Market Overview

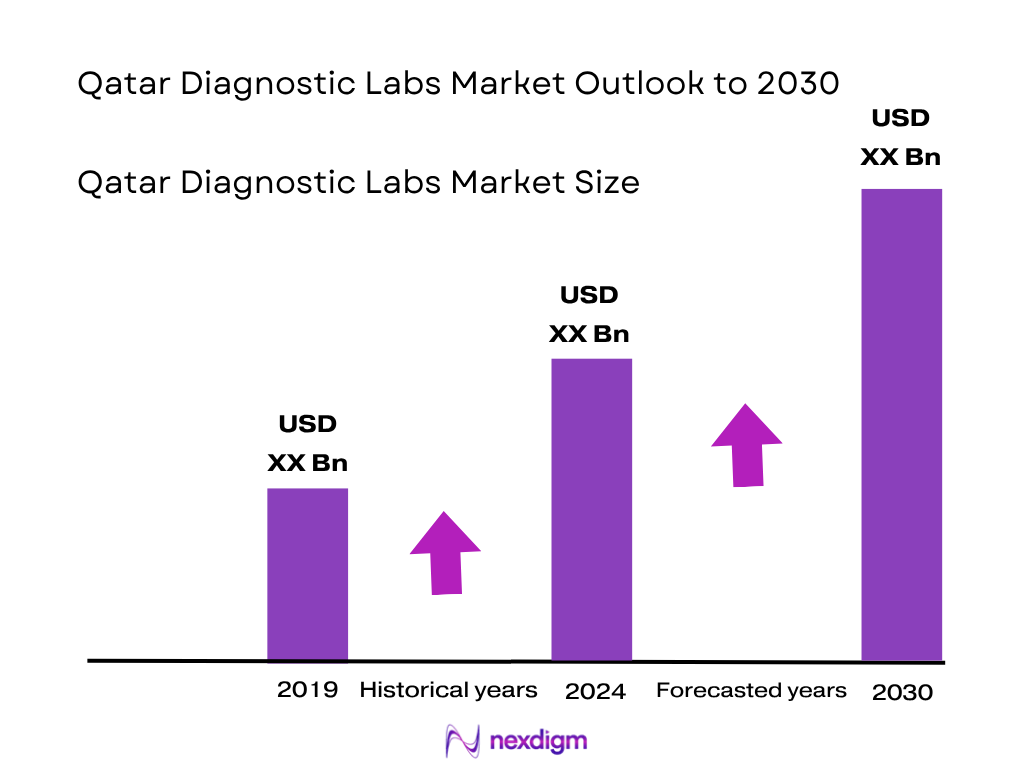

The Qatar diagnostic labs market is valued at approximately USD 14.5 million in 2024. The broader clinical diagnostics / medical laboratories sector has been expanding, driven by rising non-communicable disease incidence, growing expatriate and insured populations, investments in healthcare infrastructure and preventive care programmes. The increased testing volumes, advanced instrumentation and higher test fees contribute to value growth. According to a regional review, the GCC clinical laboratory services market alone was estimated at USD 2.45 billion in 2024. These drivers indicate the diagnostics labs market in Qatar is being propelled by both demand-side (screening, chronic disease monitoring) and supply-side (lab infrastructure, digital/automation) factors.

Within the country, the Doha metropolitan region remains the dominant hub for diagnostic lab services, followed by key industrial and expatriate-dense municipalities of Qatar. This dominance is due to the concentration of major tertiary hospitals, diagnostic chain operators, corporate occupational health contracts, and premium imaging & molecular-testing centres in and around Doha. In addition, the high per-capita healthcare spending and favourable regulatory environment make the capital region a preferred base for lab service providers. The broader GCC region likewise sees leading diagnostics hubs in Saudi Arabia and UAE for similar reasons (scale, infrastructure, private-sector expansion) which sets a basis for benchmark comparisons.

Market Segmentation

By Test/Service Type

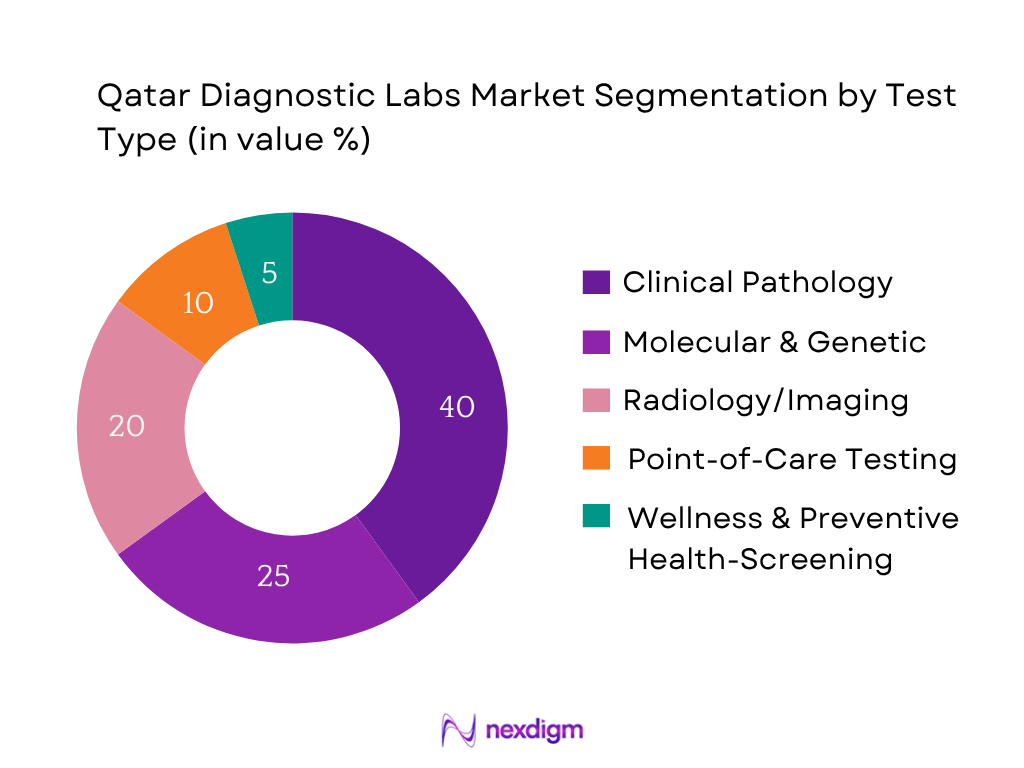

The Qatar diagnostic labs market is segmented into clinical pathology, molecular & genetic diagnostics, radiology/imaging, point-of-care testing and wellness/health-screening services. Among these, clinical pathology holds the dominant market share because it represents the broadest volume of routine tests (blood counts, biochemistry panels, immunology assays) across hospitals, independent labs and corporate screening programmes. The high throughput of routine pathology tests combined with strong demand due to chronic disease monitoring and general medical check-ups ensures that this sub-segment remains the largest contributor to revenue. Molecular diagnostics, although fastest growing, still has a smaller base and higher unit costs, which limits its share relative to routine pathology.

By End User / Client Segment

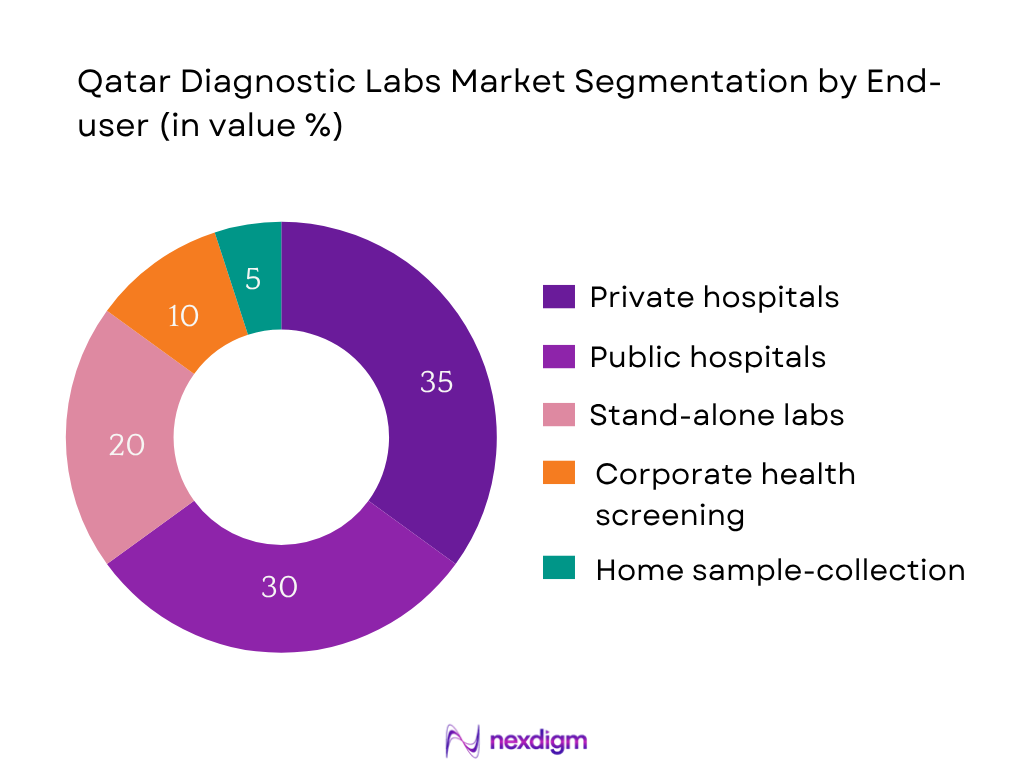

In the Qatar diagnostic labs market, the segmentation by end-user client encompasses private hospitals, public hospitals, stand-alone independent labs, corporate/occupational health screening and home collection/tele-health lab services. The dominant share here lies with private hospitals and specialty clinics, as they constitute major referral sources for diagnostic testing and imaging, and have high throughput volumes of complex tests, thereby contributing significantly to revenue. Private hospitals also tend to offer premium pricing, advanced diagnostics and value-added lab services, providing higher margins. Public hospitals, while having large volumes, tend to operate under cost constraints and lower margins, though they remain a significant segment due to national healthcare coverage and repeat volume of tests.

Competitive Landscape

The competitive environment in Qatar’s diagnostic labs market is characterised by a mix of local independent players, hospital-owned lab networks and international diagnostic service chains. Consolidation is moderate, with major firms focusing on accreditation, digital services, molecular testing and home-collection. Key players continue to invest in capacity expansion, value-added imaging + pathology packages, and partnerships with corporate health/occupational screening providers.

| Company | Establishment Year | Headquarters | Ownership Model | Service Scope | Accreditation Status | Tests/Day Capacity | Number of Collection Centres |

| Al Ahli Diagnostic Center | 2003 | Doha, Qatar | – | – | – | – | – |

| Al Emadi Laboratories | 1998 | Doha, Qatar | – | – | – | – | – |

| West Bay Medical Diagnostic Center | 2005 | Doha, Qatar | – | – | – | – | – |

| Biolab Qatar | 2010 | Doha, Qatar | – | – | – | – | – |

| Aster Diagnostics Doha | 2013 | Doha, Qatar | – | – | – | – | – |

Qatar Diagnostic Labs Market Analysis

Growth Drivers

Rising NCD Burden and Preventive Screening Mandates

The burden of non-communicable diseases (NCDs) in Qatar places a substantial impetus on diagnostic lab demand. A UNDP investment-case report estimated that in 2019 the direct health care expenditure on four major NCD groups (cardiovascular diseases, diabetes, cancer, chronic respiratory diseases) amounted to QAR 7.25 billion (≈ USD 2 billion) and indirect productivity losses to QAR 10.9 billion (≈ USD 3 billion) in the same year. Screening programmes show that among Qataris aged 18+, prevalence of diabetes (elevated HbA1c) was 16.7 % and elevated blood pressure was 33 % in a recent study. With such high NCD prevalence and mounting national focus on screening, the diagnostic-labs market benefits from a surge in test volumes for pathology, molecular diagnostics and imaging tied to disease-management and prevention pathways.

Health Insurance Penetration and Outpatient Diagnostic Coverage Expansion

Health insurance coverage in Qatar is on a rising trajectory, creating greater outpatient diagnostic utilisation. Data from the Qatar Open Data portal indicate that the number of insured individuals in Qatar for 2024 is captured in the dataset “Number of Insured Individuals – 2024”. In 2022 the health-insurance penetration rate was 0.7% of GDP (the lowest in the GCC), rising to 0.8% in 2023. Further, mandatory visitors’ health insurance premiums (QR 50 ≈ USD 14 per month) were introduced in policy updates. These factors signal expanding insurance-driven diagnostic demand as more outpatient labs, screenings and diagnostic packages become covered, enabling independent and hospital-affiliated labs to capture higher volumes of insured tests.

Market Challenges

High Import Dependency for Reagents and Instruments

The Qatar diagnostics-labs market is constrained by heavy reliance on imports of medical instruments and reagents. According to UN Comtrade data via the World Bank’s WITS portal, Qatar imported medical instrument-HS code 901890 (“Instruments and appliances used in medical or veterinary sciences”) valued at USD 75.17 million in 2023. In addition, a market-report highlighted that medical-device imports in 2024 exceeded USD 650 million, with negligible domestic production. This dependence increases vulnerability to supply-chain disruptions, currency shifts and delayed equipment upgrades—hindering diagnostic-lab expansion and capacity enhancement.

Workforce Shortages (Pathologists, Lab Technologists)

Although Qatar boasts a sophisticated healthcare infrastructure, workforce shortages remain a bottleneck for diagnostic labs. A 2024 government-data overview noted 8,365 licensed physicians and nurse-to-patient ratio of 116 patients per nurse in 2021. With the diagnostic labs market growing, the availability of highly trained lab technologists, molecular diagnosticians and pathologists is limited. This constrains the ability of labs to expand high-complexity testing, maintain turnaround-times and scale operations—thereby limiting market growth potential.

Opportunities

Rise of Molecular and Genetic Testing

There is expanding demand for molecular diagnostics (PCR, next-generation sequencing, oncology panels) in Qatar as healthcare shifts toward precision medicine and complex disease management. While specific volumes for Qatar’s molecular-diagnostics market are not publicly segmented, broader reports for the region indicate growing test-complexity. With cancer and cardiovascular conditions receiving national focus, labs that expand genetic/molecular test portfolios can capture a premium service segment. The national health-strategy and health-tech investment plans further support this shift, positioning molecular diagnostics as a major growth avenue for diagnostic labs.

Expansion of Home Sample Collection Networks

Home-collection and tele-lab services are emerging as growth levers within the diagnostics landscape in Qatar. A community-survey in pharmacies showed that 71 % of respondents had used at least one home diagnostic test. Coupled with increasing expatriate and corporate populations seeking convenient access, standalone labs can expand into home-collection, remote sampling and mobile-services. With the national digital-health push and increasing consumer health-convenience orientation, this segment offers independent labs a channel to differentiate and grow outside traditional hospital-referral flows.

Future Outlook

Over the next six years the Qatar diagnostic labs market is expected to demonstrate steady growth, underpinned by expanding non-communicable disease burdens, widespread corporate/expat population health-screening programmes, investments in molecular and imaging diagnostics, and government health-system modernisation under national health strategies. Demand for home-collection and tele-lab services will also rise as convenience and digital health uptake increase. Moreover, private-sector labs will continue to upgrade instrumentation, pursue accreditation and integrate hospital referral networks. While price pressure and regulatory compliance remain potential constraints, the overall structure is favourable for growth.

Major Players

- Al Ahli Diagnostic Center

- Al Emadi Laboratories

- Biolab Qatar

- West Bay Medical Diagnostic Center

- Aster Diagnostics Doha

- Al Kayyali Diagnostic Labs

- Naseem Al Rabah Diagnostics

- Sidra Medicine Diagnostic Laboratory

- Elite Medical Laboratory

- Vision Medical Diagnostic Center

- Alfardan Wellness Diagnostics

- JKL Wellness Labs Qatar

- DEF Imaging & Pathology Qatar

- HIJ Government Lab Contractor Qatar

- Emerging Start-up Lab Group Qatar

Key Target Audience

- Private healthcare chains and hospital groups in Qatar

- Diagnostic laboratory services providers and expansion investors

- Equipment and reagent suppliers (molecular/imaging) targeting Qatar

- Corporate occupational health service firms

- Health insurance companies and third-party administrators

- Investments and venture capital firms looking at healthcare diagnostics in the region

- Government and regulatory bodies (e.g., Qatar Ministry of Public Health, Qatar Accreditation Centre)

- Healthcare infrastructure developers and facility-investment advisors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the diagnostic labs ecosystem in Qatar, including stakeholder types (hospitals, independent labs, corporates, insurers), test-service types, sample-collection networks and pricing tiers. Secondary sources (published market-reports, government healthcare-data, company filings) were supplemented by proprietary databases.

Step 2: Market Analysis and Construction

Historical data (2018-2023) and 2024 base figures were compiled for diagnostics test volume, pricing trends, service mix and revenue. A bottom-up approach was used to estimate independent lab revenue, using test-mix, average fees and capacity utilisation. Cross-checked with a top-down proxy from GCC data.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about growth drivers (e.g., corporate screening, molecular uptake) and segmentation shifts were validated through telephone and video interviews with lab-managers, equipment-vendors, hospital procurement leads and accreditation-body officials in Qatar.

Step 4: Research Synthesis and Final Output

Data inputs were triangulated to develop the market size, segmentation shares, competitive landscape, forecast (2024-2030) and recommendations. The final report was peer-reviewed, sanity-checked for coherence and aligned with professional market-reporting standards.

- Executive Summary

- Research Methodology (Market Definitions, Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Framework, In-Depth Industry Interviews, Primary and Secondary Data Validation, Data Triangulation, Limitations, and Future Assumptions)

- Definition and Scope

- Evolution of the Diagnostic Ecosystem in Qatar

- Healthcare Infrastructure Readiness for Diagnostic Services

- Regulatory Environment (QCHP, MoPH, QCHCA Accreditation Policies)

- Diagnostic Value Chain and Workflow Mapping (Sample Collection → Testing → Reporting → Referral → Archival)

- Business Cycle Analysis (Insurance Reimbursement, Public-Private Referrals, Procurement Patterns)

- Integration with National Health Digitization (Hukoomi, eHealth, LIS Interoperability)

- Growth Drivers

Rising NCD Burden and Preventive Screening Mandates (Diabetes, Cardiovascular, Oncology)

Health Insurance Penetration and Outpatient Diagnostic Coverage Expansion

Government Investments in Healthcare Infrastructure (QNV 2030, Primary Health Centers)

Growing Expat Population and Corporate Health-Screening Demand

Integration of AI, IoT, and Cloud-Based Diagnostics - Market Challenges

High Import Dependency for Reagents and Instruments

Workforce Shortages (Pathologists, Lab Technologists)

Regulatory Approval Delays and Licensing Constraints

Data Interoperability Gaps Between Hospital LIS and Labs

Price Competition among Private Labs - Opportunities

Rise of Molecular and Genetic Testing

Expansion of Home Sample Collection Networks

Tele-Radiology and Cross-Border Diagnostic Outsourcing

Corporate Preventive Health Partnerships

Investment in ISO and CAP-Accredited Labs - Emerging Trends

Digital Lab Transformation (AI-Enabled Diagnostics, Smart Analyzers)

Integration of EHR-Linked Lab Portals

Growth of Preventive Health Screening Packages

Public-Private Lab Collaborations

Automation and Robotics in Sample Handling - Government Regulation

MoPH Licensing Requirements

Accreditation Frameworks (CAP, ISO 15189)

Data Privacy and Interoperability Regulations

Reimbursement Tariff Framework (National Health Insurance Scheme) - SWOT Analysis (Sector-Level)

- Stakeholder Ecosystem (Diagnostic Chains, Hospitals, Equipment Suppliers, Insurance Providers, Regulators, Logistics Partners)

- Porter’s Five Forces Analysis (Supplier Power, Buyer Power, Substitutes, New Entrants, Rivalry)

- Value Chain & Cost Structure Analysis (Reagent Cost, Equipment Capex, Staffing, Logistics, IT Integration)

- By Value, 2019-2024

- By Volume (Number of Tests Conducted, Samples Processed, Imaging Scans Performed), 2019-2024

- By Average Fee per Test/Panel, 2019-2024

- By Test Type (In Value %)

Clinical Pathology (Hematology, Biochemistry, Immunology)

Molecular Diagnostics (PCR, Genomics, COVID Panels, Oncology Panels)

Imaging and Radiology (CT, MRI, X-Ray, Ultrasound)

Point-of-Care Testing (Blood Glucose, Troponin, Rapid Kits)

Wellness and Preventive Health Screening - By End User (In Value %)

Public Hospitals and Medical Centers

Private Hospitals and Specialty Clinics

Independent Diagnostic Laboratories

Corporate/Occupational Health Programs

Home Sample Collection and Tele-Diagnostics - By Ownership Model (In Value %)

Private Chain Laboratories

Public-Private Partnership Laboratories

Hospital-Owned In-house Labs

Franchise or Branded Labs - By Region (In Value %)

Doha Metropolitan Region

Northern Region (Al Khor, Al Daayen)

Southern Region (Al Wakra, Mesaieed)

Western and Industrial Zones (Al Rayyan, Dukhan) - By Technology Platform (In Value %)

Automated Immunoassay & Clinical Chemistry Analyzers

Molecular Platforms (NGS, PCR, Microarray)

Digital Radiology and PACS Systems

LIS/HIS Integrated Digital Workflow Platforms

Point-of-Care and Handheld Diagnostic Devices

- Market Share Analysis (Value/Volume)

- Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Diagnostic Specialization, Infrastructure Capacity (tests/day), Service Pricing, Accreditation Status, Digital Integration Level, Strategic Partnerships)

- SWOT Analysis of Key Players

- Pricing Analysis (By Test Panels, Imaging Packages, Molecular Tests)

- Detailed Profiles of Major Companies

Al Ahli Diagnostic Center

Al Emadi Laboratories

Biolab Qatar

Doha Clinic Laboratory

West Bay Medical Diagnostic Center

Alfardan Medical with Northwestern Medicine Diagnostics

Naseem Al Rabah Diagnostics

Al Kayyali Diagnostic Labs

Sidra Medicine Diagnostic Laboratory

Hamad Medical Corporation Labs (Reference Lab Network)

Alfardan Wellness Diagnostics

Aster Diagnostics Doha

Allevia Diagnostics Center

Elite Medical Laboratory

Vision Medical Diagnostic Center

- Test Demand and Utilization Trends

- Institutional Budget Allocation and Procurement Models

- Compliance Requirements for Diagnostic Vendors

- Customer Preference Mapping (TAT, Accuracy, Convenience, Digital Reports)

- Decision-Making Hierarchies in Procurement (Lab Heads, Procurement Directors, Quality Managers)

- By Value, 2025-2030

- By Volume (Number of Tests Conducted, Samples Processed, Imaging Scans Performed), 2025-2030

- By Average Fee per Test/Panel, 2025-2030