Market Overview

The Qatar Flight Data Monitoring market is experiencing significant growth, primarily driven by increasing air traffic, the need for enhanced passenger safety, and technological advancements in flight data analysis. With Qatar’s expanding airline industry and its status as a global aviation hub, demand for sophisticated flight data systems is on the rise. As of 2024, the market size is valued at USD ~ million, reflecting a steady increase in installations and upgrades of flight data monitoring systems. This growth is supported by regulatory requirements for real-time data monitoring and analytics, along with the integration of advanced AI technologies for improved flight safety.

Qatar, specifically Doha, stands at the forefront of the flight data monitoring market. The city is home to Hamad International Airport, one of the busiest airports globally, contributing to a high demand for advanced aviation technologies. Other dominant countries include the UAE and Saudi Arabia, driven by large-scale infrastructure projects, growing aviation industries, and an increasing number of international flights. These regions prioritize safety standards, regulatory compliance, and technological innovations, which further boost the demand for flight data monitoring solutions in their aviation sectors.

Market Segmentation

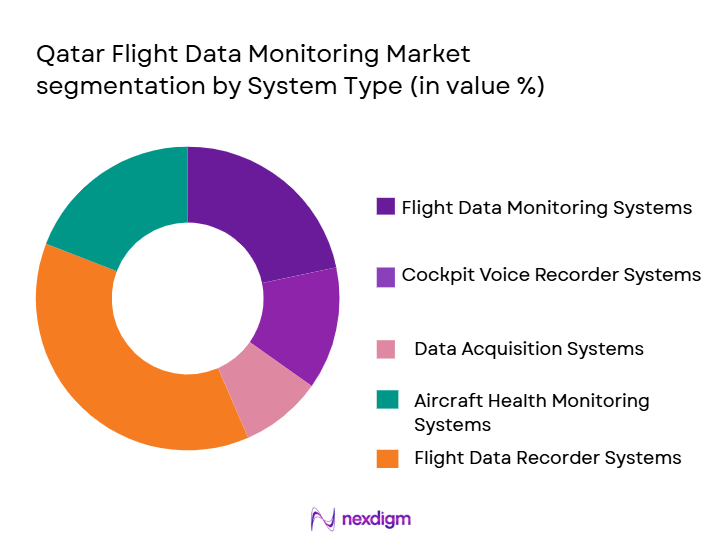

By System Type

The Qatar Flight Data Monitoring market is segmented by system type, encompassing flight data monitoring systems, cockpit voice recorders, data acquisition systems, aircraft health monitoring systems, and flight data recorders. Among these, flight data monitoring systems have the dominant market share in 2024, accounting for 35%. This segment leads due to the increasing emphasis on real-time data analysis for flight safety and operational efficiency. Airlines and aviation agencies are prioritizing the installation of flight data monitoring systems to comply with international aviation safety standards and enhance operational capabilities.

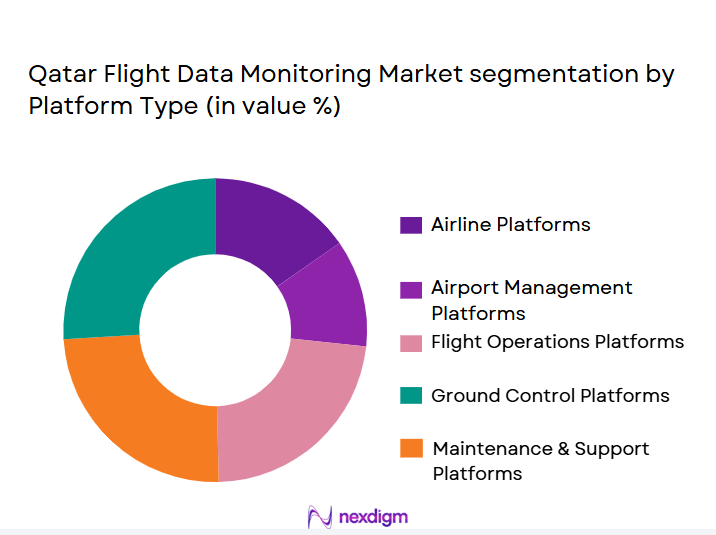

By Platform Type

The market is also segmented by platform type, including airline platforms, airport management platforms, flight operations platforms, ground control platforms, and maintenance & support platforms. Airline platforms dominate the segment with a market share of 40% in 2024. This dominance is driven by the growing number of airline operations and the need for integrated systems that offer seamless communication and real-time data analysis for enhanced safety. Airlines are increasingly investing in advanced flight monitoring systems to optimize their flight operations, improve passenger safety, and comply with global aviation regulations.

Competitive Landscape

The Qatar Flight Data Monitoring market is dominated by a few key players, both local and global, offering advanced solutions to meet the growing demand for flight safety and data analysis. Leading players include Honeywell, Thales Group, Collins Aerospace, Rockwell Collins, and Garmin. These companies hold substantial market share due to their expertise, innovation in flight data management, and global presence. The competition is intensifying as these players continually innovate to meet regulatory standards and satisfy the rising need for enhanced flight monitoring systems.

| Company Name | Establishment Year | Headquarters | Technology Focus | Key Products | Market Reach |

| Honeywell | 1906 | USA | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ |

| Rockwell Collins | 1973 | USA | ~ | ~ | ~ |

| Garmin | 1989 | USA | ~ | ~ | ~ |

Qatar flight data monitoring Market Dynamics

Growth Drivers

Increasing Air Traffic in Singapore and Southeast Asia

Singapore’s strategic location as a global aviation hub drives the demand for aircraft sensors, especially as air traffic continues to rise. Singapore Changi Airport, one of the busiest airports globally, handled 68.3 million passengers in 2024. This growth in air traffic is prompting airlines and airports to invest in advanced sensor systems for enhanced safety, efficiency, and monitoring. The demand for sensors that can monitor aircraft health, fuel efficiency, and environmental factors is expected to continue to grow in line with air traffic expansion across Southeast Asia.

Government Initiatives in Aviation Infrastructure

The Singapore government continues to invest heavily in its aviation infrastructure, including the upgrade and modernization of airport facilities and aircraft systems. The Changi Airport Terminal 5 project, which is set to increase capacity significantly, is expected to further drive the demand for aircraft sensors, which are integral to ensuring smooth operations. Additionally, Singapore’s push for smart airports and sustainable aviation technology increases the need for advanced sensor systems that enhance operational monitoring, safety, and maintenance.

Market Challenges

High Costs of Advanced Sensor Technologies

One of the major challenges facing the Singapore Aircraft Sensors market is the high cost of advanced sensor technologies. Implementing cutting-edge sensors, such as those for real-time health monitoring, structural health monitoring, and engine performance analysis, requires substantial investment. This presents a challenge for smaller airlines or airports with limited budgets, especially in the face of growing operational costs. Additionally, the maintenance and upgrading of these sophisticated sensors over time adds to the financial burden, making it difficult for some players to adopt the latest technologies.

Integration with Legacy Systems

Many of the aircraft operating in Singapore’s airspace still rely on legacy systems that are not fully compatible with newer sensor technologies. The integration of advanced sensors with these older systems can be a complex and costly process, often leading to inefficiencies and delayed upgrades. Airlines and MRO (Maintenance, Repair, and Overhaul) providers may face challenges in ensuring compatibility between older aircraft and the latest sensor technologies, potentially hindering the overall performance and benefits of these innovations.

Opportunities

Adoption of IoT and Smart Sensors

The growing adoption of Internet of Things (IoT) technologies and smart sensors in the aviation sector offers significant opportunities for the Singapore Aircraft Sensors market. IoT-enabled sensors allow real-time data collection and monitoring, which can enhance aircraft performance, reduce maintenance costs, and improve safety. As airlines and airports increasingly invest in digital transformation and smart aviation solutions, there is a growing demand for IoT-based sensors that can monitor aircraft systems in real-time. Singapore’s push towards becoming a smart city, including its smart airport initiatives, is a key driver of this trend.

Focus on Sustainable Aviation Technologies

The increasing emphasis on sustainability in aviation presents opportunities for the aircraft sensors market in Singapore. As airlines work to meet global environmental standards, there is a growing demand for sensors that can monitor fuel efficiency, emissions, and other environmental factors. Singapore Airlines, for example, is actively seeking to reduce its carbon footprint by integrating energy-efficient technologies. Aircraft sensors that monitor energy consumption and optimize flight paths for reduced emissions will be key to meeting these sustainability targets, offering significant market opportunities.

Future Outlook

Over the next decade, the Qatar Flight Data Monitoring market is expected to experience considerable growth, driven by the increasing need for real-time flight data analysis, enhanced flight safety, and the ongoing expansion of Qatar’s aviation sector. Technological advancements, such as the integration of AI and machine learning in flight data systems, are set to further improve operational efficiencies and safety standards. Additionally, the growing adoption of cloud-based flight monitoring solutions is anticipated to enhance market growth by offering cost-effective, scalable options for airlines and aviation companies.

Major Players

- Honeywell

- Thales Group

- Collins Aerospace

- Rockwell Collins

- Garmin

- Airbus

- Boeing

- Safran

- L3 Technologies

- SITA

- Avionics Services

- Indra Sistemas

- Navtech

- GE Aviation

- UTC Aerospace Systems

Key Target Audience

- Airlines and Aviation Operators

- Airport Management Authorities (e.g., Qatar Civil Aviation Authority)

- Aviation Safety Regulatory Bodies (e.g., ICAO, FAA)

- Aircraft Manufacturers

- Aerospace Technology Providers

- Aircraft Maintenance, Repair, and Overhaul (MRO) Companies

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar Flight Data Monitoring market. This step includes extensive desk research using secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical market variables influencing flight data systems.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data related to the Qatar Flight Data Monitoring market, including system penetration, sales data, and revenue generation. An evaluation of service quality and technology adoption will be conducted to ensure the accuracy of the market estimates and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with industry experts from aviation technology providers, regulatory bodies, and major airlines. These consultations will help refine assumptions and provide critical insights into product adoption rates and future market trends.

Step 4: Research Synthesis and Final Output

The final stage includes collaboration with key manufacturers and stakeholders to refine the findings. Product segment performance, consumer preferences, and market dynamics will be validated through additional consultations and verification with bottom-up analysis. This will ensure a robust and validated analysis of the market’s future trajectory.

- Executive Summary

- Qatar Flight Data Monitoring Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing air traffic in Qatar and the Gulf region

Technological advancements in flight data analysis

Rising demand for passenger safety and security - Market Challenges

High cost of installation and maintenance

Complex regulatory requirements for data security

Integration issues with legacy systems - Market Opportunities

Adoption of AI and machine learning for data analysis

Expansion of Qatar’s airline industry

Growing demand for real-time flight monitoring systems - Trends

Emergence of cloud-based flight data management solutions

Increasing collaboration between airlines and tech providers

Integration of IoT in flight data collection systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight Data Monitoring Systems

Cockpit Voice Recorder Systems

Data Acquisition Systems

Aircraft Health Monitoring Systems

Flight Data Recorder Systems - By Platform Type (In Value%)

Airline Platforms

Airport Management Platforms

Flight Operations Platforms

Ground Control Platforms

Maintenance & Support Platforms - By Fitment Type (In Value%)

New Aircraft Fitment

Retrofit Systems

Upgrades & Replacements

Emergency System Fitment

Modular Fitment - By EndUser Segment (In Value%)

Commercial Airlines

Government Agencies

Private Jet Operators

Cargo & Freight Airlines

Airline Maintenance Companies - By Procurement Channel (In Value%)

Direct Procurement

Supplier Partnerships

Third-party Resellers

OEM Network Procurement

Online Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market share, System complexity, Installation type, Platform type, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Fitment type) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Qatar Airways

Airbus

Boeing

Honeywell

Collins Aerospace

Thales Group

Garmin

Rockwell Collins

Safran

Daimler

L3 Technologies

SITA

Navtech

Avionics Services

Indra Sistemas

- Increased demand from commercial airlines for real-time flight data

- Government agencies focusing on flight data security

- Private jet operators seeking advanced monitoring systems

- Cargo airlines adopting flight data systems for operational efficiency

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035