Market Overview

The Qatar hang glider market is valued at approximately USD ~ billion in 2024. This market is primarily driven by the increasing interest in extreme sports, tourism, and outdoor adventure activities. Qatar’s consistent development of tourism infrastructure, combined with favorable weather conditions for hang gliding, has contributed to the rising demand. Moreover, the nation’s growing affluent population and an increase in leisure activities contribute significantly to the market’s growth. As Qatar’s adventure tourism continues to gain popularity, the hang gliding segment is set to expand, driven by both local participation and tourists.

Qatar’s hang glider market is primarily concentrated in Doha, the capital city, due to its well-established tourism infrastructure, accessibility, and favorable flying conditions. Additionally, other regions along the coast and in the desert areas offer scenic views that attract adventure enthusiasts for hang gliding. Qatar’s investment in promoting tourism and adventure sports, coupled with its position as a gateway to the Middle East for international tourists, further strengthens Doha’s dominance in the market. These cities benefit from the nation’s economic growth and a growing interest in outdoor recreational activities.

Market Segmentation

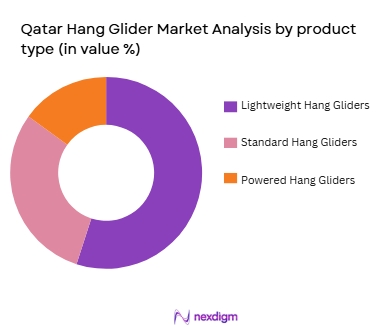

By Product Type:

The Qatar hang glider market is segmented by product type into lightweight hang gliders, standard hang gliders, and powered hang gliders. Among these, lightweight hang gliders dominate the market due to their portability and ease of use for both beginners and experienced pilots. These gliders are particularly popular for recreational flying and are suitable for different flying environments, including coastal and desert areas. The lightweight design offers a balance between performance, safety, and convenience, making it the preferred choice for most users. Their popularity is also driven by their versatility, allowing easy transportation to various locations for recreational purposes.

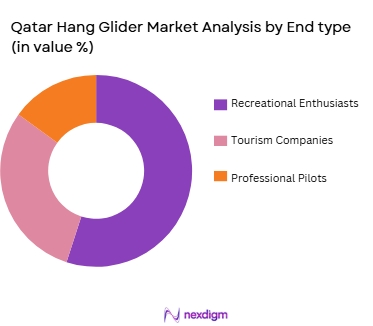

By End User:

In the Qatar hang glider market, the primary end users are recreational enthusiasts, tourism companies, and professional pilots. Recreational enthusiasts hold the largest market share due to the increasing popularity of hang gliding as a leisure activity. The growing interest in adventure tourism and outdoor sports has led to a surge in demand for hang gliders. Tourism companies contribute to the market by offering hang gliding as part of adventure sports packages. Professional pilots, although a smaller segment, contribute to the market’s high-end demand for advanced gliders and training equipment for competitive purposes.

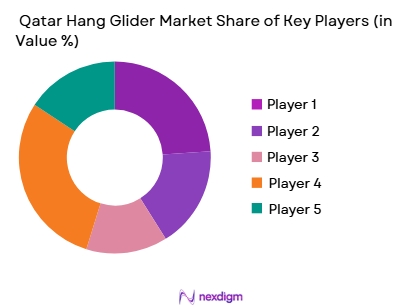

Competitive Landscape

The Qatar hang glider market is home to a few key players that dominate the space, including both local distributors and international brands. These companies offer a wide range of hang gliders, accessories, and training services. Leading global brands such as Airwave, Wills Wing, and Ozone, which have strong reputations for safety and performance, are widely popular in Qatar. Local distributors like Qatar Hang Gliders have also made significant contributions to the market by offering tailored products and services catering to local demands, including gliders for desert environments.

| Company | Established Year | Headquarters | Revenue (2024) | Product Portfolio | Key Technologies | Global Reach |

| Airwave | 1982 | USA | ~ | ~ | ~ | ~ |

| Wills Wing | 1973 | USA | ~ | ~ | ~ | ~ |

| Ozone | 1999 | UK | ~ | ~ | ~ | ~ |

| Qatar Hang Gliders | 2010 | Doha, Qatar | ~ | ~ | ~ | ~ |

| FlyQatar | 2015 | Doha, Qatar | ~ | ~ | ~ | ~ |

Qatar Hang Glider Market Analysis

Growth Drivers

Rising Adventure Tourism & Experience Economy

Qatar’s expanding tourism strategy — including sports, cultural, and outdoor pursuits — supports demand for adventure activities. As global travellers seek immersive, high‑adrenaline experiences, hang gliding can be promoted as a signature aerial sport over scenic desert landscapes and coastal areas. This aligns with global growth in adventure tourism, where unique, experiential offers attract higher spending tourists. Tourism events such as international festivals and sports showcases increase exposure, encouraging more visitors to seek hang gliding experiences. As leisure spending grows, especially among GCC visitors and expatriates, this broader interest fuels steady expansion of hang glider participation and associated services in Qatar.

Technological Advancements & Training Infrastructure

Improvements in hang glider design, materials, and safety technologies are making the sport more accessible and reliable. Lighter, stronger composite materials and enhanced safety gear make hang gliding more appealing to adventure enthusiasts. Qatar’s investment in sports infrastructure could extend to training facilities and certified instruction programs, reducing barriers to beginner participation. These advancements support safer, more enjoyable flying, which boosts consumer confidence and expands potential user bases beyond experienced flyers. If local operators adopt modern equipment and training protocols, participation rates are likely to rise, supporting long‑term market growth through 2035.

Market Challenges

High Cost of Equipment & Participation

Hang gliding involves significant upfront costs — including purchasing quality gliders, safety gear, and training — which can deter many potential users. Globally, high‑end hang gliders and associated safety equipment represent a substantial financial commitment for hobbyists and beginners alike. In Qatar, where leisure markets are still developing and competing with established sports and hospitality offerings, these costs may limit broader adoption. Additionally, dedicated facilities and certified instructors must be established locally; without economies of scale, prices may remain high, restricting participation largely to affluent tourists and expatriates.

Regulatory, Safety & Weather Constraints

Hang gliding is inherently dependent on favorable weather and strict safety standards. Qatar’s desert climate includes strong winds and extreme heat at times, which can limit flying windows and impact consistent operations — particularly outside optimal seasons. Regulatory frameworks for aerial sports may also require specialized certifications, permits, and oversight, adding complexity for operators and participants. Ensuring compliance with safety protocols and insurance requirements increases operational overhead. These logistical and environmental challenges can restrict the number of viable launch sites and reduce the reliability of year‑round hang gliding services.

Opportunities

Integration with Tourism & Sports Events

Qatar’s strategic focus on attracting global visitors through mega‑events, luxury travel, and sporting showcases presents a niche opportunity for hang gliding as part of bundled tourism packages. Operators can partner with tour agencies and hospitality providers to include aerial sport experiences in desert or coastal itineraries, appealing to adrenaline seekers and social media travellers. Linkages with seasonal festivals or youth‑oriented adventure circuits can enhance visibility and uptake. Promoting tandem flights and guided experiences for tourists rather than requiring full pilot certification can make hang gliding more accessible and commercially viable.

Training, Schools & Youth Engagement Programs

Developing certified training schools and youth engagement programs can cultivate a local hang gliding community over time. These programs — potentially supported by government sports ministries or aviation clubs — can reduce entry barriers by offering structured, affordable courses. Schools can also serve as hubs for equipment rental, safety education, and pilot certification, helping to establish Qatar as a regional learning centre for hang gliding. Engaging local youth and expatriate communities through outreach initiatives and beginner workshops can stimulate grassroots interest, creating a sustainable base of future participants and advocates for the sport.

Future Outlook

Over the next decade, the Qatar hang glider market is expected to show considerable growth. With Qatar’s increasing focus on boosting its tourism sector and the rise in demand for adventure sports, the market for hang gliders is forecasted to expand. Key factors such as the development of new adventure tourism locations, increasing awareness of hang gliding as a recreational activity, and improvements in glider technology will contribute to this growth. Qatar’s economic diversification and continued investment in outdoor tourism will support market expansion and increase consumer interest in hang gliding.

Major Players

- Airwave

- Wills Wing

- Ozone

- Qatar Hang Gliders

- FlyQatar

- Cloud Base

- Gin Gliders

- Nova Gliders

- Horizon Gliders

- Skyman Gliders

- Morningside Hang Gliders

- Air Design

- Paramania

- Axis Hang Gliders

- Acro Paragliders

Key Target Audience

- Adventure tourism companies

- Hang gliding enthusiasts and clubs

- Recreational sports retailers

- Government and regulatory bodies (Qatar Civil Aviation Authority)

- Investment and venture capital firms

- Aerospace and aviation manufacturers

- Professional pilots and trainers

- Extreme sports and outdoor event organizers

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying and mapping key factors that influence the Qatar hang glider market, such as tourism trends, consumer behavior, and product developments. This is achieved through secondary data collection and market research reports, aiming to create a comprehensive framework for analysis.

Step 2: Market Analysis and Construction

This phase includes analyzing historical and current market data, including demand trends for different types of hang gliders, end-user preferences, and regional factors that influence purchasing decisions. The aim is to evaluate the size and scope of the market and build a robust forecasting model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including hang glider manufacturers, distributors, and tourism operators. These consultations help refine market insights and provide actionable data regarding product developments and customer trends.

Step 4: Research Synthesis and Final Output

In the final stage, the research findings are synthesized into a comprehensive market report. This phase involves a deep dive into consumer preferences, technological trends, and competitor strategies to provide a thorough analysis of the Qatar hang glider market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising interest in adventure sports

Government support for tourism initiatives

Increase in air tourism and recreational activities - Market Challenges

High initial investment and maintenance costs

Weather dependency and safety concerns

Regulatory restrictions and certification processes - Market Opportunities

Emerging popularity of powered hang gliders

Expansion of adventure tourism in Qatar

Advancements in glider technology and safety features - Trends

Growth of eco-tourism and sustainable adventure sports

Rising adoption of electric-powered hang gliders

Technological innovations in lightweight materials - Government regulations

Mandatory safety certification for hang gliders

Regulations regarding airspace management for recreational flight

Safety standards for equipment maintenance and operation

- SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Rigid-wing hang gliders

Flex-wing hang gliders

Motorized hang gliders

Recreational hang gliders

Professional hang gliders - By Platform Type (In Value%)

Land-based platforms

Air-based platforms

Water-based platforms

Hybrid platforms

Portable platforms - By Fitment Type (In Value%)

Aftermarket fitment

OEM fitment

Custom-fitment

Fixed-fitment

Portable-fitment - By End-User Segment (In Value%)

Recreational users

Professional pilots

Adventure tourism

Commercial operations

Training centers - By Procurement Channel (In Value%)

Direct procurement

Dealer network

Online platforms

B2B procurement

Distributor channels

- Cross Comparison Parameters (Market Value, Installed Units, Average System Price, Fitment Type, Platform Type, Price Range, Material & Build Quality, Distribution Channel, Pilot Skill Level, Material & Build Quality)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Al Jazeera Hang Gliders

Aerosport Qatar

Hang Glide Ventures

Qatar Air Sports

GliderTech Qatar

SkyWings Adventures

Desert Gliders Co.

Airborne Qatar

Adventure Sky Sports

Flying Wings Qatar

Qatar Glider Training Academy

Ozone Gliders

Aerosystems Qatar

Hang Gliding Qatar

Sky Pilots QATAR

- Increased demand for hang gliding in adventure tourism

- Growing interest among professional pilots for training and certification

- Recreational use driven by tourism and leisure activities

- Expansion of hang gliding schools and training facilities

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035