Market Overview

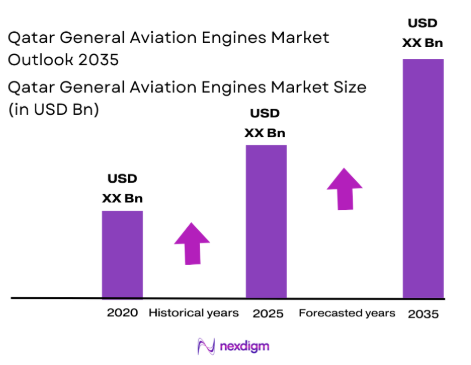

The Qatar General Aviation Engines market is valued at USD~ million in 2025 and is experiencing steady growth, primarily driven by rising demand for both private and commercial aviation. Key drivers include the expansion of the country’s aviation infrastructure, the increasing number of private aircraft, and the growing interest in air travel in the region. Technological advancements in engine efficiency and performance, coupled with governmental policies promoting private aviation, further fuel market growth. As a significant contributor to the region’s economic diversification, the market is supported by robust investment in aviation technology and engine manufacturing capabilities. The continuous development of Qatar’s infrastructure and air transportation systems is expected to sustain the positive growth trajectory of the general aviation engines market.

Qatar, particularly the capital city Doha, is the dominant region in the General Aviation Engines market. The country’s strategic location as a major aviation hub in the Middle East, combined with its growing number of private aircraft and the expansion of infrastructure like the Hamad International Airport, contributes significantly to this dominance. Furthermore, government investments in aviation, coupled with initiatives to increase airspace usage, ensure Qatar’s preeminence in the regional general aviation sector. The increasing trend of private aviation in the region, supported by strong economic growth and favorable regulations, solidifies the country’s position as a key player in the market.

Market Segmentation

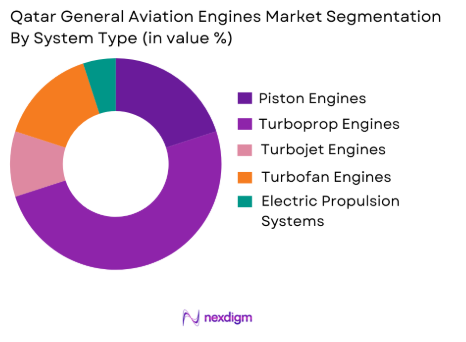

By System Type

The Qatar General Aviation Engines market is segmented by system type into piston engines, turboprop engines, turbojet engines, turbofan engines, and electric propulsion systems. Among these, the dominant segment is turboprop engines, which capture the largest share of the market. This dominance is attributed to the growing preference for turboprop engines in regional and smaller aircraft due to their fuel efficiency and cost-effectiveness. These engines are widely used in general aviation, including for business and leisure flights. The robustness of turboprop engines for both short and medium-range flights, along with their lower operational costs compared to other types, makes them a preferred choice for aircraft operators in Qatar.

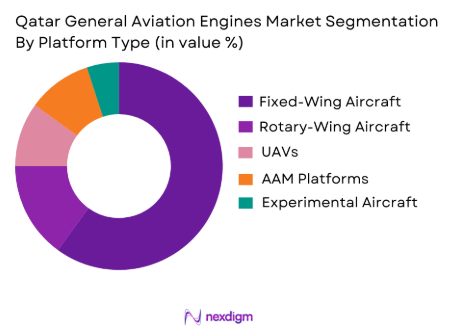

By Platform Type

The Qatar General Aviation Engines market is also segmented by platform type, including fixed-wing aircraft, rotary-wing aircraft, UAVs, Advanced Air Mobility (AAM) platforms, and experimental aircraft. Fixed-wing aircraft lead the market, mainly due to their widespread use in business aviation and private travel. Fixed-wing aircraft are known for their higher capacity and longer-range capabilities compared to other platform types. Additionally, the continuous development of new, more efficient models, as well as the increasing number of private aircraft in Qatar, has led to a steady demand for general aviation engines for fixed-wing aircraft.

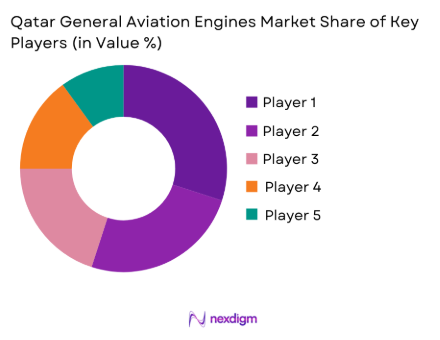

Competitive Landscape

The Qatar General Aviation Engines market is characterized by a competitive landscape dominated by a few major global players. These players have significant control over engine production and the integration of advanced technologies into general aviation engines. The market is highly competitive due to the presence of both established manufacturers and new entrants focusing on innovative solutions, such as electric propulsion systems. Companies like Rolls-Royce, GE Aviation, and Pratt & Whitney are key players due to their long-standing expertise and cutting-edge engine technologies.

| Company Name | Establishment Year | Headquarters | Product Type | Engine Type | Revenue in 2023 (USD) | Market Segment Focus |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | United States | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | United States | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ |

Qatar General Aviation Engines Market Analysis

Growth Drivers

Increasing Demand for Private and Business Aviation

Qatar’s growing economy and affluence among individuals and businesses have significantly boosted the demand for private and business aviation services. General aviation engines, which power light aircraft, are crucial to meeting this demand. Qatar’s wealthy population and rising number of corporate executives seek flexibility and convenience in air travel, which has led to an increase in demand for private jets and business aircraft. As the demand for these services grows, there is a direct need for advanced, reliable, and efficient engines that can power a variety of general aviation aircraft. Additionally, Qatar’s strategic location as a hub for business travel in the Middle East has made it a key player in the general aviation market, further driving the need for a larger fleet and associated aviation engines.

Government Investments in Aviation Infrastructure

Qatar’s government has been making substantial investments in aviation infrastructure, particularly with the development of Hamad International Airport and the expansion of the aviation sector. These investments include improving air traffic management systems, building state-of-the-art facilities, and enhancing the capacity for both commercial and general aviation. Such infrastructure development fosters growth in the aviation industry by providing more operational opportunities for general aviation aircraft, thereby increasing the demand for aviation engines. Qatar’s vision to become a leading aviation hub, supported by infrastructure advancements and a commitment to safety and operational excellence, further propels the growth of the general aviation engines market in the region.

Market Challenges

High Cost of Aircraft and Engine Maintenance

One of the primary challenges facing the general aviation engine market in Qatar is the high cost of purchasing and maintaining aircraft and engines. General aviation aircraft, especially private jets, require substantial capital investments and ongoing maintenance, including engine overhauls and replacement parts, which can be costly. These high operational costs can limit the growth of the market, particularly for smaller companies or individuals who might otherwise be interested in entering the general aviation sector. The expense of maintaining engines and the need for high-quality technical support to ensure their longevity create financial barriers, which can slow down the growth of the market, even though there is strong demand.

Regulatory Compliance and Environmental Concerns

The general aviation industry is subject to stringent regulations set by aviation authorities like the Qatari Civil Aviation Authority (QCAA). These regulations govern air safety, engine performance standards, emissions, and noise pollution, which can sometimes create operational challenges. The growing global focus on reducing aviation’s carbon footprint has also prompted regulatory bodies to enforce stricter environmental standards. This presents a challenge for engine manufacturers, who must continually innovate to meet these new standards while maintaining engine performance. Additionally, Qatar’s commitment to sustainability and reducing environmental impact adds pressure on the general aviation engines market to adopt eco-friendly technologies, further complicating operational and development costs.

Opportunities

Technological Advancements in Engine Efficiency

One of the most promising opportunities in the Qatar general aviation engines market lies in the development and adoption of more efficient and environmentally friendly engine technologies. Manufacturers are increasingly focusing on producing engines that are not only more fuel-efficient but also generate fewer emissions and noise. As global concerns about climate change and sustainability continue to rise, the demand for greener aviation solutions is expected to grow. In Qatar, where air quality and environmental issues are taken seriously, there is significant opportunity for the market to innovate by introducing next-generation engines that meet these demands, opening doors for manufacturers to lead in sustainable aviation solutions.

Expansion of Aircraft Fleets for Tourism and Leisure

Qatar’s aviation sector is seeing growth in its tourism and leisure industries, driving demand for private jet services and chartered flights. This presents an opportunity for general aviation engine manufacturers to expand their reach within the leisure and tourism market. As Qatar continues to host international events, such as the 2025 FIFA World Cup, the demand for short-range aircraft and engines capable of supporting tourism activities, including private tours, air taxis, and charter flights, is expected to rise. The expansion of these services will require additional fleets of general aviation aircraft, which, in turn, creates a demand for advanced and efficient engines, opening up significant growth prospects for engine manufacturers in the region.

Future Outlook

Over the next decade, the Qatar General Aviation Engines market is expected to witness sustained growth, driven by technological advancements and the increasing popularity of private and business aviation. The market will benefit from continuous government support for infrastructure expansion and regulatory advancements that encourage the use of general aviation for business and leisure. Furthermore, the rise of electric propulsion systems and sustainable aviation technologies is expected to create new opportunities within the market, transforming the landscape of general aviation in Qatar.

Key Players

- Rolls-Royce

- GE Aviation

- Pratt & Whitney

- Safran Aircraft Engines

- Honeywell Aerospace

- MTU Aero Engines

- Turbomeca

- Williams International

- Continental Motors

- Textron Aviation

- L3 Technologies

- Garrett Advancing Motion

- Zodiac Aerospace

- AeroVironment

- Schreiner Group

Key Target Audience

- Investment Firms & Venture Capitalists

- Government and Regulatory Bodies

- Aircraft Manufacturers

- Aviation Maintenance Providers

- Aircraft Leasing Companies

- Private Aircraft Owners

- Airlines with Private Jet Services

- Defense & Military Organizations

Research Methodology

Step 1: Identification of Key Variables

In this step, key stakeholders in the Qatar General Aviation Engines market are identified, including manufacturers, operators, and regulatory bodies. Secondary research is utilized to collect industry-level data from authoritative sources such as government reports and industry journals. The focus is on determining key variables affecting the market, such as technological advancements, regulatory policies, and consumer preferences.

Step 2: Market Analysis and Construction

Historical data for the Qatar General Aviation Engines market is compiled and analyzed. This step involves examining factors like market penetration rates, production volumes, and technology adoption. The research also evaluates the broader economic impact of the aviation sector in Qatar, as it plays a crucial role in driving demand for general aviation engines.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from leading companies are consulted through direct interviews and surveys to validate market hypotheses. These consultations provide critical insights on trends, technological changes, and the evolving needs of consumers in the aviation sector. Data from these discussions is integrated with secondary research to refine the market analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data into a comprehensive report, cross-referencing information from both primary and secondary sources. Direct engagement with key industry players helps in ensuring the validity of the market data, confirming the trends, forecasts, and technological shifts driving the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growth in private and commercial aviation demand

Technological advancements in engine fuel efficiency

Government investments in aviation infrastructure - Market Challenges

High costs of general aviation engines

Regulatory and certification challenges

Supply chain constraints and production delays - Market Opportunities

Expansion of air charter services in the region

Demand for sustainable and hybrid propulsion systems

Growth of UAV applications in commercial and military sectors - Trends

Shift towards hybrid-electric propulsion systems

Increased focus on engine performance and reliability

Rising demand for lightweight engines

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Piston Engines

Turboprop Engines

Turbojet Engines

Turbofan Engines

Electric Propulsion Systems - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

UAVs (Unmanned Aerial Vehicles)

Advanced Air Mobility (AAM) Platforms

Experimental Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer) Fitment

Aftermarket Fitment

Retrofit Fitment

Engine Overhaul & Maintenance

Propulsion System Modifications - By End User Segment (In Value%)

Private Operators

Commercial Operators

Military & Defense

Charter and Leasing Services

Aircraft Maintenance Organizations - By Procurement Channel (In Value%)

Direct Purchase from OEM

Third-Party Suppliers

Government Contracts

Leasing

Online Marketplaces

- Market Share Analysis

- Cross Comparison Parameters (Market Share by Manufacturer, Price Segmentation by System Complexity, Market Share by End-User Segment, Product Innovation, Customer Satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

GE Aviation

Pratt & Whitney

Rolls-Royce

Honeywell Aerospace

MTU Aero Engines

Turbomeca

Williams International

Safran Aircraft Engines

Continental Motors

Textron Aviation

L3 Technologies

Garrett Advancing Motion

Zodiac Aerospace

AeroVironment

Schreiner Group

- Increasing adoption of general aviation by private and business travelers

- Growth of the air charter industry due to demand for flexible travel

- Military aviation upgrades pushing for advanced propulsion systems

- Strong growth in UAV and drone applications across various sectors

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035