Market Overview

The Qatar glider aircraft market is valued at approximately USD ~ million, driven by the increasing popularity of air sports, including gliding, and rising disposable income among affluent consumers. The market has been influenced by advancements in glider technology, such as the development of more fuel-efficient and eco-friendly gliders. Moreover, Qatar’s commitment to diversifying its economy beyond oil and gas and promoting aviation activities supports the growth of this market. The government’s focus on aviation infrastructure and regulatory advancements further fuels market expansion.

Qatar, with its robust infrastructure and active aviation sector, dominates the glider aircraft market in the region. The country’s focus on promoting air sports through institutions like the Qatar Aeronautical College, coupled with strategic partnerships with international aviation companies, has positioned it as a leading hub for gliding activities in the Middle East. Additionally, Qatar’s high income levels, stable economic environment, and government initiatives for tourism and leisure sports make it a key player in the glider aircraft market. Other cities in the region, such as Dubai, also contribute significantly to the market’s dominance due to their focus on aviation and high net-worth individuals.

Market Segmentation

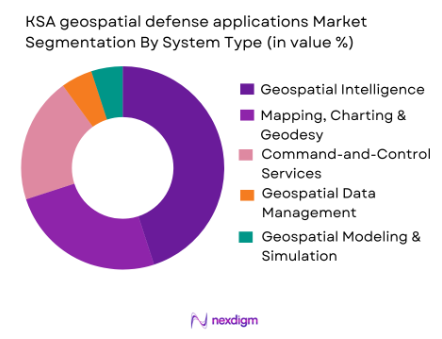

By System Type

The Qatar glider aircraft market is segmented by system type into high-performance gliders, motorized gliders, sailplanes, training gliders, and experimental gliders. Among these, the high-performance gliders segment holds the largest market share due to the growing demand for high-speed, long-duration flight experiences and competitive gliding events. High-performance gliders are popular among private enthusiasts and competitive gliders because they offer advanced aerodynamic capabilities and are suited for cross-country flying. This segment’s dominance is bolstered by their ability to meet the needs of high-net-worth individuals and elite flying clubs, which are prominent in Qatar and the wider Gulf region.

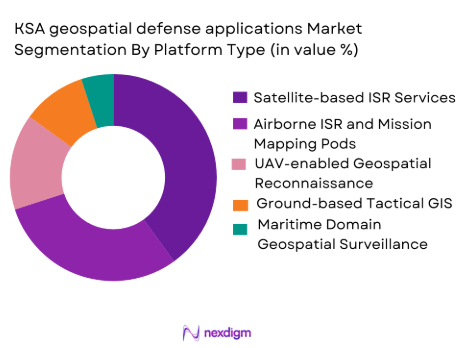

By Platform Type

The market is segmented into fixed-wing gliders, electric-powered gliders, towed gliders, self-launching gliders, and unmanned gliders. The fixed-wing gliders segment is currently leading the market. This segment benefits from its widespread use in recreational and competitive flying, where stability and efficiency are key. Fixed-wing gliders are often the preferred choice for flying schools and private operators, which are prominent in Qatar. Moreover, fixed-wing gliders have a proven track record in long-range performance, which makes them a popular choice for both beginners and experienced pilots.

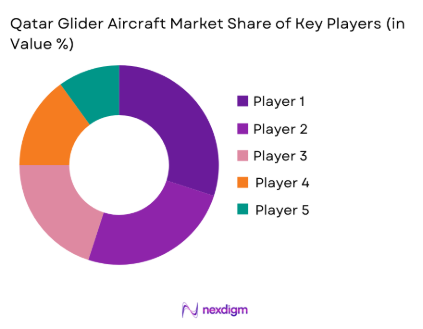

Competitive Landscape

The Qatar glider aircraft market is highly competitive, with several international and regional players vying for market share. Major players in the market include both global manufacturers and regional aviation companies, each bringing innovations and quality products to the forefront.

| Company Name | Establishment Year | Headquarters | Product Offerings | Revenue | Manufacturing Capability | R&D Focus | Market Focus |

| Schempp-Hirth Flugzeugbau | 1951 | Germany | High-performance gliders | ~ | ~ | ~ | ~ |

| DG Flugzeugbau | 1980 | Germany | Sailplanes, gliders | ~ | ~ | ~ | ~ |

| Alexander Schleicher GmbH | 1951 | Germany | Training gliders | ~ | ~ | ~ | ~ |

| Let L-13 | 1955 | Czech Republic | Training gliders | ~ | ~ | ~ | ~ |

| Albatros Aircraft | 1995 | Germany | Experimental gliders | ~ | ~ | ~ | ~ |

Qatar Glider Aircraft Market Analysis

Growth Drivers

Rising Interest in Air Sports and Recreation

The increasing popularity of air sports, particularly gliding, is a significant driver for the growth of the Qatar glider aircraft market. Qatar’s affluent population and favorable weather conditions create an ideal environment for recreational flying. Additionally, Qatar’s aviation infrastructure is expanding, with facilities and services catering to glider enthusiasts. This growing interest among both private operators and flight schools drives demand for glider aircraft, especially for leisure and competitive purposes, further contributing to market growth.

Technological Advancements in Glider Aircraft

Innovations in glider aircraft technology, such as more efficient aerodynamic designs, lighter materials, and the development of electric-powered gliders, are fuelling market growth. These advancements offer better performance, longer flight durations, and reduced environmental impact. As glider technology improves, it becomes more attractive to both individual pilots and flying schools in Qatar, encouraging adoption of newer and more advanced gliders. This trend is boosting both sales and the overall market demand in the region.

Market Challenges

High Initial Investment Costs

One of the major challenges in the Qatar glider aircraft market is the high initial cost of purchasing glider aircraft. These aircraft, particularly high-performance and motorized models, require substantial capital investment, making them less accessible for smaller flying clubs, private operators, and beginners. This can deter new entrants into the market and limit the overall expansion of the glider aviation industry in Qatar, especially among non-affluent consumers or those with limited access to financing options.

Regulatory and Certification Hurdles

Strict regulatory requirements and the need for certification of glider aircraft present challenges for manufacturers and operators in Qatar. Navigating the bureaucratic and safety regulations set by aviation authorities can delay the process of importing, selling, and operating gliders. These regulatory hurdles can also increase operational costs for businesses and reduce the availability of gliders in the market. Ensuring compliance with local and international aviation standards remains a key challenge for the sector.

Opportunities

Government Support for Aviation and Tourism

Qatar’s government is actively supporting the growth of its aviation sector as part of its broader strategy to diversify the economy and promote tourism. The government has made significant investments in infrastructure, including airports and aviation training facilities, which are beneficial for the glider aircraft market. Additionally, initiatives to promote Qatar as a global destination for sports and leisure activities present an opportunity for growth in the gliding sector. These efforts can attract both international and regional glider enthusiasts to the country, boosting demand.

Growing Demand for Eco-Friendly Aviation

The increasing demand for sustainable and eco-friendly transportation solutions presents a major opportunity for the Qatar glider aircraft market. With growing awareness of environmental issues, electric-powered gliders, which offer lower operational costs and reduced carbon footprints compared to traditional aircraft, are becoming more popular. This trend aligns with Qatar’s commitment to sustainable development and could drive the adoption of green aviation technologies in the country. As a result, the market for electric gliders is expected to grow rapidly in the coming years, creating new opportunities for manufacturers and operators.

Future Outlook

Over the next decade, the Qatar glider aircraft market is expected to show significant growth, driven by the continuous development of high-performance and electric-powered gliders. Increased interest in eco-friendly aviation technologies and Qatar’s focus on diversifying its economy will play a pivotal role in the market’s expansion. Furthermore, rising demand for air sports, especially in the affluent regions of the Middle East, will fuel the adoption of gliders for recreational purposes. Advances in aviation technology, along with government initiatives supporting tourism and leisure activities, are also expected to bolster the market’s growth.

Major Players

- Schempp-Hirth Flugzeugbau

- DG Flugzeugbau

- Alexander Schleicher GmbH

- Let L-13

- Albatros Aircraft

- Glaser-Dirks Aircraft

- Sailplane Limited

- Soaring Society of America

- Airborne Wind Energy

- ASW Aircraft GmbH

- Oehling Aircraft

- Silent Wings GmbH

- Jodel Aircraft

- Ventus Aircraft

- Cub Crafters

Key Target Audience

- Aviation enthusiasts and private operators

- Glider flight schools and instructors

- Airlines and aviation companies looking to expand into gliding

- Military and defense agencies

- Aviation regulatory bodies

- Research organizations involved in aviation and environmental studies

- Investment and venture capital firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves defining the key variables that affect the glider aircraft market in Qatar. This step includes identifying major drivers such as government policies, technological advancements, and economic factors. A combination of secondary data from aviation industry reports and direct surveys of industry players will be utilized to gather relevant information.

Step 2: Market Analysis and Construction

In this phase, historical data on glider aircraft sales, trends, and technological evolution will be analyzed to assess the market’s current position and trajectory. The analysis will focus on key segments such as system types, platform types, and procurement channels, with attention given to regional preferences and consumer behaviors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth rates, market drivers, and consumer behavior will be validated through expert interviews and consultations with key stakeholders, including manufacturers, aviation regulatory bodies, and aviation schools. Insights gained from these consultations will refine the market model.

Step 4: Research Synthesis and Final Output

The final phase includes compiling and synthesizing the findings from the previous steps to deliver a comprehensive market analysis. This will include a review of the competitive landscape, market segmentation, and key trends shaping the Qatar glider aircraft market. The findings will be verified with stakeholders to ensure accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for recreational flying activities

Advances in glider technology and materials

Growing interest in air sports and aviation clubs - Market Challenges

High initial investment costs

Limited infrastructure for glider operations

Strict regulatory compliance requirements - Market Opportunities

Technological advancements in electric-powered gliders

Rising interest in glider-based environmental research

Potential growth in government and military contracts - Trends

Shift towards sustainable and electric-powered gliders

Increase in glider sports and competitive events

Technological innovations in glider aerodynamics

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

High-performance gliders

Motorized gliders

Sailplanes

Training gliders

Experimental gliders - By Platform Type (In Value%)

Fixed-wing gliders

Electric-powered gliders

Towed gliders

Self-launching gliders

Unmanned gliders - By Fitment Type (In Value%)

Custom fitment

Standard fitment

Integrated fitment

Retrofitted fitment

OEM fitment - By End User Segment (In Value%)

Private operators

Flight schools

Military and defense

Research institutions

Air clubs - By Procurement Channel (In Value%)

Direct sales

Online channels

Dealers and distributors

Government procurement

Leasing

- Market Share Analysis

- Cross Comparison Parameters (Market penetration, Technological innovation, Regulatory compliance, Distribution network, Pricing strategy)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Schempp-Hirth Flugzeugbau

DG Flugzeugbau

Alexander Schleicher GmbH & Co

Let L-13

Meyer Aircraft GmbH

Albatros Aircraft

Glaser-Dirks Aircraft

Sailplane Limited

Soaring Society of America

Airborne Wind Energy

ASW Aircraft GmbH

Oehling Aircraft

Silent Wings GmbH

Jodel Aircraft

Ventus Aircraft

- Flight schools focusing on glider training programs

- Private operators seeking cost-effective aircraft solutions

- Military institutions exploring glider-based surveillance

- Research institutes utilizing gliders for environmental studies

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035