Market Overview

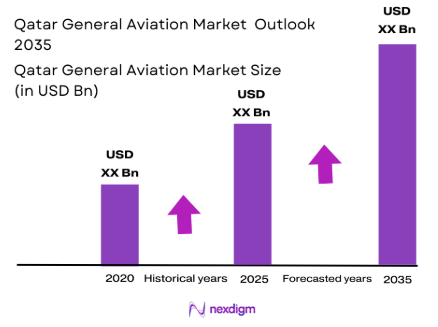

The Qatar General Aviation market is valued at approximately USD~ billion in 2025, with a steady growth trajectory driven by the growing demand for private air travel, particularly for business and tourism purposes. The market is influenced by several factors, including the increasing purchasing power of individuals, the expansion of luxury services, and government initiatives to boost aviation infrastructure. Qatar’s strategic geographic location and the rise of affluent business and government sectors have bolstered the need for more private aviation solutions.

Qatar’s general aviation market is dominated by Doha, the capital city, which serves as the epicenter for business and tourism activities. Doha’s role as a global business hub, combined with its growing aviation infrastructure, including Hamad International Airport, positions it as the key player in the market. Additionally, the country’s economic diversification efforts and significant investments in aviation-related infrastructure have led to Qatar’s dominance in the region, making it a prime destination for private aviation services.

Market Segmentation

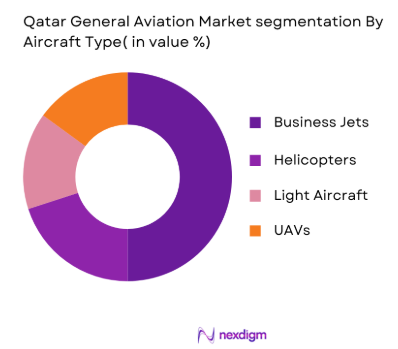

By Aircraft Type

The Qatar General Aviation market is segmented by aircraft type into business jets, helicopters, light aircraft, and UAVs. Business jets dominate the market due to their growing demand among corporate clients and government officials for efficient travel solutions. With Qatar’s expanding economy and the increasing number of high-net-worth individuals, the demand for business jets has been consistently rising. These aircraft offer the necessary flexibility, comfort, and speed for business executives traveling to and from Qatar. The continued support for private aviation through governmental incentives further strengthens the dominance of business jets in the market.

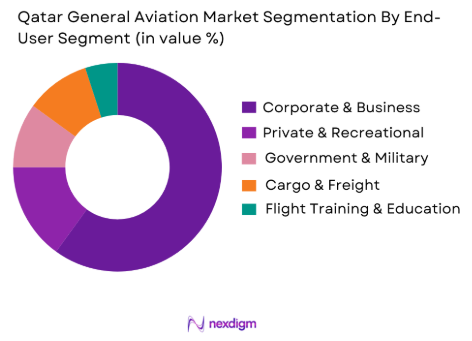

By End-User Segment

The market is also segmented by end-user type into corporate & business aviation, private & recreational aviation, government & military aviation, cargo & freight aviation, and flight training & education. Corporate & business aviation is the dominant segment, accounting for a significant share of the market due to the high demand for private air travel by businesses and executives. The surge in the corporate sector, especially in Doha, has fuelled the demand for private jet services, as companies seek efficient and flexible transportation options. The expansion of Qatar’s tourism sector also adds to the demand for private aviation services, particularly for high-net-worth individuals.

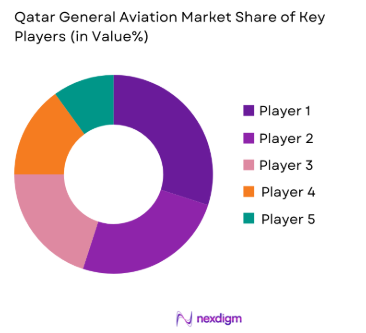

Competitive Landscape

The Qatar General Aviation market is dominated by a few major players, including global aircraft manufacturers like Gulfstream Aerospace and Embraer, alongside regional players like Qatar Airways. These companies play a significant role in shaping the market through their extensive service offerings and premium customer experiences. The market has seen consolidation, with key players focusing on expanding their fleets and improving services to cater to the increasing demand for private aviation.

| Company Name | Establishment Year | Headquarters | Fleet Size | Market Reach | Partnerships | Service Portfolio | Technological Innovation | Customization Options |

| Gulfstream Aerospace | 1958 | USA | 400+ | Global | ~ | ~ | ~ | ~ |

| Embraer S.A. | 1969 | Brazil | 300+ | Global | ~ | ~ | ~ | ~ |

| Bombardier Inc. | 1942 | Canada | 300+ | Global | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | 200+ | Global | ~ | ~ | ~ | ~ |

| Textron Aviation | 1923 | USA | 500+ | Global | ~ | ~ | ~ | ~ |

Qatar General Aviation Market Analysis

Growth Drivers

Increased Demand for Private and Business Aviation

The growth of the general aviation sector in Qatar is significantly driven by the increasing demand for private and business aviation. As Qatar’s economy continues to flourish, driven by its vast oil and gas reserves, there is a growing preference among high-net-worth individuals and business executives for private air travel. Qatar’s strategic geographical location, bridging the East and the West, has also made it an attractive hub for business travelers. Moreover, with the development of world-class infrastructure and facilities, such as the Hamad International Airport, Qatar offers a seamless and luxurious flying experience. The rising awareness about the convenience, privacy, and flexibility offered by private aviation further contributes to the growing demand. As a result, the demand for private jets, charter services, and related amenities is expected to grow, fueling the expansion of the general aviation market in Qatar.

Government Support and Investment in Infrastructure

The Qatari government’s proactive support and investment in the aviation sector have been a crucial driver of growth for the general aviation market. The country’s Vision 2035 has emphasized developing a world-class aviation infrastructure to support economic diversification and global connectivity. Qatar’s significant investments in airport infrastructure, such as the expansion of Hamad International Airport and the development of Al Udeid Air Base, have improved the country’s aviation capabilities. These developments facilitate enhanced services for general aviation users, including private terminals and VIP lounges, fueling market growth. Furthermore, the government’s efforts to simplify regulatory processes and create favorable policies for private aviation operators have attracted investment and allowed local businesses and international players to flourish within the market.

Market Challenges

Regulatory Barriers and Airspace Congestion

While Qatar has made significant strides in developing its aviation sector, regulatory barriers and airspace congestion remain considerable challenges for the general aviation market. The country’s airspace is heavily utilized by both commercial and military aviation, leading to restrictions on general aviation operations in certain regions. Additionally, the regulatory framework for private aviation, including flight permissions, air traffic control procedures, and pilot certifications, can be complex and slow-moving. These challenges can delay operations, increase costs, and deter operators from entering the market or expanding their services. Striking the right balance between accommodating growing demand and maintaining airspace safety and efficiency is a key challenge that needs to be addressed for sustained market growth.

High Operating Costs and Limited Infrastructure for Small Aircraft

Despite Qatar’s vast infrastructure investments in aviation, general aviation operators, particularly those offering smaller aircraft or charter services, face high operational costs. Fuel costs, maintenance expenses, and crew salaries can make it expensive to maintain fleet operations, particularly for smaller operators who might not benefit from economies of scale. In addition, while the infrastructure for commercial aviation is world-class, the facilities and support for smaller general aviation aircraft, such as dedicated hangars, fixed-base operators (FBOs), and suitable runways, are relatively limited. This lack of infrastructure for small aircraft operations increases operating costs and reduces the attractiveness of the general aviation sector for smaller firms and individual aircraft owners.

Opportunities

Expansion of Air Taxi and Urban Air Mobility (UAM) Solutions

One of the key opportunities for the general aviation market in Qatar lies in the development of air taxi and urban air mobility (UAM) services. As global trends move toward innovative transportation solutions, Qatar is well-positioned to capitalize on this opportunity, given its advanced infrastructure and wealthy population. The potential to introduce electric vertical take-off and landing (eVTOL) aircraft for urban air mobility can revolutionize intra-city travel, reducing traffic congestion, and offering a faster, more efficient mode of transport. With growing interest in sustainable, futuristic mobility solutions, Qatar could become a regional leader in UAM, attracting investment and enhancing the market’s appeal.

Increase in Tourism and Leisure Aviation

Qatar’s growing tourism sector presents a significant opportunity for the general aviation market. As the country continues to attract visitors for leisure, business, and sporting events, there is an increasing need for tailored aviation services, including private jet charters and sightseeing flights. Qatar’s position as a host of high-profile events, such as the FIFA World Cup, has brought global attention to the country’s tourism potential. This increase in visitors can stimulate demand for aviation services that cater to high-end tourists, including VIP air travel, bespoke travel packages, and scenic flights. This shift toward leisure and tourism-related aviation services presents an untapped market for general aviation operators to target, driving growth and diversification within the sector.

Future Outlook

Over the next decade, Qatar’s General Aviation market is expected to experience robust growth, driven by increasing investments in aviation infrastructure, rising demand for business and luxury air travel, and the country’s strategic push towards economic diversification. The global demand for private aviation is anticipated to remain strong, supported by both corporate and leisure travel. Moreover, Qatar’s position as a regional aviation hub and the expanding high-net-worth individual population will likely propel further growth. New technological advancements in avionics and aircraft design are also expected to fuel market growth, offering better efficiency, comfort, and sustainability in the aviation sector.

Major Players

- Gulfstream Aerospace

- Embraer S.A.

- Bombardier Inc.

- Dassault Aviation

- Textron Aviation

- Pilatus Aircraft

- Bell Helicopter

- Leonardo S.p.A.

- Airbus Helicopters

- Boeing

- Safran

- Rockwell Collins

- Honeywell Aerospace

- General Electric

- Piper Aircraft

Key Target Audience

- Aircraft Manufacturers

- Corporate and Private Jet Operators

- Aviation Infrastructure Developers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airlines and Aviation Service Providers

- Private Jet Charter Services

- Aviation Leasing Companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the ecosystem of stakeholders in Qatar’s General Aviation market. This includes conducting secondary research using reliable databases and industry reports. The goal is to identify critical factors such as demand for private aviation, aircraft types, and major players that impact market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on collecting and analysing historical data related to Qatar’s General Aviation market, such as fleet sizes, consumer behaviour, and revenue generation. A detailed analysis of service providers, aircraft manufacturers, and market penetration is performed to build a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are refined by consulting with industry experts through surveys, interviews, and focus groups. These experts provide valuable insights into current market trends, challenges, and opportunities, ensuring the accuracy of the data collected.

Step 4: Research Synthesis and Final Output

This phase involves verifying the insights and data collected from various stakeholders, including aircraft manufacturers and service providers. The final output synthesizes all market data, validating the forecasted market trends, potential growth areas, and competitive strategies.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for private air travel

Government investments in aviation infrastructure

Development of tourism and business sectors - Market Challenges

High initial investment costs for general aviation aircraft

Regulatory and certification complexities

Operational costs and fuel price fluctuations - Market Opportunities

Emerging demand for aircraft leasing and fractional ownership

Technological advancements in avionics and aviation systems

Growth of air cargo and logistics services - Trends

Increasing adoption of electric and hybrid aircraft

Rising demand for urban air mobility (UAM)

Shift toward more sustainable aviation practices

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Aircraft Systems

Avionics Systems

Communication Systems

Navigation Systems

Flight Control Systems - By Platform Type (In Value%)

Fixed-wing Aircraft

Rotorcraft

Light Aircraft

Business Jets

Helicopters - By Fitment Type (In Value%)

OEM Fitments

Retrofit Fitments

Fleet Upgrade Fitments

Custom Fitments

Maintenance Fitments - By End User Segment (In Value%)

Corporate & Business Aviation

Private & Recreational Aviation

Government & Military Aviation

Cargo & Freight Aviation

Flight Training & Education - By Procurement Channel (In Value%)

Direct Purchases

Leasing

Government Contracts

Third-party Distributors

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Revenue, Market Share, Product Offering, Geographic Presence, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Gulfstream Aerospace

Embraer S.A.

Bombardier Inc.

Dassault Aviation

Textron Aviation

Bell Helicopter

Leonardo S.p.A.

Pilatus Aircraft

Airbus Helicopters

Boeing

Safran

Rockwell Collins

Honeywell International

Honeywell Aerospace

General Electric

- Growing adoption of private jet services for business executives

- Increased interest from the tourism sector for chartered flights

- Government investments in military aviation capabilities

- Expansion of flight training programs to meet pilot demand

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035