Market Overview

The Qatar GPS GNSS receivers aviation market is valued at USD ~billion, driven by growing demand for accurate and reliable positioning systems in aviation. The market has seen a steady increase due to advancements in technology, including the integration of multi-constellation GNSS systems, and rising investments in aviation infrastructure in the Middle East. These systems are widely adopted for enhancing the performance of aircraft navigation, improving safety, and increasing operational efficiency. The market is expected to continue its growth trajectory in the coming years, with the continued development of the aviation sector and the increasing preference for advanced navigation solutions.

Qatar remains a leading player in the GPS GNSS receivers aviation market due to its strategic location and the rapid growth of its aviation sector. The country’s investment in infrastructure, particularly at Hamad International Airport, and the expansion of Qatar Airways, which operates a large fleet, significantly influence the demand for GNSS receivers. Other countries like the UAE and Saudi Arabia also dominate the market due to their substantial investments in aviation technology and infrastructure. These nations’ investments in their national airlines and airport infrastructure further drive the adoption of advanced navigation systems like GPS GNSS receivers.

Market Segmentation

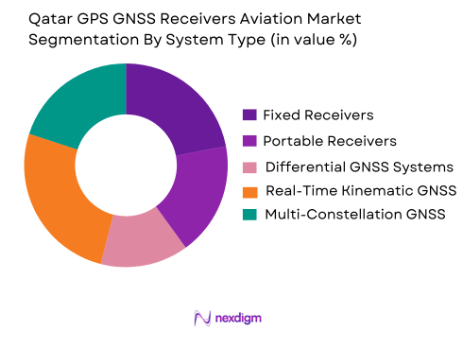

By System Type

The Qatar GPS GNSS receivers aviation market is segmented into several system types, including Fixed Receivers, Portable Receivers, Differential GNSS Systems, Real-Time Kinematic GNSS Systems, and Multi-Constellation GNSS Systems. Among these, the Multi-Constellation GNSS Systems have emerged as the dominant sub-segment. This is due to their ability to access multiple satellite constellations, such as GPS, GLONASS, Galileo, and BeiDou, which significantly improves accuracy and reliability. As aviation demands for precise positioning continue to rise, the adoption of multi-constellation systems has become crucial for enhancing safety and efficiency in air travel.

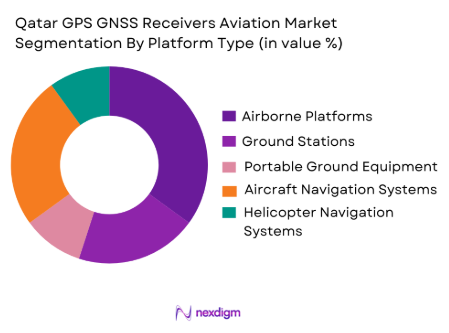

By Platform Type

The market is further segmented by platform type into Airborne Platforms, Ground Stations, Portable Ground Equipment, Aircraft Navigation Systems, and Helicopter Navigation Systems. Airborne Platforms dominate this segment due to the increasing need for advanced navigation systems in commercial, military, and private aviation. As the aviation sector continues to expand, the demand for reliable and high-performance GNSS systems onboard aircraft grows. This adoption is driven by the need for improved safety measures and efficiency in air travel, which makes airborne platforms essential for GPS GNSS system deployment.

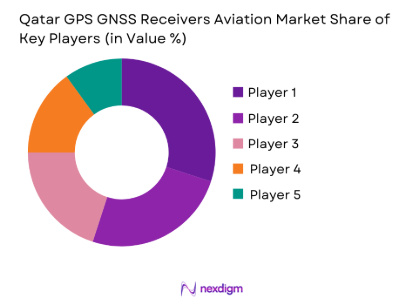

Competitive Landscape

The Qatar GPS GNSS receiver’s aviation market is dominated by a few major players, including international giants and regional specialists. This consolidation reflects the significant influence of these key players, with companies like Thales Group, Garmin, and Honeywell International leading the market. Their advanced technology, global reach, and long-standing reputation in the aerospace industry give them a competitive edge. The presence of these established players significantly influences the market dynamics, particularly in terms of pricing and innovation.

| Company Name | Establishment Year | Headquarters | Product Innovation | Customer Reach | Distribution Network | Pricing Strategy | After-Sales Service | Technological Advancements | Partnerships & Collaborations |

| Thales Group | 1893 | Paris, France | High | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | Olathe, Kansas, USA | Moderate | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Charlotte, North Carolina, USA | High | ~ | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | Cedar Rapids, Iowa, USA | High | ~ | ~ | ~ | ~ | ~ | ~ |

| NovAtel Inc. | 1986 | Calgary, Canada | High | ~ | ~ | ~ | ~ | ~ | ~ |

Qatar GPS GNSS Receivers Aviation Market Analysis

Growth Drivers

Expansion of Qatar’s aviation industry and fleet modernization

Qatar’s aviation sector has been undergoing significant growth, driven by expanding commercial flight operations, national carrier fleet modernization, and increased air traffic. As airlines and airports adopt next‑generation navigation systems to improve operational efficiency and safety, demand for GPS/GNSS receivers — which provide precise positioning, navigation, and timing (PNT) — is rising. These systems are essential not just for en‑route navigation but also for advanced flight management systems, autopilot integration, and enhanced situational awareness. Globally, aviation navigation systems including GNSS components are forecast to grow strongly over the next decade, reflecting broader industry trends where precision satellite navigation becomes a standard requirement for both commercial and military aircraft. Integrating GNSS receivers into newly acquired or retrofitted aircraft enhances route optimization, fuel savings, and compliance with international airspace requirements, making them a key technology investment for Qatar’s aviation stakeholders.

Broader global GNSS market growth and technology adoption

The global GNSS market — of which aviation receivables are a critical segment — is expanding rapidly, with projected multi‑billion‑dollar valuation increases driven by rising demand for precise navigation in transportation, military, and commercial aviation. Forecasts suggest significant compound annual growth rates in GNSS adoption across industries, reinforcing aviation’s reliance on advanced navigation hardware. As global navigation satellite constellations modernize and add new signals (e.g., Galileo, BeiDou enhancements), aviation operators benefit from better accuracy, redundancy, and multi‑constellation compatibility. In the Qatar context, positioning the country’s aviation infrastructure to utilize these improvements can strengthen its role as an international transit hub. Enhanced GNSS technology in aircraft supports performance‑based navigation (PBN) standards, which many regional regulators and service providers increasingly mandate, driving sustained procurements of certified aviation‑grade GPS/GNSS receivers.

Challenges

Signal interference, vulnerability, and operational risk

One of the significant challenges for GPS/GNSS receivers in aviation is the susceptibility of satellite signals to various forms of interference, including natural atmospheric effects, unintentional radio frequency noise, and deliberate actions such as jamming or spoofing. Civil aviation systems rely heavily on GNSS signals that are relatively weak by the time they reach Earth’s surface, making them vulnerable to disruptions which can degrade navigation accuracy or, in extreme cases, force aircraft to rely on alternate systems or reroute. Such interference can undermine safety margins and increase pilot workload, especially under challenging meteorological or high‑traffic conditions. Addressing these vulnerabilities often requires additional system redundancies, signal augmentation (like SBAS or GBAS), and sophisticated mitigation techniques — all of which add complexity and cost to receiver integration and certification processes in Qatar’s aviation ecosystem.

Regulatory and certification barriers in aviation deployment

Aviation is one of the most tightly regulated sectors globally, with strict requirements for equipment certification, system interoperability, and adherence to standards such as ICAO’s navigation performance criteria. The certification process for GNSS receivers in aircraft involves rigorous testing for accuracy, integrity, continuity, and resistance to failure modes, making market entry for new hardware or upgrades costly and time‑intensive. In Qatar, aligning with both regional and international regulatory frameworks introduces additional hurdles for suppliers and operators, especially when retrofitting existing fleets. Compliance with airworthiness directives, interoperability with augmentation systems, and ensuring system reliability throughout all phases of flight demand significant investment and long validation cycles. These regulatory pressures can slow procurement cycles and increase the total cost of ownership for aviation GNSS solutions in the region.

Opportunities

Adoption of advanced GNSS augmentation and augmentation infrastructure

As aviation navigation requirements become more stringent — particularly for precision approaches and performance‑based navigation (PBN) — opportunities arise for deploying augmentation systems that enhance GNSS accuracy, integrity, and availability. Technologies such as Wide Area Augmentation Systems (WAAS), Ground‑Based Augmentation Systems (GBAS), and future Satellite‑Based Augmentation Systems (SBAS) enhance GPS/GNSS performance to meet safety‑of‑life standards for all phases of flight. Investing in or partnering to extend such augmentation infrastructure in the Middle East, including potential localized systems supporting Qatar’s airspace, could significantly increase demand for certified GNSS receivers. These systems enable airlines to achieve more efficient flight paths, reduce fuel consumption, and improve schedule reliability — benefits that align with both operational and sustainability goals.

Integration with next‑generation aviation technologies and digital transformation

The broader trend toward digitalization and connectivity in aviation opens new avenues for GPS/GNSS receiver application beyond basic navigation. Advanced air traffic management systems, unmanned aerial vehicles (UAVs) for logistics and surveillance, and data‑driven flight optimization solutions all rely on high‑precision PNT data. As Qatar invests in smart airport initiatives, autonomous aircraft operations, and advanced fleet management, demand for integrated GNSS solutions — often combined with inertial measurement units (IMUs), multi‑constellation receivers, and real‑time data analytics — will increase. Providers that can offer differentiated products with enhanced performance, cybersecurity features, and seamless integration into aviation data ecosystems are well positioned to capture emerging revenue streams, especially as airlines and regulators push toward highly automated airspace and next‑generation operational concepts.

Future Outlook

Over the next 5 years, the Qatar GPS GNSS receivers aviation market is expected to show significant growth driven by continuous investments in aviation infrastructure, technological advancements in GNSS systems, and the increasing need for precision navigation in the aviation sector. As Qatar continues to develop its aviation industry, particularly with the expansion of its national carrier and improvements to its airport facilities, the demand for GPS GNSS receivers will continue to rise, particularly with the adoption of multi-constellation GNSS systems for enhanced accuracy and safety.

Major Player

- Thales Group

- Garmin Ltd.

- Honeywell International

- Rockwell Collins

- NovAtel Inc.

- Furuno Electric Co.

- Leica Geosystems

- Satcom Direct

- L3 Technologies

- Teledyne Marine

- Cobham plc

- Hexagon AB

- AeroNav

- Trimble Inc.

- Garmin International

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aviation equipment manufacturers

- Airline operators

- Airport infrastructure developers

- Aviation technology solution providers

- Aerospace and defense contractors

- System integrators for GNSS and aviation systems

Research Methodology

Step 1: Identification of Key Variables

The first phase involves gathering data on all key players and stakeholders within the Qatar GPS GNSS receivers aviation market. This step includes reviewing secondary sources, government publications, and industry reports to map the ecosystem of aviation and GNSS technology providers.

Step 2: Market Analysis and Construction

The market analysis is conducted by evaluating historical data, focusing on key trends within the aviation and GNSS sectors. We assess market penetration and revenue generation from top system types and platform types, and we further dissect the contributions of each sub-segment to market growth.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, expert opinions are sought through surveys and interviews with industry professionals to validate the hypotheses drawn from the collected data. The interviews include stakeholders such as GNSS system manufacturers, airline operators, and technology consultants.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing findings from primary and secondary research to compile the comprehensive market report. This step ensures the validity of market data, utilizing expert consultation and direct engagement with manufacturers to finalize estimates and forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for accurate positioning systems in aviation

Growth of the aviation sector in the Middle East

Technological advancements in GPS and GNSS technologies - Market Challenges

High initial cost of GPS GNSS receivers

Technological barriers in integrating advanced systems

Regulatory compliance and certification challenges - Market Opportunities

Growing use of GPS GNSS systems in unmanned aerial vehicles (UAVs)

Increasing adoption of satellite-based navigation systems

Expansion of aviation infrastructure in the Middle East - Trends

Rise of multi-constellation GNSS solutions for enhanced accuracy

Shift towards autonomous aircraft navigation

Growth in demand for portable and flexible navigation solutions

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Fixed Receivers

Portable Receivers

Differential GNSS Systems

Real-Time Kinematic GNSS Systems

Multi-Constellation GNSS Systems - By Platform Type (In Value%)

Airborne Platforms

Ground Stations

Portable Ground Equipment

Aircraft Navigation Systems

Helicopter Navigation Systems - By Fitment Type (In Value%)

OEM Integration

Aftermarket Integration

Stand-Alone Systems

Modular Systems

Retrofit Solutions - By End User Segment (In Value%)

Commercial Aviation

Private Aviation

Military Aviation

Helicopter Operators

Unmanned Aircraft Systems - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Platforms

Government Procurement

OEM Partnerships

- Market Share Analysis

- Cross Comparison Parameters (Market Share by Company, Product Performance, Pricing Trends, Technology Adoption, Customer Satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Thales Group

Garmin Ltd.

Honeywell International Inc.

Trimble Inc.

Rockwell Collins

NovAtel Inc.

Pentagon Precision Ltd.

Furuno Electric Co.

AeroNav

Satcom Direct

L3 Technologies

Cobham plc

Hexagon AB

Leica Geosystems

Teledyne Marine

- Demand for GNSS systems from commercial aviation is growing rapidly

- Military aviation is seeing a steady rise in adoption for precision navigation

- Private aviation is increasingly opting for advanced navigation solutions

- UAV operators are driving the demand for portable and compact GNSS systems

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035