Market Overview

Based on a recent historical assessment, the Qatar Aviation Software Market is valued at approximately USD ~ billion. The growth of this market is primarily driven by the increasing demand for advanced technology solutions in aviation, such as air traffic management systems, flight management software, and fleet management solutions. With the expansion of Qatar’s aviation infrastructure and the government’s emphasis on technological advancements in aviation, the demand for software solutions tailored to the aviation sector continues to rise, reflecting the market’s robust growth potential.

Qatar’s aviation sector is largely dominated by the presence of world-class airports, notably Hamad International Airport, and strong government support for aviation-related technologies. The country’s strategic location as a global aviation hub, alongside its investments in air traffic management systems and airport modernization, places it at the forefront of the regional aviation software market. Furthermore, Qatar’s ambitions to expand its global connectivity and its hosting of major events like the FIFA World Cup have heightened the demand for innovative aviation software solutions.

Market Segmentation

By Product Type

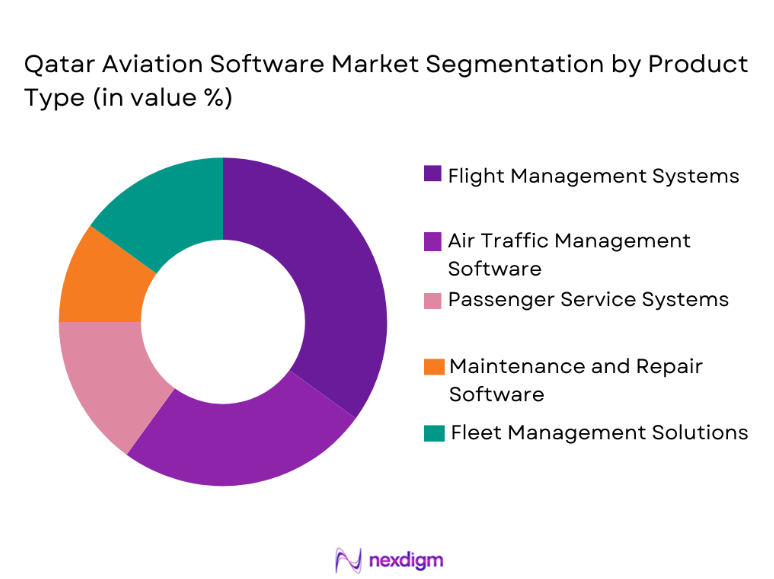

The Qatar Aviation Software Market is segmented by product type into various software solutions that cater to different aspects of aviation management. Recently, flight management systems have dominated the market due to their critical role in ensuring safe and efficient aircraft operations. These systems are increasingly essential for managing flight routes, optimizing fuel usage, and ensuring compliance with international safety regulations. The growing need for real-time data processing and predictive analytics in flight operations is driving demand for these solutions. As Qatar continues to focus on modernizing its aviation infrastructure, the integration of advanced flight management systems remains pivotal to improving the efficiency and safety of air travel across the region.

By Platform Type

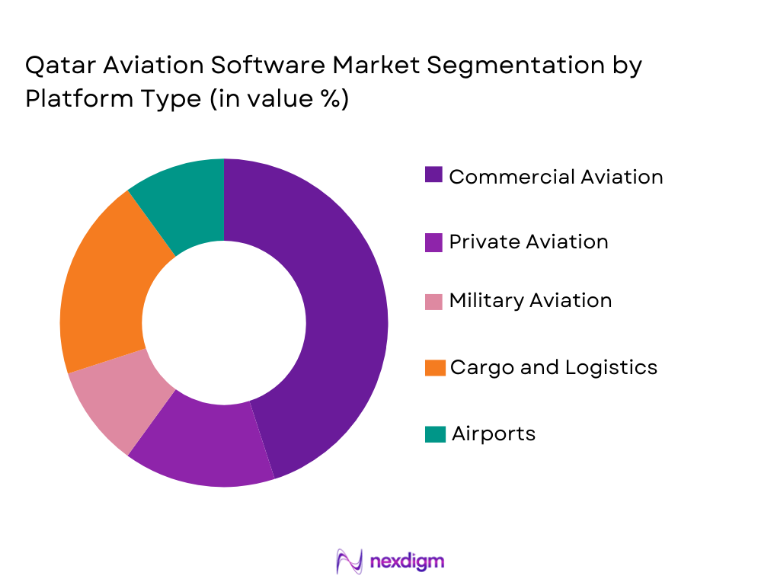

The Qatar Aviation Software Market is segmented by platform type into commercial aviation, private aviation, military aviation, cargo and logistics, and airports. Among these, commercial aviation has the largest market share, largely driven by the rising demand for efficient and automated systems that enhance operational efficiency. With the growing number of international flights and the expansion of Qatar Airways, commercial aviation continues to be the dominant platform for aviation software applications. The need for innovative software to manage logistics, passenger services, and air traffic control systems for commercial flights is fueling market growth. Furthermore, Qatar’s strategic positioning as a global hub for commercial air traffic further solidifies the dominance of this segment in the regional market.

Competitive Landscape

The competitive landscape of the Qatar Aviation Software Market is shaped by a mix of established global players and emerging regional companies. The market is experiencing consolidation, with large players acquiring smaller, innovative firms to expand their product offerings. Major players are focusing on partnerships with airports, airlines, and government agencies to provide integrated software solutions for aviation management. This has led to increased competition, with a focus on technological advancements, customer service, and system integration to cater to the evolving demands of the aviation industry in Qatar.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| SITA | 1949 | Geneva, Switzerland | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1999 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ |

| GE Aviation | 1892 | Evendale, USA | ~ | ~ | ~ | ~ | ~ |

| Amadeus IT Group | 1987 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ |

Qatar Aviation Software Market Analysis

Growth Drivers

Government Investment in Aviation Infrastructure

The government’s continuous investment in expanding and modernizing aviation infrastructure is a significant driver of the Qatar Aviation Software Market. As part of its broader economic diversification strategy, Qatar has prioritized investments in its aviation sector, which includes upgrading airports and enhancing air traffic control systems. This increased investment in infrastructure has created a strong demand for innovative aviation software solutions that can optimize operations and improve safety standards. Additionally, Qatar’s ambition to become a leading global aviation hub has further accelerated the demand for advanced software solutions to manage growing air traffic, enhance airport efficiency, and provide seamless passenger experiences. The government’s push for technological advancements in aviation and its focus on smart airports has also facilitated the adoption of advanced aviation software systems. Consequently, the growth of the aviation infrastructure in Qatar is creating opportunities for software providers to offer tailored solutions that can meet the complex needs of the aviation sector.

Increasing Demand for Automation in Aviation Operations

The increasing demand for automation in aviation operations has emerged as another significant growth driver for the Qatar Aviation Software Market. As air traffic continues to increase, the need for more efficient, reliable, and safe operations has made automation in flight management, air traffic control, and maintenance systems essential. Automation helps reduce human error, optimize resource allocation, and streamline airport operations, which is especially critical as Qatar aims to accommodate a higher volume of flights and passengers. Moreover, automation technologies, such as AI, machine learning, and predictive analytics, are transforming how airlines and airports manage logistics, maintenance schedules, and flight routing. The adoption of automated systems allows for real-time data analysis, which enhances decision-making and improves operational efficiency. As Qatar continues to invest in automation technologies, the demand for software solutions that can integrate these systems is expected to grow, further driving market expansion.

Market Challenges

Integration with Legacy Systems

One of the significant challenges faced by the Qatar Aviation Software Market is the integration of modern software systems with legacy infrastructure. Many aviation companies and airports in Qatar continue to operate using older technologies that are not compatible with newer software solutions. This creates difficulties in transitioning to more advanced systems, as legacy systems often lack the flexibility and scalability required for modern aviation operations. The complexity of integrating these old systems with newer technologies such as cloud computing, AI, and IoT is a key obstacle for software providers. Moreover, the cost and time required to overhaul existing infrastructure to accommodate new systems are significant challenges that many stakeholders in the aviation industry face. These integration hurdles slow down the adoption of newer, more efficient software solutions and can hinder the overall growth of the market.

High Cost of Implementation

The high cost associated with the implementation of advanced aviation software is another challenge that impacts the growth of the market in Qatar. Although the demand for sophisticated software solutions is growing, many smaller players in the aviation industry may find it challenging to invest in high-cost solutions, especially when faced with the ongoing need for upgrades and maintenance. The initial investment in software licenses, hardware infrastructure, and employee training can be prohibitively expensive for smaller airlines and regional airports. Additionally, the ongoing maintenance and updates required for these systems can further strain budgets, particularly in a highly competitive market where profit margins are thin. The cost factor can limit the adoption of innovative solutions and may result in delays in software implementation, affecting overall market growth.

Opportunities

Expansion of Cloud-Based Solutions

The rapid adoption of cloud computing in the aviation industry presents significant opportunities for growth in the Qatar Aviation Software Market. Cloud-based solutions offer a range of benefits, including scalability, cost-effectiveness, and ease of integration with existing systems. By moving software systems to the cloud, aviation companies in Qatar can streamline operations, reduce infrastructure costs, and improve accessibility to real-time data. Cloud computing also enables better collaboration between various stakeholders, such as airlines, airports, and government agencies, as they can share data and communicate more efficiently. As Qatar continues to push for technological advancements in aviation, cloud-based software solutions are expected to play a critical role in enabling this transformation. Furthermore, cloud solutions offer enhanced security and disaster recovery options, which are essential for maintaining the integrity of aviation operations. This makes the market for cloud-based aviation software poised for significant expansion in the coming years.

Increasing Demand for Advanced Security Systems

As the aviation industry grows, so does the need for enhanced security systems to protect against cyber threats and ensure passenger safety. In Qatar, the increasing frequency of international flights and the expansion of airports have heightened the demand for advanced security solutions in aviation software. Technologies such as biometric screening, AI-driven surveillance, and automated threat detection systems are becoming integral parts of aviation security infrastructure. The need for more robust and secure software solutions to safeguard passenger data, prevent cyberattacks, and comply with international regulations presents significant opportunities for software developers. By investing in advanced security features, software companies can cater to the rising demand for high-security systems in Qatar’s aviation sector, ensuring both safety and regulatory compliance. This opportunity is expected to drive the growth of security-focused software solutions in the market.

Future Outlook

The future of the Qatar Aviation Software Market looks promising, with continued investment in technology-driven advancements in the aviation sector. As Qatar expands its airport infrastructure and strengthens its position as a global aviation hub, demand for advanced software solutions is expected to rise. The growing adoption of cloud-based solutions, along with an emphasis on automation and data analytics, will drive innovation in the market. Additionally, government support for technological advancements, combined with the rise in air traffic and passenger numbers, will fuel continued growth in the sector. The next five years will likely see greater integration of AI and machine learning, further enhancing operational efficiency and safety in the aviation industry.

Major Players

- SITA

- Collins Aerospace

- Honeywell Aerospace

- GE Aviation

- Amadeus IT Group

- Thales Group

- Rockwell Collins

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Atos SE

- Indra Sistemas

- Rheinmetall AG

- L3 Technologies

- Saab Group

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Airports

- Aviation service providers

- Cargo and logistics companies

- Technology providers in aviation

- Aviation consultants

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables that influence the market, including demand drivers, regulatory factors, technological trends, and competition.

Step 2: Market Analysis and Construction

Detailed market analysis is conducted using primary and secondary research to gather insights into market trends, growth factors, and challenges.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts, stakeholders, and key players in the market to validate hypotheses and ensure data accuracy.

Step 4: Research Synthesis and Final Output

Data and insights are synthesized into a comprehensive report, which includes all findings, projections, and market recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growth in Air Traffic and Aviation Operations

Government Investment in Aviation Infrastructure

Increasing Demand for Air Passenger Safety Solutions

Shift Toward Cloud-based Software Solutions

Technological Advancements in Automation - Market Challenges

High Initial Investment Costs

Integration Issues with Legacy Systems

Cybersecurity and Data Protection Concerns

Regulatory Compliance and Certification Issues

Resistance to Change in Legacy Operations - Market Opportunities

Expansion of Cloud-based Solutions

Integration of AI and Data Analytics in Aviation Operations

Government Initiatives for Aviation Modernization - Trends

Adoption of IoT for Aircraft Maintenance

Integration of Big Data for Operational Efficiency

Increased Focus on Automation and AI in Air Traffic Control

Growth of Low-Cost Carriers

Demand for Real-Time Data for Passenger Services - Government Regulations & Defense Policy

Regulations for Data Privacy and Security

Aviation Safety Standards by ICAO

Government Investments in Airport and Aviation Infrastructure - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Management Systems

Air Traffic Management Software

Passenger Service Systems

Maintenance and Repair Software

Fleet Management Solutions - By Platform Type (In Value%)

Commercial Aviation

Private Aviation

Military Aviation

Cargo and Logistics

Airports - By Fitment Type (In Value%)

OEM Aviation Software

Aftermarket Aviation Software

Integrated Aviation Software

Customized Aviation Software

Cloud-based Aviation Software - By EndUser Segment (In Value%)

Airlines

Airport Operators

Government and Defense Agencies

Aviation Service Providers

Cargo and Freight Companies - By Procurement Channel (In Value%)

Direct Procurement from Software Vendors

Procurement through System Integrators

Procurement through Value-Added Resellers

Procurement through Aviation Consultancies

Government Tenders and Contracts - By Material / Technology (In Value%)

Cloud Computing

AI and Machine Learning Solutions

IoT Integration

Big Data Analytics

Blockchain Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Product Innovation, Service Offerings, Market Penetration, Brand Recognition, Customer Support, Pricing Strategy, Technological Advancements, Market Leadership, Strategic Alliances, Regulatory Compliance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

SITA

Collins Aerospace

Honeywell Aerospace

L3 Technologies

Rockwell Collins

Thales Group

GE Aviation

Amadeus IT Group

Sabre Corporation

Microsoft Corporation

Oracle Corporation

IBM Corporation

Atos SE

Rheinmetall AG

Indra Sistemas

- Airlines seeking operational optimization

- Government agencies focusing on aviation security

- Airports focusing on passenger experience improvements

- Private aviation players investing in software automation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035