Market Overview

The Qatar flight inspection market is valued at USD ~ million, driven primarily by the expansion of the aviation sector and increasing regulatory demands for aviation safety and compliance. Market growth is fueled by government initiatives to enhance the safety and performance of air traffic systems. Qatar’s strategic investments in aviation infrastructure, including state-of-the-art flight inspection technologies, further bolster market growth. Additionally, the rapid increase in air traffic volumes and flight operations across the Middle East contributes significantly to the demand for advanced flight inspection systems.

Qatar is a dominant player in the flight inspection market due to its strategic location as a major aviation hub in the Middle East. Cities like Doha are at the forefront, with Hamad International Airport serving as a key gateway for international flights. The country’s investments in infrastructure, along with the continuous growth of Qatar Airways, have positioned it as a leading market for flight inspection services. The growing demand for air traffic management and the regulatory requirements of the Gulf Cooperation Council (GCC) countries further enhance Qatar’s prominence in this market.

Qatar Flight Inspection Market Segmentation

By System Type

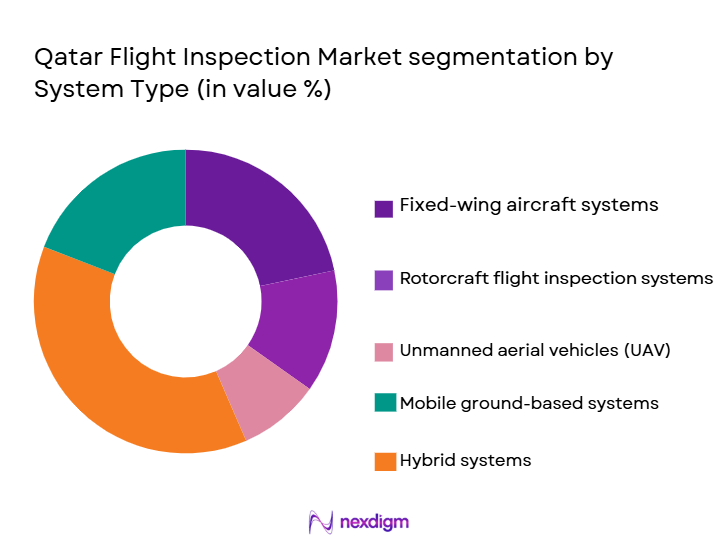

The Qatar flight inspection market is segmented by system type into fixed-wing aircraft systems, rotorcraft flight inspection systems, unmanned aerial vehicles (UAV), mobile ground-based systems, and hybrid systems. Currently, fixed-wing aircraft systems dominate the market share due to their ability to cover large geographic areas efficiently. Fixed-wing systems are widely used for their long endurance, speed, and reliability in performing thorough and consistent flight inspections. Additionally, these systems are preferred for large-scale, routine inspections of airways, runways, and air navigation facilities.

By Platform Type

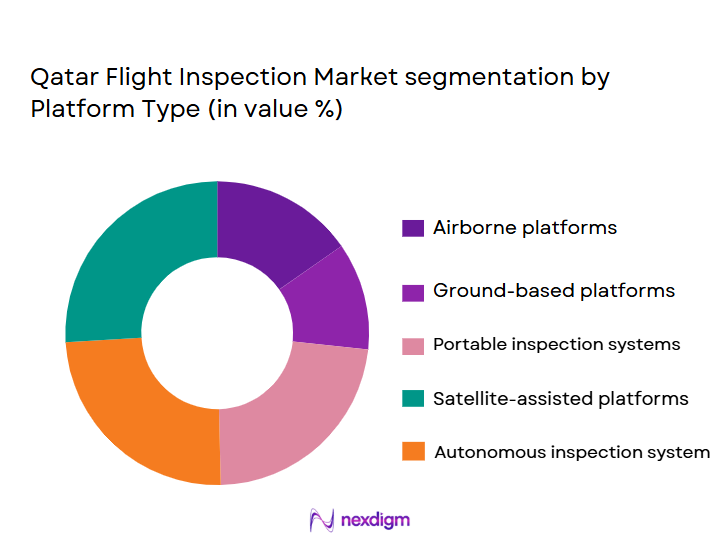

The Qatar flight inspection market is segmented by platform type into airborne platforms, ground-based platforms, portable inspection systems, satellite-assisted platforms, and autonomous inspection systems. Airborne platforms currently hold the largest market share in the region, mainly due to their capability to inspect large areas in a single mission. Airborne systems are essential for inspecting airports, airspace, and air navigation systems with high accuracy and efficiency. The increasing adoption of unmanned systems for flight inspections is driving the demand for both airborne and UAV platforms.

Qatar Flight Inspection Competitive Landscape

The Qatar flight inspection market is characterized by the presence of key global players offering advanced technologies and solutions. These include companies like Honeywell Aerospace, Rockwell Collins, and L3Harris Technologies, which dominate due to their technological expertise, extensive product offerings, and strong customer relationships. Additionally, local players such as Qatar Airways and Aviation Technology Qatar are also significant contributors to the market, focusing on tailored solutions for local needs. The market consolidation is evident as these key players leverage strategic partnerships to expand their offerings and enhance market penetration.

| Company Name | Establishment Year | Headquarters | Technology Adoption | Service Portfolio | Market Penetration | R&D Investment | Customer Base | Strategic Partnerships | Regulatory Compliance | Product Innovation |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | United States | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Aviation Technology Qatar | 2005 | Qatar | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Qatar Airways | 1993 | Qatar | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar flight inspection Market Dynamics

Growth Drivers

Expansion of Singapore’s Aviation Sector

Singapore’s aviation industry continues to experience robust growth, driven by the country’s strategic location as a global aviation hub and the increasing demand for air travel across Asia. With Changi Airport’s expanding capacity and Singapore Airlines’ fleet modernization initiatives, the demand for advanced aircraft sensors to ensure safety, efficiency, and performance of aircraft systems is on the rise. The government’s commitment to supporting the aviation sector, as outlined in its long-term infrastructure plans, further accelerates the need for cutting-edge sensor technologies to enhance flight operations.

Technological Advancements in Aircraft Sensor Systems

The development of next-generation aircraft sensors is a key factor fueling the market’s growth in Singapore. These advanced sensors, such as those used for navigation, environmental monitoring, and flight data analysis, play a crucial role in enhancing aircraft safety and performance. The rapid advancements in sensor technologies, such as IoT-enabled sensors and AI-driven systems, have led to greater efficiency and reliability, meeting the growing demands for precise flight monitoring and data collection. As aircraft become more technologically advanced, the need for high-performance sensors is expected to increase significantly.

Market Challenges

High Costs of Sensor Integration and Maintenance

One of the primary challenges facing the Singapore aircraft sensors market is the high cost of integrating and maintaining advanced sensor systems within aircraft. The initial investment required for the installation of state-of-the-art sensors, along with the long-term maintenance costs, can be substantial. For airlines and manufacturers, these expenses can limit the adoption of cutting-edge sensor technologies, especially smaller fleets. Despite the technological benefits, the cost factor remains a key barrier to widespread adoption, particularly in an industry with tight profit margins.

Complex Regulatory Requirements

The aircraft sensors market in Singapore is also hindered by stringent regulatory requirements imposed by aviation authorities. Sensors used in aircraft must adhere to strict standards and certifications set by bodies such as the Civil Aviation Authority of Singapore (CAAS). Compliance with these regulations requires significant time and investment, slowing down the adoption of new technologies. Additionally, the lengthy certification processes for new sensor systems can delay their integration into commercial fleets, presenting a challenge for manufacturers and operators looking to modernize their aircraft systems.

Opportunities

Increasing Demand for Autonomous Aircraft and Advanced Sensors

The rise of autonomous aircraft and unmanned aerial vehicles (UAVs) in the aviation sector presents a significant opportunity for the aircraft sensors market in Singapore. As UAVs and autonomous flight systems gain traction, the need for advanced sensors to ensure safety, navigation, and flight stability will increase. The integration of AI, machine learning, and sensor fusion technologies into aircraft systems creates opportunities for the development of sophisticated sensor solutions that meet the needs of these cutting-edge aircraft technologies.

Growing Focus on Aircraft Safety and Environmental Monitoring

As the global aviation industry focuses more on sustainability and safety, the demand for aircraft sensors that monitor environmental factors, fuel efficiency, and flight performance is growing. Singapore, being a leader in aviation safety and environmental stewardship, is increasingly adopting sensors that can improve fuel consumption, reduce emissions, and enhance overall aircraft safety. The push for greener and more efficient aircraft technologies opens up opportunities for sensor manufacturers to develop innovative solutions that help airlines comply with stricter environmental regulations while improving operational efficiency.

Future Outlook

Over the next decade, the Qatar flight inspection market is poised for significant growth driven by technological advancements, increasing air traffic, and the need for more stringent safety standards in the aviation industry. The growing demand for automated flight inspection systems, such as unmanned aerial vehicles (UAVs), will play a key role in shaping the future of this market. Additionally, Qatar’s focus on modernizing its aviation infrastructure and its role as a major international aviation hub ensures continued demand for flight inspection services. Innovations in AI and machine learning, coupled with growing regulatory frameworks across the GCC, will further enhance the market’s prospects.

Major Players

- Honeywell Aerospace

- Rockwell Collins

- L3Harris Technologies

- Aviation Technology Qatar

- Qatar Airways

- FLIR Systems

- Airbus

- Boeing

- Garmin

- Textron Aviation

- Collins Aerospace

- General Electric

- AeroTech Aviation

- Flight Safety International

- SensoTech

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Qatar Civil Aviation Authority)

- Air traffic management authorities

- Airline operators and aviation service providers

- Airport infrastructure developers

- Military and defense agencies

- Aviation safety and compliance organizations

- Aviation technology manufacturers and suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar flight inspection market. This step involves detailed desk research and the utilization of secondary and proprietary databases to collect comprehensive industry-level data. The goal is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data relating to the Qatar flight inspection market will be compiled and analyzed. This includes examining market penetration, the ratio of service providers, and related revenue generation. An assessment of the market’s size, including geographical and technological factors, will be conducted to ensure accurate insights.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the market dynamics will be developed and validated through direct consultations with industry experts. These consultations will provide operational and financial insights from companies in the flight inspection industry, ensuring the credibility and accuracy of the data.

Step 4: Research Synthesis and Final Output

The final phase involves interacting with flight inspection service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other relevant factors. This interaction will serve to validate the statistics derived from previous steps and ensure a comprehensive and accurate analysis.

- Executive Summary

- Qatar Flight Inspection Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government investments in aviation infrastructure

Increase in air traffic and flight safety regulations

Advancements in UAV technology for inspection - Market Challenges

High initial investment costs for advanced inspection systems

Regulatory and certification hurdles for new technologies

Dependency on weather and environmental factors for inspection - Market Opportunities

Expanding demand for UAV-based flight inspection services

Growing need for regulatory compliance in emerging airspaces

Technological advancements driving demand for cost-effective systems - Trends

Integration of AI and machine learning for automated inspections

Rise in autonomous flight inspection platforms

Growth in public-private partnerships in aviation infrastructure

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed-wing aircraft systems

Rotorcraft flight inspection systems

Unmanned aerial vehicles (UAV)

Mobile ground-based systems

Hybrid systems - By Platform Type (In Value%)

Airborne platforms

Ground-based platforms

Portable inspection systems

Satellite-assisted platforms

Autonomous inspection systems - By Fitment Type (In Value%)

Retrofit systems

New installation systems

Modular flight inspection systems

Custom-built systems

Pre-engineered systems - By End-user Segment (In Value%)

Civil aviation authorities

Private aviation operators

Airlines and flight schools

Regulatory and compliance agencies

Military and defense organizations - By Procurement Channel (In Value%)

Direct sales

Distributor/Channel partner sales

Online platforms

Government contracts

Tender-based procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market share, growth rate, technology adoption, customer base, service diversification Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Qatar Airways

Aviation Technology Qatar

Flight Safety International

Aerotech Aviation

Boeing

Honeywell Aerospace

Airbus

Textron Aviation

NATA Aviation Services

FLIR Systems

L3Harris Technologies

Rockwell Collins

Collins Aerospace

Garmin

General Electric

- Increased demand for flight inspection services from commercial airlines

- Rising safety and compliance concerns in the aviation sector

- Emergence of new entrants in the aviation sector requiring inspection services

- Increasing number of government-led aviation initiatives

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035