Market Overview

The Qatar Fighter Aircraft market has been shaped by its evolving defense needs and growing investment in enhancing national security capabilities. The market size is influenced by Qatar’s ongoing defense modernization plans, which have accelerated due to regional security concerns and a desire for advanced air power. The Qatar Emiri Air Force (QEAF) is upgrading its fleet with cutting-edge fighter aircraft, particularly with platforms like the F-15QA and potential future acquisitions such as the F-35. Qatar’s defense expenditure has steadily increased, reaching approximately USD 6 billion, with a significant portion allocated to enhancing its air combat capabilities. This steady investment ensures the market will continue to expand, with substantial procurement volumes expected over the next few years.

Qatar is a key player in the Middle Eastern defense sector, and its fighter aircraft market is dominated by the government’s strategic defense acquisitions. Qatar’s political stability and its position in the Gulf Cooperation Council (GCC) allow for robust defense partnerships, especially with global powers like the United States and European nations. Major players include the U.S. and European manufacturers like Boeing, Lockheed Martin, and Dassault Aviation, which supply advanced fighter jets tailored to Qatar’s needs. Qatar’s strategic location and defense posture, including its relationships with NATO and Gulf allies, drive its prominence in the market.

Market Segmentation

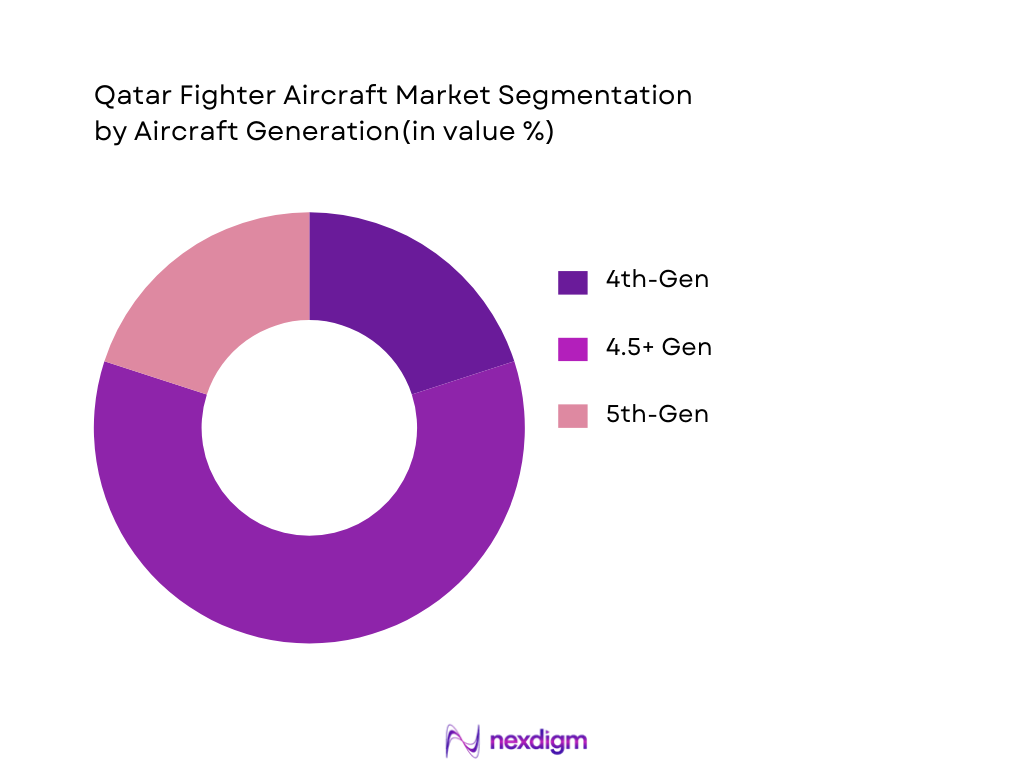

By Aircraft Generation

The Qatar Fighter Aircraft market is segmented by aircraft generation into 4th-gen, 4.5+ gen, and 5th-gen fighter aircraft. The 4.5+ generation aircraft, particularly the F-15QA, is leading the market due to its advanced avionics, long-range capabilities, and high interoperability with Qatar’s defense infrastructure. These aircraft offer an optimal balance between cost and performance, making them the preferred choice for modernizing Qatar’s fleet. This generation’s superiority in combat versatility and its advanced radar systems position it as a dominant force in Qatar’s defense strategy.

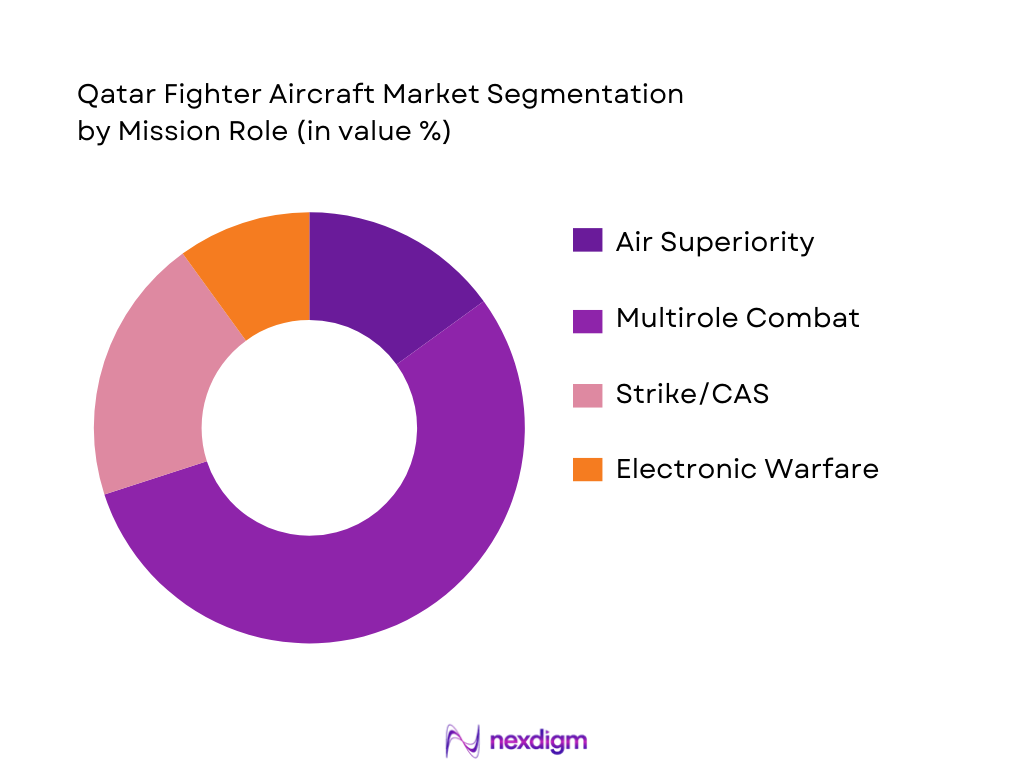

By Mission Role

The mission role segmentation in Qatar’s fighter aircraft market covers air superiority, multirole combat, strike, and electronic warfare. Multirole combat aircraft are dominating the market, as they offer flexibility in a variety of operational settings. The ability of these aircraft to perform multiple tasks—ranging from air superiority to strike missions—aligns well with Qatar’s defense objectives. These platforms are equipped with advanced sensor fusion and multirole capabilities, allowing Qatar’s air force to maintain a formidable presence both in defense and offensive operations, thus driving their dominance in the market.

Competitive Landscape

The Qatar Fighter Aircraft market is dominated by several key players, with U.S. and European companies leading the supply of next-generation fighter jets. Qatar has heavily invested in partnerships with companies like Boeing and Lockheed Martin, which are integral in providing high-tech aircraft like the F-15QA and potential future purchases like the F-35. The consolidation of defense contracts with these global aerospace companies highlights the dominance of these players in meeting Qatar’s strategic defense requirements.

| Company Name | Establishment Year | Headquarters | Aircraft Type | Production Capacity | Technology Level | Global Presence |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ |

| Saab | 1937 | Sweden | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Germany | ~ | ~ | ~ | ~ |

Qatar Fighter Aircraft Market Analysis

Growth Drivers

Strategic Defense Posture & Regional Threat Perception

Qatar’s defense strategy is shaped by its location in the Middle East, where ongoing regional tensions and threats from neighboring nations drive the demand for modernized air capabilities. Given the volatile security environment, Qatar focuses on ensuring its air force is equipped to address emerging threats. The need for an advanced fighter fleet to maintain air superiority and protect national security is central to its procurement decisions, fueling the demand for cutting-edge fighter aircraft to counter regional adversaries.

Air Power Modernization Initiatives

Qatar is dedicated to modernizing its air force, exemplified by the acquisition of advanced platforms like the F-15QA. The country’s focus on technological superiority includes potential future integration of 5th-generation fighters. This modernization is vital to maintaining a robust defense posture and strategic deterrence, ensuring Qatar’s air force remains competitive in an increasingly complex and challenging regional security landscape.

Challenges

Budgetary Constraints and Lifecycle O&S Costs

Despite substantial defense investments, Qatar faces budgetary constraints that limit its ability to continuously fund large-scale procurement. The high lifecycle and operational support costs for advanced fighter aircraft—such as maintenance, upgrades, and specialized personnel training—pose long-term financial challenges, affecting Qatar’s capacity for future acquisitions and military sustainability.

Integration of Legacy Forces with Next-Gen Platforms

Integrating next-generation fighter aircraft, like the F-15QA, with Qatar’s existing fleets of older aircraft presents a complex challenge. Ensuring interoperability between these diverse platforms requires significant investment in infrastructure, training, and technology. This integration process can strain defense budgets and extend the timeline for achieving full modernization, hindering the air force’s ability to operate at peak efficiency.

Opportunities

Potential F-35 Negotiations Revival

Although Qatar’s discussions to acquire F-35 aircraft were previously stalled, there remains potential for renewed negotiations. The acquisition of this 5th-generation fighter jet would provide Qatar with a technological edge and strengthen its defense capabilities, significantly enhancing air power. The addition of the F-35 would modernize Qatar’s fleet and improve its strategic position in the region.

Local Industry Growth via Offset & Tech Transfer

Qatar’s defense procurement strategy includes offset agreements and technology transfer initiatives. These agreements foster growth in the local aerospace and defense industries, enabling Qatar to build its own manufacturing and technical expertise. This local industry expansion not only strengthens Qatar’s long-term defense capabilities but also supports broader economic development by creating jobs and technological innovation in the aerospace sector.

Future Outlook

The Qatar Fighter Aircraft market is expected to witness steady growth in the coming years, driven by continuous modernization efforts, ongoing defense needs, and evolving security threats in the region. Qatar’s focus on acquiring the latest-generation fighter aircraft will be propelled by the need for advanced air combat capabilities to maintain regional security and assert air superiority. Additionally, collaborations with Western aerospace giants and an expanding defense budget further support the market’s positive growth trajectory. The procurement of next-generation platforms, especially multirole and advanced stealth aircraft, will remain central to Qatar’s defense strategy.

Major Players

- Boeing

- Lockheed Martin

- Dassault Aviation

- Saab AB

- BAE Systems

- Northrop Grumman

- Raytheon Technologies

- General Dynamics

- Leonardo S.p.A.

- Thales Group

- Airbus

- Pratt & Whitney

- Rolls-Royce

- Honeywell Aerospace

- MBDA

Key Target Audience

- Defense Ministry (Qatar Ministry of Defence)

- National Armed Forces (Qatar Emiri Air Force)

- Investments and Venture Capitalist Firms

- Aerospace and Defense Manufacturers

- Procurement Authorities (GCC Military Procurement Authorities)

- Government and Regulatory Bodies (Qatar National Security Council)

- Military Contractors and System Integrators

- Regional Defense Alliances and NATO Members

Research Methodology

Step 1: Identification of Key Variables

In this phase, a comprehensive stakeholder map is created to understand the ecosystem of the Qatar Fighter Aircraft market. This is achieved through a combination of primary and secondary research, including discussions with aerospace industry experts, suppliers, and defense professionals, in addition to analyzing government procurement documents.

Step 2: Market Analysis and Construction

This phase focuses on the historical data analysis of Qatar’s fighter aircraft procurement. The market’s growth trajectory is assessed by examining key parameters such as the volume of aircraft purchases, operational needs, and evolving defense strategies.

Step 3: Hypothesis Validation and Expert Consultation

We validate our research hypotheses through in-depth interviews with defense experts, senior military officials, and procurement specialists. These consultations help refine the market model by providing insights into procurement trends, platform preferences, and future requirements.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from interviews, government reports, and industry publications to provide a robust and well-validated outlook on the Qatar Fighter Aircraft market. This includes data verification through engagements with key suppliers and stakeholders to ensure accuracy in projections.

- Executive Summary

- Research Methodology (Market Definitions; Assumptions; Primary & Secondary Research; Defense Procurement Data Sources; Model Universe of Fighter Platforms; Forecasting Approach)

- Market Definition and Scope

- Industry Genesis and Defence Modernization Narrative

- Air Force Force Structure & Capability Roadmap

- Regional Strategic Dynamics Influencing Procurement

- Defense Budget Allocation & Fighter Aircraft Procurement Priorities

- Growth Drivers

Strategic Defense Posture & Regional Threat Perception

Air Power Modernization Initiatives

Alliance and Partnership Imperatives (US/EU/UK) - Challenges

Budgetary Constraints and Lifecycle O&S Cost

Integration of Legacy Forces with Next‑Gen Platforms

Export Controls & International Qualitative Military Edge (QME) Policies - Opportunities

Potential F‑35 Negotiations Revival

Local Industry Growth via Offset & Tech Transfer

Aerial ISR & UAV‑Manned Teaming Integrations - Trends

Shift to Sensor‑Fusion & Software‑Defined Fighters

Contract Structuring (Performance‑Based Logistics)

Regional Competitive Aircraft Procurements - Regulatory Environment

Qatar Defense Procurement Regulations

Export Licenses and Compliance

Certification Standards - SWOT Analysis (Market Capabilities vs External Threats)

- Porter’s Five Forces (Defense Contracting View)

- Stakeholder Ecosystem (Government, OEMs, Integrators, End Users)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Aircraft Generation (In Value %)

4th‑Gen (e.g., Rafale equivalents)

4.5+ Gen (e.g., Eurofighter/Advanced F‑15 variants)

5th Gen (Stealth platforms / F‑35 potential) - By Fighter Mission Role (In Value %)

Air Superiority

Multirole Combat

Strike/CAS

Electronic Warfare & SEAD/DEAD

Training/Lead‑in Fighter - By OEM/Prime Source Country (In Value %)

USA

Europe (UK/France/Germany/Italy Consortium)

Sweden

Other Exporters - By Acquisition Mode (In Value %)

New Build

Second‑hand / Pre‑owned Transfers

Lease/Interim Capability Contracts (gap fills) - By Key Performance Metrics (In Value %)

Thrust/Weight, Avionics Suite Tier, Sensor Fusion Level

Network‑Centric Capability Index

Interoperability Score (NATO/Coalition)

Lifecycle O&S Cost Bands

- Market Share by Platform & OEM (Value/Volume)

- Cross‑Comparison Parameters (Company Profile & Ownership, Strategic Positioning, Platform Tech Level (Gen/Avionics/Stealth Index), Procurement Value with Qatar Government, Support & Maintenance Footprint in Region, Aftermarket Services and Upgrade Pathways, Offset & Local Industry Commitments, Network Interoperability Scores, Production Capacity and Delivery Lead Times, Lifecycle Cost Estimation, Risk & Warranty Terms)

- SWOT of Key Competitors (Market Position & Capability)

- Pricing & Contract Structures Benchmarks

- Detailed Profiles of Major Competitors

Boeing (F‑15QA & F‑15EX Offerings)

Lockheed Martin (F‑35 Program / F‑16 Offerings)

Dassault Aviation (Rafale)

Airbus/Eurofighter GmbH (Eurofighter Typhoon)

Saab AB (Gripen / EW Offers)

BAE Systems

Northrop Grumman (Systems & Avionics)

Raytheon Technologies (Sensors & Missiles Integration)

General Dynamics (Force Protection & Training Systems)

Leonardo S.p.A. (Avionics & Support Systems)

Thales Group (Sensor & EW Suites)

MBDA (Missile Systems Suppliers)

Rolls‑Royce (Engine Supply/Service Agreements)

Honeywell Aerospace (Avionics/ENG Support)

Pratt & Whitney

- Qatar Emiri Air Force (QEAF) Force Structure & Capability Needs

- Operational Deployment Patterns

- Tactical Requirements and Procurement Drivers

- Decision Drivers (Range, Payload, Sensor Suite, Sustainment)

- Budget Prioritization & Acquisition Trade‑offs

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035