Market Overview

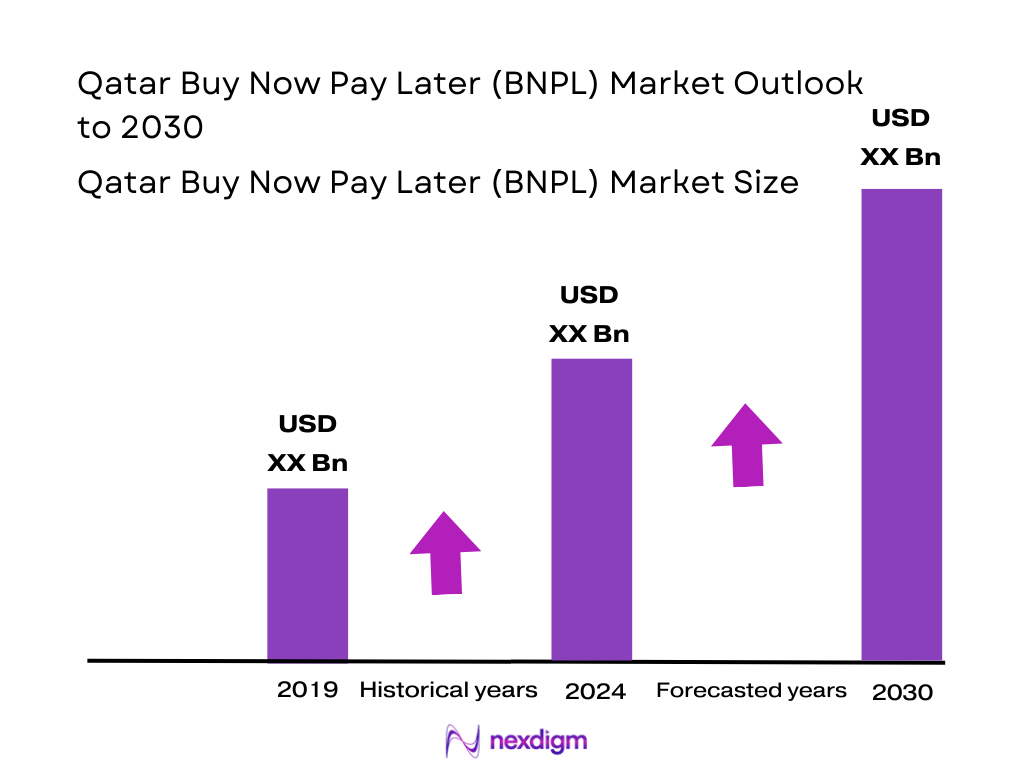

The Qatar BNPL market is valued at USD 184.0 million, based on the 2024 GCC‑level data. Although this figure covers the entire GCC, it is the most recent region‑specific benchmark available and shows Qatar’s inclusion in a collectively consolidated BNPL ecosystem. The market’s current scale is propelled by rising digitization, burgeoning online and POS-based retail, widespread smartphone penetration, and consumer demand for flexible installment payments—all supported by evolving risk assessment models.

Within the GCC, Qatar and the UAE emerge as dominant markets, along with Saudi Arabia, due to their advanced digital infrastructure, high fintech adoption rates, and regulatory openness encouraging BNPL proliferation. Qatar benefits from strong government fintech initiatives, high per‑capita income, and tech‑friendly consumer behavior, which together accelerate merchant acceptance and consumer adoption of BNPL services in Doha and major urban centers.

Market Segmentation

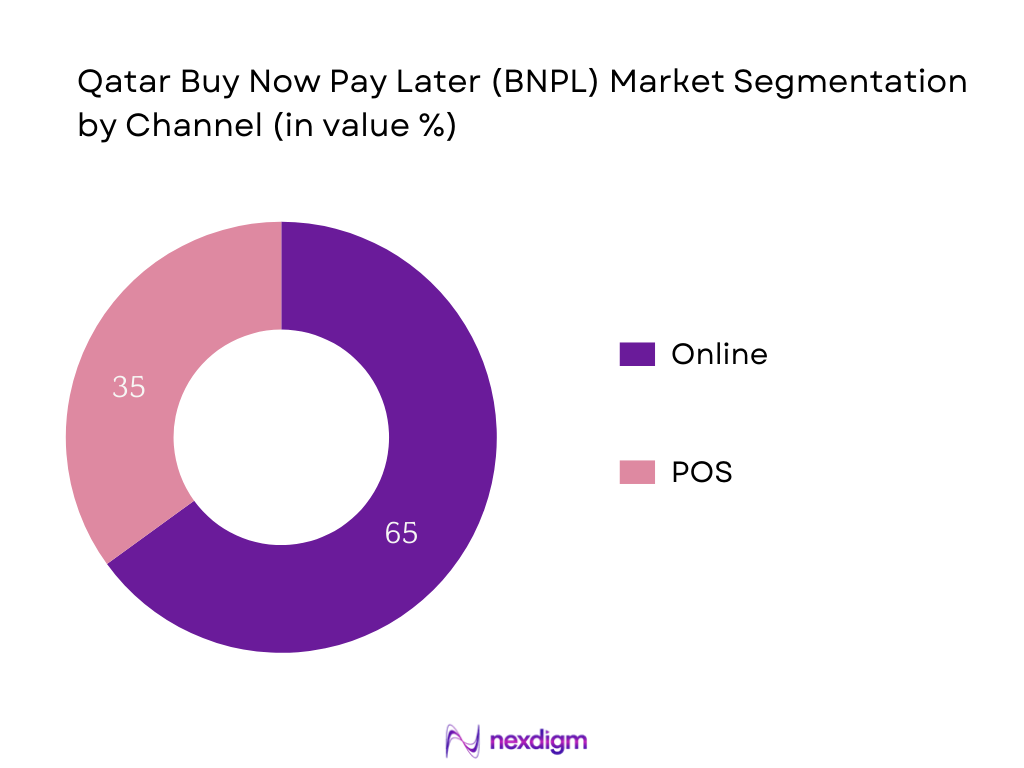

By Channel

The BNPL space is divided into online and POS offerings. Online BNPL dominates market share in 2024, chiefly because e-commerce penetration in Qatar is robust, growing internet and mobile usage facilitate seamless integration, and digital retailers prefer BNPL modules to boost conversion rates. Online BNPL’s agility and consumer convenience—especially for millennial and Gen Z shoppers—secure its leadership.

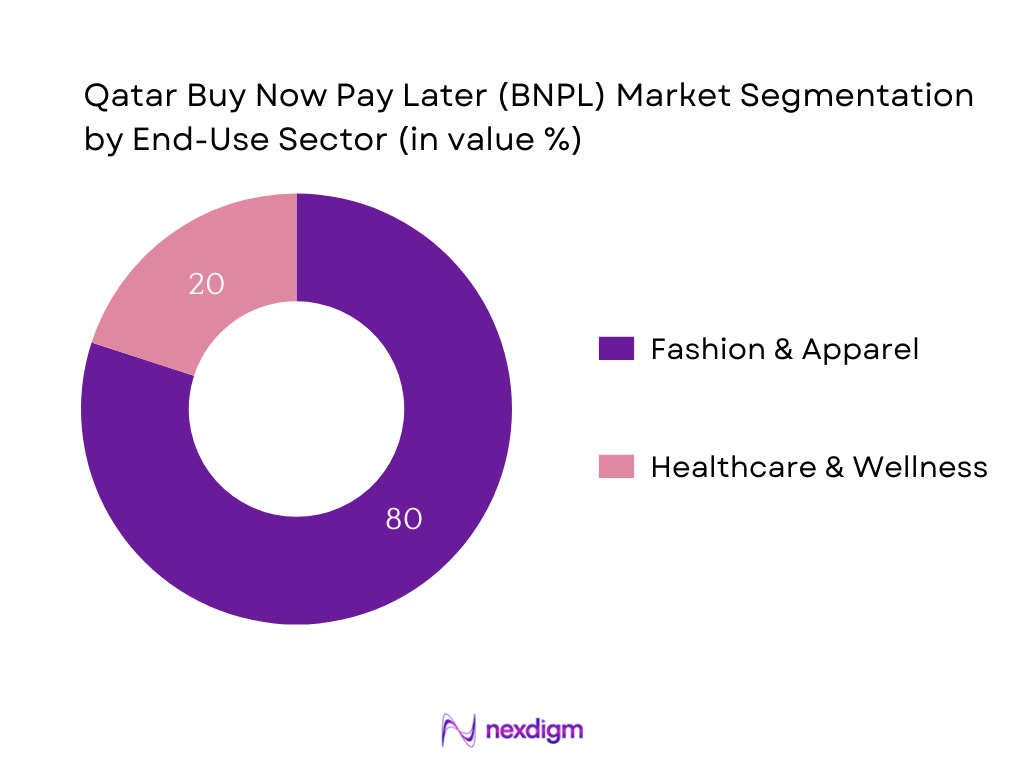

By End‑use Industry

Fashion & Apparel holds the largest market share, attributed to Qatar’s fashion-forward, high-income consumer base, strong retail and mall presence, and frequent promotional campaigns. The appeal of installment options for apparel purchases in both physical and online retail means customers are more likely to split payments without bearing immediate cost.

Competitive Landscape

The Qatar BNPL market is shaped by a mix of regional fintechs and global platforms, with consolidation led by companies licensed under QCB regulations and international players exploring entry. Their strategic positioning and partnerships define the competitive terrain.

| Company | Establishment Year | Headquarters | QCB Licensing Status | Channel Focus | Sharia Compliance | Merchant Network Scope | Average Payout Time | Funding Stage |

| PayLater | — | Qatar | – | – | – | – | – | – |

| Tabby | — | UAE | – | – | – | – | – | – |

| Tamara | — | Saudi Arabia | – | – | – | – | – | – |

| PostPay | — | UAE | – | – | – | – | – | – |

| Spotti | — | Qatar | – | – | – | – | – | – |

Qatar BNPL Market Analysis

Key Growth Drivers

Rapid Growth in Digital Retail Transactions

The digital payments ecosystem in Qatar recorded a total transaction value of QAR 13.8 billion, equivalent to USD 3.8 billion, in March 2025 across POS and e‑commerce platforms, underscoring massive consumer activity across digital retail channels. Furthermore, in early February 2024, the average transaction value in the “Law & Government” e‑commerce category alone stood at USD 251.79, indicating the maturity of digital purchasing behaviors. These figures reflect a thriving digital commerce environment, which directly influences the demand for BNPL services—shoppers increasingly expect installment options as standard checkout features.

Government Push for FinTech Adoption (QCB sandbox, National Payments Gateway)

In 2024, Qatar’s internet penetration reached 99.7 percent, nearing full saturation, while contactless in‑store payments accounted for 96 percent of digital transactions, highlighting the population’s readiness for digital payment innovations. Accompanying this, the Qatar FinTech Hub (QFTH), backed by QCB, graduated over 50 fintech startups with a combined portfolio valued at USD 500 million, demonstrating considerable institutional and financial support for new fintech ventures including BNPL solutions. These macro data points illustrate how regulatory frameworks and infrastructure are laying a foundation for BNPL growth in Qatar.

Key Market Challenges

Regulatory Limitations on Interest/Profit Margins

Qatar’s banking landscape remains robust, with the Capital Adequacy Ratio standing close to 20 percent by third quarter 2024, reflecting resilient financial institutions. While such stability ensures consumer protection, it also implies tight regulatory control over financial product margins, potentially constraining the fees BNPL providers can impose. This dynamic can limit BNPL firms’ revenue models, especially when attempting to balance underwriting costs and operational profitability.

Consumer Credit Risk and Repayment Defaults

Qatar’s nominal GDP in 2024 is estimated at USD 356.0 billion, with GDP per capita pegged at USD 115,075, indicating high-income levels among residents. However, elevated disposable income does not eliminate credit risk; affluent markets often hide default vulnerabilities tied to overextension. Although macroeconomic indicators signal stability, BNPL providers must still navigate potential repayment defaults without direct data on default rates. The high per capita income suggests consumer capacity but also raises concerns over unmonitored BNPL credit usage.

Emerging Opportunities

Integration with National e‑Wallet Platforms

In June 2024, Mastercard partnered with Doha Bank to boost Qatar’s digital payment infrastructure, enhancing the adoption of e-wallet solutions. Additionally, the Qatar Mobile Payment System (QMPS) was launched in 2020, bolstering e‑wallet uptake. At the same time, average digital transaction values reached USD 3,960 in 2024—more than double those seen across the GCC—underscoring high consumer propensity for premium, digital-first payment methods. This environment positions BNPL to embed seamlessly within national wallet ecosystems, enabling frictionless installment options at checkout.

BNPL for Healthcare & Education Sector Financing

Educational and healthcare sectors in Qatar are undergoing digitization, though no direct BNPL data is available. However, macro indicators suggest opportunity: USD 428.4 million is projected as the AI market size in Qatar by end‑2024, reflecting significant digital transformation, including in sectors like healthcare. This investment in AI and digitization across sectors can enable BNPL providers to tailor installment models for healthcare services and educational institutions, aligning with Qatar’s tech-driven modernization agenda.

Future Outlook

Over the next five years, the BNPL market in Qatar is expected to experience robust growth, fueled by increasing digital commerce, supportive fintech regulation, and consumer affinity for flexible financing. With rising demand across e-commerce and in‑store shopping, innovations such as embedded BNPL options in super‑apps and Sharia‑compliant installment models will further expand the market.

Major Players

- PayLater

- Tabby

- Tamara

- PostPay

- Spotti

- Valu (potential entrant)

- Paymob

- Telr

- NymCard

- QIB (via ready‑made BNPL)

- Snoonu Pay

- Fawry

- Klarna (exploring region)

- Affirm (global brand)

- Afterpay (regionally relevant)

Key Target Audience

- Fintech Investors

- Investments and Venture Capitalist Firms

- Retail and E‑commerce Merchants (Large Retail Chains, Apparel Brands, Electronics Sellers)

- Banks and Payment Service Providers

- Government and Regulatory Bodies (Qatar Central Bank, Ministry of Commerce and Industry)

- Digital Wallet and Super‑app Operators

- Healthcare Providers (hospitals, clinics integrating BNPL for patient financing)

- Travel and Hospitality Groups (hotels, tour operators embedding BNPL)

Research Methodology

Step 1: Market Definition & Data Collection

We collected precise GCC-level BNPL market size data for 2024 with global and regional sources. Stakeholder mapping, regulatory frameworks, and consumer preferences were defined through desk research and secondary databases.

Step 2: Segmentation Analysis & Benchmarking

Detailed segmentation by channel and end-use industry was constructed using global segment shares and GCC trends. These informed the identification of dominant sub-segments and their drivers.

Step 3: Competitive Mapping & Benchmark Parameters

We identified major players active in Qatar, mapped parameters like licensing, compliance, channel focus, and merchant coverage, using company disclosures, fintech news, and regulatory filings.

Step 4: Forecast Modeling & Validation

Growth trajectory (CAGR) for the region (22.4%) was applied to forecast future expansion, cross-checked with fintech adoption trends and regulatory support in Qatar to ensure plausible alignment with local dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- BNPL Market Evolution in Qatar

- Key Milestones & Licensing Developments (QCB Fintech Sandbox, BNPL Licensing Guidelines)

- BNPL Business Model Adaptations in Qatar (Shariah-compliant and Conventional)

- BNPL Value Chain and Stakeholder Mapping (Fintechs, QCB, Banks, Retailers, Payment Aggregators, Consumers)

- Integration with Qatar’s Digital Economy Vision (QNV 2030, FinTech Strategy 2023–2027)

- Key Growth Drivers

Rapid Growth in Digital Retail Transactions

Government Push for FinTech Adoption (QCB sandbox, National Payments Gateway) - Key Market Challenges

Regulatory Limitations on Interest/Profit Margins

Consumer Credit Risk and Repayment Defaults - Emerging Opportunities

Integration with National e-Wallet Platforms (e.g., Qatar Mobile Payment system – QMP)

BNPL for Healthcare & Education Sector Financing - Market Trends

Consolidation of BNPL Players via M&A

Shift Toward AI-based Risk Assessment for Installment Approvals - Government Regulation (QCB Circulars and Compliance Framework)

BNPL Licensing Requirements

AML, KYC, and Consumer Protection Norms - WOT Analysis (Qatar BNPL Ecosystem)

- Stake Ecosystem (Consumers, Merchants, Aggregators, Fintechs, Government)

- Porter’s Five Forces Analysis

- Competitive Ecosystem Mapping (Online vs. POS Players, Vertical Integrators)

- Market Size by Value, 2019-2024

- Market Size by Volume, 2019-2024

- Average Ticket Size and Installment Terms, 2019-2024

- BNPL Penetration Rate in E-commerce and POS Segments, 2019-2024

- By Channel (In Value %)

Online BNPL

Point-of-Sale BNPL - By End-use Industry (In Value %)

Fashion and Apparel

Electronics

Healthcare

Travel and Tourism

Hypermarkets & Retail Chains - By Ticket Size (In Value %)

≤QAR 1,000

QAR 1,001–5,000

QAR 5,001–10,000

>QAR 10,000 - By Compliance Model (In Value %)

Shariah-compliant BNPL

Conventional BNPL

By Customer Type

Salaried Individuals

Freelancers

Students

Micro-entrepreneurs

Expatriates

- Market Share of Major Players (By Value and Transaction Volume)

- Cross Comparison Parameters (Company Overview, Licensing Status with QCB, Number of Merchants, Compliance Type, Channel Focus, Ticket Size Focus, Technology Stack, Average Payout Time, Funding Stage)

- SWOT Analysis of Top 15 Players

- Pricing Models Comparison (Interest-free, Deferred Payments, Fee-based Models)

- Detailed Profiles of 15 Key Players

PayLater

Tabby

Tamara

PostPay

Spotti

Valu (Qatar Entry Plans)

Paymob

Telr

NymCard

TamweelPay

Qatar Islamic Bank – QIB (with PayLater partnership)

Snoonu Pay

Fawry

Klarna

Spotii

- Usage Pattern Analysis by Demographics

- Spending Power and Frequency of BNPL Usage

- Merchant Incentivization and Discount-driven BNPL Usage

- End User Pain Points & Feedback (Payment Delay Penalties, Limited Tenure Options)

- Adoption Curve by Consumer Category (Expats vs Nationals)

- Market Size by Value, 2025-2030

- Market Size by Volume, 2025-2030

- Average Ticket Size and Installment Terms, 2025-2030

- BNPL Penetration Rate in E-commerce and POS Segments, 2025-2030