Market Overview

The Qatar Flight Navigation System market is a crucial component of the country’s aviation infrastructure, valued at USD ~billion in 2025. This market has experienced steady growth driven by the country’s investments in modernizing its airport systems, including the development of new air traffic control technologies and navigation systems. The demand is further fuelled by Qatar’s significant role as a global aviation hub and its growing air traffic, driven by its key airport, Hamad International Airport, and national carrier Qatar Airways. These investments, coupled with advancements in satellite-based navigation systems and an expanding airport capacity, are the primary drivers for the sector’s growth.

Qatar dominates the flight navigation system market due to its strategic position as a global aviation hub. Doha, the capital city, stands out as a major player in the aviation industry, thanks to Hamad International Airport’s state-of-the-art infrastructure and Qatar Airways’ expansive network. The country has also been investing heavily in advanced navigation and communication systems to support its expanding aviation sector. The dominance is reinforced by the government’s commitment to infrastructure development, driven by the National Vision 2035, which emphasizes enhancing the transportation and aviation sectors.

Market Segmentation

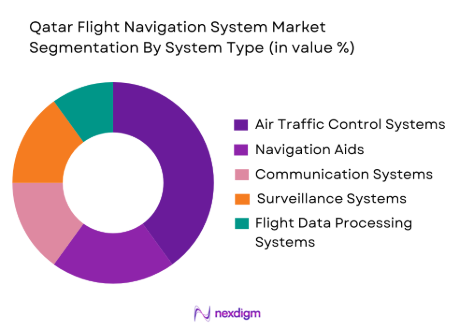

By System Type

The Qatar Flight Navigation System market is segmented by system type into air traffic control systems, navigation aids, communication systems, surveillance systems, and flight data processing systems. Among these, air traffic control systems hold the dominant market share. This is due to the essential role air traffic control plays in managing the increasing air traffic in Qatar’s airspace. Hamad International Airport’s continuous expansion and the high frequency of flights, particularly from Qatar Airways, require advanced and reliable air traffic control systems to ensure safety and efficiency. These systems are critical in coordinating air traffic, ensuring seamless transitions for arriving and departing flights, and maintaining Qatar’s airspace efficiency.

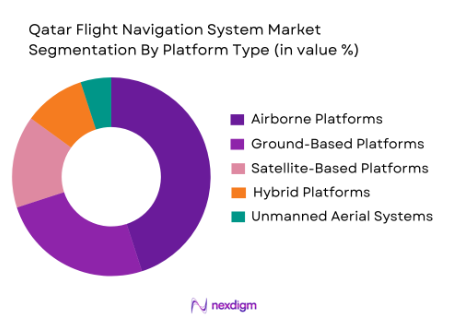

By Platform Type

The market is also segmented by platform type into airborne platforms, ground-based platforms, satellite-based platforms, hybrid platforms, and unmanned aerial systems (UAS). Airborne platforms dominate the market, primarily due to their significant role in ensuring real-time communication and navigation for aircraft operating in Qatar’s airspace. These platforms are crucial for managing flights across long distances, providing data and connectivity between the aircraft and air traffic control centres. With Qatar’s expanding air fleet, particularly through Qatar Airways, the demand for reliable airborne platforms continues to rise, contributing to their market dominance.

Competitive Landscape

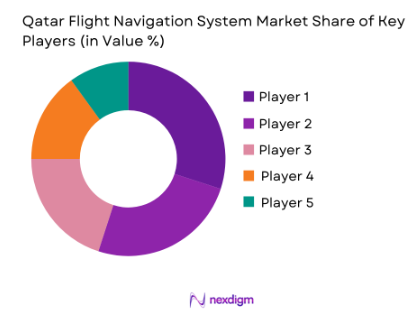

The Qatar Flight Navigation System market is dominated by a few major players, including global giants like Thales Group, Honeywell International, and Indra Sistemas, as well as key regional players who cater to the specific needs of the Qatari aviation sector. These companies lead the market due to their technological expertise, robust product offerings, and strong relationships with government and regulatory bodies in Qatar. The competitive landscape reflects the critical importance of these navigation systems in ensuring the safety and efficiency of Qatar’s growing aviation industry.

| Company | Establishment Year | Headquarters | Technology Integration | Product Portfolio | Market Penetration | Strategic Partnerships |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Madrid, Spain | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | Cedar Rapids, USA | ~ | ~ | ~ | ~ |

Qatar Flight Navigation System Market Analysis

Growth Driver

Increasing Air Traffic and Infrastructure Modernization

A major growth driver for the Qatar Flight Navigation System market is the rapid increase in air traffic facilitated by Qatar’s strategic role as a global aviation hub. Hamad International Airport in Doha has consistently seen a rise in passenger and aircraft movements, prompting investments in state‑of‑the‑art flight navigation systems to ensure safe and efficient airspace management. These systems—which include sophisticated air traffic control, GNSS‑based navigation aids, and real‑time surveillance technologies—are essential to handle higher traffic volumes without compromising operational safety or punctuality. Additionally, ongoing infrastructure modernization programs, such as enhancements to airport facilities and integration of advanced avionics technologies, further incentivize airlines and regulatory authorities to adopt next‑generation navigation platforms. This trend is reinforced by broader regional aviation growth strategies and Qatar’s emphasis on maintaining international connectivity, thereby boosting demand for reliable, advanced navigation solutions across both civilian and military aviation segments.

Technological Advancements and Digital Transformation

Another significant growth driver is the accelerated adoption of advanced technologies within navigation systems, driven by the need for precision, automation, and efficiency in flight operations. Global industry reports indicate that advancements in satellite navigation, digital flight management systems, and AI‑powered data processing are propelling market expansion by enhancing positional accuracy, reducing pilot workload, and improving route optimization. In Qatar, aviation authorities and major carriers increasingly deploy cutting‑edge navigation solutions to support seamless communication between aircraft and ground control, enabling superior situational awareness and reduced congestion in controlled airspace. The integration of digital tools such as automated dependent surveillance—broadcast performance‑based navigation (PBN), and predictive analytics further enhances operational resilience and safety. Such technology‑led improvements not only elevate service quality but also align with Qatar’s national vision of building a smart, technologically advanced aviation ecosystem, driving sustained investment into flight navigation capabilities.

Market Challenge

High Implementation and Integration Costs

A primary challenge facing the Qatar Flight Navigation System market is the significant cost associated with acquiring, deploying, and integrating advanced navigation technologies. Flight navigation systems involve complex hardware and software components—such as GNSS receivers, radars, air traffic management consoles, and digital communication networks—which require substantial capital investment. For national aviation authorities and airlines, the initial procurement and long‑term maintenance costs present financial burdens, particularly when upgrading legacy systems to next‑generation platforms. Moreover, integrating new systems with existing infrastructure often demands extensive testing, certification, and personnel training, adding layers of technical and operational complexity. These high costs can slow adoption rates, especially for smaller operators without large budgetary allocations. While larger carriers like Qatar Airways and government agencies can absorb such expenditures, the broader aviation ecosystem in Qatar must navigate budget constraints and ensure returns on investment. This cost barrier remains a persistent constraint on market growth, necessitating strategic financing and phased implementation plans.

Regulatory and Certification Complexities

Another key challenge in the Qatar Flight Navigation System market is navigating the complex regulatory and certification landscape required for system deployment and airspace operations. Aviation navigation systems must comply with stringent international and national standards—such as those established by the International Civil Aviation Organization (ICAO)—to ensure safety, reliability, and interoperability across global airspace. Achieving these certifications often involves lengthy validation processes, rigorous testing, and detailed documentation, which can delay implementation and increase compliance costs. In Qatar, the Civil Aviation Authority must balance innovative upgrades with adherence to both ICAO mandates and local aviation policies, leading to extended approval cycles for new technologies. These regulatory hurdles not only impose time‑consuming procedural requirements but may also constrain flexibility in rapidly adopting cutting‑edge solutions. Additionally, aligning navigation systems with evolving regulations in areas like spectrum usage, cybersecurity standards, and performance‑based navigation adds to the operational burden, making regulatory compliance a critical challenge for stakeholders.

Opportunity

Expansion of Satellite‑Based Navigation Services

One of the most compelling opportunities for the Qatar Flight Navigation System market lies in the expansion of satellite‑based navigation services and integration of performance‑based navigation (PBN). Satellite navigation, including GNSS and related augmentation systems, offers higher accuracy, improved reliability, and global coverage compared to traditional ground‑based systems. As global aviation shifts toward more efficient airspace utilization, Qatar’s aviation authorities and airlines can leverage satellite solutions to optimize flight paths, reduce fuel consumption, and enhance on‑time performance. Additionally, the adoption of performance‑based navigation enables more flexible route planning and precise approaches, particularly beneficial for congested hubs like Hamad International Airport. With continued investments in digital infrastructure and partnerships with international satellite navigation initiatives, Qatar is well‑positioned to capitalize on this trend. This not only supports enhanced safety and operational efficiency, but also fosters innovation in navigation services, opening doors for local and international collaborations in satellite navigation deployment across the region.

Rising Demand for Unmanned Aerial Systems (UAS) and Autonomous Flight Technologies

A burgeoning opportunity for the Qatar Flight Navigation System market is the increasing demand for unmanned aerial systems (UAS) and autonomous flight technologies, which require sophisticated navigation solutions tailored to new operational paradigms. As commercial and governmental applications of drones expand—from logistics and surveillance to inspection and emergency response—there is a growing need for integrated navigation platforms capable of managing UAS traffic within controlled airspace. Qatar’s focus on smart infrastructure and innovation further drives interest in autonomous aerial solutions, presenting a unique opportunity for navigation system providers to develop UAS‑compatible avionics, traffic management systems, and AI‑enabled guidance tools. Moreover, collaborations with technology startups, research institutions, and defence agencies can accelerate the development of advanced navigation modules that support autonomous operations, paving the way for broader market adoption. This emerging segment complements traditional aviation navigation, positioning Qatar as a forward‑looking adopter of next‑generation aerial mobility solutions.

Future Outlook

Over the next decade, the Qatar Flight Navigation System market is expected to witness substantial growth driven by technological advancements in satellite-based navigation systems, the expansion of Qatar’s aviation infrastructure, and the increased demand for air traffic control solutions due to the growing number of flights. Continuous government investment in aviation infrastructure, particularly through Qatar’s National Vision 2035, is set to bolster this growth. Moreover, the increasing adoption of unmanned aerial systems and hybrid platforms will contribute to diversification and technological evolution in the market.

Major Players

- Thales Group

- Honeywell International

- Indra Sistemas

- Raytheon Technologies

- Rockwell Collins

- Frequentis AG

- L3 Technologies

- Leonardo S.p.A

- Navcom Technology

- Aireon LLC

- SITA

- Cobham PLC

- MTU Aero Engines

- Northrop Grumman

- Garmin Ltd.

Key Target Audience

- Investment and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Air traffic control providers

- Aerospace and aviation technology companies

- Airports

- Aviation consultancy firms

- Aircraft manufacturers and suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key stakeholders in Qatar’s flight navigation system ecosystem, including aviation authorities, major airlines, and technology providers. This phase is supported by extensive secondary research and proprietary databases to understand the critical components driving market demand and development.

Step 2: Market Analysis and Construction

This phase involves gathering and analyzing historical data related to the Qatar Flight Navigation System market, focusing on system adoption rates, market growth, and technology integration. It also includes the evaluation of infrastructure expansion and air traffic trends over the past years to predict future trends.

Step 3: Hypothesis Validation and Expert Consultation

The developed market hypotheses will be validated by conducting interviews with industry experts, including engineers and government officials from Qatar’s aviation authorities. These consultations will provide key insights into operational trends, regulatory changes, and challenges faced by the sector.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered information into a comprehensive analysis, cross-referencing it with primary data from key industry players, and providing actionable insights. This phase ensures the reliability of forecasts and recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government investment in aviation infrastructure

Increased air traffic and airport expansions

Advancements in air navigation technology - Challenges

High capital investment required for system implementation

Regulatory complexities and certification delays

Integration issues with existing legacy systems - Opportunities

Development of satellite-based navigation solutions

Increasing demand for automation and AI in flight navigation systems

Collaborations for smart city and airport development projects - Trends

Growth of autonomous aircraft and unmanned aerial systems (UAS)

Rise in demand for real-time data processing and analytics

Shift towards more sustainable, energy-efficient navigation systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Air Traffic Control Systems

Navigation Aids

Communication Systems

Surveillance Systems

Flight Data Processing Systems - By Platform Type (In Value%)

Airborne Platforms

Ground-Based Platforms

Satellite-Based Platforms

Hybrid Platforms

Unmanned Aerial Systems (UAS) - By Fitment Type (In Value%)

New Installations

Upgrades & Modernization

Retrofitting

Maintenance & Support

System Integration - By End User Segment (In Value%)

Commercial Aviation

Military Aviation

Private & General Aviation

Cargo & Freight Services

Government & Regulatory Agencies - By Procurement Channel (In Value%)

Direct Sales

Distributors & Resellers

Online Sales

OEM Partnerships

Public Sector Tendering

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Growth Rate, Competitive Intensity, Technological Advancements, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Thales Group

Honeywell International

Indra Sistemas

Northrop Grumman

Raytheon Technologies

Garmin Ltd.

Rockwell Collins

Frequentis AG

L3 Technologies

Leonardo S.p.A

Navcom Technology

Aireon LLC

SITA

Cobham PLC

MTU Aero Engines

- Commercial airlines investing in advanced flight navigation systems

- Military organizations upgrading systems for security and surveillance

- Private operators seeking cost-effective navigation solutions

- Regulatory bodies adopting new standards for airspace management

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035