Market Overview

The Qatar fixed wing turbine aircraft market is driven by increasing demand in both the military and civilian aviation sectors. The market size is $~ largely influenced by Qatar’s growing defense expenditure and a surge in private aviation, supported by the nation’s rising wealth and strategic positioning as a hub for international air travel. The number of fixed-wing aircraft continues to rise as the demand for modern and fuel-efficient aircraft increases in both sectors. This expansion in the aircraft fleet is primarily supported by procurement from global manufacturers, as well as local defense initiatives.

Qatar remains a dominant player in the Gulf region for fixed-wing turbine aircraft. Its strategic location, high-income economy, and investment in military modernization make it an attractive market for both defense and civilian aviation companies. Cities like Doha, which serves as the economic and air transport hub, are central to the market’s development, benefiting from continuous government spending on advanced defense systems and a robust aviation infrastructure. These factors position Qatar as a leader in regional aviation, particularly in turbine-powered aircraft.

Market Segmentation

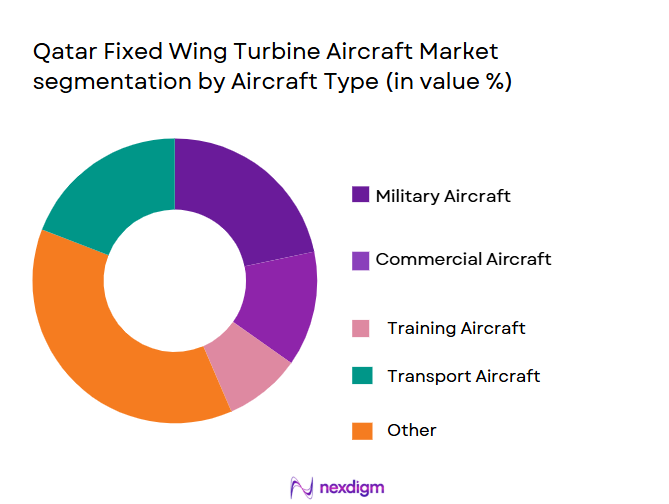

By Aircraft Type

The Qatar fixed wing turbine aircraft market is divided into segments based on aircraft type, with military and commercial aircraft being the dominant segments. Military aircraft, which include surveillance and transport planes, have the largest share in the market due to Qatar’s strategic investments in defense. The government’s continuous defense modernization plan, including procurement of advanced turbine-powered aircraft, has made military aircraft a key segment in the market. These aircraft are often utilized for surveillance, transport, and training missions. Additionally, the demand for commercial turbine aircraft is also high, driven by the growing demand for private and business aviation among the country’s affluent population and its status as a global air travel hub.

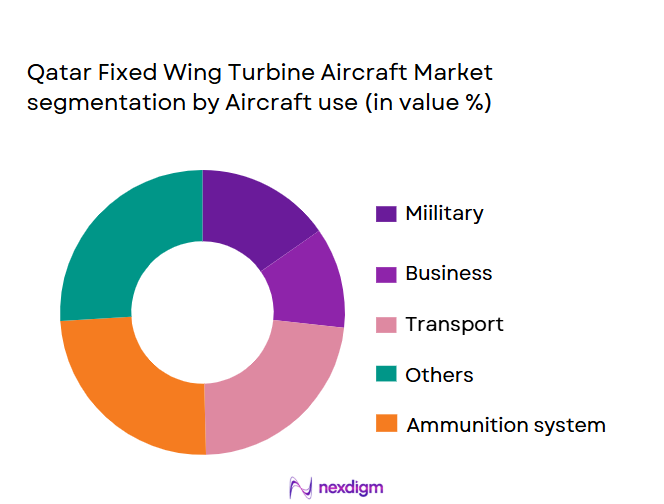

By Aircraft Use

The Qatar fixed wing turbine aircraft market is also segmented by aircraft use into military, business, and transport categories. The military segment holds the largest market share due to Qatar’s significant investments in its defense capabilities. This includes acquiring aircraft for surveillance, reconnaissance, and tactical missions. Business and private aviation are also growing sectors within the market as Qatar continues to experience a rise in the number of wealthy individuals and companies seeking advanced turbine-powered aircraft for personal or corporate use. The rise of Qatar Airways, coupled with increased air traffic in the region, drives the growth in business aviation, where the demand for high-performance turbine aircraft is growing rapidly.

Competitive Landscape

The Qatar fixed wing turbine aircraft market is dominated by a few major players, including global giants such as Boeing, Airbus, and Lockheed Martin, as well as local manufacturers and suppliers. These companies lead the market due to their advanced technology, extensive experience in the defense and commercial aviation sectors, and strong relationships with the government. Boeing and Airbus, for example, provide Qatar with a wide range of commercial aircraft, while Lockheed Martin and other defense contractors supply military aircraft. The market is highly competitive with a strong focus on innovation, performance, and sustainability.

| Company | Establishment Year | Headquarters | Aircraft Type | Focus Areas | Key Technologies | Regional Presence |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Gulfstream Aerospace | 1958 | Savannah, USA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, USA | ~ | ~ | ~ | ~ |

Qatar fixed wing turbine aircraft Market Dynamics

Growth Drivers

Increasing Demand for Military Aircraft

Qatar has significantly increased its military spending in recent years, with a focus on modernizing its air force. The country’s defense strategy emphasizes strengthening air power through the acquisition of advanced fixed-wing turbine aircraft. Qatar’s strategic investments in military infrastructure are driven by the need for enhanced surveillance, reconnaissance, and defense capabilities. This growing demand for advanced military aircraft is supported by Qatar’s defense budget allocation, which continues to rise as part of its national security strategy.

Expansion of Civilian Aviation

Qatar’s aviation sector, led by Qatar Airways, continues to experience rapid expansion. With the growth of business and leisure travel, particularly in the Middle East and Asia, there is an increasing demand for modern and fuel-efficient aircraft. Qatar Airways’ acquisition of new, advanced fixed-wing turbine aircraft and its expanding international routes are a clear indication of this trend. The rise in passenger numbers, combined with Qatar’s positioning as a global aviation hub, has contributed to a growing demand for both commercial and private fixed-wing aircraft in the region.

Market Challenges

High Operational Costs

The acquisition and maintenance of fixed-wing turbine aircraft in Qatar come with significant costs. Aircraft procurement, coupled with expensive maintenance and operational costs, presents a financial challenge for operators, especially smaller companies and private entities. Maintenance of turbine-powered aircraft requires specialized parts and services, and any disruption in the supply chain or increase in fuel prices can heavily impact operational efficiency. As Qatar continues to invest in advanced aircraft, the high operational expenses associated with these sophisticated systems could be a limiting factor for the market’s growth.

Regulatory Barriers

Qatar’s aviation sector is subject to stringent regulatory requirements imposed by the Qatar Civil Aviation Authority (QCAA) and international aviation bodies like the ICAO. These regulations ensure the safety, security, and environmental standards of aircraft operations but also create barriers for new entrants and existing players looking to expand quickly. Stringent certification processes for fixed-wing turbine aircraft can result in delays in aircraft deliveries and introduce additional compliance costs for operators. The evolving regulatory landscape in Qatar could be a challenge for companies looking to introduce new technologies or aircraft models in the market.

Opportunities

Infrastructure Development in Aviation

Qatar’s ongoing investments in aviation infrastructure, including the expansion of Hamad International Airport and new maintenance facilities, present significant opportunities for the fixed-wing turbine aircraft market. The airport’s continued development will facilitate the growth of both commercial and military aviation, providing a more extensive operational base for new aircraft. Furthermore, the growing demand for specialized aviation services, including aircraft maintenance and upgrades, creates opportunities for new partnerships and service providers to enter the market.

Strategic Defense Alliances

Qatar’s growing defense budget and its efforts to strengthen military capabilities open opportunities for partnerships with leading global defense contractors. The country is increasingly turning to international defense manufacturers to procure advanced military aircraft, which boosts demand for turbine-powered aircraft. Collaborations with firms that specialize in military aviation and defense technologies are expected to continue growing, which in turn supports market growth. These alliances also foster long-term maintenance, service contracts, and technology sharing, which are key growth opportunities for market players in the region.

Future Outlook

Over the next 5 years, the Qatar fixed wing turbine aircraft market is expected to witness substantial growth. This will be driven by Qatar’s ongoing investments in both defense and commercial aviation, as well as an increasing demand for advanced turbine-powered aircraft in business and military sectors. The market will benefit from a combination of technological advancements in aircraft performance and sustainability, as well as continued demand from affluent individuals and companies seeking high-performance aircraft for personal and corporate use. Additionally, the government’s efforts to enhance its defense infrastructure are expected to keep military aircraft demand high.

Major Players in the Market

- Boeing

- Airbus

- Lockheed Martin

- Gulfstream Aerospace

- Raytheon Technologies

- Dassault Aviation

- Bombardier

- Textron Aviation

- Northrop Grumman

- Honeywell Aerospace

- Pratt & Whitney

- General Electric

- Leonardo S.p.A.

- Saab AB

- Embraer

Key Target Audience

- Government Agencies (Ministry of Defense, Qatar Armed Forces)

- Airlines (Qatar Airways)

- Aircraft Manufacturers (Boeing, Airbus)

- Private Aviation Operators

- Defense Contractors (Lockheed Martin, Raytheon)

- Aircraft Leasing Companies

- Investors and Venture Capitalist Firms

- Regulatory Bodies (Civil Aviation Authority of Qatar)

Research Methodology

Step 1: Identification of Key Variables

This step involves constructing an ecosystem map of key stakeholders within the Qatar fixed wing turbine aircraft market. Desk research will be conducted to identify and define the critical variables impacting the market. This will involve analyzing secondary data sources, such as government publications and industry reports.

Step 2: Market Analysis and Construction

In this phase, historical data will be collected and analyzed to understand market trends and growth patterns. This will include an assessment of aircraft type preferences, procurement channels, and industry-specific financials. An analysis of supply chain dynamics and market penetration will also be performed.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics and future trends will be validated through consultations with industry experts. These will include manufacturers, suppliers, and operators who will provide insights into the operational and financial aspects of the market.

Step 4: Research Synthesis and Final Output

The final research phase will involve synthesizing the data gathered from secondary research and expert consultations. This will be used to create a comprehensive report, validating the market projections and key findings related to the Qatar fixed wing turbine aircraft market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

Market Definition and Scope

Value Chain & Stakeholder Ecosystem

Regulatory / Certification Landscape

Sector Dynamics Affecting Demand

Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Government and Military Spending

Demand for Efficient and Sustainable Aircraft

Growing Private Aviation Sector - Market Challenges

High Aircraft Acquisition Costs

Stringent Regulatory and Certification Requirements

Limited Local Manufacturing Capabilities - Market Opportunities

Expansion of Qatar’s Aviation Infrastructure

Rising Demand for Military and Surveillance Aircraft

Partnerships for Aircraft Maintenance and Upgrades - Trends

Adoption of Advanced Turbine Technology

Integration of Aircraft with Smart Systems

Increase in Aircraft Fleet Modernization

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Turbine Aircraft

Medium Turbine Aircraft

Heavy Turbine Aircraft

Business Aviation Turbine Aircraft

Military Turbine Aircraft - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Private Aircraft

Government Aircraft

Aerial Surveillance Aircraft - By Fitment Type (In Value%)

OEM Fitment

Retrofit

Upgraded Systems

New Aircraft Systems

Custom Fitment - By EndUser Segment (In Value%)

Commercial Airlines

Private Operators

Military

Government Agencies

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct Procurement

Through OEMs

Third-Party Vendors

Defense Contractors

Government Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Aircraft Performance, Fuel Efficiency, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversit Technology Integration, Cost of Ownership, Service Availability) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Qatar Airways

Qatar Aircraft Leasing Company

Emirates Airlines

Lockheed Martin

Airbus

Boeing

General Electric

Rolls-Royce

Honeywell Aerospace

Dassault Aviation

Bell Helicopter

Cessna

Gulfstream Aerospace

Textron Aviation

Raytheon Technologies

- Private operators seeking more fuel-efficient turbine aircraft

- Government investing in advanced surveillance aircraft

- Military focusing on modernizing fleet with turbine-powered aircraft

- Aircraft leasing companies expanding their portfolio with turbine aircraft

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035