossroads of various geopolitical conflicts that could impact its aviation manufacturing sector. Trade restrictions, export controls, and disruptions in the flow of raw materials, especially in the defense and military aviation sub-segments, are risks that manufacturers face. In particular, regional conflicts can affect the flow of critical materials and components, delaying production schedules and inflating costs. These supply chain vulnerabilities further complicate the growth prospects of local manufacturers who depend on imports for key parts and materials. Companies must address these challenges through strategic partnerships and sourcing alternatives to mitigate the risks associated with supply chain disruptions.

Opportunities

Technological Advancements in Aircraft Manufacturing

The continued advancement of technology presents a significant opportunity for the Qatar Aviation Manufacturing Market. Innovations such as the development of electric aircraft, improvements in fuel efficiency, and the integration of artificial intelligence in avionics systems are all poised to transform the aviation sector. For manufacturers in Qatar, embracing these technological advancements opens up opportunities for creating cutting-edge products that meet the demand for eco-friendly aviation solutions. The focus on reducing carbon emissions and increasing energy efficiency in the aviation sector aligns with global trends towards sustainability. This technological shift provides a platform for Qatar’s aviation manufacturing industry to lead in the development of next-generation aircraft and related technologies, increasing its competitive edge in global markets. Companies that invest in R&D and form partnerships with technology providers will benefit from these innovations, opening up new revenue streams.

Increased Military and Defense Spending

Qatar’s growing defense budget offers opportunities for the aviation manufacturing sector, particularly in military aviation. The country’s increasing focus on strengthening its defense capabilities, especially given regional security concerns, has driven demand for advanced military aircraft and systems. As the Qatari government continues to invest in military modernization, local manufacturers have the opportunity to provide critical components and technology for defense projects. The growing defense aviation sector presents a strategic opportunity for both local and international manufacturers to expand their market share by offering advanced, specialized products. Additionally, Qatar’s defense initiatives encourage collaboration between local manufacturers and global defense companies, further enhancing the country’s position as a regional aerospace manufacturing hub.

Future Outlook

The future outlook for the Qatar Aviation Manufacturing Market appears promising, with continued growth expected over the next five years. Government investments in aviation infrastructure, coupled with Qatar Airways’ expansion plans, will continue to drive demand for aircraft manufacturing, maintenance, and related services. Technological developments in fuel-efficient aircraft and green aviation technologies are expected to play a pivotal role in shaping the market. As Qatar seeks to enhance its position as a global aviation hub, it will increasingly focus on strengthening its domestic manufacturing capabilities, reducing dependency on foreign suppliers, and tapping into regional defense and military contracts.

Major Players

- Boeing

- Airbus

- Raytheon Technologies

- Lockheed Martin

- Qatar Airways

- Rolls-Royce

- General Electric

- Honeywell Aerospace

- Northrop Grumman

- Thales Group

- Safran

- Dassault Aviation

- Bombardier

- Embraer

- Gulfstream Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial airlines

- Privateaircraftowners

- Military forces

- Government aviation bodies

- MRO service providers

- Aircraftcomponent suppliers

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market size, technological trends, and geopolitical influences are identified to understand the dynamics of the market.

Step 2: Market Analysis and Construction

A detailed market analysis is conducted to understand the competitive landscape, market trends, and growth drivers.

Step 3: Hypothesis Validation and Expert Consultation

Insights and data are validated through consultations with industry experts and stakeholders to ensure accuracy.

Step 4: Research Synthesis and Final Output

The final research findings are synthesized to produce a comprehensive and actionable market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of Qatar Airways fleet

Increasing demand for MRO services

Government support for aerospace sector

Technological innovations in aircraft manufacturing

Rising military expenditure - Market Challenges

High production and R&D costs

Geopolitical tensions in the region

Supply chain disruptions

Dependency on global suppliers

Stringent regulatory compliance - Market Opportunities

Collaborations with international aviation manufacturers

Growth in private and chartered aviation

Advancements in green aviation technologies - Trends

Adoption of sustainable aviation fuel (SAF)

Growth in drone and UAV manufacturing

Increased demand for lightweight materials

Rise of autonomous aircraft technologies

Integration of artificial intelligence in aviation systems - Government Regulations & Defense Policy

Aerospace defense procurement policies

Aviation safety and certification regulations

National security and export controls - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Commercial aircraft manufacturing

Aircraft components and parts

Avionics systems manufacturing

Maintenance, repair, and overhaul (MRO) services

Military aviation manufacturing - By Platform Type (In Value%)

Civil aviation

Defense aviation

Helicopters and UAVs

Commercial aircraft fleets

Private aviation - By Fitment Type (In Value%)

OEM components

Aftermarket components

Refurbished parts

Upgraded components

Custom-made parts - By EndUser Segment (In Value%)

Commercial airlines

Private aircraft owners

Military forces

Government aviation bodies

MRO service providers - By Procurement Channel (In Value%)

Direct purchases

Third-party distributors

Online platforms

OEM suppliers

Military procurement channels - By Material / Technology (in Value%)

Aluminum alloys

Composite materials

Advanced avionics technology

Aircraft engines

Fuel-efficient materials

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Price, Product Quality, Lead Time, Market Penetration, Brand Strength, Customer Loyalty, Technological Advancement, Distribution Network, Customer Service, Innovation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Qatar Airways

Qatar Aviation Services

Doha International Airport

Qatar Armed Forces

Raytheon Technologies

Airbus

Boeing

General Electric

Rolls-Royce

Honeywell Aerospace

Lockheed Martin

Northrop Grumman

Thales Group

Dassault Aviation

Safran

- Demand for advanced aircraft from Qatar Airways

- Growing private aviation sector in Qatar

- Government contracts for defense aviation

- Military modernization and aircraft procurement

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035