Market Overview

As of 2024, the Qatar electronics manufacturing market is valued at USD 2.5 billion, with a growing CAGR of 5.4% from 2024 to 2030, showcasing consistent growth driven by rapid urbanization and governmental push towards a digital economy. The demand for consumer electronics, telecommunications equipment, and advanced industrial technology are major contributors to this growth. The market benefits from substantial investments in infrastructure and technological advancements, establishing Qatar as a lucrative hub for electronics manufacturing in the GCC region, especially as it progresses towards its National Vision 2030 goals.

Key cities such as Doha, Al Rayyan, and Al Wakrah dominate the Qatar electronics manufacturing market due to their strategic locations and economic initiatives. Doha, as the capital, serves as the central business and commercial hub, fostering innovation and development in electronics. The presence of various multinational corporations and local firms in these cities enhances competition and stimulates growth, making the region an attractive destination for investments and technology transfer.

Market Segmentation

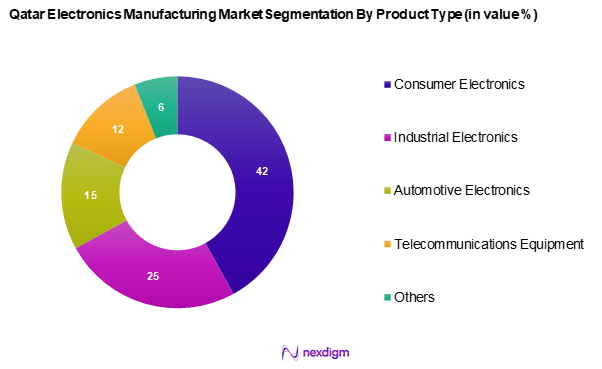

By Product Type

The Qatar electronics manufacturing market is segmented into consumer electronics, industrial electronics, automotive electronics, telecommunications equipment, and others. Consumer electronics currently hold the largest market share in this segmentation. This dominance stems from the high demand for electronic devices such as smartphones, laptops, and home appliances among tech-savvy consumers. The growing preference for smart home solutions and audiovisual equipment additionally drives the substantial sales of consumer electronics, with major brands solidifying their presence through aggressive marketing strategies and product innovations.

By End User

The Qatar electronics manufacturing market is segmented into government, healthcare, defense & aerospace, automotive, telecommunications, and others. The government sector is the leading end user, primarily due to substantial investments in smart city initiatives and digital transformation projects. Government initiatives aimed at enhancing operational efficiency and service delivery in various sectors stimulate the demand for advanced electronic equipment. This trend is further supported by strategic collaborations with international firms to implement cutting-edge technology solutions.

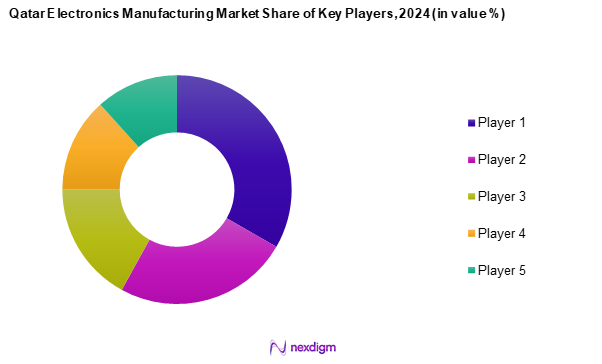

Competitive Landscape

The Qatar electronics manufacturing market is dominated by a limited number of key players, reflecting a competitive yet consolidated landscape. Major companies like Switchgear International WLL, Q-Tec Switchgear W.L.L., Standex Electronics, Inc., Elcome International LLC, and Arabian Gulf Switchgear lead innovation in manufacturing technologies. Their established reputations and extensive distribution networks significantly influence market dynamics.

| Major Players | Establishment Year | Headquarters | Revenue (USD Mn) | Key Product Type | Market Strategy | Market

Share (%) |

| Switchgear International WLL | 2006 | Doha, Qatar | – | – | – | – |

| Q-Tec Switchgear W.L.L. | 2009 | Doha, Qatar | – | – | – | – |

| Standex Electronics, Inc. | 1969 | Ohio, U.S.A. | – | – | – | – |

| Elcome International LLC | 1970 | Dubai,

U.A.E. |

– | – | – | – |

| Arabian Gulf Switchgear | 1977 | Sharjah, U.A.E | – | – | – | – |

Qatar Electronics Manufacturing Market Analysis

Growth Drivers

Increasing Urbanization

In Qatar, urbanization continues to power the electronics manufacturing market, fueled by robust infrastructural developments. By 2024, Qatar’s urban population is expected to touch 3 million according to the World Bank, driven by ambitious projects such as Lusail City and the Doha Metro. This rapid urban expansion demands an increase in consumer electronics and smart appliances to meet modern urban living requirements. Moreover, as urban areas burgeon, the demand for telecommunications and energy-efficient devices rises, thereby fostering significant opportunities within the electronics manufacturing sector.

Government Initiatives towards Digital Economy

Qatar’s vision to become a digitally advanced economy is significantly shaping the electronics manufacturing sector. Through strategic plans aligned with national long-term goals, the government is actively investing in digital infrastructure and fostering innovation in information and communication technologies. Efforts to strengthen local manufacturing capabilities are evident in initiatives promoting cloud computing, data centers, and digital services. These advancements are boosting demand for high-tech and IoT-enabled electronics, helping position Qatar as a forward-thinking regional technology hub.

Market Challenges

Supply Chain Disruptions

One of the critical issues facing the electronics manufacturing industry in Qatar is the vulnerability of its supply chain. External pressures such as geopolitical instability and inconsistencies in global trade have led to delays and limited access to essential components. These disruptions not only strain production timelines but also result in increased costs.

High Production Costs

Production costs in Qatar’s electronics sector remain high, influenced by labor market dynamics and the reliance on imported materials. Rising wages and tariffs on imported components are adding to the financial burden faced by manufacturers. Additionally, utility expenses contribute to operational overheads. These challenges are prompting manufacturers to adopt automation and invest in advanced production technologies, aiming to boost efficiency and maintain cost competitiveness in both domestic and international markets.

Opportunities

Expansion in Renewable Energy Technology

Qatar, with its commitment to sustainability, presents robust opportunities for electronics geared towards renewable energy technology. In 2024, Qatar launched its 800 MW solar power plant at Al Kharsaah, underscoring the shift towards green energy. This transition fosters demand for solar modules, inverters, and smart energy management systems. As the nation aspires to generate 20% of its electricity from renewable sources by 2030, manufacturers can capitalize on the burgeoning need for energy-efficient electronics, contributing to environmental goals while tapping into a lucrative sector.

Shift Toward IoT and Smart Solutions

The surge towards IoT and smart solutions is unlocking new potentials within Qatar’s electronics manufacturing market. Government projects and corporate headquarters are increasingly adopting smart HVAC systems, lighting, and security solutions as part of digital transformation agendas. The IoT market within Qatar is projected to reach high adoption rates, spurred by initiatives like the Smart Qatar Program (TASMU), which promotes the integration of connected devices into everyday infrastructure. This trend is leading to new product development opportunities for manufacturers targeting the smart solutions segment.

Future Outlook

Over the next five years, the Qatar electronics manufacturing market is poised for significant growth, driven by ongoing governmental support, technological advancements, and a pronounced shift toward smart consumer solutions. The focus on the expansion of digital infrastructure and the increasing adoption of Internet of Things (IoT) devices will likely catalyze further innovation and investment, solidifying Qatar’s position as a competitive player within the regional electronics manufacturing landscape.

Major Players

- Switchgear International WLL

- Q-Tec Switchgear W.L.L.

- Elcome International LLC

- AGS

- Ertibat Engineering Co. W.L.L.

- Integra Switchgear Projects Solutions WLL

- Mackins

- Farah Trading & Contracting

- Bonocle

- Standex Electronics, Inc.

- Super Engineering Works

- Hawaii LED

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Communications and Information Technology)

- Telecommunications Corporations

- Healthcare Institutions

- Automotive Manufacturers

- Defense Contractors

- Retail Distributors

- Technology Development Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step in this research involved creating an ecosystem map that outlines all prominent stakeholders within the Qatar electronics manufacturing market. This step was supported by extensive desk research leveraging a mix of secondary and proprietary databases to collect comprehensive industry-level insights. The aim was to identify and define significant variables affecting market dynamics, including trends, challenges, and growth opportunities.

Step 2: Market Analysis and Construction

In this phase, historical data pertinent to the Qatar electronics manufacturing market was compiled and analyzed. This encompasses the evaluation of market penetration, service offerings, and resultant revenue generation. Additionally, a careful assessment of service quality metrics was undertaken to ensure the accuracy and reliability of the generated revenue estimates, thereby enhancing the robustness of market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and subsequently validated through in-depth consultations with industry experts, utilizing computer-assisted telephone interviews (CATIs). Experts representing a diverse array of companies provided valuable insights into operational and financial dynamics within the market. This expert validation was integral in refining the market data and ensuring accuracy through firsthand industry perspectives.

Step 4: Research Synthesis and Final Output

The final phase of the research involved direct engagements with various electronics manufacturing companies in Qatar. These interactions allowed for the collection of detailed insights about product segments, sales performance, and consumer preferences. Such qualitative data served to verify and complement quantitative findings derived from the bottom-up approach, resulting in a comprehensive, accurate, and thoroughly validated analysis of the Qatar electronics manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Urbanization

Government Initiatives towards Digital Economy - Market Challenges

Supply Chain Disruptions

High Production Costs - Opportunities

Expansion in Renewable Energy Technology

Shift Toward IoT and Smart Solutions - Trends

Adoption of Automation in Manufacturing

Increase in R&D Investments - Government Regulation

Quality Standards

Environmental Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Consumer Electronics

– Smartphones

– Televisions

– Laptops and Tablets

– Wearables

Industrial Electronics

– Control Systems and PLCs

– Industrial Sensors

– Power Electronics

– Automation Controllers

Automotive Electronics

– Infotainment Systems

– Advanced Driver Assistance Systems (ADAS)

– Battery Management Systems for EVs

– Navigation and Telematics

Telecommunications Equipment

– Routers and Switches

– Network Infrastructure Equipment

– 5G Modules and Base Stations

– Satellite Communication Devices

Others

– Medical Electronics

– Educational Devices

– Smart Home Devices - By End User (In Value %)

Government

– Smart City Projects

– Public Safety Electronics

– Surveillance Systems

Healthcare

– Diagnostic Imaging Devices

– Patient Monitoring Systems

– Health IT Equipment

Defense & Aerospace

– Radar and Communication Systems

– Navigation Instruments

– UAV Electronics

Automotive

– In-Vehicle Entertainment

– EV Battery Systems

– Vehicle Control Units

Telecommunications

– 5G Infrastructure Electronics

– Optical Transmission Equipment

– Mobile Network Equipment

Others

– Education Institutions

– Retail and Smart Buildings - By Sales Channel (In Value %)

Direct Sales

– B2B Institutional Contracts

– Long-Term Supplier Agreements

Distributors

– National Electronic Distributors

– Value-Added Resellers

Online Retail

– E-commerce Platforms

– Brand-Owned Online Stores

Others

– Electronic Expos & Trade Events

– Government Procurement Platforms - By Region (In Value %)

Doha

Al Rayyan

Al Wakrah

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Type, Number of Facilities, Distribution Channels, Innovation Pipeline, Production Capacity)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Switchgear International WLL

Q-Tec Switchgear W.L.L.

Alkindi

Qatar Site and Power W.L.L.

AGS

Ertibat Engineering Co. W.L.L.

Integra Switchgear Projects Solutions WLL

Mackins

Farah Trading & Contracting

Bonocle

Standex Electronics, Inc.

Super Engineering Works

Hawaii LED

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030