Market Overview

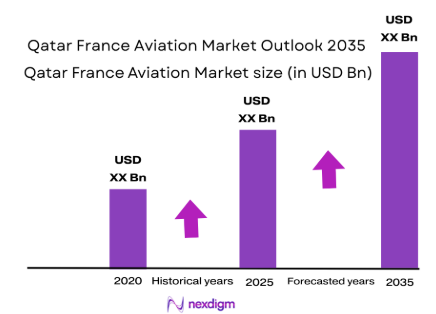

The Qatar France Aviation market is valued at USD~billion in 2025, with growth being primarily driven by the strong economic ties between Qatar and France, coupled with Qatar’s heavy investments in both infrastructure and fleet modernization. The aviation sector has witnessed a continuous increase in passenger and freight demand. Qatar Airways remains a pivotal player in the market, alongside significant investments from both private and government stakeholders. A rising demand for more sustainable aviation technologies also influences the market’s expansion.

The dominant countries in the Qatar France Aviation market include Qatar and France. Qatar’s position as a global aviation hub, coupled with its flagship carrier Qatar Airways, has led to substantial growth in the aviation sector. France, as a key European aviation player, benefits from both domestic aviation needs and growing international connections. The strategic locations of both nations enhance their roles in global air transport, strengthening their dominance in the aviation sector.

Market Segmentation

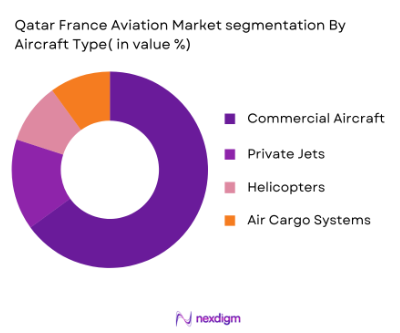

By Aircraft Type

The Qatar France Aviation market is segmented by aircraft type into commercial aircraft, private jets, helicopters, and air cargo systems. Among these, commercial aircraft hold the dominant market share. This is due to the booming demand for long-haul flights between Qatar and France, facilitated by the presence of key airlines like Qatar Airways and Air France. Both airlines have consistently upgraded their fleets to accommodate increasing passenger volumes, leading to the prominence of commercial aircraft in the market.

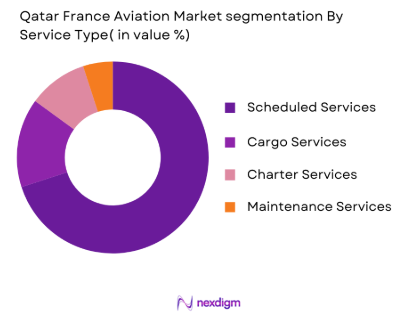

By Service Type

The Qatar France Aviation market is segmented by service type into scheduled services, cargo services, charter services, and maintenance services. Scheduled services dominate the market, primarily due to the increasing frequency of flights between Qatar and France. Airlines like Qatar Airways and Air France provide daily and direct flights, making scheduled services a key segment. Furthermore, Qatar’s investment in aviation infrastructure further bolsters the growth of scheduled services in the market.

Competitive Landscape

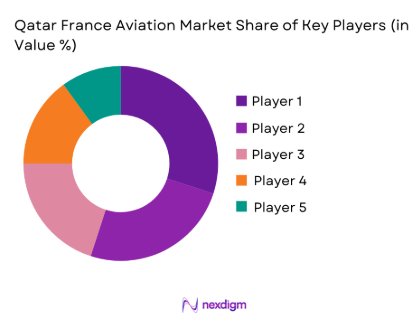

The Qatar France Aviation market is dominated by several key players, including both established local carriers and international aviation giants. Qatar Airways, as the flag carrier of Qatar, plays a significant role in shaping the market, alongside other influential players like Air France and Airbus. These companies leverage their strong infrastructure, global networks, and strategic alliances to maintain dominance in the market.

| Company | Establishment Year | Headquarters | Fleet Size | Annual Revenue (USD) | Market Presence | Key Strengths |

| Qatar Airways | 1993 | Doha, Qatar | 250+ | ~ | ~ | ~ |

| Air France | 1933 | Paris, France | 250+ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | 1000+ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | 1000+ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | Derby, UK | N/A | ~ | ~ | ~ |

Qatar France Aviation Market Analysis

Growth Drivers

Increased Bilateral Trade and Tourism Between Qatar and France

The Qatar-France aviation market has seen significant growth due to the strong economic and cultural ties between the two countries. Qatar’s status as a global business hub, alongside its strategic location between Asia and Europe, drives demand for air travel. Tourism also plays a major role in boosting flight services, with Qatar being a popular stopover for travelers end route to various destinations. France, with its global cultural and tourism influence, attracts a significant number of Qatari tourists annually. This bilateral flow of business and leisure travel contributes heavily to demand for both passenger and cargo services. Airlines such as Qatar Airways and Air France have capitalized on these dynamics, expanding routes and increasing flight frequencies to meet the growing demand. With both countries continuing to foster trade relations, the aviation market is expected to benefit from sustained growth in both tourism and commerce.

Investment in Sustainable Aviation Technologies

Sustainability has become a key focus for the aviation industry, with both Qatar and France emphasizing green aviation technologies. Qatar, through its national carrier Qatar Airways, is investing in more fuel-efficient, low-emission aircraft, such as the Airbus A350 and Boeing ~, as part of its long-term environmental goals. France, home to Airbus, is also advancing in the development of sustainable aircraft and infrastructure. In addition to new aircraft, both countries are focusing on adopting alternative fuels and enhancing airport infrastructure to reduce carbon footprints. These investments in green technologies not only improve operational efficiency but also appeal to environmentally-conscious consumers. The growing emphasis on sustainability is likely to attract further investment into the aviation market, as demand for eco-friendly travel solutions continues to rise, ensuring that both nations remain at the forefront of the global aviation industry.

Market Challenges

Rising Fuel Costs and Operational Costs

One of the biggest challenges facing the Qatar-France aviation market is the volatile price of aviation fuel. Fuel costs account for a substantial portion of an airline’s operating expenses, and fluctuations in fuel prices can significantly impact profitability. Qatar Airways and Air France are not immune to these cost pressures, and while they have implemented fuel-saving strategies, such as upgrading to more fuel-efficient aircraft, the unpredictability of global fuel prices remains a key challenge. As the aviation industry recovers post-pandemic, the pressure of rising operational costs continues to influence ticket prices, profitability, and even the frequency of flights. In addition, higher costs could lead to increased financial strain on smaller carriers that serve niche markets, potentially limiting competition and market access.

Regulatory and Safety Compliance

Aviation safety regulations are becoming increasingly stringent across the globe, and both Qatar and France are required to comply with international and domestic safety standards. While this is essential for passenger safety, it also presents challenges for airlines operating in both markets. Compliance with regulatory bodies such as the European Union Aviation Safety Agency (EASA) and Qatar’s Civil Aviation Authority (QCAA) involves significant costs in terms of updating aircraft, implementing advanced safety technologies, and training staff. Furthermore, differing regulatory requirements between the two countries, as well as evolving safety standards, create complexity for international operations. The challenge lies in maintaining compliance while balancing operational efficiency and cost-effectiveness, especially with rising safety expectations from consumers. This regulatory pressure can restrict flexibility and result in delays or increased costs for airlines.

Opportunities

Expansion of Cargo Services Driven by E-Commerce Growth

The growth of global e-commerce is one of the most promising opportunities for the Qatar-France aviation market, particularly in the air cargo segment. Both Qatar and France serve as major hubs for international trade, with Qatar acting as a transshipment hub in the Middle East and France having a significant position in Europe. The increasing demand for fast, reliable cargo services—especially in light of the e-commerce boom—presents a substantial opportunity for air freight services. Companies like Qatar Airways Cargo have already strengthened their presence in this sector, expanding routes and investing in state-of-the-art cargo handling facilities. As e-commerce platforms such as Amazon, Alibaba, and others require fast and efficient shipping, demand for air cargo will continue to increase. Airlines in both countries are likely to expand their cargo fleets and enhance infrastructure to capture this growing market, ensuring sustainable growth in the long term.

Growth in Business and Premium Travel Segments

As Qatar continues to strengthen its position as a global business hub and France maintains its role as a major European destination, there is a growing opportunity in the premium travel segment. Both countries have a highly affluent population, and luxury travel services are seeing consistent demand. Qatar Airways, known for its premium offerings, and Air France, with its refined service on long-haul flights, are well-positioned to tap into this market. Increasing demand for private jets, business-class services, and luxury travel experiences reflects the growing affluence of both business travellers and high-net-worth individuals. With an increase in corporate travel, particularly in industries like finance, real estate, and technology, airlines can offer tailored solutions for this premium market, including bespoke services, private terminals, and high-end in-flight experiences. This trend will continue to drive demand for premium services, ensuring long-term profitability for aviation players in both markets.

Future Outlook

Over the next decade, the Qatar France Aviation market is expected to show continued growth, with advancements in aircraft technology, increased air travel demand, and expanding international connections. Qatar’s vision to become a leading aviation hub, coupled with the increasing demand for luxury and sustainable travel options, will drive future market expansion. France, as a European aviation leader, will continue to strengthen its international presence, especially in key sectors like passenger services and aircraft manufacturing.

Major Players

- Qatar Airways

- Air France

- Airbus

- Boeing

- Rolls-Royce

- Emirates Airlines

- ATR Aircraft

- Bombardier Aerospace

- Safran

- Thales Group

- GE Aviation

- Lufthansa

- Singapore Airlines

- United Airlines

- Jet Aviation

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aircraft Manufacturers

- Airlines and Aviation Service Providers

- Airports and Ground Handling Companies

- Aircraft Leasing Firms

- Freight Forwarding and Logistics Companies

- Infrastructure and Technology Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Qatar France Aviation market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Qatar France Aviation market. This includes assessing market penetration, the ratio of marketplace to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aircraft manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Qatar France Aviation market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for air travel between Qatar and France

Advancements in aircraft technology driving market expansion

Government investments in aviation infrastructure and fleet upgrades - Challenges

High fuel costs affecting operational efficiency

Stringent regulatory frameworks for aviation safety

Increasing competition from regional aviation markets - Opportunities

Growing tourism between Qatar and France fueling aviation demand

Technological innovations in sustainable aviation solutions

Expansion of cargo services with increased international trade - Trends

Adoption of electric aircraft in commercial aviation

Emerging demand for more efficient and sustainable aviation solutions

Increased use of AI and automation in air traffic control and fleet management

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Commercial Aircraft

Private Jets

Helicopters

Air Cargo Systems

Aircraft Maintenance Systems - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Unmanned Aerial Vehicles (UAVs)

Hybrid Aircraft

Cargo Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket Parts

Maintenance & Repairs

Retrofit Systems

Upgrade Solutions - By End User Segment (In Value%)

Airlines

Private Aviation

Cargo & Logistics

Government & Military

Aviation Service Providers - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Indirect Purchase via Third Parties

E-commerce & Online Platforms

Government & Military Contracts

Leasing Companies

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Growth Rate, Technological Innovation, Regional Penetration, Product Diversification)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Qatar Airways

Air France

Airbus

Boeing

Dassault Aviation

Emirates Airlines

ATR Aircraft

Bombardier Aerospace

Safran

Thales Group

GE Aviation

Rolls-Royce

Jet Aviation

EADS

International Airlines Group

- Increasing demand from private aviation and luxury air travel

- Airlines focusing on fleet modernization and fuel efficiency

- Growth in cargo and logistics operations impacting aviation demand

- Increased investment in military aviation and defense systems

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035