Market Overview

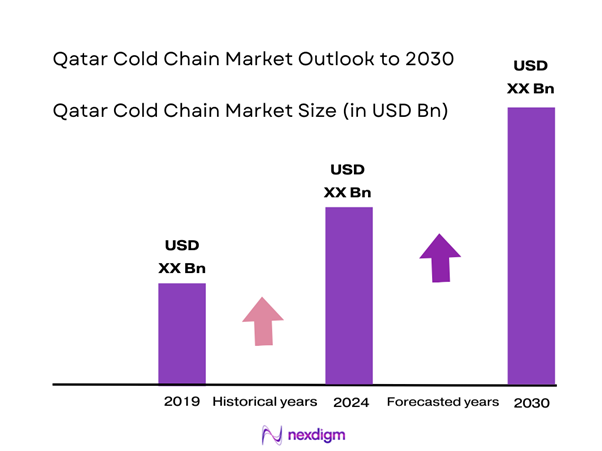

The Qatar cold chain market is valued at USD 1.49 billion in 2024, driven primarily by the increasing demand for perishable goods, including food and pharmaceuticals. The market is supported by a developing logistics infrastructure and growing consumer awareness regarding food safety. Investments in advanced refrigeration technologies and temperature-controlled storage facilities are further propelling this segment.

Cities like Doha and Al Rayyan dominate the cold chain market in Qatar due to their strategic locations, advanced infrastructure, and proximity to key supply points. Doha serves as a major logistics hub, facilitating access to international markets and supporting the import and export of temperature-sensitive goods. Moreover, the growing number of retail outlets and supermarkets in these cities enhances the demand for efficient cold storage solutions, making them pivotal to the region’s cold chain ecosystem.

The retail landscape in Qatar is evolving with the entry of more organized retail players, contributing to the increasing demand for efficient cold chain solutions. The value of organized retail is projected to reach USD 4 billion by end of 2025, indicating a shift from traditional retail to modern formats. Major supermarket chains are investing heavily in cold storage facilities to maintain supply chains for perishable goods. The rise in supermarket penetration, which currently stands at 42% of the overall retail market, signals the growing significance of cold chain logistics in meeting consumer demand.

Market Segmentation

By Product Type

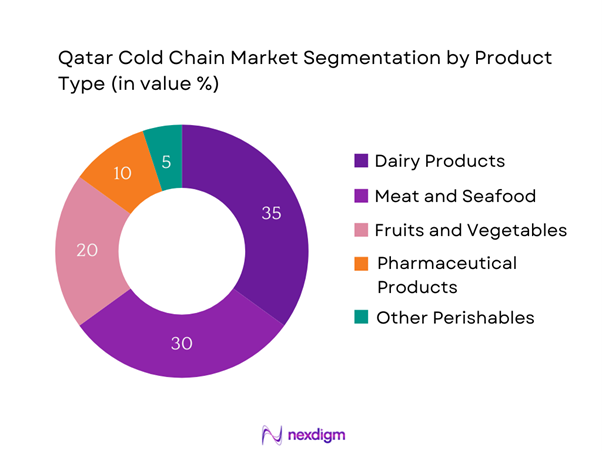

The Qatar cold chain market is segmented by product type into dairy products, meat and seafood, fruits and vegetables, pharmaceutical products, and other perishables. Among these, dairy products hold a dominant market share due to the steady rise in consumer demand for milk and cheese, along with enhanced distribution channels catering to supermarkets and restaurants. Companies are increasingly investing in specialized refrigerated transport for dairy, ensuring quality and freshness. This sector thrives from a growing health-conscious consumer base seeking dairy products in their diets, thus reinforcing its market leadership.

By End User

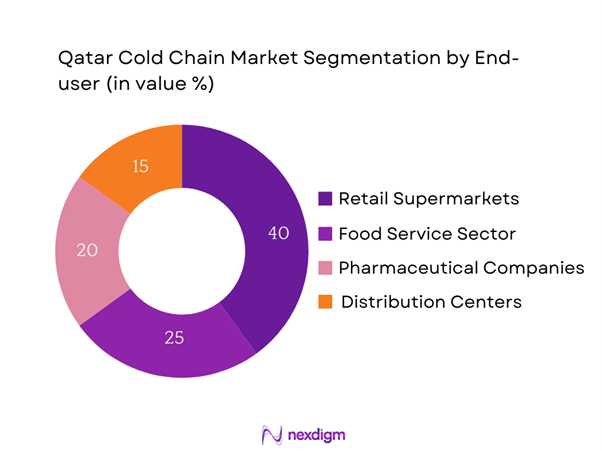

Another significant segmentation in the Qatar cold chain market is by end user, which includes retail supermarkets, food service sectors, pharmaceutical companies, and distribution centers. The retail supermarket sector is currently dominating this segment. The growing trend of grocery shopping, coupled with the rapid expansion of modern retail formats, necessitates efficient cold chain logistics, ensuring that fresh produce and dairy items are readily available to consumers. Retailers are increasingly adopting cold storage technologies and transport solutions for better inventory management, which underscores the importance of this segment’s role in the overall market.

Competitive Landscape

The Qatar cold chain market is dominated by a few major players, including Qatar Industries for Refrigerated Transport, Al Khor Cold Storage, and Qatar Cool. Their dominance in the market highlights the significance of established entities in delivering effective cold chain solutions to meet the increasing demand for perishable goods. These companies are known for their advanced facilities and comprehensive service offerings, which enhance their competitive edge.

| Company Name | Establishment Year | Headquarters | Market Size Impact | Distribution Channels | Key Product Offerings | Innovations |

| Qatar Industries for Refrigerated Transport | 1995 | Doha, Qatar | – | – | – | – |

| Al Khor Cold Storage | 2000 | Al Khor, Qatar | – | – | – | – |

| Qatar Cool | 2003 | Doha, Qatar | – | – | – | – |

| Gulf Warehousing Company | 2004 | Doha, Qatar | – | – | – | – |

| United Foods Company | 2001 | Doha, Qatar | – | – | – | – |

Qatar Cold Chain Market Analysis

Growth Drivers

Increasing Demand for Fresh Produce

The demand for fresh produce in Qatar is significantly influenced by consumer trends towards healthy eating and nutritious diets. In 2023, the total agricultural output in Qatar was valued at approximately USD 1.2 billion, with fresh vegetables and fruits constituting a substantial portion of this figure. The population is growing rapidly, projected to reach 2.9 million by end of 2025, further driving the need for fresh produce. Coupled with this, 39% of Qatari households prioritize organic products, which demand rigorous cold chain logistics to maintain quality and shelf life.

Expansion of the Food and Beverage Industry

Qatar’s food and beverage industry is rapidly expanding, driven by a booming tourism sector and the FIFA World Cup 2022, which led to a surge in hospitality demand. The food and beverage industry revenue reached approximately USD 7 billion in 2022 and is expected to continue growing as new restaurants and cafes open throughout the country. This has increased the need for effective cold chain solutions to ensure the safe transport of perishable goods, with the number of food outlets rising to over 1,300 in the same year, indicating robust sectoral growth.

Market Challenges

High Operational Costs

Operational costs remain a significant hurdle for the cold chain market in Qatar, primarily due to the high energy requirements for refrigeration and the maintenance of temperature-controlled transport. As of 2023, energy costs in Qatar have risen significantly, with natural gas prices averaging USD 2.50 per million British thermal units (MMBtu). Additionally, labor costs in the logistics sector have increased by approximately 4% compared to the previous year, amplifying operational expenditures for cold chain providers. These high operational costs compel many businesses to seek efficiencies and optimal resource management in their logistics operations.

Infrastructure Limitations

Despite advancements in logistics, Qatar’s cold chain infrastructure faces challenges that inhibit its growth potential. The total length of refrigerated transport routes has expanded to around 1,200 km; however, many areas still lack adequate cold storage facilities, especially in the more remote regions. The Qatar National Development Strategy highlights that only 30% of transport routes in rural areas are optimized for temperature-sensitive products, posing a challenge for cold chain operators. This infrastructural gap impacts the ability of businesses to deliver perishables efficiently and sustainably across the country.

Opportunities

Adoption of IoT and Automation

There is a significant push towards the adoption of IoT and automation in the cold chain market, driven by the need for efficiency and improved traceability in logistics. Currently, approximately 25% of Qatar’s cold storage facilities are equipped with IoT technology, enhancing inventory management and monitoring of temperature fluctuations in real-time. The Ministry of Transport and Communications has outlined initiatives to promote smart logistics solutions that incorporate automation, which are set to revolutionize the cold chain operations and improve supply chain efficiency, presenting significant market opportunities.

Sustainability Trends in Food Supply Chains

Sustainability is becoming a core focus in the cold chain market, with businesses increasingly recognizing the need to reduce their carbon footprint. Presently, 46% of food and beverage businesses in Qatar are investing in eco-friendly practices, such as energy-efficient refrigeration systems and sustainable packaging solutions. The government’s commitment to sustainability, as outlined in the Qatar National Vision 2030, creates opportunities for cold chain providers to innovate and develop sustainable solutions, ultimately positioning them in a favorable market environment.

Future Outlook

Over the next five years, the Qatar cold chain market is expected to witness significant growth driven by continuous investments in logistics infrastructure, advancements in refrigeration technology, and rising consumer demand for fresh produce. The increasing emphasis on food safety regulations and quality assurance will further boost the adoption of cold chain solutions among retailers and food service businesses. As consumer preferences shift towards more diverse and healthy options, cold chain providers are poised to expand their offerings, ensuring a robust market outlook.

Major Players

- Qatar Industries for Refrigerated Transport

- Al Khor Cold Storage

- Qatar Cool

- Gulf Warehousing Company

- United Foods Company

- Qatar Distribution Company

- Mazaya Qatar Real Estate

- Al Muftah Group

- American Gaseous Technologies

- Nabil Foods

- ASCO Qatar

- Qatari Cold Logistics

- Al Ahlia Cold Storage

- Fuchs Lubricants

- Mazaya Cold Storage

Key Target Audience

- Retail Supermarket Chains

- Food Service Operators

- Pharmaceutical and Healthcare Providers

- Logistics and Supply Chain Companies

- Importers and Exporters of Perishable Goods

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Public Health, Qatar)

- Agriculture and Food Industry Stakeholders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar cold chain market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Qatar cold chain market. This includes assessing market penetration, the ratio of marketplaces to service providers, and resulting revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cold chain logistics providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Qatar cold chain market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Fresh Produce

Expansion of the Food and Beverage Industry

Rising Number of Organized Retail Players - Market Challenges

High Operational Costs

Infrastructure Limitations - Opportunities

Adoption of IoT and Automation

Sustainability Trends in Food Supply Chains - Trends

Increasing Investments in Cold Storage Facilities

Development of Smart Transportation Solutions - Government Regulation

Compliance with Food Safety Standards

Import Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Temperature Type (In Value %)

Refrigerated

– 0°C to 4°C Storage (e.g., fresh produce, dairy)

– 5°C to 8°C Storage (e.g., chilled beverages)

Frozen

– -18°C and below (e.g., meat, frozen foods)

– -10°C to -15°C (short-term storage)

Chilled

– 1°C to 5°C (ready-to-eat meals, salads)

– 6°C to 8°C (processed foods and bakery items) - By Type of Product (In Value %)

Dairy Products

– Milk & Milk-Based Beverages

– Cheese & Butter

– Yogurts & Creams

Meat and Seafood

– Fresh Poultry & Meat

– Frozen Processed Meat

– Fresh & Frozen Fish and Shellfish

Fruits and Vegetables

– Fresh Fruits

– Leafy Greens and Root Vegetables

– Packaged and Cut Vegetables

Pharmaceutical Products

– Vaccines

– Biopharmaceuticals

– Diagnostic Kits and Lab Samples

Other Perishables

– Bakery & Confectionery

– Ready-to-Eat Meals

– Flowers & Plants - By End User (In Value %)

Retail Supermarkets

– Hypermarkets

– Local Grocery Chains

Food Service Sector

– Hotels & Catering

– Restaurants & QSR Chains

Pharmaceutical Companies

– Vaccine & Biotech Manufacturers

– Clinical Trial Suppliers

Distribution Centers

– 3PL-operated Cold Warehouses

– Centralized Storage for Retail Chains - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer to Retailer

– Manufacturer to HoReCa

Online Retail

– E-Grocery Platforms

– E-Pharmacy Delivery

Third-party Logistics

– Temperature-Controlled Transport Companies

– 3PL Cold Storage Providers - By Region (In Value %)

Doha

Al Rayyan

Umm Salal

Madinat ash Shamal

Al Khor

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Number of Temperature-Controlled Facilities, Distribution Channels, Margins, Unique Value Offering, Technology Adoption, Geographic Coverage, others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Qatar Industries for Refrigerated Transport

Al Khor Cold Storage

Qatar Cool

Qatari Cold Logistics

Gulf Warehousing Company

QDC (Qatar Distribution Company)

Mazaya Qatar Real Estate

Al Muftah Group

United Foods Company

Al Ahlia Cold Storage

American Gaseous Technologies

Fuchs Lubricants

Nabil Foods

ASCO Qatar

Qatar National Food Security Programme

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030