Market Overview

The Qatar Fire Fighting Aircraft market is expected to witness substantial growth, driven by increasing demand for efficient aerial firefighting systems. The market size in 2024 is valued at USD ~ million, supported by the region’s growing infrastructure and an increasing focus on safety measures. Market drivers include advancements in fire suppression technology and Qatar’s ongoing investments in modernizing its fire safety infrastructure. A key growth driver is the country’s proactive approach to preventing natural disasters, with aerial fire fighting systems being integral to the region’s disaster management plans. These developments contribute to expanding the market’s adoption of advanced firefighting aircraft, both for prevention and mitigation of wildfires and other disasters.

Qatar’s market dominance is fueled by the government’s heavy investments in emergency response systems, including aerial firefighting aircraft. The country’s strategic location, vulnerability to wildfires, and high occurrence of fire-related emergencies in industrial and oil & gas sectors make it a key player in the market. Cities such as Doha, with their extensive infrastructure and proximity to high-risk zones, drive the demand for specialized fire-fighting equipment, reinforcing the central role of Qatar in the Middle Eastern firefighting equipment market.

Market Segmentation

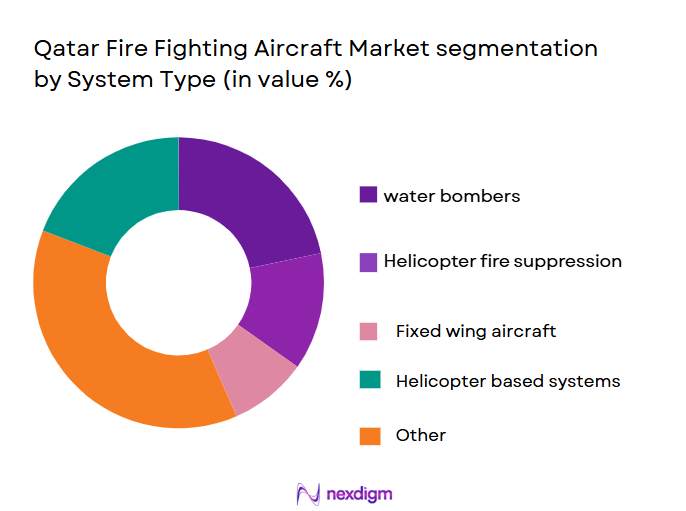

By System Type

The Qatar Fire Fighting Aircraft market is segmented by system type into various categories, including water bombers, helicopter fire suppression systems, and fixed-wing aircraft designed for fire fighting. The water bomber segment holds the dominant market share in 2024, primarily due to its versatility and high effectiveness in tackling large-scale wildfires, especially in arid regions like Qatar. Water bombers are used to deploy large amounts of water over fire zones, making them an essential tool for managing and controlling fires in vast open areas. Qatar’s extensive desert landscape and limited access to water sources further emphasize the critical role of water bombers in firefighting operations.

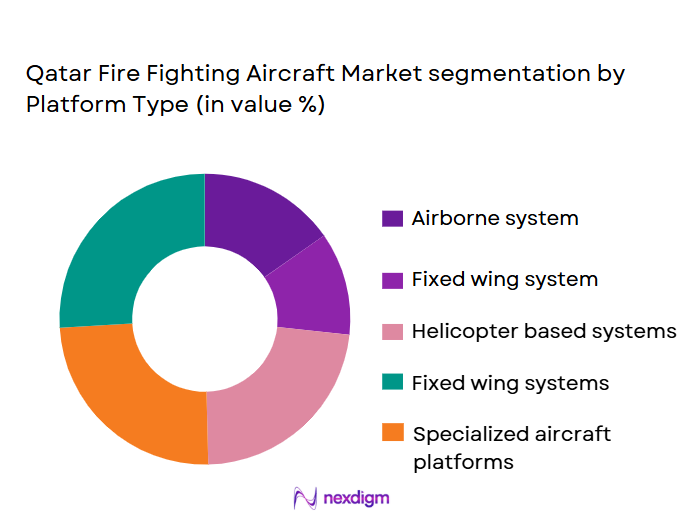

By Platform Type

The market is also segmented by platform type, including airborne systems, specialized aircraft platforms, fixed-wing platforms, and helicopter-based platforms. Airborne systems are anticipated to have the largest market share in 2024, owing to their ability to be rapidly deployed in various emergency situations. The flexibility of airborne platforms, which can carry a variety of firefighting systems, gives them an edge over traditional aircraft, ensuring that they remain a preferred choice for firefighting efforts. This trend is particularly evident in Qatar, where swift response times are crucial due to the country’s harsh environmental conditions and the need for fast deployment to combat fires.

Competitive Landscape

The Qatar Fire Fighting Aircraft market is highly competitive, with a mix of global and regional players vying for dominance. The market is primarily driven by a few large players, such as Bell Helicopter, Airbus Helicopters, and Lockheed Martin, which have established themselves through technological advancements, strong brand loyalty, and reliable product performance. These companies offer a range of aerial firefighting solutions tailored to meet Qatar’s specific fire-fighting needs. The market sees continuous product innovations from these players, especially in the areas of fuel efficiency, system integration, and automation. The consolidation of a few key players also suggests strong barriers to entry for new market participants, maintaining a level of stability in the competitive landscape.

| Company | Establishment Year | Headquarters | Aircraft Type | Product Offering | Market Focus | Innovation |

| Bell Helicopter | 1935 | United States | ~ | ~ | ~ | ~ |

| Airbus Helicopters | 2000 | France | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ |

| Boeing | 1916 | United States | ~ | ~ | ~ | ~ |

Qatar firefighting aircraft Market Analysis

Growth Drivers

Government Investments in Safety Infrastructure

The Qatari government is heavily investing in improving fire safety infrastructure, including advanced aerial firefighting equipment. This is part of a broader initiative to modernize emergency response systems, with a focus on protecting both urban and industrial areas, such as oil & gas facilities. The 2024 budget allocates substantial funds for this purpose, emphasizing the importance of proactive disaster prevention and ensuring that fire-fighting aircraft play a central role in these efforts.

Increasing Fire Risk Due to Climate Factors

Qatar’s arid climate and growing industrialization have heightened the risk of fires, particularly in industrial zones and large-scale construction projects. The frequency of natural disasters and fire incidents in surrounding regions of the Middle East also exacerbates the need for specialized fire-fighting aircraft. As a result, the market for aerial firefighting solutions is driven by the growing urgency for rapid and efficient fire management systems to mitigate these increasing fire risks.

Market Challenges

High Operational and Maintenance Costs

Operating and maintaining firefighting aircraft in Qatar presents significant financial challenges. The cost of acquiring, maintaining, and operating these aircraft, especially in Qatar’s harsh desert climate, is substantial. Additionally, skilled labor for these high-tech systems is limited, increasing operational expenses. This places a financial burden on both government agencies and private sector entities that rely on firefighting aircraft for rapid responses to emergencies.

Limited Availability of Local Suppliers

Qatar faces challenges in acquiring specialized firefighting aircraft due to the limited availability of local suppliers capable of meeting specific firefighting requirements. This reliance on international manufacturers and suppliers can lead to delays in procurement and maintenance. Moreover, the scarcity of skilled maintenance providers within the region further complicates the supply chain, limiting the overall growth of the market.

Opportunities

Rising Demand for Private Sector Participation

The private sector, especially in high-risk industries like oil & gas and large-scale construction, is increasingly investing in advanced fire safety measures. This trend is creating a growing demand for firefighting aircraft, both for private enterprises and as part of public-private partnerships. With Qatar’s strong focus on improving disaster management, this private-sector involvement is expected to boost the demand for aerial firefighting solutions and open up new market avenues.

Modernization of Existing Fleet

Qatar is undergoing a modernization process for its aging firefighting aircraft fleet. This presents a significant opportunity for the market, as the government and private sector look to replace outdated aircraft with newer, more efficient models. Modernizing the fleet will improve the country’s firefighting capabilities and ensure that aircraft are equipped with the latest technologies for more effective disaster management, presenting new growth prospects for suppliers and service providers.

Future Outlook

Over the next decade, the Qatar Fire Fighting Aircraft market is expected to experience steady growth, driven by ongoing infrastructure developments, increased wildfire prevention efforts, and technological advancements in firefighting aircraft. Additionally, the country’s strategic location and the increasing frequency of fire-related incidents are likely to further stimulate demand for specialized firefighting solutions. Investments in both government and private sectors are expected to increase, with a focus on enhancing the country’s capabilities to respond to disasters efficiently.

The market is projected to grow at a CAGR of ~% from 2026 to 2035, fueled by continued advancements in firefighting technology and the country’s commitment to enhancing its disaster management infrastructure. As demand for both public and private firefighting services increases, the need for advanced, cost-effective solutions will continue to drive market expansion.

Major Players in the Market

- Bell Helicopter

- Airbus Helicopters

- Lockheed Martin

- Embraer

- Boeing

- Sikorsky Aircraft

- Leonardo

- Textron Aviation

- Russian Helicopters

- GE Aviation

- Avro Aircraft

- Cessna

- Bombardier

- SAAB Group

- DynCorp International

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (e.g., Qatar Civil Defense, Ministry of Interior)

- Emergency management organizations

- Military and defense agencies

- Oil & gas industry stakeholders

- Firefighting service providers

- Aviation regulatory authorities

- Private sector corporations with fire safety requirements

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology is to identify the major variables impacting the Qatar Fire Fighting Aircraft market. This includes stakeholders such as government agencies, private sector contractors, and firefighting equipment manufacturers. Extensive desk research is conducted to collect secondary data from government reports, industry journals, and market surveys.

Step 2: Market Analysis and Construction

This phase involves constructing a comprehensive market model based on historical data, including past market performance and projected trends. Key metrics like the number of firefighting aircraft in operation, sales volumes, and market revenue are assessed. Additionally, data regarding consumer demand and purchasing behavior are incorporated to build a reliable market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Once hypotheses regarding market trends and drivers are developed, they are tested through consultations with industry experts. These experts, drawn from manufacturers, service providers, and government agencies, provide real-world insights that validate or refine the initial assumptions. This step ensures accuracy and reliability in the final market report.

Step 4: Research Synthesis and Final Output

In the final phase, the gathered data is synthesized into a cohesive market report, integrating both qualitative and quantitative insights. Direct engagement with key market players helps to gather final product performance and industry insights. This final synthesis provides an accurate and validated forecast for the Qatar Fire Fighting Aircraft market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing number of wildfires and natural disasters

Government investments in fire safety infrastructure

Technological advancements in aerial firefighting equipment - Market Challenges

High operational and maintenance costs of firefighting aircraft

Limited availability of specialized fire fighting aircraft in the region

Regulatory and certification complexities - Market Opportunities

Rising demand for private sector involvement in firefighting

Potential for modernization of existing fleets

Expansion of airport firefighting capabilities - Trends

Increasing adoption of automation in firefighting systems

Integration of drones and UAVs in aerial firefighting

Growing preference for multi-role firefighting platforms - Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aerial Fire Fighting Aircraft

Helicopter Fire Fighting Systems

Fixed-Wing Aircraft for Fire Fighting

Water Bombers

Helicopter Fire Suppression Systems - By Platform Type (In Value%)

Aerial Platforms

Airborne Systems

Helicopter-based Platforms

Fixed-Wing Platforms

Specialized Aircraft Platforms - By Fitment Type (In Value%)

OEM Installations

Retrofit Systems

Integrated Aircraft Systems

Standalone Fire Fighting Units

Custom-modified Aircraft for Fire Fighting - By EndUser Segment (In Value%)

Government Agencies

Private Firefighting Contractors

Military and Defense Agencies

Airport Firefighting Services

Oil & Gas Industry - By Procurement Channel (In Value%)

Direct Government Contracts

Private Purchases

Third-Party Distributors

OEM Suppliers

International Firefighting Agencies

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Installed Units, Regional Presence, Product Innovation, Pricing Strategy Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bell Helicopter

Airbus Helicopters

Bombardier

Lockheed Martin

Embraer

Saab Group

Boeing

Leonardo

Sikorsky Aircraft

Daimler AG

Textron Aviation

Russian Helicopters

GE Aviation

Avro Aircraft

Cessna

- Government agencies seeking efficient and rapid deployment systems

- Private contractors focusing on cost-effective solutions

- Military agencies requiring specialized firefighting units

- Oil & gas sector’s demand for large-scale fire suppression systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035