Market Overview

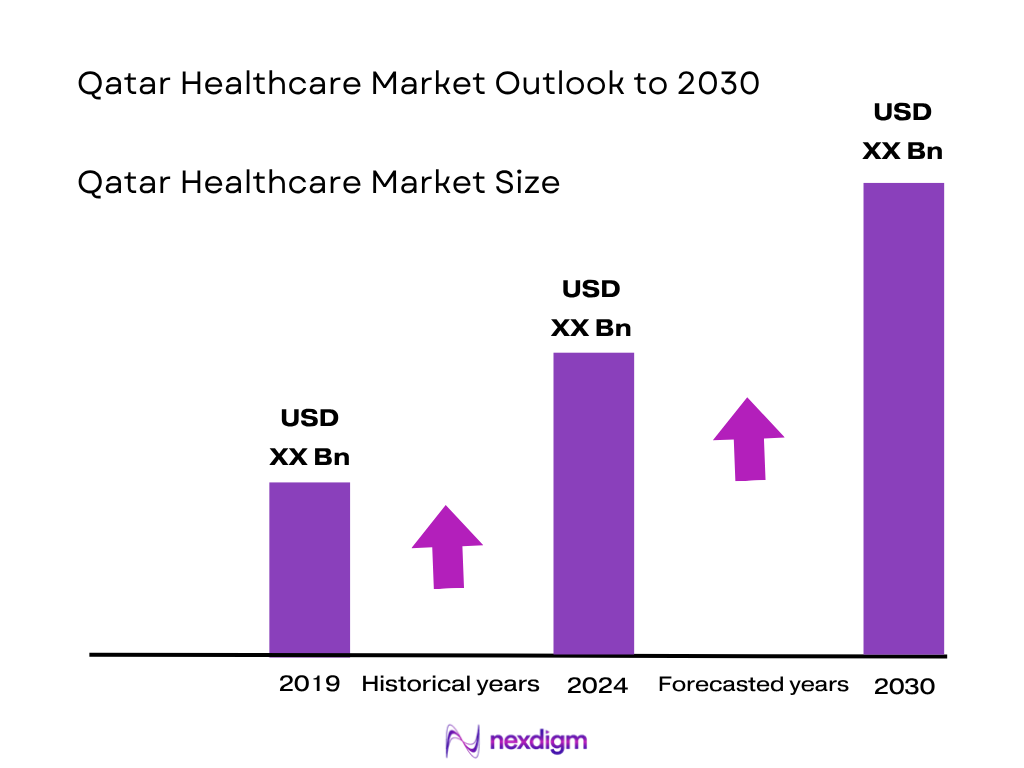

The Qatar Healthcare Market is valued at USD 5.8 billion in 2023 and expanded to USD 6.0 billion in 2024, based on government budget allocations and healthcare spending trends. This is fuelled by increased public healthcare budget (11% of national expenditure), substantial investments into infrastructure such as the Doha Medical City, and an expanded primary care network through PHCC and Hamad Medical Corporation.

Healthcare delivery is heavily centered in Doha, the capital and home of major hubs such as Hamad Medical Corporation’s Medical City, Sidra Medicine, and national disease centres. Adjacent municipalities Al Rayyan and Al Wakrah are also gaining prominence due to satellite clinics and PHCC expansion efforts. These areas dominate due to high concentration of infrastructure investment, government-led facility development, and presence of tertiary care centres in the Doha metropolitan cluster.

Market Segmentation

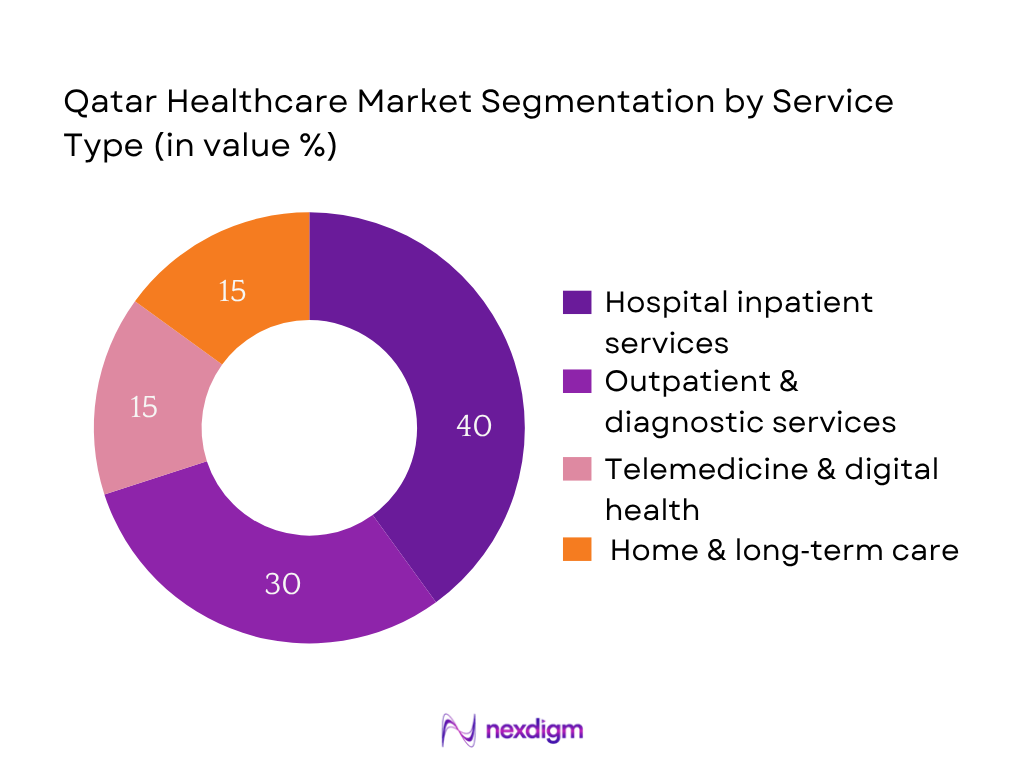

By Service Type

Hospital inpatient services hold the largest share (approx. 40%) in 2024, owing to ongoing expansion of hospital infrastructure including tertiary wings at Medical City and new psychiatric and cancer centres. Government’s continued investment in bed capacity and surgical capabilities underlies strong volume and revenue contribution from inpatient operations. The dominance reflects both public system delivery and rising utilization of secondary and tertiary services by nationals and expatriates.

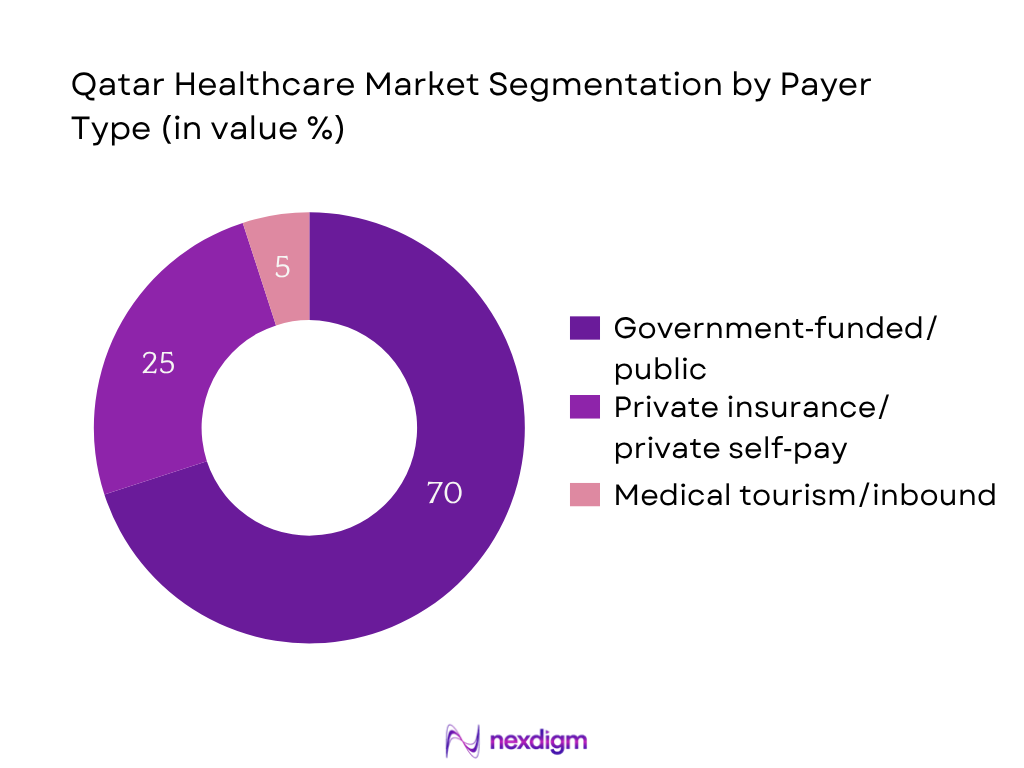

By Payer Type

Government‑funded services account for about 70% of total healthcare spend in 2024, due to policy commitment to subsidized care and coverage of public facilities’ operating costs. Public insurance and direct government disbursements via Hamad Medical Corporation and PHCC ensure that bulk of care is publicly funded, even as private insurance penetration and medical tourism revenues grow gradually.

Competitive Landscape

The Qatar healthcare market is dominated by a small set of major providers, including public entities such as Hamad Medical Corporation and PHCC, alongside private institutions like Al Ahli Hospital and Sidra Medicine. These leading institutions shape service delivery, uphold high standards of care and benefit from scale and government affiliation, reinforcing their dominant positions in both inpatient and outpatient segments.

| Company | Establishment Year | Headquarters | Number of Beds | Outpatient Volume | Insurance Tie‑ups | Tech Infrastructure (EHR/tele‑health) | Doctor‑to‑Patient Ratio | Geographic Coverage |

| Hamad Medical Corporation | 1979 | Doha | – | – | – | – | – | – |

| PHCC (Primary Health Care Corp) | 2012 | Doha region | – | – | – | – | – | – |

| Sidra Medicine | 2014 | Doha | – | – | – | – | – | – |

| Al Ahli Hospital | 1982 | Doha | – | – | – | – | – | – |

| Doha Clinic Hospital | 1984 | Doha | – | – | – | – | – | – |

Qatar Healthcare Market Analysis

Growth Drivers

Increasing Healthcare Budget Allocation

Qatar’s government health expenditure per capita, on a purchasing‑power‑parity basis, stood at USD 2,317.84 in 2022, as reported by the World Bank’s Global Health Expenditure Database. In 2021 the data shows USD 1,934.08 per person health spending. This steady fiscal allocation reflects governmental prioritization of public health infrastructure. The 2024 national budget allocated over QAR 17 billion (approx USD 4.67 billion) to health institutions and programmes (Ministry of Finance projection). Such directed public investment fuels expansion of primary health centres, hospital construction, ambulance services, and homecare, thereby significantly driving service volume in the Qatar Healthcare Market.

Rising Lifestyle Diseases and Aging Population

Qatar’s population reached 2,979,082 in 2023, per WHO country data. Though only 1.16% of the population is aged 65 and over, the high expatriate density and long-term residents have increased prevalence of diabetes and cardiovascular disease. The Ministry of Public Health reports over 300,000 diagnosed diabetics as of mid‑2024, up from 285,000 in 2022. This growth in chronic lifestyle diseases has driven higher utilization of outpatient diagnostic services, outpatient visits exceeded 1.8 million at PHCC in 2024. Rising long‑term care demand cascades into both inpatient and ambulatory segments.

Market Challenges

Shortage of Skilled Medical Professionals

Qatar’s 2024 workforce data shows 4,800 physicians, 2,600 dentists, and 14,000 nurses, translating to approximately 1.6 physicians per 1,000 population and 4.7 nurses per 1,000. Despite this, due to population growth and rising demand, 35% of physician vacancies in Hamad Medical Corporation remained unfilled as of mid‑2024, per MoPH internal staffing report. Reliance on expatriate medical staff (non‑nationals constitute over 90% of healthcare workforce) adds variability and high turnover. These shortages limit expansion pace in inpatient and specialist services, constraining market scale despite infrastructure expansion.

Regulatory Compliance and Licensing Issues

Healthcare providers in Qatar must comply with licensing via the Qatar Council for Healthcare Practitioners and MoPH. In 2023, average licence processing times reached 75 days, up from 60 days in 2022, according to MoPH public administration updates. Additionally, the number of compliance audits increased from 245 inspections in 2022 to 310 inspections in 2024, leading to 17 facility suspensions for non‑compliance. These regulatory bottlenecks delay opening of new facilities and impede service expansion pipelines, imposing operational and financial strain on both private and PPP investors.

Opportunities

Digital Health and Telemedicine Expansion

In 2023, teleconsultation appointments at PHCC and HMC exceeded 220,000 sessions, up from 150,000 in 2022, per MoPH digital health statistics. The Naraakom app reached 1.1 million registered users in mid‑2024, compared to 800,000 in 2022. Remote monitoring devices distributed to chronic disease patients numbered 12,500 units in 2024. Government launched digital health pilots in 48 PHCC branches. This rapid uptake of digital platforms amid healthcare expenditure per capita of USD 2,317 in 2022 encourages expansion of telemedicine, e-medicine and remote diagnostics, indicating strong opportunity for health‑tech integration and service innovation.

PPP Models in Secondary and Tertiary Care

Out of the 48 infrastructure projects under National Vision 2030, 12 major PPP hospitals are operational or under construction with 1,200 new beds expected by 2025. Private developers have committed QAR 8 billion in capital alongside government funding. The PPP model has enabled faster commissioning of specialist oncology, orthopaedics and women’s healthcare facilities. With expatriate population around 2.7 million and insured patient volumes rising to 2.1 million employer‑covered beneficiaries in 2023, the payor base supports scalable demand for these PPP‑delivered services, underlining strong future growth for private investors.

Future Outlook

Over the forecast horizon, the Qatar Healthcare Market is expected to accelerate significantly. The market is forecast to grow at a CAGR of 13.6% between 2024 and 2029, reaching approximately USD 12.8 billion by 2029. Key drivers include rapid expansion of private health expenditure, digital transformation under the National Health Strategy 2024–2030, expansion of medical tourism, and infrastructure investments in tertiary care. These trends are expected to profoundly reshape healthcare delivery, increase capacity, and invite further private sector engagement in both clinical services and health-tech.

Key Players in the Market

- Hamad Medical Corporation

- PHCC (Primary Health Care Corporation)

- Sidra Medicine

- Al Ahli Hospital

- Doha Clinic Hospital

- Al Emadi Hospital

- Turkish Hospital Doha

- Aster DM Healthcare (Doha operations)

- Naseem Healthcare

- The View Hospital

- Cuban Hospital

- Atlas Medical Center

- Apollo Clinic Qatar

- Future Medical Center

- American Hospital Clinics

Key Target Audience

- Hospital group CEOs and executive management

- Ministry of Public Health (MoPH), Qatar

- Hamad Medical Corporation leadership

- Primary Health Care Corporation decision-makers

- Insurance providers and payor organizations in Qatar

- Private hospital investors and developers

- Medical technology and digital health solution providers

- Investment and venture capitalist firms

- Government and regulatory bodies (e.g. MoPH, Qatar Council for Healthcare Practitioners)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping Qatar’s healthcare ecosystem covering public institutions (MoPH, HMC, PHCC), private hospitals, clinics, digital health providers, and insurance payors. Desk research sourced data from BMI, Alpen Capital, government budgets, MoPH and PHCC statistics to define key variables such as expenditure, patient volumes, infrastructure capacity, and digitalization levels.

Step 2: Market Analysis and Construction

This phase compiled historical financial and utilization data for the healthcare sector in Qatar. We analyzed healthcare spending by public and private channels, patient throughput in inpatient/outpatient settings, bed additions, and digital service penetration trends to build a bottom‑up revenue and volume estimate model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding growth drivers (e.g. infrastructure expansion, private insurance penetration) were validated via structured interviews (CATI scopes) with senior executives at MoPH, HMC, PHCC, private hospital chains, and insurance providers to cross-check assumptions around future expansion, capacity building, and patient trends.

Step 4: Research Synthesis and Final Output

The final stage integrated insights from Qatari health institutions and vendors to refine segmentation, projections, and service-level capacity data. Interactions with hospital executives and digital health suppliers enabled confirmation of revenue drivers, technology adoption rates, and ensured the robustness of forecasted growth and demand estimates.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution of Qatar’s Healthcare Sector

- Public vs Private Healthcare Framework

- Timeline of Major Healthcare Policies and Reforms

- Healthcare Value Chain and Supply Chain

- Medical Insurance and Financing Models

- Role of National Health Strategy and Vision 2030

- Growth Drivers

Increasing Healthcare Budget Allocation

Rising Lifestyle Diseases and Aging Population

Surge in Medical Tourism and Expats

Government Vision 2030 and Public-Private Partnership (PPP)

Expansion of Health Insurance Coverage - Market Challenges

Shortage of Skilled Medical Professionals

Regulatory Compliance and Licensing Issues

High Operational Costs for Private Healthcare Facilities

Supply Chain Dependency on Imports

Patient Data Integration and IT Infrastructure Gaps - Opportunities

Digital Health and Telemedicine Expansion

PPP Models in Secondary and Tertiary Care

Investment in Specialized Care Centers (Cardiology, Oncology, Geriatrics)

Integration of AI and Robotics in Surgeries

Clinical Trials and Medical Research Expansion - Trends

Rising Penetration of Electronic Medical Records (EMR)

Growing Demand for Wellness and Preventive Care

Localization of Medical Supplies Manufacturing - Regulatory Environment

Role of MOPH and Hamad Medical Corporation

Accreditation Standards and Licensing Guidelines

Health Insurance Regulations (Seha Program) - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Healthcare Penetration Index, 2019-2024

- By Bed Capacity Addition Projections, 2019-2024

- By Service Type (In Value %)

Hospital Services

Diagnostic and Imaging Services

Outpatient Services

Emergency Services

Long-term and Homecare Services - By Facility Type (In Value %)

Public Hospitals

Private Hospitals

Polyclinics

Specialty Centers

Ambulatory Surgical Centers - By Application (In Value %)

General Healthcare

Chronic Disease Management

Maternity and Pediatrics

Geriatric Care

Preventive and Wellness Programs - By End User (In Value %)

Individual Patients

Government Institutions

Corporates & Insurance Providers

Medical Tourists - By Region (In Value %)

Doha

Al Rayyan

Al Wakrah

Al Khor

Umm Salal

- Market Share by Facility Type and Revenue Contribution

Cross Comparison Parameters (Company Overview, Core Specializations, Number of Beds, Outpatient Footfall, Geographic Presence, Doctor-to-Patient Ratio, Insurance Tie-ups, Technology Infrastructure, Revenue Breakdown (Public vs Private)) - SWOT Analysis of Major Players

- Pricing and Service Benchmarking Across Facilities

- Detailed Profiles of Key Players

Hamad Medical Corporation (HMC)

Sidra Medicine

Al Ahli Hospital

The View Hospital

Aster DM Healthcare

Naseem Healthcare

Doha Clinic Hospital

Turkish Hospital Doha

Al Emadi Hospital

Cuban Hospital

Qatar Red Crescent

Atlas Medical Center

Apollo Clinic Qatar

Future Medical Center

American Hospital Clinics

- Public vs Private Utilization Patterns

- Healthcare Spending Behavior by Demographics

- Needs and Preference Mapping (Qatari Nationals vs Expats)

- Accessibility and Affordability Analysis

- Decision-Making Journey in Healthcare Consumption

- By Value, 2025-2030

- By Volume, 2025-2030

- By Healthcare Penetration Index, 2025-2030

- By Bed Capacity Addition Projections, 2025-2030