Market Overview

The Qatar Flight Management Systems market is driven by the increasing demand for advanced technological systems to enhance air traffic control and improve operational efficiency in the aviation industry. The market is valued at USD ~billion in 2024, with growth attributed to government-backed infrastructure investments, an expanding aviation sector, and the rising importance of automation and safety measures in airspace management. The need for innovative flight management solutions is further supported by the growing commercial aviation industry and the adoption of cloud-based technologies. Qatar’s market benefits from the nation’s investments in upgrading its aviation infrastructure and aligning with international safety and operational standards.

Qatar is one of the dominant players in the Middle East’s flight management systems market due to its strategic location, which serves as a hub for international air traffic. Key airports, such as Hamad International Airport, are at the forefront of technological advancements, making Qatar a leader in the adoption of flight management systems. The country’s investments in the aviation sector, coupled with ongoing projects like the expansion of airport capacity and the development of air traffic control systems, have bolstered its position as a key player in the market. Furthermore, Qatar’s strategic role in regional and international air traffic has prompted a surge in demand for more sophisticated management solutions to ensure smooth and safe operations.

Market Segmentation

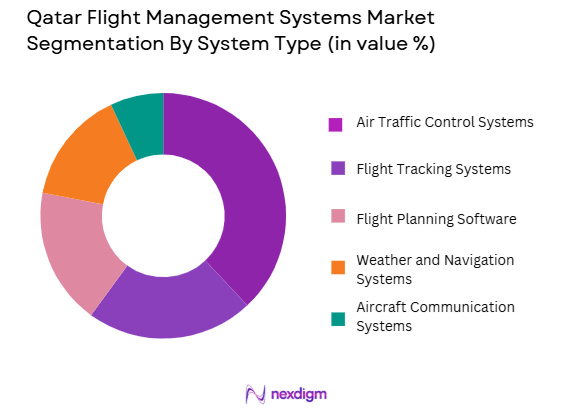

By System Type

The Qatar Flight Management Systems market is segmented by system type into air traffic control systems, flight tracking systems, flight planning software, weather and navigation systems, and aircraft communication systems. Among these, air traffic control systems hold a dominant share in the market due to their essential role in managing the increasing volume of air traffic and ensuring the safety of flights. Qatar’s emphasis on maintaining an efficient and safe airspace, supported by government-backed infrastructure initiatives, has led to the widespread adoption of advanced air traffic control solutions, driving the market for these systems. With the increasing number of flights passing through Qatar’s airspace, the demand for high-end, automated air traffic management systems is expected to continue to grow, leading this market segment to maintain its dominant share.

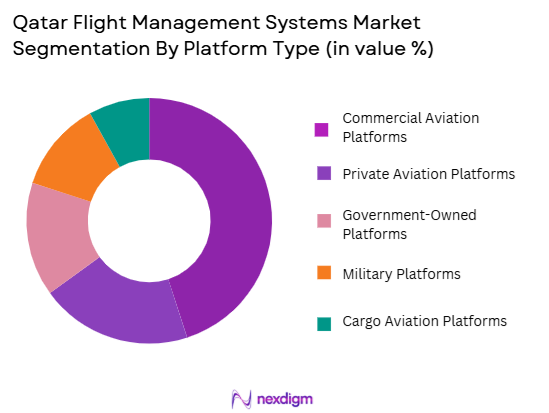

By Platform Type

The Qatar Flight Management Systems market is segmented by platform type into commercial aviation platforms, private aviation platforms, government-owned platforms, military platforms, and cargo aviation platforms. Among these, commercial aviation platforms lead the market in terms of share due to the substantial number of commercial flights operating through Qatar. The nation’s growing international tourism and business travel sectors drive the demand for sophisticated flight management systems that cater to commercial airlines. Additionally, Qatar’s large fleet of commercial aircraft further reinforces the dominance of this segment, as airlines seek to implement state-of-the-art technology for efficient and safe flight operations. The commercial aviation sector’s continued growth, alongside Qatar’s position as a global aviation hub, ensures the market’s expansion in this segment.

Competitive Landscape

The Qatar Flight Management Systems market is dominated by key global players with a significant presence in the Middle East region. These companies include major aerospace and aviation technology providers that supply state-of-the-art systems for air traffic management, flight planning, communication, and navigation. The market is characterized by a few dominant players, including multinational corporations that have established themselves as trusted partners in the region due to their expertise in aviation systems and their ability to meet Qatar’s high standards for safety and operational efficiency. Some of the leading companies in this space are Honeywell Aerospace, Rockwell Collins, and Thales Group. These companies provide advanced solutions, and their long-term collaborations with governments and major airlines have solidified their market positions.

| Company Name | Establishment Year | Headquarters | Market Share (%) | System Type Expertise | Regional Focus | Product Innovation |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ |

| SITA | 1949 | Switzerland | ~ | ~ | ~ | ~ |

Qatar Flight Management Systems Market Analysis

Growth Drivers

Increased Air Traffic and Airline Expansion

A key driver in the Qatar Flight Management Systems market is the rapid increase in air traffic, which directly necessitates the adoption of advanced flight management systems to ensure efficient flight operations. Qatar’s strategic location as a global aviation hub further accelerates the demand for flight management systems. Doha’s Hamad International Airport serves as a major transshipment point for global airlines, driving the need for improved air traffic control systems. This increase in air traffic is complemented by the ongoing expansion of Qatar Airways, one of the largest airlines in the world, which continues to increase its fleet size. As airlines invest in newer and larger fleets, they require more advanced flight management systems to maintain operational efficiency, optimize fuel consumption, and ensure passenger safety. Qatar’s regulatory body, the Qatar Civil Aviation Authority (QCAA), has also implemented stricter safety standards and digitalization initiatives, further pushing the demand for advanced systems. Furthermore, the government’s investments in aviation infrastructure and technological upgrades at key airports enhance the integration of flight management systems. This trend is expected to continue with the further expansion of global air travel and the growing complexity of air traffic systems.

Technological Advancements and AI Integration

Technological advancements, particularly in AI and IoT, are playing a significant role in the growth of the Qatar Flight Management Systems market. The integration of AI in flight management systems allows for real-time data analysis, predictive maintenance, and optimization of flight routes. Qatar has been investing heavily in technology-driven solutions, and the integration of AI in aviation is becoming more pronounced. The adoption of IoT enables the seamless collection and exchange of real-time data, improving decision-making in flight operations. As Qatar’s aviation sector expands and modernizes, the demand for these advanced systems increases, with airlines and airports seeking more sophisticated solutions to improve operational efficiency, reduce delays, and enhance passenger experience. The convergence of AI, IoT, and cloud computing further strengthens the capabilities of flight management systems, making them indispensable in managing complex air traffic and operational logistics. The Qatar government’s focus on technological advancements in aviation, including the use of AI for air traffic management and optimization, will continue to drive the market.

Market Challenges

High Initial Investment and Implementation Costs

One of the primary challenges in the Qatar Flight Management Systems market is the high initial investment required for the installation and integration of these systems. Advanced flight management systems often come with significant upfront costs, which can deter smaller airports and carriers from adopting these technologies. Additionally, the complex integration of these systems into existing aviation infrastructure requires substantial financial and human resources. For Qatar’s national carriers and airports, this high cost of adoption is a major concern. As the government pushes for more sophisticated technology, airlines may face budget constraints, especially when considering the expense of upgrading entire fleets and training personnel. While the long-term benefits, such as enhanced operational efficiency and fuel savings, may offset these costs, the initial financial outlay remains a barrier for some entities within the aviation ecosystem.

Regulatory Challenges and Compliance Issues

The stringent regulatory environment governing flight management systems, along with the need for compliance with international aviation safety standards, presents a significant challenge. In Qatar, the Qatar Civil Aviation Authority (QCAA) oversees the aviation sector, and any new technology must comply with both national and international regulations, including those set by the International Civil Aviation Organization (ICAO). Ensuring that all flight management systems meet the necessary safety, security, and operational standards can lead to delays in the deployment of new technologies. Furthermore, the continuous changes in regulations to enhance aviation safety and reduce environmental impacts could require additional modifications to flight management systems. These regulatory challenges can slow down market growth, as technology providers and airlines must adapt their systems to meet evolving compliance requirements.

Opportunities

Growth in Air Travel and Demand for Efficient Air Traffic Management

Qatar’s position as a growing global aviation hub presents a substantial opportunity for the flight management systems market. The rapid growth in passenger numbers, particularly with Qatar Airways expanding its international network, calls for advanced systems to manage air traffic efficiently. The ongoing development of the Hamad International Airport and other regional airports creates a favorable environment for the adoption of cutting-edge flight management systems. These systems are essential for managing complex airspace, ensuring that Qatar maintains its status as a key player in the global aviation sector. Additionally, as air traffic continues to rise, Qatar’s aviation infrastructure will require ongoing upgrades, creating significant opportunities for technology providers in the flight management systems space. The government’s continued focus on aviation infrastructure development and its initiatives to boost air traffic capacity offer a promising growth avenue for the market.

Integration of Smart City Technologies with Aviation Systems

With Qatar’s ambitious plans for smart city initiatives, particularly within the capital city of Doha, there is a growing opportunity to integrate flight management systems with smart city technologies. The synergy between smart city infrastructure and aviation systems can lead to improved air traffic management, better fuel efficiency, and enhanced safety measures. Integrating flight management systems with smart city technologies will allow for more seamless coordination between various transportation modes, improving overall urban mobility. The increasing use of IoT and AI in both sectors will likely drive the convergence of these technologies, creating new opportunities for innovation and expansion within the flight management systems market. As Qatar continues to embrace smart city initiatives, the need for advanced, connected systems in aviation will only intensify, offering a significant opportunity for market players.

Future Outlook

Over the next decade, the Qatar Flight Management Systems market is expected to show steady growth driven by the continued expansion of the country’s aviation sector, significant government investments in air traffic management infrastructure, and the increasing adoption of advanced technologies such as automation and artificial intelligence. Qatar’s ambition to maintain a leading position in global aviation and its focus on enhancing safety standards will continue to drive demand for state-of-the-art flight management solutions. The market will also benefit from innovations in communication, navigation, and flight planning technologies, contributing to the expansion of the market for flight management systems.

Major Players in the Market

- Honeywell Aerospace

- Rockwell Collins

- Thales Group

- Collins Aerospace

- SITA

- Garmin Ltd.

- Cobham PLC

- L3 Technologies

- Saab AB

- FLIR Systems

- Raytheon Technologies

- NavAero

- AeroVironment

- Boeing

- Airbus

Key Target Audience

- Airlines

- Aircraft Manufacturers

- Aviation Service Providers

- Air Traffic Management Authorities

- Airport Authorities

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Freight and Logistics Companies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the key drivers, restraints, and opportunities in the Qatar Flight Management Systems market. This includes analyzing historical data and conducting in-depth desk research using secondary databases to develop a comprehensive understanding of market trends and forecasts.

Step 2: Market Analysis and Construction

The market analysis phase includes compiling and analyzing market data based on key segments, including system type, platform type, and end-user demand. The goal is to assess market dynamics, such as demand for specific system types, and the effect of technological advancements on market growth.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted through structured interviews with industry leaders and stakeholders to validate hypotheses and ensure the accuracy of the data. These consultations help gather insights into operational strategies, technology adoption, and regional dynamics influencing the market.

Step 4: Research Synthesis and Final Output

In the final stage, the data is synthesized, and detailed market reports are prepared. This phase involves engagement with key market players, including system providers and end-users, to verify the market insights and refine the final report.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for automation in flight operations

Government investments in aviation infrastructure

Rising need for enhanced air traffic management systems - Market Challenges

High initial investment costs

Complexity of system integration and maintenance

Regulatory and compliance hurdles - Trends

Increased use of cloud-based flight management systems

Integration of real-time data analytics

Growing demand for sustainable aviation technologies

- Market Opportunities

Expansion of the commercial aviation sector

Adoption of artificial intelligence and machine learning

Growing demand for advanced air traffic management solutions - Government regulations

Regulations on air traffic control automation

Safety and security regulations for aviation systems

Environmental regulations for reducing aircraft emissions - SWOT analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Air Traffic Control Systems

Flight Tracking Systems

Flight Planning Software

Weather and Navigation Systems

Aircraft Communication Systems - By Platform Type (In Value%)

Commercial Aviation Platforms

Private Aviation Platforms

Government-Owned Platforms

Military Platforms

Cargo Aviation Platforms - By Fitment Type (In Value%)

OEM Systems

Aftermarket Systems

Integration Systems

Replacement Parts

Upgrades and Add-ons - By EndUser Segment (In Value%)

Airlines

Airport Authorities

Aircraft Manufacturers

Military Organizations

Freight & Logistics Companies - By Procurement Channel (In Value%)

Direct Sales

Third-Party Resellers

Online Procurement

Public Sector Tenders

OEM Distribution Channels

- Market Share Analysis

- CrossComparison Parameters(System Price, Market Share, Technology Adoption, Customer Base, Growth Potential)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Rockwell Collins

Thales Group

Garmin Ltd.

Cobham PLC

SITA

L3 Technologies

Collins Aerospace

Saab AB

FLIR Systems

Raytheon Technologies

NavAero

AeroVironment

Boeing

Airbus

- Increased adoption of flight management systems in Qatar-based airlines

- Military applications driving demand for customized systems

- The role of Qatar’s infrastructure projects in system procurement

- Demand for flight management solutions in freight and logistics

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035