Market Overview

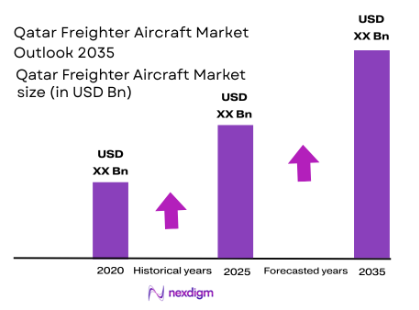

The Qatar Freighter Aircraft market is valued at USD~ billion in 2025. The growth of the market is primarily driven by the expanding logistics and e-commerce industries, which are pushing demand for air freight services. Qatar’s strategic location as a global aviation hub, supported by state-of-the-art infrastructure like Hamad International Airport, enhances the country’s position as a key player in the air cargo space. Qatar Airways, with its increasing fleet of freighters, is at the forefront of this growth, capitalizing on its established reputation in the logistics sector.

Qatar and the broader Middle East region dominate the Freighter Aircraft market due to several factors. Qatar Airways has established a world-class cargo network with a significant fleet of freighters, making Doha a key centre for air cargo. Countries in the region such as the UAE, Saudi Arabia, and Oman are also major players in the freighter aircraft market, owing to the region’s role as a global logistics hub, its expanding trade routes, and growing demand for air cargo services driven by regional economic growth.

Market Segmentation

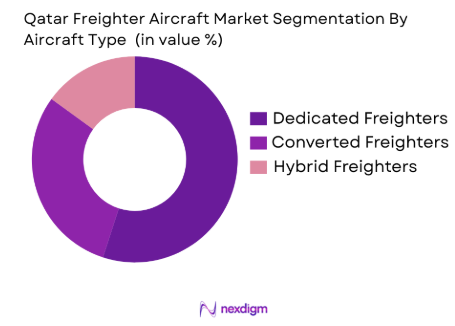

By Aircraft Type

The Qatar Freighter Aircraft market is segmented by aircraft type into dedicated freighters, converted freighters, and hybrid freighters. Dedicated freighters are the dominant sub-segment in this market, contributing significantly to the overall market share in 2025. These freighters are purpose-built for cargo, offering higher capacity and efficiency compared to converted freighters. The large fleets of Boeing ~, Airbus A330, and Boeing~ freighters operated by major players such as Qatar Airways and Emirates SkyCargo contribute to the dominance of this sub-segment, as they provide reliable and efficient services for high-volume international cargo transport.

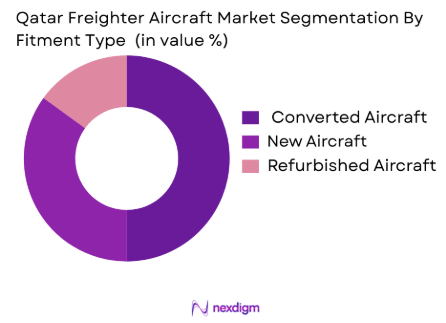

By Fitment Type

Fitment type segmentation in the Qatar Freighter Aircraft market includes new aircraft, converted aircraft, and refurbished aircraft. The sub-segment of converted aircraft holds the largest market share in 2024. This is primarily due to the growing trend of repurposing passenger aircraft into freighters, which offers an economical solution for airlines looking to expand their cargo capacity. Airlines like Qatar Airways, Turkish Airlines, and Emirates have been converting older aircraft to freighters, making this sub-segment a more cost-effective option for expanding cargo fleets.

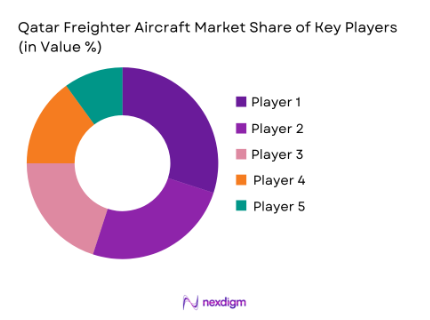

Competitive Landscape

The Qatar Freighter Aircraft market is dominated by major global players, including Qatar Airways, Emirates SkyCargo, and Saudi Arabian Airlines. These companies play a pivotal role in the Middle East’s air cargo industry due to their extensive fleets, efficient operations, and strategic locations. Additionally, global players like FedEx Express, UPS Airlines, and DHL Aviation have significant market presence in the region.

| Company Name | Year Established | Headquarters | Fleet Size | Cargo Network | Key Aircraft Models | Major Market Focus |

| Qatar Airways | 1993 | Doha, Qatar | 250+ | ~ | ~ | ~ |

| Emirates SkyCargo | 1985 | Dubai, UAE | 270+ | ~ | ~ | ~ |

| Saudi Arabian Airlines | 1945 | Jeddah, Saudi Arabia | 200+ | ~ | ~ | ~ |

| FedEx Express | 1971 | Memphis, USA | 650+ | ~ | ~ | ~ |

| UPS Airlines | 1988 | Louisville, USA | 250+ | ~ | ~ | ~ |

Qatar Freighter Aircraft Market Analysis

Growth Drivers

Expansion of E-commerce and Global Trade

The continued growth of e-commerce and global trade significantly drives the demand for air cargo, including freighter aircraft in Qatar. As online shopping continues to surge, particularly in the Middle East and Asia-Pacific regions, the need for efficient and fast delivery services has risen sharply. Freighter aircraft provide the ideal solution for high-volume, time-sensitive goods. Qatar, strategically located as a global aviation hub, benefits from this trend, with Qatar Airways serving as a key player in global logistics. The increased demand for rapid, cross-border shipping has led airlines and logistics providers to expand their freighter fleets, enhancing operational efficiency and meeting consumer expectations for quick delivery times. This growth in e-commerce, coupled with Qatar’s central location between major global markets, makes the freighter aircraft sector one of the fastest-growing areas in the Middle Eastern aviation industry.

Increasing Air Cargo Capacity and Infrastructure Investments

Another significant growth driver for the Qatar freighter aircraft market is the consistent investment in air cargo infrastructure, both by the government and private players. Hamad International Airport, Qatar’s state-of-the-art cargo terminal, is a major enabler, facilitating the expansion of air cargo operations by offering a world-class hub for freight handling. Additionally, Qatar Airways continues to expand its fleet, including dedicated freighters, to meet the growing demand for air cargo services. The government’s commitment to positioning Qatar as a global logistics hub through infrastructural investments further accelerates the expansion of the air cargo market. The development of modernized airfields, advanced air traffic control systems, and increased cargo handling capacity ensures Qatar can support the growth of its freighter aircraft fleet, making it an attractive destination for global logistics operations.

Market Challenges

High Operational Costs

One of the most significant challenges facing the Qatar freighter aircraft market is the high operational cost associated with maintaining a fleet of freighter aircraft. These costs include fuel, aircraft maintenance, crew expenses, and airport fees, all of which contribute to the overall financial burden of operating freighters. While Qatar Airways has an expansive fleet and global network, the airline must continually manage rising operational costs to maintain its competitive edge. Additionally, the demand for more fuel-efficient aircraft is increasing, as the cost of aviation fuel remains volatile. This presents a challenge for airlines in balancing the need for operational cost management while expanding and upgrading their fleets to keep up with growing market demand. As competition intensifies, particularly from other Middle Eastern and global carriers, maintaining profitability while minimizing operational costs becomes a critical challenge for key players in the sector.

Regulatory Constraints and Fleet Expansion Challenges

Regulatory constraints and challenges surrounding fleet expansion pose a significant hurdle for freighter operators in Qatar. The aviation industry is subject to stringent international and regional regulations, including certification requirements for both aircraft and operators. These regulations can sometimes slow down fleet expansion and the introduction of new aircraft types. Furthermore, regional airspace congestion, alongside restrictions imposed by various air traffic management authorities, may limit the operational capacity of freighter aircraft. For instance, airspace limitations in the Gulf region, particularly around busy airports like Hamad International, could affect cargo schedules and efficiency. Navigating complex regulatory environments while expanding fleets and optimizing operations is a persistent challenge for Qatar’s freighter aircraft market, demanding ongoing collaboration between industry players, regulators, and governments.

Opportunities

Growing Demand for Converted Freighters

One of the significant opportunities in the Qatar freighter aircraft market lies in the growing demand for converted freighters. With increasing pressure to expand air cargo capacity without the high costs of purchasing new aircraft, many airlines are opting to convert existing passenger aircraft into dedicated freighters. This offers a more cost-effective and quicker solution to meet growing demand for air cargo services. Airlines in Qatar and the broader Middle East are increasingly utilizing converted freighters to increase their fleet size while reducing capital expenditure. Conversion companies are also capitalizing on this opportunity, offering specialized services that allow airlines to upgrade older aircraft. Qatar Airways and other regional carriers are embracing this trend as a viable method of expanding their cargo operations without the high costs associated with purchasing new, purpose-built freighters.

Technological Advancements in Aircraft Design and Efficiency

Technological advancements in aircraft design and efficiency present a promising opportunity for the Qatar freighter aircraft market. Innovations in aircraft materials, engine technology, and fuel efficiency are significantly enhancing the operational capabilities of freighter fleets. Airlines operating in Qatar, like Qatar Airways, are increasingly adopting newer, more fuel-efficient models such as the Boeing ~ and Airbus A330 freighters. These advancements not only reduce the operational costs of running a freighter aircraft but also improve their environmental footprint by reducing carbon emissions. Moreover, innovations in cargo handling and management systems are allowing for faster and more efficient processing of goods, which enhances delivery speeds and customer satisfaction. As Qatar continues to invest in its aviation sector, embracing these technological advancements will provide significant operational benefits and create new opportunities for growth within the air freight sector.

Future Outlook

Over the next decade, the Qatar Freighter Aircraft market is expected to grow significantly, driven by increased demand for air freight services and the expansion of e-commerce across the globe. The Qatar Airways fleet is expected to increase in size, complemented by fleet modernization and the continued trend of converting passenger aircraft to freighters. With growing infrastructure investments in airports and regional logistics hubs, the Middle East, led by Qatar, will continue to be a critical player in the global air freight sector.

Major Players

- Qatar Airways

- Emirates SkyCargo

- Saudi Arabian Airlines

- FedEx Express

- UPS Airlines

- Cathay Pacific Cargo

- Singapore Airlines Cargo

- Korean Air Cargo

- China Airlines Cargo

- AirBridge Cargo Airlines

- Atlas Air

- Polar Air Cargo

- Turkish Airlines Cargo

- Etihad Cargo

- Japan Airlines Cargo

Key Target Audience

- Airlines

- Freight Operators

- Logistics Providers

- E-commerce Companies

- Aviation Regulatory Bodies

- Military and Defense Agencies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key market variables affecting the Qatar Freighter Aircraft market. This includes understanding the market’s demand drivers, segmentation, and technological trends. This process is supported by secondary data gathered from credible sources, including market reports, company filings, and industry publications.

Step 2: Market Analysis and Construction

Market data is collected, compiled, and analysed to construct a comprehensive picture of the Qatar Freighter Aircraft market. Historical data, combined with current industry performance, is used to determine market size and forecast future growth. This phase also examines fleet composition, operational efficiency, and logistics capabilities.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses are validated through expert consultations with key stakeholders such as aircraft manufacturers, logistics companies, and regulatory authorities. This ensures that the research is grounded in real-world industry insights and that data interpretations are accurate.

Step 4: Research Synthesis and Final Output

Final outputs are synthesized by integrating the findings from the analysis and expert consultations. These insights are then used to refine the market forecasts and provide actionable conclusions for stakeholders looking to invest or operate within the Qatar Freighter Aircraft market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for e-commerce and global freight

Expansion of Qatar Airways and regional carriers’ fleets

Strategic alliances between freighter operators and logistic companies - Challenges

High operational costs for freighter aircraft

Limited availability of converted freighter aircraft

Regulatory constraints on airspace and fleet operation - Opportunities

Growing air freight volume in the Middle East

Technological advancements in fuel-efficient freighters

Increase in demand for dedicated freighters due to global supply chain needs - Trends

Shift towards larger freighter aircraft

Growing use of data analytics in fleet management

Increasing number of dedicated freighter routes in Middle Eastern airspace

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Dedicated Freighters

Converted Freighters

Large-Scale Freighters

Medium-Scale Freighters

Small-Scale Freighters - By Platform Type (In Value%)

Boeing 747 Freighters

Airbus A330 Freighters

Boeing 777 Freighters

Airbus A300 Freighters

Other Freighter Platforms - By Fitment Type (In Value%)

New Aircraft

Refurbished Aircraft

Converted Aircraft

Hybrid Aircraft

Customized Aircraft - By End User Segment (In Value%)

Airlines

Freight Operators

Third-Party Logistics Providers

Cargo Charter Operators

Government & Military - By Procurement Channel (In Value%)

Direct Procurement

Leasing

OEM Sales

Third-Party Vendors

Private Market

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Aircraft Type, Procurement Channel, End-User Segment, Price Per Unit)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Qatar Airways

Emirates SkyCargo

Saudia Cargo

DHL Aviation

FedEx Express

UPS Airlines

Cathay Pacific Cargo

Singapore Airlines Cargo

Korean Air Cargo

China Airlines Cargo

AirBridgeCargo Airlines

Atlas Air

Polar Air Cargo

Turkish Airlines Cargo

Etihad Cargo

- Airlines are increasing their focus on enhancing freight operations for higher profitability.

- Freight operators are expanding their fleets to accommodate growing demand in the region.

- Logistics companies are adopting hybrid models of dedicated and converted freighters.

- Governments are investing in military freighter capabilities and infrastructure.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035