Market Overview

As of 2024, the Qatar car rental and leasing market is valued at USD ~ million, with a growing CAGR of 6.4% from 2024 to 2030, demonstrating robust performance fuelled by increased tourism and the growing demand for convenient transportation solutions. The sector has evolved significantly, bolstered by a surge in infrastructure development and major events, such as the FIFA World Cup, which attracts international visitors seeking reliable vehicle rental services. Additionally, ongoing urbanization trends contribute to the market’s expansion by enhancing the overall mobility landscape.

Key cities like Doha, Al Rayyan, and Lusail dominate the Qatar car rental and leasing market due to their rapid urban development, significant population growth, and tourist influx. Doha, as the capital and a major economic hub, plays a pivotal role in shaping the market’s dynamics. Al Rayyan and Lusail are experiencing infrastructural improvements and investments in tourism, thereby driving the demand for car rental services. The strategic location of these cities further strengthens their positions in the market.

Market Segmentation

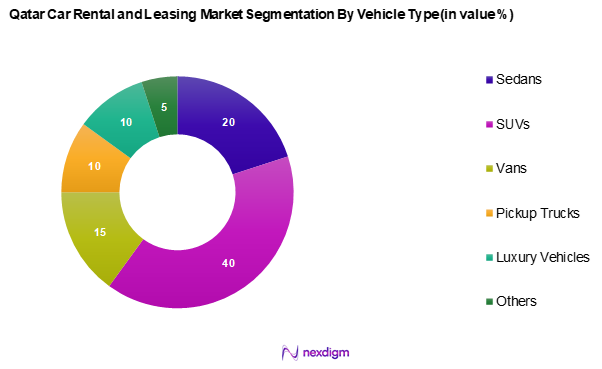

By Vehicle Type

The Qatar car rental and leasing market is segmented into sedans, SUVs, vans, pickup trucks, luxury vehicles, and others. Currently, SUVs hold a dominant market share within this segment due to their versatility, comfort, and growing popularity among tourists and locals for both leisure and corporate rentals. The preference for SUVs is attributed to their spacious interiors and off-road capabilities, making them ideal for exploring diverse terrains in Qatar. Furthermore, the increasing availability and competitive pricing of SUV rentals have significantly boosted their market presence.

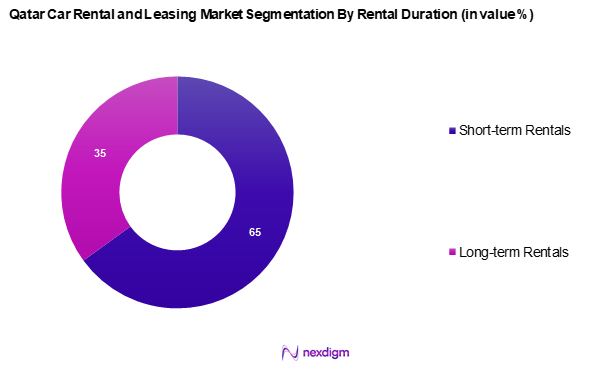

By Rental Duration

The Qatar car rental and leasing market is segmented into short-term and long-term rentals. Short-term rentals dominate this segment as they cater primarily to tourists and business travellers seeking flexibility during their stay in Qatar. The rise in tourism and business activities has led to a surge in demand for short-term rentals. Moreover, companies often prefer short-term rentals for corporate travel due to budget constraints and operational flexibility, further solidifying short-term rentals as the leading segment in the market.

Competitive Landscape

The Qatar car rental and leasing market is characterized by significant concentration among a few major players, including both local and international firms with strong international brands. This consolidation reinforces the need for service differentiation and innovation in operational processes to maintain market relevance.

| Company | Establishment Year | Headquarters | Market Segment Focus | Vehicle Types Offered | Online Booking Options | Fleet Size | Customer Base | Key Partnerships |

| Al-Fardan Group | 1997 | Doha, Qatar | – | – | – | – | – | – |

| Al-Mulla | 1938 | Shuwaikh,Kuwait | – | – | – | – | – | – |

| Europcar | 1949 | Paris, France | – | – | – | – | – | – |

| Hertz Corporation | 1918 | Florida, USA | – | – | – | – | – | – |

| Sixt | 1912 | Pullach, Germany | – | – | – | – | – | – |

Qatar Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Tourism and Events

Qatar’s car rental and leasing market is experiencing strong growth due to the increasing influx of tourists and the country’s focus on hosting major global events. The nation has positioned itself as a premier travel destination, attracting international visitors with high-profile sporting events, cultural festivals, and business conventions. Significant investments in the hospitality sector, including the expansion of hotel infrastructure, further support this growth. The rise in tourism-related activities translates into greater demand for car rentals, as visitors seek convenient and flexible transportation options to explore the region.

Urbanization and Infrastructure Development

Rapid urbanization and large-scale infrastructure projects are key contributors to the expansion of Qatar’s car rental market. The government has heavily invested in enhancing transportation networks, including metro systems, airport expansions, and extensive road developments, improving accessibility across the country. These advancements create a strong need for flexible and temporary vehicle rental solutions, catering to the growing urban population and expatriate workforce. As Qatar continues its modernization efforts, rental services are becoming an integral part of daily transportation for residents and visitors alike.

Market Challenges

Regulatory and Compliance Issues

The regulatory landscape in Qatar presents challenges for the car rental and leasing market, as strict compliance with safety and rental regulations is a priority. Authorities emphasize rigorous vehicle safety checks, insurance requirements, and operational guidelines to maintain industry standards. Non-compliance can lead to penalties and reputational risks, making it difficult for new entrants to establish themselves in the market.

High Competition from Ride-Sharing Services

The growing popularity of ride-sharing platforms has intensified competition for traditional car rental services. Consumers increasingly favour app-based transportation solutions due to their convenience, affordability, and ease of use. This shift in customer preference has led to a decline in demand for conventional rental services, pushing rental companies to explore new business models.

Opportunities

Expansion of Electric Vehicle Rental Services

Qatar’s commitment to sustainability presents a major opportunity for the expansion of electric vehicle (EV) rental services. The government is actively promoting green initiatives, investing in charging infrastructure, and encouraging the adoption of environmentally friendly transportation solutions. As awareness of sustainability grows, rental companies incorporating EVs into their fleets stand to attract eco-conscious consumers and corporate clients looking for greener mobility options. This shift aligns with national sustainability goals and offers long-term growth potential for rental service providers.

Growth in Behind-the-Wheel Training Programs

The increasing demand for driver training programs presents another avenue for market expansion. With a steady rise in new drivers seeking hands-on experience before renting vehicles, there is a growing opportunity for rental companies to collaborate with driving schools and training institutions. Offering integrated rental and training services can enhance customer trust, ensure safer driving practices, and create a competitive edge in the industry. Companies that align with this trend will not only support road safety initiatives but also establish themselves as key players in driver education and mobility solutions.

Future Outlook

Over the next five years, the Qatar car rental and leasing market is expected to exhibit significant growth driven by increasing government support for tourism and infrastructure projects, along with a growing demand for sustainable transportation options. As the market evolves, companies will likely focus on enhancing their digital platforms to streamline booking processes, engage customers more effectively, and cater to a wider array of preferences and needs.

Major Players

- Alfardan Group

- Al- Mulla

- Al Saad Rent A Car Co.W.L.L.

- Al Sayer

- Auto rent

- Avis Corporation Regency

- City Car

- Europcar

- Fast Rent A Car

- Hertz Corporation

- Market Rent- A- Car

- Q motor

- Sixt

- Uber

- Select Transportation Solutions

- Al-Mana Car Rental

- KAYAK

- mannaiautos.com

- Al-Futtaim Vehicle Rentals (AVR)

- Al Khaleej Auto Car Trading Company

- Aayan Leasing Holding Company

- AUDI AG

- Abdullah Abdulghani & Bros. Co. W.L.L

- Wafi Group

- Others

Key Target Audience

- Government and Regulatory Bodies (Qatar Tourism Authority)

- Investments and Venture Capitalist Firms

- Automotive Manufacturers

- Corporate Clients

- Travel Agencies

- Tour Operators

- Event Organizers

- Hospitality Industry (Hotels and Resorts)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar car rental and leasing market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Qatar car rental and leasing market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple car rental service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Qatar car rental and leasing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Tourism and Events

Urbanization and Infrastructure Development - Market Challenges

Regulatory and Compliance Issues

High Competition from Ride-sharing Services - Opportunities

Expansion of Electric Vehicle Rental Services

Growth in Behind-the-Wheel Training Programs - Trends

Surge in Subscription-based Rental Models

Increased Adoption of Technology in Operations - Government Regulation

Licensing and Safety Standards

Environmental Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Vehicle Type, (In Value %)

Sedans

SUVs

Vans

Pickup Trucks

Luxury Vehicles - By Rental Duration, (In Value %)

Short-term Rentals

Long-term Rentals - By Customer Type, (In Value %)

Corporate Clients

Individual Consumers - By Region, (In Value %)

Doha

Al Rayyan

Al Wakrah

Lusail

Other Regions - By Fuel Type, (In Value %)

Gasoline

Diesel

Electric - By Booking Type, (In Value %)

Offline Booking

Online Booking

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Vehicle Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenue, Distribution Channels, Number of Locations)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Alfardan Group

Al- Mulla

Al Saad Rent A Car Co.W.L.L.

Al Sayer

Auto rent

Avis Corporation Regency

City Car

Europcar

Fast Rent A Car

Hertz Corporation

Market Rent- A- Car

Q motor

Sixt

Uber

Select Transportation Solutions

- Market Demand and Utilization Rate

- Purchasing Power and Behavioural Insights

- Regulatory Compliance and Customer Preferences

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Projections by Value, 2025-2030

- Projections by Volume, 2025-2030

- Projections by Average Daily Rental Rate, 2025-2030