Market Overview

The Qatar Education Market is valued at USD 7.5 billion, supported by a significant increase in public and private educational institutions due to government investment in the education sector. The market is driven by factors such as a rising population, an emphasis on the development of human capital, and the integration of technology in the learning environment. The education sector is experiencing an increasing shift towards private institutions, which offer innovative curricula and international standards.

Dominating cities in the market include Doha and Al Rayyan, which host the majority of educational institutions, including international schools and universities. Doha is the capital and largest city, serving as a hub for educational activities due to its strategic initiatives to attract foreign educational institutions. The region’s affluent population, increased investment in educational infrastructure, and a push towards academic excellence contribute to the dominance of these cities in Qatar’s education landscape.

The Qatari government has made significant investments in education, with education expenditure projected to reach USD 12.7 billion in 2024, reflecting ongoing commitment to enhancing educational infrastructure. The government’s Qatar National Vision 2030 includes a focus on education reform and quality enhancement, with initiatives aimed at improving curriculum standards and promoting innovation. Additionally, funding from the Ministry of Education and Higher Education supports the establishment of new institutions and the enhancement of existing ones, fostering an environment conducive to educational growth.

Market Segmentation

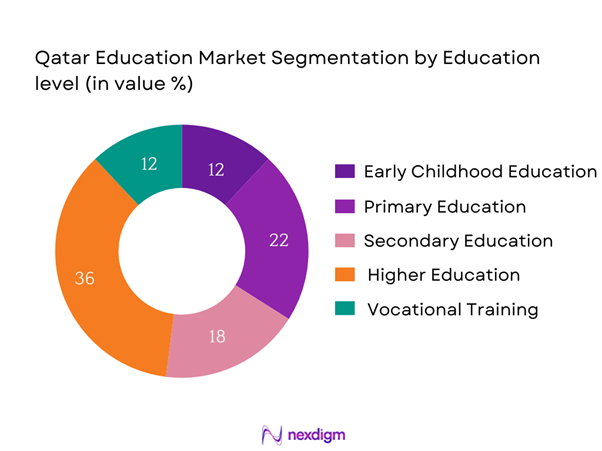

By Education Level

The Qatar Education Market is segmented by education level into Early Childhood Education, Primary Education, Secondary Education, Higher Education, and Vocational Training. Among these segments, Higher Education is the dominant market share holder due to the increasing emphasis on tertiary education driven by government policies promoting skill development and knowledge-based economy. Institutions such as Qatar University and College of the North Atlantic have established a robust reputation, attracting both local and international students. Moreover, with partnerships and collaboration with global educational entities, this sector is experiencing significant growth as it meets the needs of a diversifying economy.

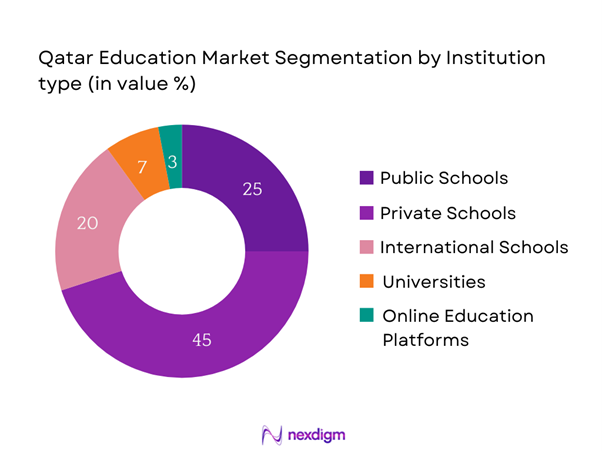

By Institution Type

The Qatar Education Market is also segmented by institution type into Public Schools, Private Schools, International Schools, Universities, and Online Education Platforms. The Private Schools segment has seen considerable growth and currently holds a dominant market share. The preference for international curricula and small class sizes offered by private institutions make them attractive to parents. Furthermore, the wide array of specialized programs available in private schools aligns well with the diverse demands of expatriates and affluent local families, thereby strengthening this segment’s position in the market.

Competitive Landscape

The Qatar Education Market is characterized by a competitive landscape dominated by a mix of international and local players. Major institutions like Qatar University and College of the North Atlantic provide quality education and contribute to the overall growth of the sector. The consolidation of educational services highlights the influence of key companies and their efforts towards innovation in teaching methodologies.

| Company | Establishment Year | Headquarters | Key Facilities/Programs | Enrollment Capacity | Strategic Partnerships | Notable Achievements |

| Qatar University | 1973 | Doha | – | – | – | – |

| College of the North Atlantic | 2002 | Doha | – | – | – | – |

| Doha College | 1997 | Doha | – | – | – | – |

| International School of London Qatar | 2008 | Doha | – | – | – | – |

| Qatar Academy | 1996 | Doha | – | – | – | – |

Qatar Education Market Analysis

Growth Drivers

Increasing Population and Enrollment Rates

Qatar’s population has grown significantly, reaching approximately 2.95 million in 2023, an increase from 2.88 million in 2022. This growing population naturally leads to a larger student base in educational institutions. Enrollment rates in higher education have also seen positive trends, with around 59% of high school graduates continuing to tertiary education. This demographic shift is essential for sustaining demand in the educational sector. The increasing influx of expatriates contributes further to these dynamics, bolstering the demand for diverse educational services catering to varying cultures and languages.

Integration of Technology in Education

The digital transformation in education is rapidly evolving, with over 90% of Qatari educational institutions implementing digital tools in their curricula as of 2023. This trend has been significantly supported by government-led initiatives to integrate technology in education, including the National ICT Plan, which aims to enhance educational practices through IT innovations. Schools are increasingly utilizing online learning platforms and digital educational resources, significantly improving accessibility and engagement for students. The Qatar Digital Government Strategy 2025 aims to enhance the digital delivery of educational services and improve communication channels by introducing Ed-tech solutions.

Market Challenges

High Competition Among Institutions

The competitive landscape in Qatar’s education sector has intensified, with over 500 private and public schools and numerous international higher education institutions operating in the region. This increased competition has led to a diverse offering of educational programs, making it challenging for institutions to differentiate themselves. Schools must continually enhance their curriculum and facilities to attract students. Additionally, parental choice drives competition, as more families opt for international and private schools that offer unique learning experiences, thus creating an environment where maintaining enrollment levels is increasingly competitive.

Regulatory and Compliance Issues

Compliance with local educational regulations is imperative for institutions in Qatar, with stringent guidelines enforced by the Ministry of Education and Higher Education. These regulations govern curriculum standards, teacher qualifications, and facility quality. Institutions must adhere to these regulations to ensure they meet the criteria for operation, which can be a complex process. Moreover, regulatory updates and changes can necessitate rapid adaptation, leading to additional operational costs for compliance, particularly for international schools navigating local accreditation requirements. Government inspections and evaluations contribute to this ongoing challenge.

Opportunities

Growing Demand for Online Education

The demand for online education in Qatar is gaining traction, with an estimated 35% of high school students now engaging in some form of online study. This shift is driven by the flexibility and accessibility online platforms offer. As of 2023, around 40% of educational institutions are incorporating fully-fledged online programs. The ongoing pandemic has increased the acceptance of distance learning, positioning online education institutions to capture a larger market share, especially among working adults seeking skills advancement or adult education. This opportunity is solidified by the government’s ongoing investment in e-learning technologies targeting educational accessibility for diverse populations across Qatar.

Rising Importance of Skill Development

There is a pronounced emphasis on skill development in Qatar, evident from the significant investment by the government in vocational education programs and partnerships with various industries. With over 40% of employers in Qatar citing skills shortages in certain sectors, the initiative to bridge this gap is crucial. Government-supported training programs that emphasize workforce readiness are being prioritized, thus creating more opportunities for educational institutions focused on vocational and professional training. As Qatar evolves into a knowledge-based economy, educational providers that pivot towards skill-specific training are positioned to thrive and align closely with national goals.

Future Outlook

Over the next 5 years, the Qatar Education Market is poised for significant growth driven by continuous government investment, enhanced educational infrastructure, and an increasing focus on skill development to meet labor market needs. The integration of technology and innovation within the curriculum is also expected to transform educational delivery, supporting an increase in demand for diverse educational services. The diversification of the education ecosystem will likely culminate in a robust education market, adapting to global standards and local demands.

Major Players

- Qatar University

- College of the North Atlantic

- Doha College

- International School of London Qatar

- Qatar Academy

- American School of Doha

- Dukhan English School

- Gulf English School

- International Community School

- Al Jazeera Academy

- Lycee Francais de Doha

- Compass International School

- Middle East International School

- British School of Qatar

- Aspire Academy

Key Target Audience

- Government Agencies (Ministry of Education and Higher Education, Qatar)

- Educational Institutions

- Investments and Venture Capitalist Firms

- Private Sector Corporations

- International Educational Organizations

- School Administrators & Board Members

- Parent Advocacy Groups

- Non-Governmental Organizations (NGOs)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar Education Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Qatar Education Market. This includes assessing market penetration, the ratio of education institutions to student enrollment, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of educational institutions. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple educational institutions to acquire detailed insights into course offerings, enrollment performance, student demographics, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Qatar Education Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Overview of Historical Trends

- Business Cycle and Economic Impact

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Population and Enrollment Rates

Government Initiatives and Funding

Integration of Technology in Education - Market Challenges

High Competition Among Institutions

Regulatory and Compliance Issues - Opportunities

Growing Demand for Online Education

Rising Importance of Skill Development - Trends

Personalized Learning Experiences

Increased Focus on STEM Education - Government Regulation

Policies Affecting Curriculum Standards

Accreditation and Quality Assurance - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Expenditure, 2019-2024

- By Education Level (In Value %)

Early Childhood Education

– Nurseries (Ages 0–3)

– Kindergartens / Pre-schools (KG1 & KG2)

– Montessori and play-based models

Primary Education

Secondary Education

– Lower Secondary (Grades 7–9)

– Upper Secondary (Grades 10–12)

– Pre-university programs

Higher Education

– Undergraduate Degrees (BA, BSc, BBA, Engineering)

– Graduate Studies (MBA, MSc, PhD)

– International branch campuses in Education City

Vocational Training

– Technical education institutions

– Skill-based programs in healthcare, aviation, hospitality, oil & gas, etc.

– Adult re-skilling and diploma programs - By Institution Type (In Value %)

Public Schools

Private Schools

International Schools

Universities

Online Education Platforms - By Subject Area (In Value %)

STEM (Science, Technology, Engineering, Mathematics)

– Engineering, Robotics, and ICT programs

– AI, Data Science, and Renewable Energy integration

Humanities and Arts

– Languages

– History

– Literature

– Fine Arts

– Media Studies

Business and Management

– Finance

– Accounting

– International Business

– Marketing

Health Sciences

– Medicine

– Pharmacy

– Public Health

– Nursing

Social Sciences

– Economics

– Political Science

– International Relations

– Education - By Region (In Value %)

Doha

Al Rayyan

Al Wakrah

Umm Salal

Other Regions - By Delivery Mode (In Value %)

Traditional Classroom

e-Learning

Blended Learning

- Market Share of Major Players by Value/Volume, 2024

Market Share by Institution Type, 2024 - Cross Comparison Parameters (Institution Overview, Strategic Initiatives, Recent Developments, Strengths, Weaknesses, Operational Structure, Revenue Streams, Market Presence, Innovation in Education Formats, Technology Adoption Levels)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Education Services

- Detailed Profiles of Major Companies

Qatar University

College of the North Atlantic – Qatar

Doha College

International School of London Qatar

Aspire Academy

Qatar International School

American School of Doha

International Community School

British School of Qatar

Doha Institute for Graduate Studies

Qatar Academy

Lycee Francais de Doha

Gulf English School

Qatar University of Science and Technology

Universe Education Group

- Market Demand and Utilization

- Student Demographics and Behavioral Patterns

- Parental Involvement and Decision-Making

- Regulatory and Compliance Considerations

- Needs, Desires, and Pain Point Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Expenditure, 2025-2030