Market Overview

The Qatar Facility Management Market is valued at USD 7.42 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 10.15% from 2025-2030 and is driven by a boom in construction and ongoing infrastructure development initiatives across the country. Government investments in the Qatar National Vision 2030 and upcoming events like the FIFA World Cup have heightened demand for integrated facility services.

The market is predominantly concentrated in Doha, which is Qatar’s capital and largest city. Its rapid urbanization and the influx of expatriates create a thriving economy that demands comprehensive facility management services. Additional cities such as Al Rayyan and Lusail also play significant roles due to their developments in residential and commercial properties, further driving the growth of facility management solutions tailored to the unique needs of each sector.

Outsourcing facility management services has gained momentum in Qatar, attributed to the desire for companies to focus on core business areas while experts handle facility operations. As of 2023, around 60% of companies in Qatar had explicitly stated their inclination to outsource various facility management services, driven by the benefits of cost efficiency and specialized service delivery. The increase in foreign investment has brought about significant projects needing expert management, thus augmenting the outsourcing trends observed within the market.

Market Segmentation

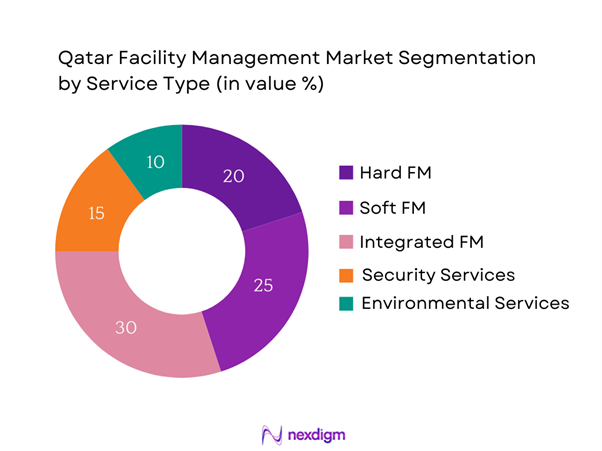

By Service Type

The Qatar Facility Management Market is segmented by service type into Hard Facility Management (Hard FM), Soft Facility Management (Soft FM), Integrated Facility Management (IFM), Security Services, and Environmental Services. The Integrated Facility Management segment dominates the market share, primarily due to its comprehensive approach to facility operations, which streamlines multiple services under a single contract. This trend allows organizations to reduce costs, improve service delivery, and enhance operational efficiency. As businesses increasingly seek holistic management solutions that encompass both hard and soft services, the demand for IFM continues to rise.

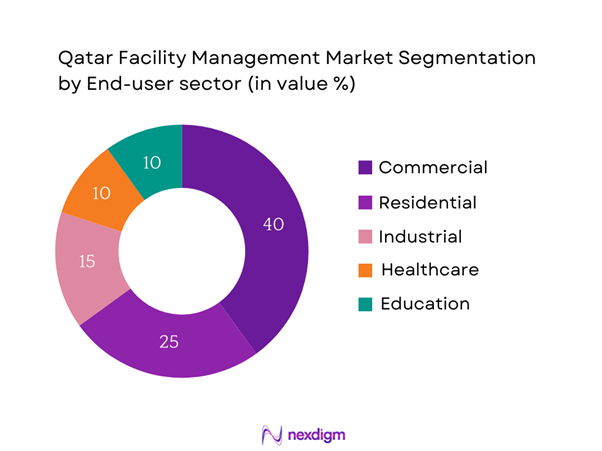

By End-User Sector

The Qatar Facility Management Market further segments by end-user sector into Commercial, Residential, Industrial, Healthcare, and Education. The Commercial segment is leading the market primarily due to the rapid growth of retail and office space developments in major cities like Doha. With a surge in the number of businesses establishing operations in Qatar, the need for efficient and scalable facility management services in this sector has become crucial. As companies look to optimize their operational costs and enhance workplace environments for improved productivity, the demand for facility management services catering to commercial properties is expected to continue its growth trajectory.

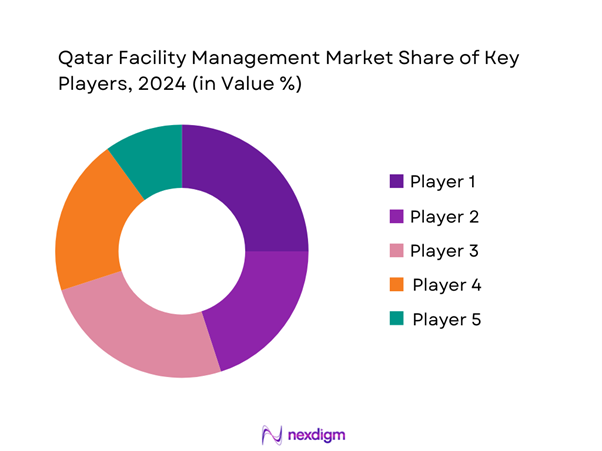

Competitive Landscape

The Qatar Facility Management Market is dominated by a few major players, including UGL Limited, ISS World, Sodexo, and CBRE Group. This consolidation highlights the significant influence of these key companies, which leverage their comprehensive service offerings and strong regional presence to capture market share. These organizations excel due to their ability to provide tailored solutions that meet the varied needs of their clients while maintaining high standards of service quality.

| Company | Establishment Year | Headquarters | Hard FM Capabilities | Soft FM Capabilities | Employee Strength | Global Reach | Service Portfolio |

| UGL Limited | 1970 | Sydney, Australia | – | – | – | – | – |

| ISS World | 1901 | Copenhagen, Denmark | – | – | – | – | – |

| Sodexo | 1966 | Paris, France | – | – | – | – | – |

| CBRE Group | 1906 | Los Angeles, USA | – | – | – | – | – |

| G4S | 1901 | London, UK | – | – | – | – | – |

Qatar Facility Management Market Analysis

Growth Drivers

Urbanization and Infrastructure Development

Urbanization in Qatar has surged, with over 88% of the population residing in urban areas as of 2022, driven by rapid economic growth and infrastructural investments. The Government of Qatar is embarking on major projects aimed at enhancing the urban landscape, such as the Lusail City development, which is expected to provide accommodations for 200,000 residents and house a variety of commercial spaces. Investments in infrastructure are projected to amend existing facilities and create new ones, contributing to a rising demand for facility management services to maintain these estates effectively.

Rising Demand for Energy Efficiency

The push for energy efficiency in Qatar is a notable growth driver for the facility management market. Qatar has set ambitious goals to reduce energy consumption, aiming for a decrease of 30% in energy usage and a 20% decline in greenhouse gas emissions by 2030. The government’s commitment to sustainability initiatives, including the implementation of energy-efficient technologies in public infrastructure, invites facility management companies to adopt modern solutions that align with these energy conservation goals. Investments in energy management systems are projected to facilitate cost reductions, thereby bolstering market demand in the facility management sector.

Market Challenges

Skills Shortages in the Sector

The facility management sector in Qatar is grappling with a shortage of skilled labor. Reports indicate that the country requires an additional 25,000 skilled workers in the construction and facility management sectors to meet the increasing demand for services by end of 2025. This shortage hampers operational efficiency and service delivery quality, as many organizations struggle to recruit qualified professionals in engineering, maintenance, and facility operations. The skills gap is further compounded by the growing complexity of technological solutions required to effectively manage modern facilities.

Regulatory Compliance Issues

Navigating regulatory compliance remains a challenge for facility management firms in Qatar due to evolving government policies. The Qatar government is continuously updating labor laws and standards, which impacts employment practices within the facility management sector. A key area of concern is the newly implemented Qatar Labor Law, which mandates specific working conditions and employee rights, affecting the operational framework of facility management companies. Companies face significant adjustments to ensure compliance, which can lead to increased operational costs and affect profitability.

Opportunities

Adoption of Green Technologies

The current landscape of Qatar’s facility management market presents ample opportunities for the adoption of green technologies. With the goal of promoting sustainability, Qatar has identified key green initiative investments amounting to QAR 10 billion (USD 2.75 billion) since 2022 to enhance energy efficiency across public buildings and commercial establishments. The drive towards implementing smart technologies and renewable energy solutions in facility operations aligns with global sustainability trends, allowing facility management firms to innovate and offer eco-friendly services that appeal to environmentally-conscious clients. The commitment to initiatives like the Qatar Green Building Council serves to further amplify these opportunities.

Innovative Smart Solutions

The integration of innovative smart solutions in facility management presents significant growth potential in the current market. The proportion of smart buildings in Qatar is projected to increase, influenced by the government’s emphasis on digitization across all sectors. According to Qatar’s Digital Economy Strategy, which intends to allocate around QAR 1 billion (USD 275 million) to develop technology infrastructures, facility management companies can leverage smart technologies like IoT and AI for predictive maintenance and enhanced operational efficiency. This progression not only streamlines operations but also leads to elevated customer satisfaction levels through improved facility management experiences.

Future Outlook

Over the next five years, the Qatar Facility Management Market is expected to show significant growth driven by the nation’s commitment to infrastructural advancements, ongoing urban development projects, and an increasing focus on sustainability. The anticipated rise in demand for smart building integration and innovative facility services will further catalyze market expansion as companies strive to enhance operational efficiency while prioritizing eco-friendly practices.

Major Players

- UGL Limited

- ISS World

- Sodexo

- CBRE Group

- G4S

- Emirates Facilities Management

- Al-Futtaim

- Mace Group

- CEG International

- Bilfinger SE

- First Service Brands

- Eram Group

- Al Jaber Group

- Al-Fanateer

- Qatari Diar

Key Target Audience

- Property Owners and Developers

- Corporations and Commercial Enterprises

- Real Estate Management Firms

- Construction Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Municipality, Ministry of Commerce and Industry)

- Facility Management Service Providers

- Large Educational Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar Facility Management Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Qatar Facility Management Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple facility management service providers to acquire detailed insights into service segments, operational performance, client preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Qatar Facility Management Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Urbanization and Infrastructure Development

Rising Demand for Energy Efficiency

Increasing Outsourcing Trends - Market Challenges

Skills Shortages in the Sector

Regulatory Compliance Issues - Opportunities

Adoption of Green Technologies

Innovative Smart Solutions - Trends

Digital Transformation in FM

Focus on Sustainability Practices - Government Regulation

Standards for Facility Management Services

Labor Laws and Employment Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Contracts Managed, 2019–2024

- By Average Price, 2019-2024

- By Service Type (In Value %)

Hard FM

– HVAC Maintenance

– Electrical Systems

– Plumbing & Water Management

– Fire Safety Systems

– Building Fabric Maintenance

Soft FM

– Housekeeping & Janitorial Services

– Landscaping & Pest Control

– Reception & Front Desk Management

– Mailroom Services

Integrated FM

– Total Facilities Outsourcing

– Bundled Hard & Soft Services

– End-to-End Facility Lifecycle Management

Security Services

– Manned Guarding

– CCTV Monitoring & Surveillance

– Access Control Systems

– Emergency & Fire Response

Environmental Services

– Waste Management

– Sustainability Audits

– Energy & Water Efficiency Services

– Green Building Support Services - By End-User Sector (In Value %)

Commercial

– Office Complexes

– Retail Malls

– Hospitality (Hotels, Resorts)

Residential

– Gated Communities

– Apartment Complexes

– Luxury Villas

Industrial

– Manufacturing Facilities

– Warehouses & Distribution Centers

– Logistics Parks

Healthcare

– Hospitals

– Clinics

– Diagnostic Centers

Education

– Universities

– K-12 Schools

– Technical Institutes - By Geography (In Value %)

Doha

Al Rayyan

Al Wakrah

Umm Salal

Lusail - By Service Delivery Method (In Value %)

Outsourced

– FM Service Contractors

– Multi-Vendor Service Management

– Public-Private Partnership (PPP) Models

In-house

– Self-managed Facility Teams

– Dedicated Facility Engineering Units

– Owner-operated Residential & Commercial Estates - By Technology Integration (In Value %)

IoT-Enabled Services

– Real-time Asset Monitoring

– Predictive Maintenance Tools

– Smart Energy Management Systems

Smart Building Technologies

– Integrated BMS Platforms

– Touchless Access & Automation

– AI-Enabled Cleaning & Scheduling

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Service Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Service Type, Number of Clients, Distribution Channels, Geographic Presence, Unique Value Offering, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis for Major Players

- Detailed Profiles of Major Companies

UGL Limited

ISS World

Sodexo

CBRE Group

Jones Lang LaSalle (JLL)

G4S

Compass Group

الفنار | Alfanar

Eram Group

Bilfinger SE

Emirates Facilities Management

Apleona

CEG International

Qatari Diar

First Service Brands

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Contracts Managed, 2025-2030

- By Average Price, 2025-2030